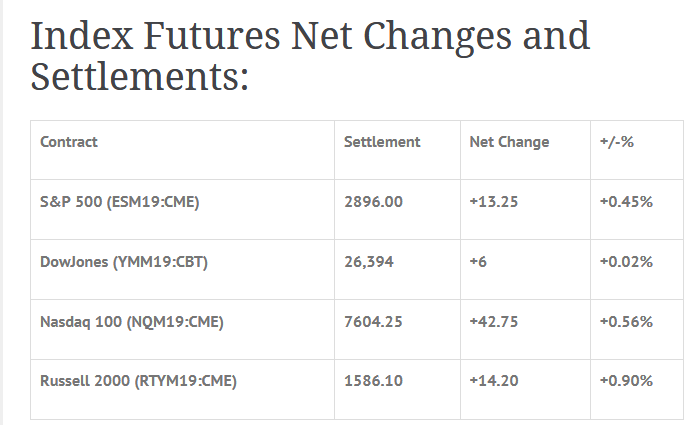

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed lower: Shanghai Comp -0.05%, Hang Seng +0.47%, Nikkei -0.21%

- In Europe 7 out of 13 markets are trading lower: CAC +0.09%, DAX -0.23%, FTSE +0.05%

- Fair Value: S&P +3.80, NASDAQ +24.06, Dow +5.21

- Total Volume: 1.2m ESM & 89 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Factory Orders 10:00 AM ET, and the TD Ameritrade IMX 12:30 PM ET.

S&P 500 Futures: #ES Late Friday RIP

During Thursday nights Globex session, the S&P 500 futures (ESM19:CME) printed a low of 2880.50, a high of 2893.50 when the jobs report came out, and opened Friday’s regular trading hours at 2890.00.

The first move after the 8:30 CT bell was a quick dip down to 2886.75, followed by rally up to a new high at 2896.50. After that the markets went flat and traded sideways in a 6 handle range for the majority of the session.

The ES didn’t break out of the range until the MiM came out showing $871M to buy MOC. It popped to make a new high at 2897.00, then printed 2896.25 on the 3:00 cash close, and went on to end the day at 2897.00, up +16.25 handles, or +0.56%.

In the end, the overall tone of the ES was firm. In terms of the days overall trade, total volume was a little higher, with 1.2 million futures contracts traded.

It’s hard to believe that the S&P is up 26% from its December 26th low. After a quiet trading session on Friday, both the Nasdaq futures (NQM19:CME) and the S&P futures (ESM19:CME) shot up to new highs on the close. One would think there should be a pullback, but trying to fight the uptrend has been literally impossible.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.