Investing.com’s stocks of the week

Stocks had a good day yesterday, bouncing back some from Tuesday’s down day. The ISM non-manufacturing index came in lower than expected 53.9 versus estimates for 54.5, and down from last months 54.7. It corresponds to a GDP growth rate of about 1.9%, which is mostly in line with what we have seen from other data points recently. So it seems at this late point of the year, the recession or even near-zero growth is not on the horizon.

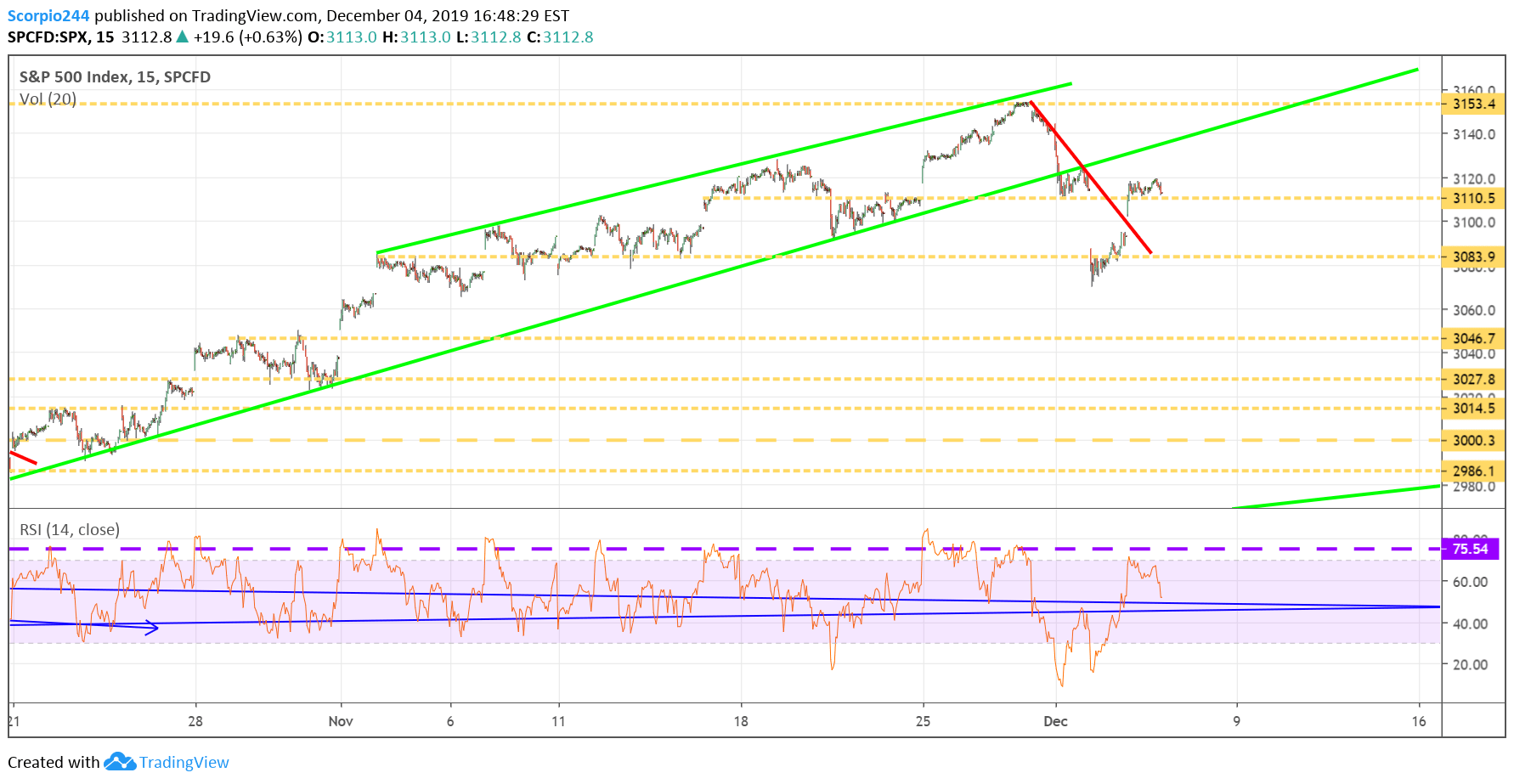

S&P 500 (SPY)

The S&P 500 did manage to close above 3,110, and I view that as a definite positive. I think it sets us up for a potential move a bit higher to the trend line up at 3,140 today.

