- US stocks edge higher amidst quiet newsflow

- French elections are around the corner

- Aussie and loonie benefit from hotter CPI reports

- Yen remains under pressure

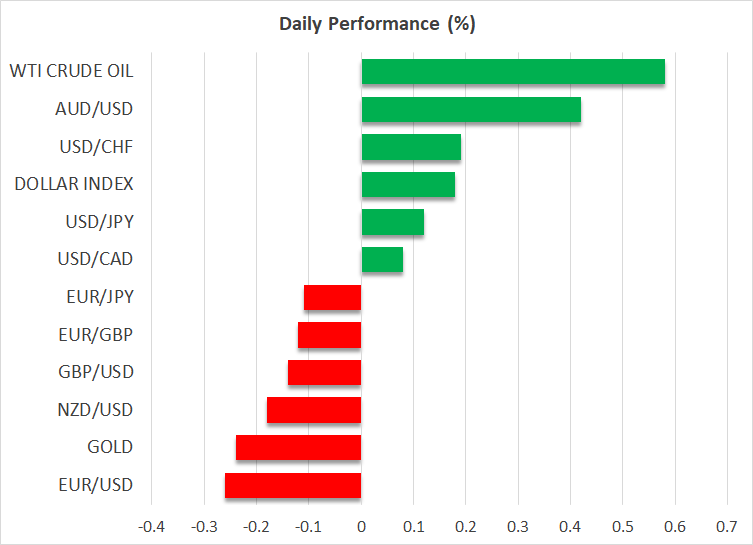

Dollar Records Small Gains Against the Euro

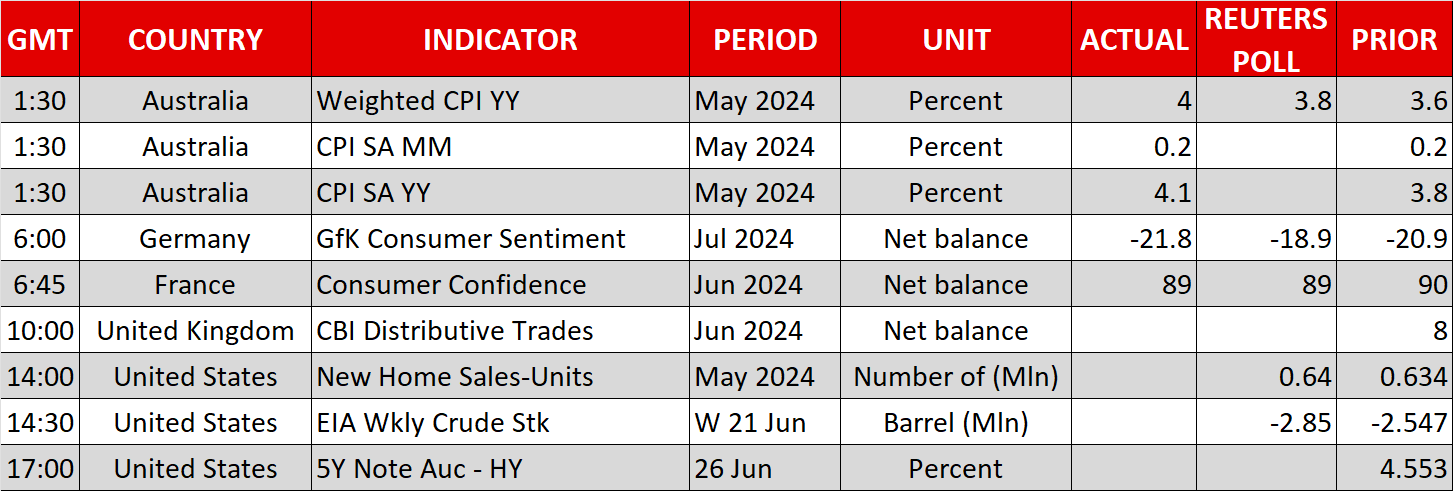

The US dollar is trying to find its footing as the market prepares for Thursday’s presidential debate between Trump and Biden and Friday’s PCE inflation report. Yesterday’s Fedspeak did not hold any surprises with the Fed’s Cook talking vaguely about the possibility of rate cuts at some point. Today’s calendar includes new home sales for May, a sector that Chairman Powell commented on during the last Fed press conference, but the market chooses to ignore at this juncture.

The Fed doves are really pinned into the corner as the window of opportunity for a rate cut ahead of the November elections is shrinking fast. If data over the next 10 days, predominantly the PCE report, the ISM surveys and next Friday’s non-farm payroll print, does not portray a weakening economy experiencing lower inflationary pressures, then a dovish shift at the 31 July Fed meeting will probably become a summer dream.

In the meantime, US stock indices had a mixed session yesterday with the S&P 500 index rising on the back of the resurgent Nvidia (NASDAQ:NVDA) stock. This index is currently around 4% in the green for June, and almost 15% higher in 2024, as the technology sector is close to recording another 10%+ monthly increase. This rally is sizeable considering the performance of the CAC 40 index following the recent European elections outcome. The French index is just 2% higher in 2024 and its outlook remains cloudy as the first round of the parliamentary elections is just around the corner.

Aussie, Loonie Benefits from Hotter CPI Reports

The Aussie and the Loonie are in the green today as the inflation reports from both Canada and Australia managed to produce an upside surprise. In the case of the former, the headline inflation rate edged higher to 2.9% year-on-year, complicating somewhat the outlook for the BoC.

The market is still pricing in a 56% probability of another 25bps rate cut in July as, on Monday, Governor Macklem appeared relatively confident that the BoC would hit its inflation target. It would be interesting to see if next week’s key data releases justify the Governor’s optimism.

Similarly, the aussie/dollar pair has jumped higher as the RBA remains one of the most hawkish central banks. Today’s stronger-than-expected inflation report for May has probably confirmed Governor Bullock et al's decision to discuss the possibility of a rate hike at the last meeting, contrary to the rest of the world preparing or already easing monetary policy.

Chances of a rate hike at the August 6 meeting have jumped to 33%, as the market is now on the lookout for further comments from RBA members. Next week’s plethora of data could add credence to the possibility of a rate hike, but the decisive figure will come on July 31 when the CPI for the second quarter of 2024 will be released.

Dollar/Yen Is Just Shy of 160 Again

Dollar/Yen is currently trading a tad below the 160-yen level as, despite the end-April double intervention, the market feels confident enough to provoke the Japanese authorities. To be fair, the BoJ is partly responsible for this ongoing yen weakness as it has consistently failed to appease the market. This week’s data prints and particularly Friday’s Tokyo CPI report could allow the BoJ to adopt a more hawkish stance going forward, and potentially positively surprise the market with a significant tapering of its bond-buying program at the July 31 gathering.