Stocks continued their winnings ways, with the S&P 500 rising by roughly 70 basis points to close around 3,287. It was another good showing for sure, and even the Russell 2000 managed to participate, rising by about 75 basis points to 1,669.

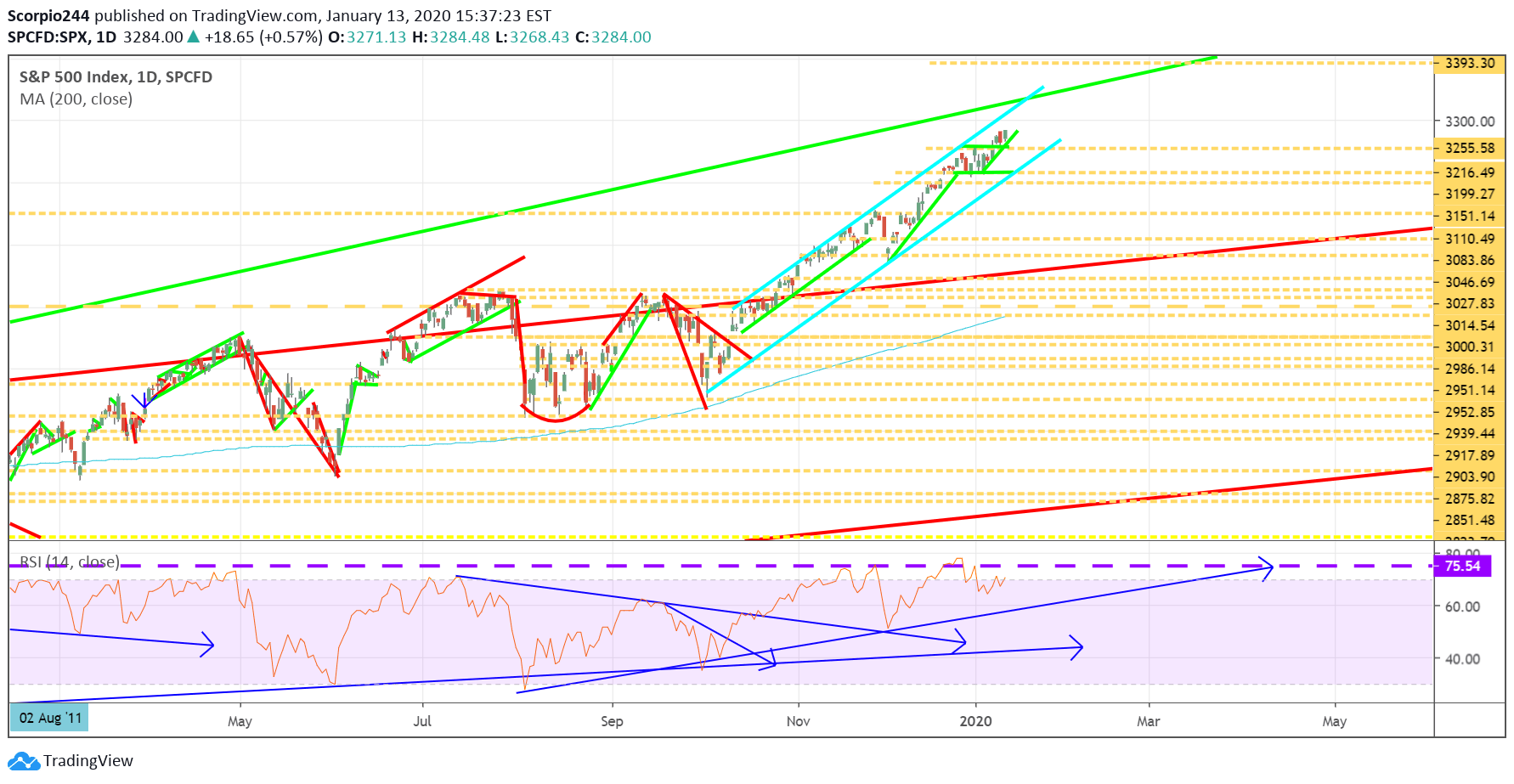

S&P 500 (SPY)

The move higher continues to be on a pace to rise to around 3,400. My preferably time would by around the end of March or the beginning of April. However, if we continue at this current pace, we may only have room to rise to around 3,350.