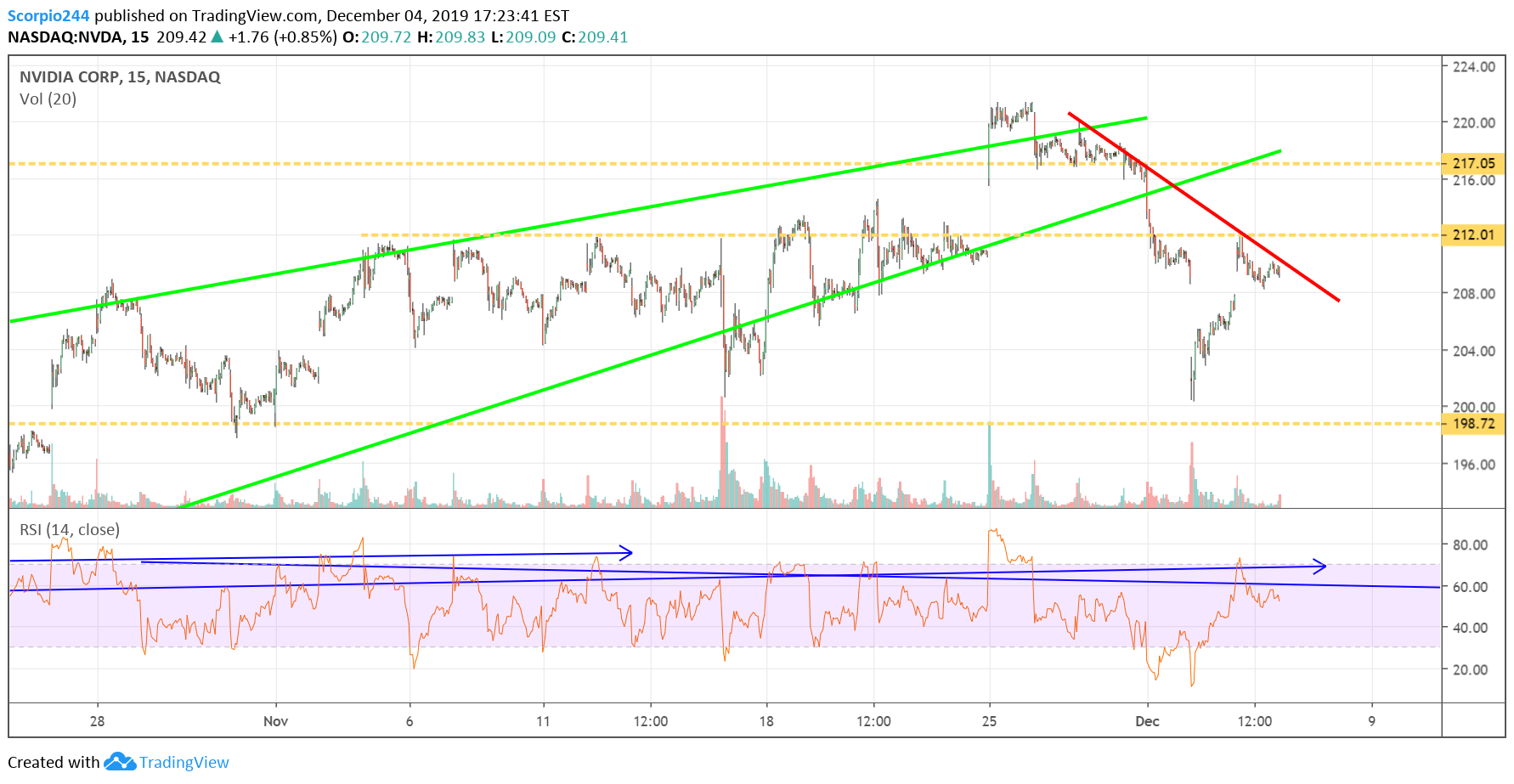

Nvidia (NVDA)

NVIDIA (NASDAQ:NVDA) failed at resistance at $212, and the RSI continues its trend lower. I think that it means the stock is going to head back to $198.

