There’s still no recession on the horizon, that is for sure. U.S. GDP grew by 2.1% in the second quarter, better than estimates of 1.9%. It doesn’t change anything the Fed is likely to do next week. The CME Group Fed Watch tool is forecasting a 78.6% chance for a 25 basis point rate cut.

Regardless, stocks continue to rise, and the recent dollar movements are suggesting that it is not likely to change, as we will likely remain in this low inflation world for a quite a while longer.

What Does The Dollar Think?

The recent price action of the dollar is very telling of what the market thinks will happen further down the road. Despite knowing the Fed will be easing its monetary stance, the dollar continues to strengthen. Why is that? Because the eurocontinues to weaken against the dollar. That is because the market is betting that the ECB will be even more dovish than the Fed. And that means that the dollar will never weaken against the euro, and implies that inflation will stay low in the U.S. A strong dollar kills inflationary forces due to rising commodity prices. Plus it means we can import more goods from abroad using fewer dollars, which is fine within itself. But that also would suggest that prices have no reason rise, and there is no reason for wages to rise.

Look at it on the bright side, low inflation and a no-growth economy, means years of easy money, and that is good for stocks.

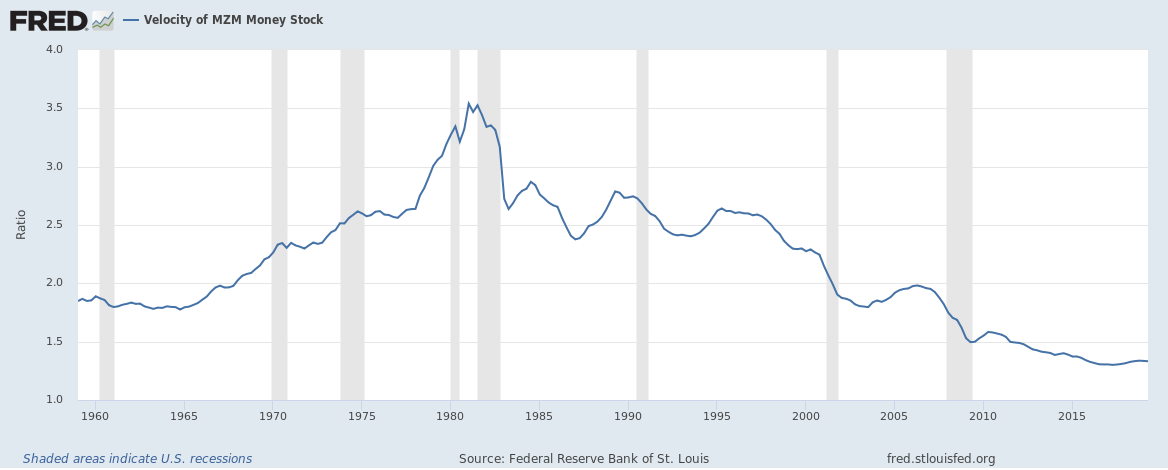

Just look at the latest velocity of MZM, which was down for the second quarter in a row and is going nowhere fast.

S&P 500 (SPY)

Anyway, the S&P 500 continues to head towards 3,050, and we are now about 25 points from my short-term target. I had thought that maybe 3,050 would the top of the range, but given how low the RSI is at the moment there could be room to perhaps 3,075. I would expect a pullback at that point, or at least I’d like to see a pullback at that point.

Amazon (AMZN)

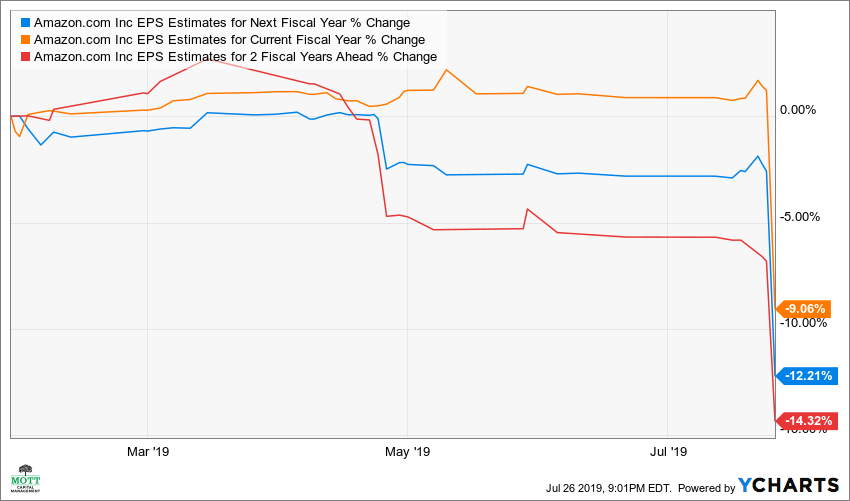

Amazon.com (NASDAQ:AMZN) was down about 1.5% today, and I expect that it shall continue to fall further. $1900 seems like a reasonable support level, but I think investors have something more to worry about then revenue growth, and that is margin compression. AWS was the enormous growth engine for Amazon’s significant earnings growth, but now AWS margins are shrinking, my guess is that earnings estimates for AMZN start falling.

Analysts have now slashed their full-year earnings estimates by 10% and see earnings growth of 21%. They are just pointing it out. The stock does trade at 74 times 2019 earnings estimates.

Microsoft (NASDAQ:MSFT) is a cleaner play on cloud growth than what AWS has to offer, without all the low margin retail business AMZN has, along with multiple that is half that of Amazon’s.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.