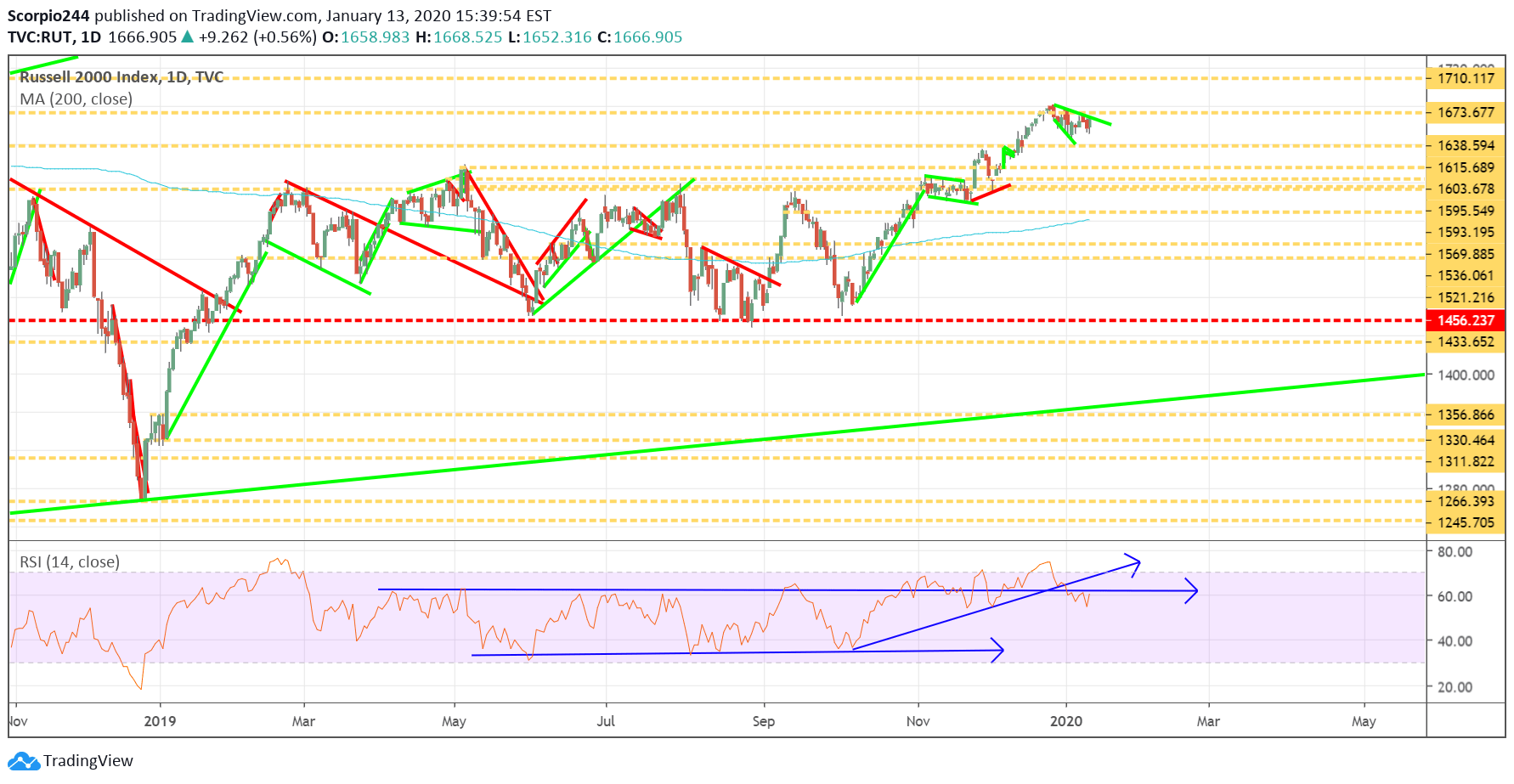

The Russell (IWM)