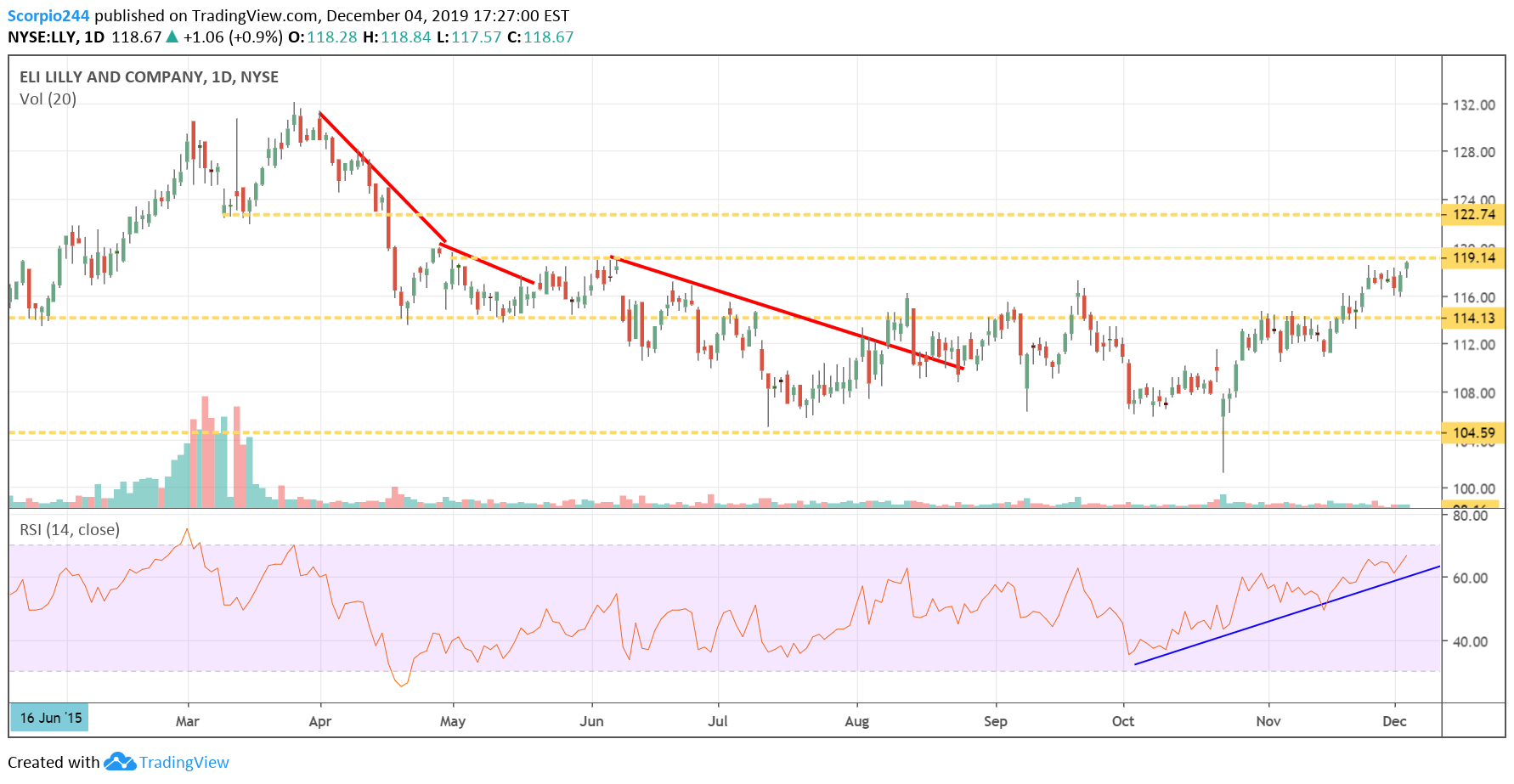

Eli Lilly (LLY)

Eli Lilly (NYSE:LLY) is very close to breaking out should it rise above resistance at $119. The RSI is trending higher, and it looks healthy, suggests the stock could go to $123.

