“Very little is needed to make a happy life; it is all within yourself, in your way of thinking.” – Marcus Aurelius

A brutal day for energy stocks and oil continues lower which is good, and bad, but overall tough on economies largely based around oil.

Markets were weak out of the gate as I mentioned in my weekend blog was likely, with a few exceptions like O:NFLX and O:MNST but they quickly reversed and I ended up taking some NFLX home overnight with a short position.

Real-Time members and I also shorted some O:ADXS, N:LNKD and O:BIDU and hopefully they will move nicely lower over the next few days.

I don’t expect to hold these shorts for long but we may as well try to grab some more gains before we setup for the next attempt at new highs for the S&P 500.

As I mentioned on the weekend, the surface strength Friday was just that, and underlying we needed more of a correction and we’re in the midst of that right now.

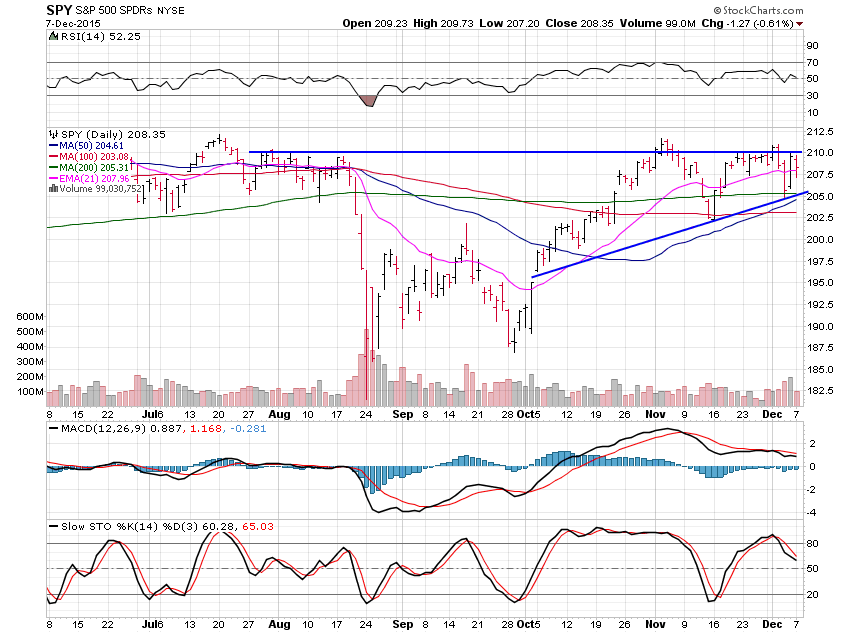

N:SPY is holding near 210 for now but stocks are not acting great so I expect SPY to continue to correct.

If we do get near 205 at the 200 day average and the lower end of this large triangle it must hold.

If the 205 area can’t hold then a likely move down to the 195 gap fill area is very likely.

Time will tell but I’m short for now and not sure how deep this correction will go.