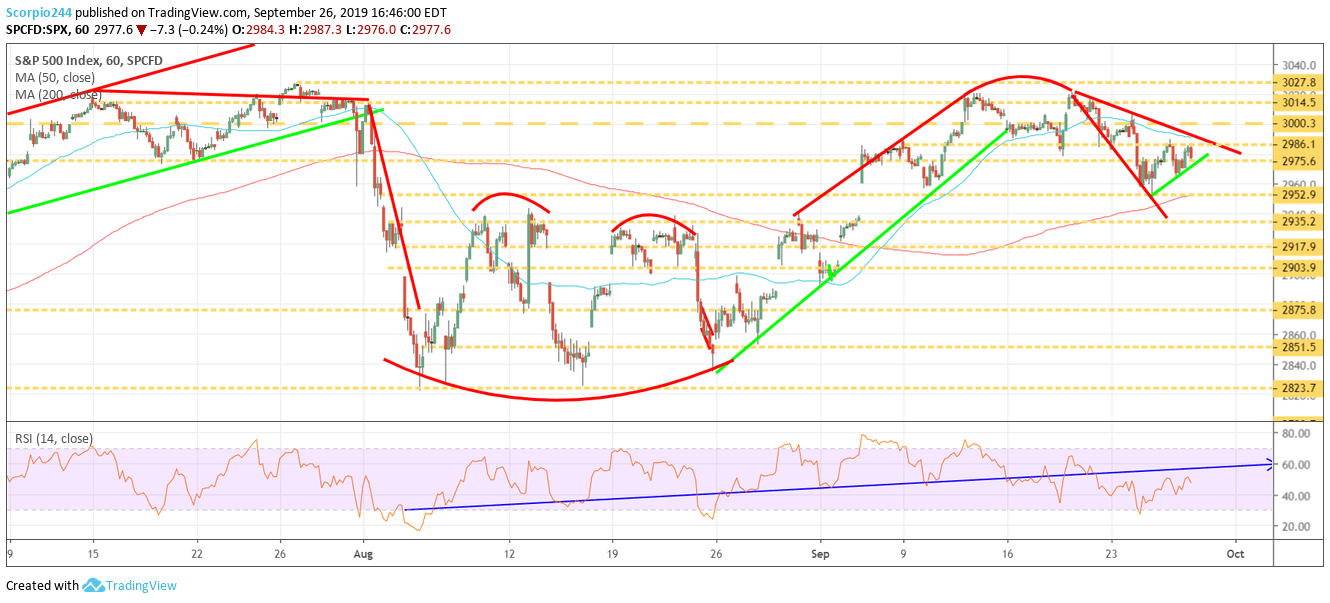

The Russell has that megaphone pattern that has formed recently, and I think that means we are approaching a move higher in the Index. For some reason, the chart reminds me an awful lot of the S&P 500 at the end of September.

Do you remember this chart from Sept. 26? It is not precisely the same, but the similarities are there.