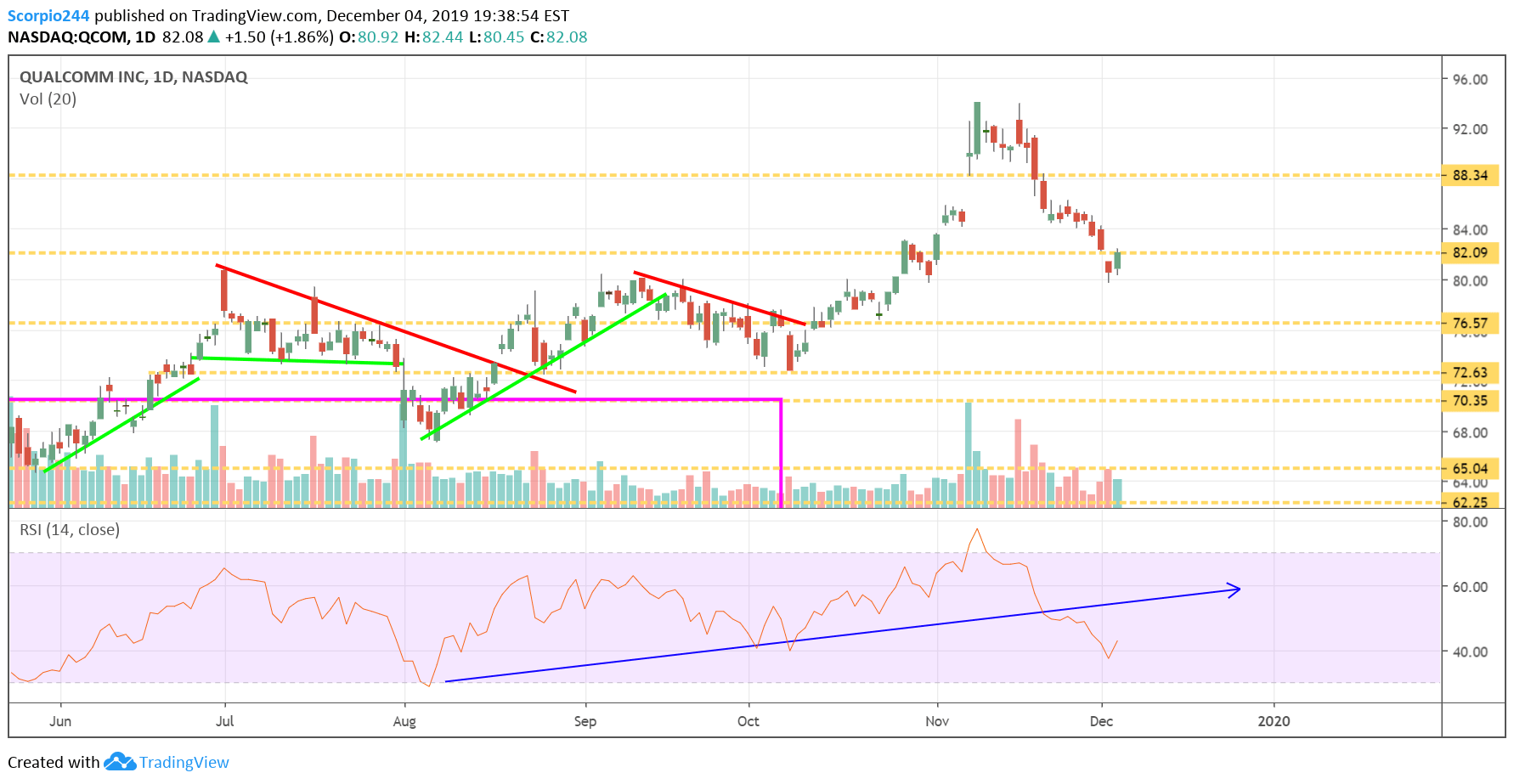

Qualcomm (QCOM)

Qualcomm (NASDAQ:QCOM) tried to get back over resistance today at $82 but was not able too. Not a great sign for the stock. I still think there is a good chance shares fall to roughly $76.50.

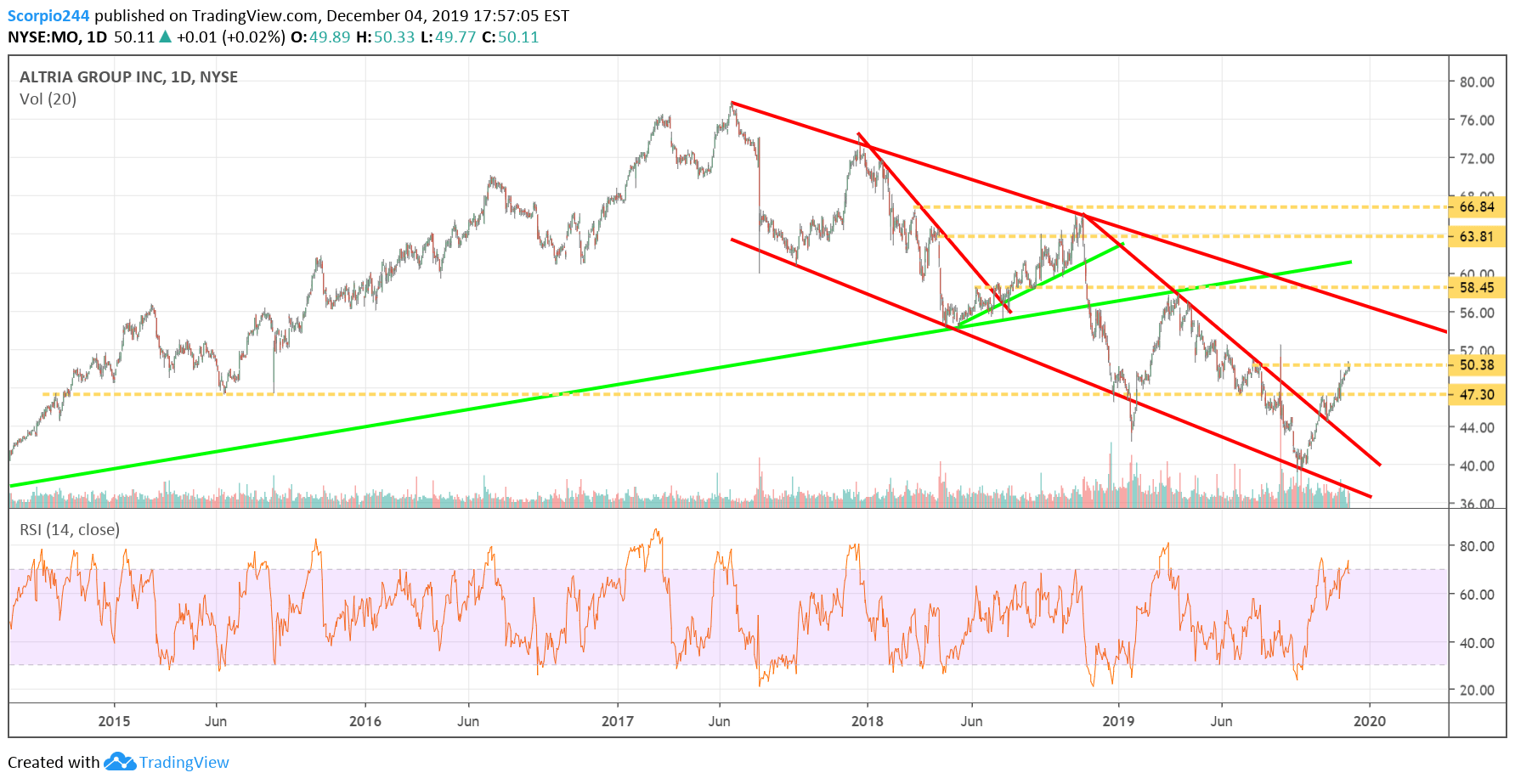

Altria (MO)

Here’s a new one Altria (NYSE:MO), the stock appears it has broken free of a falling wedge and is challenging resistance at $51 and potentially on its way to $58.