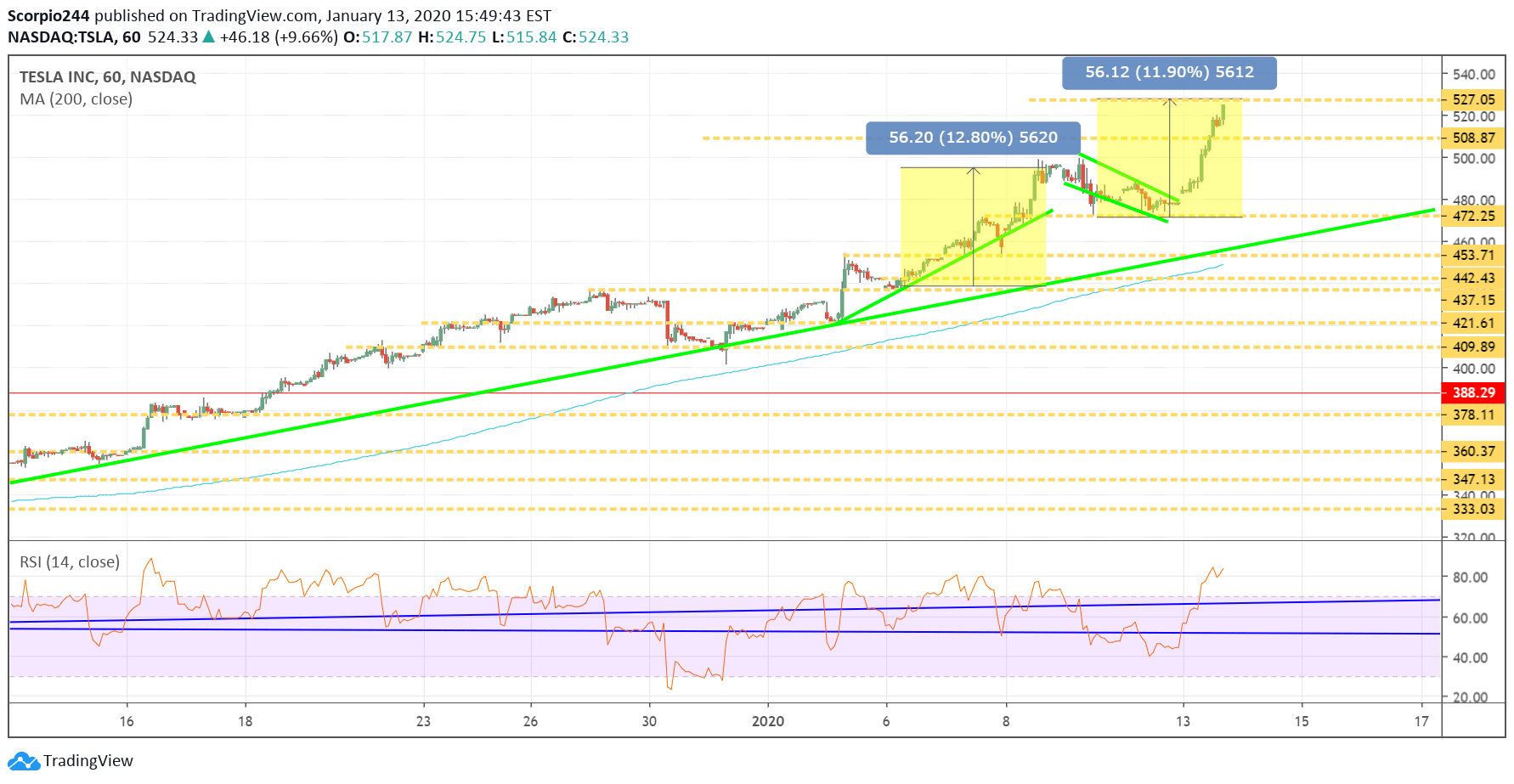

Tesla (TSLA)

Anyway, Tesla (NASDAQ:TSLA) blew right through my target of $508, and it looks like the next significant level of resistance should come around $527. The bear case is dead, and believe it or not, based on earnings growth estimates, the stock could even be cheap.