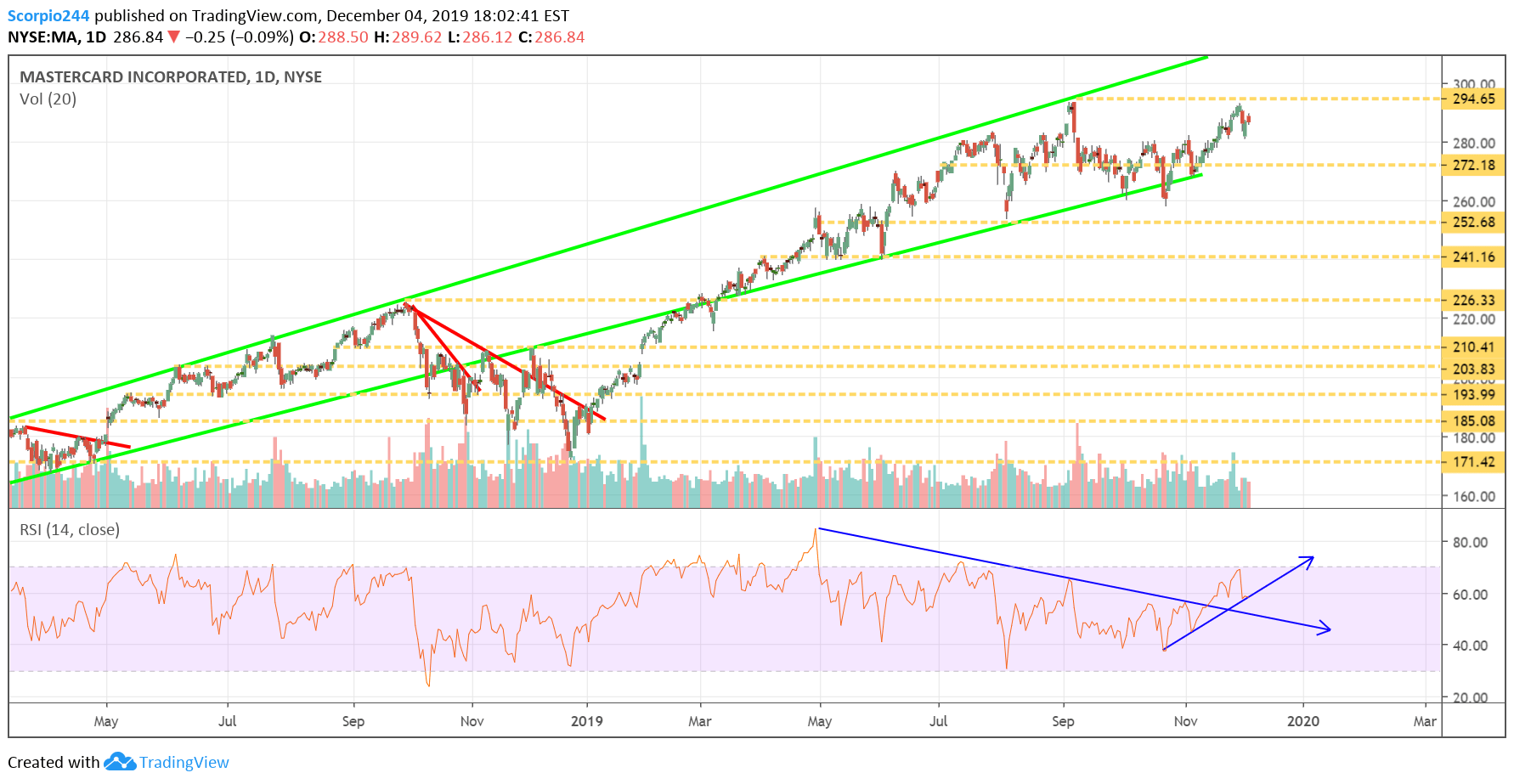

Mastercard (MA)

Mastercard’s RSI is changing trend as well, and perhaps that means the stock is setting up to take out its all-time highs before year-end. That would be nice for me since it has become my largest holding. One can only hope.