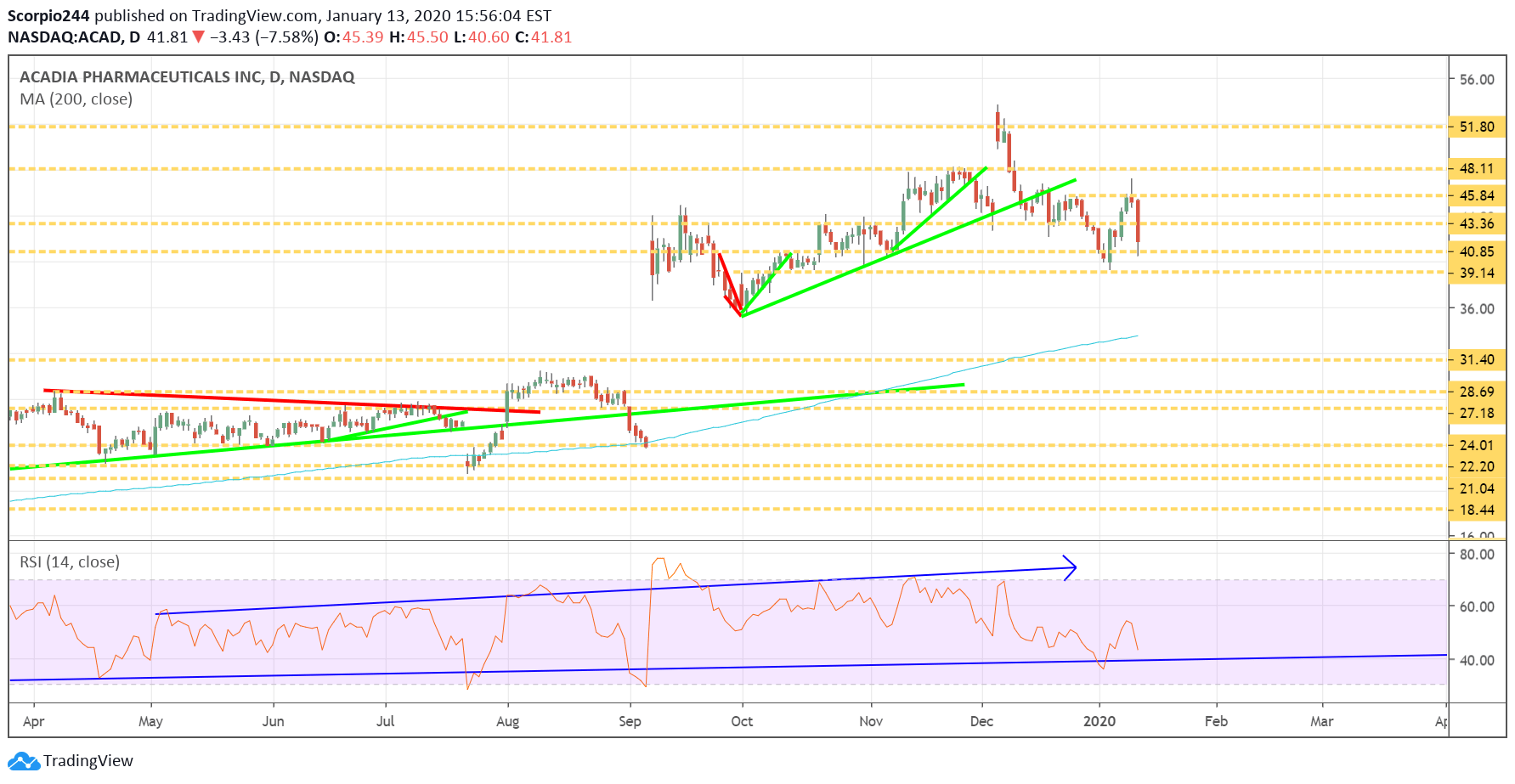

Acadia (ACAD)

ACADIA (NASDAQ:ACAD) was crushed yesterday falling by roughly 7.5% because the company’s slide show for their presentation today said that the sNDA for Dementia-Related Psychosis would be filed in the summer of 2020, versus what the company said at CTAD for the first half of 2020. If the company files the sNDA on June 29, technically that is the summer of 2020, and also the first half. I mean even if it were August does it really matter that much? Probably not. Hopefully, they can clear this up today.

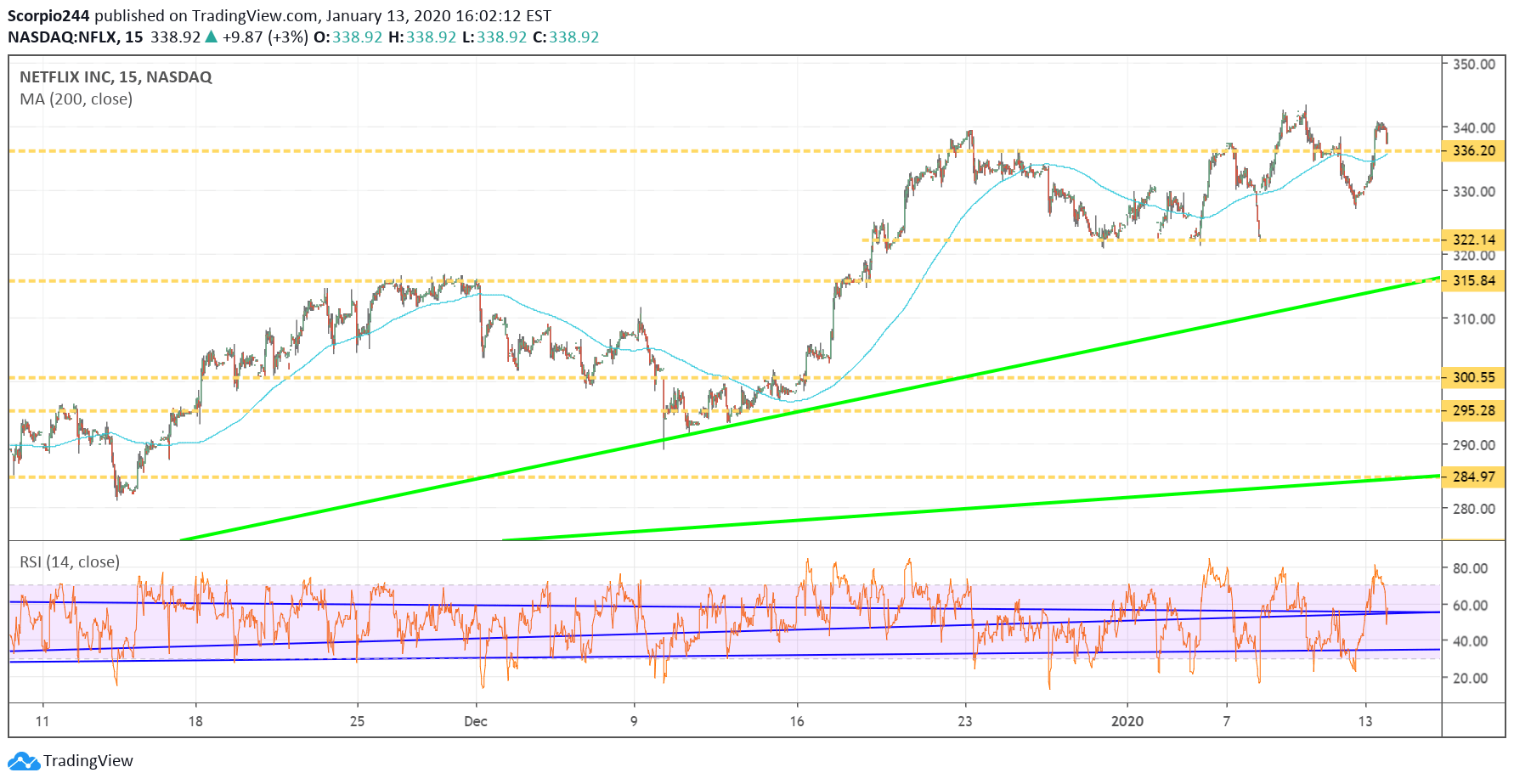

Netflix (NFLX)

Netflix (NASDAQ:NFLX) had a great day yesterday, too, after it was nominated for 24 Oscar awards. It was most out of any studio, with two for the best picture. The stock does not like the $336- $340 region; it just can’t get through it. It does make sense, though, given the next resistance comes at $360.

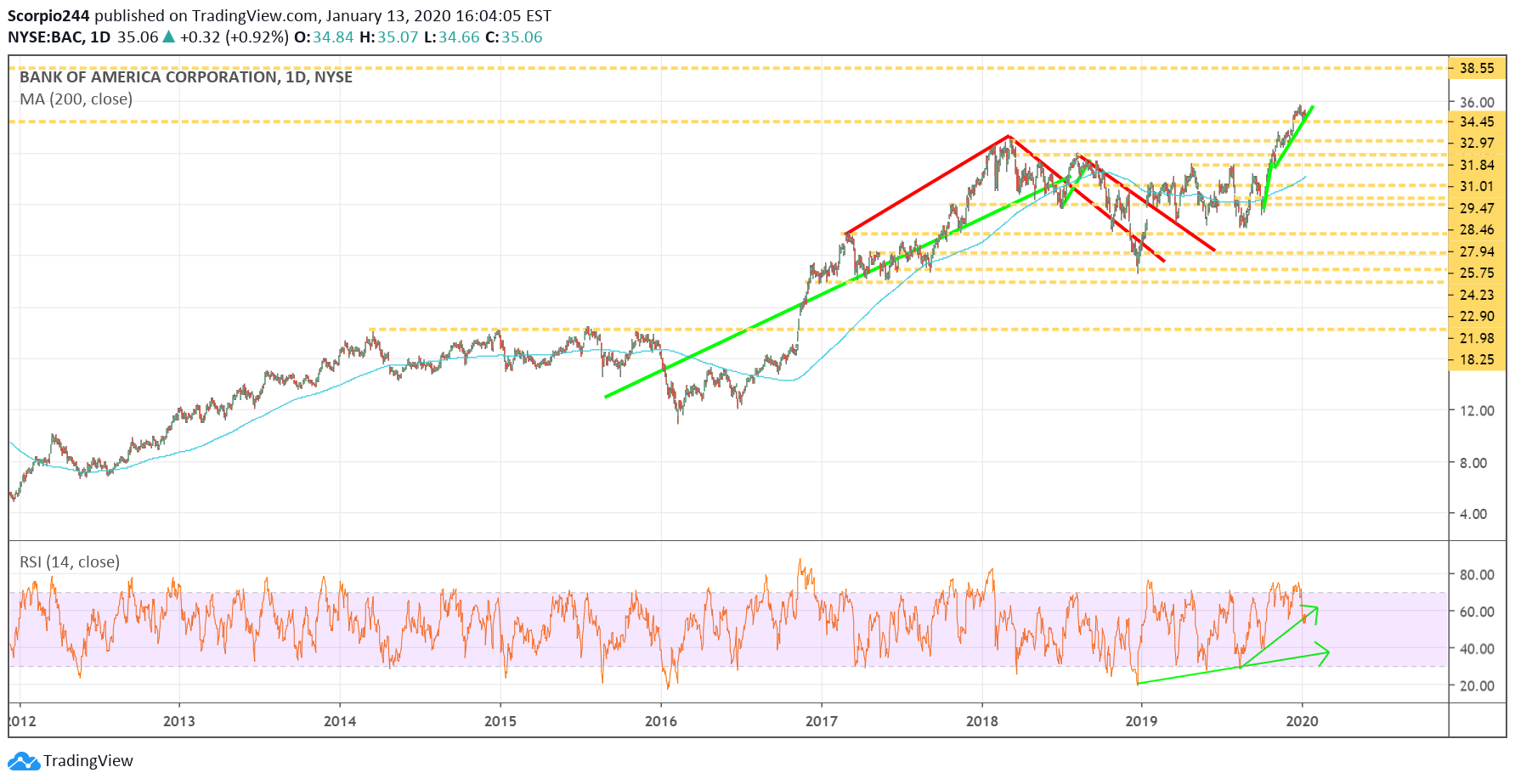

Bank of America (BAC)

Over the weekend, I thought Bank of America (NYSE:BAC) might be heading lower after results. Then I saw bullish options betting that made me change my mind. I think it could be heading above $37 in the weeks to come.