Stocks had a big rebound in 2019 out of the fourth quarter selloff of the prior year. This occurred even though earnings growth for the S&P 500 flatlined and even turned sequentially negative late in 2019 leading many to ask if the recent rally is sustainable.

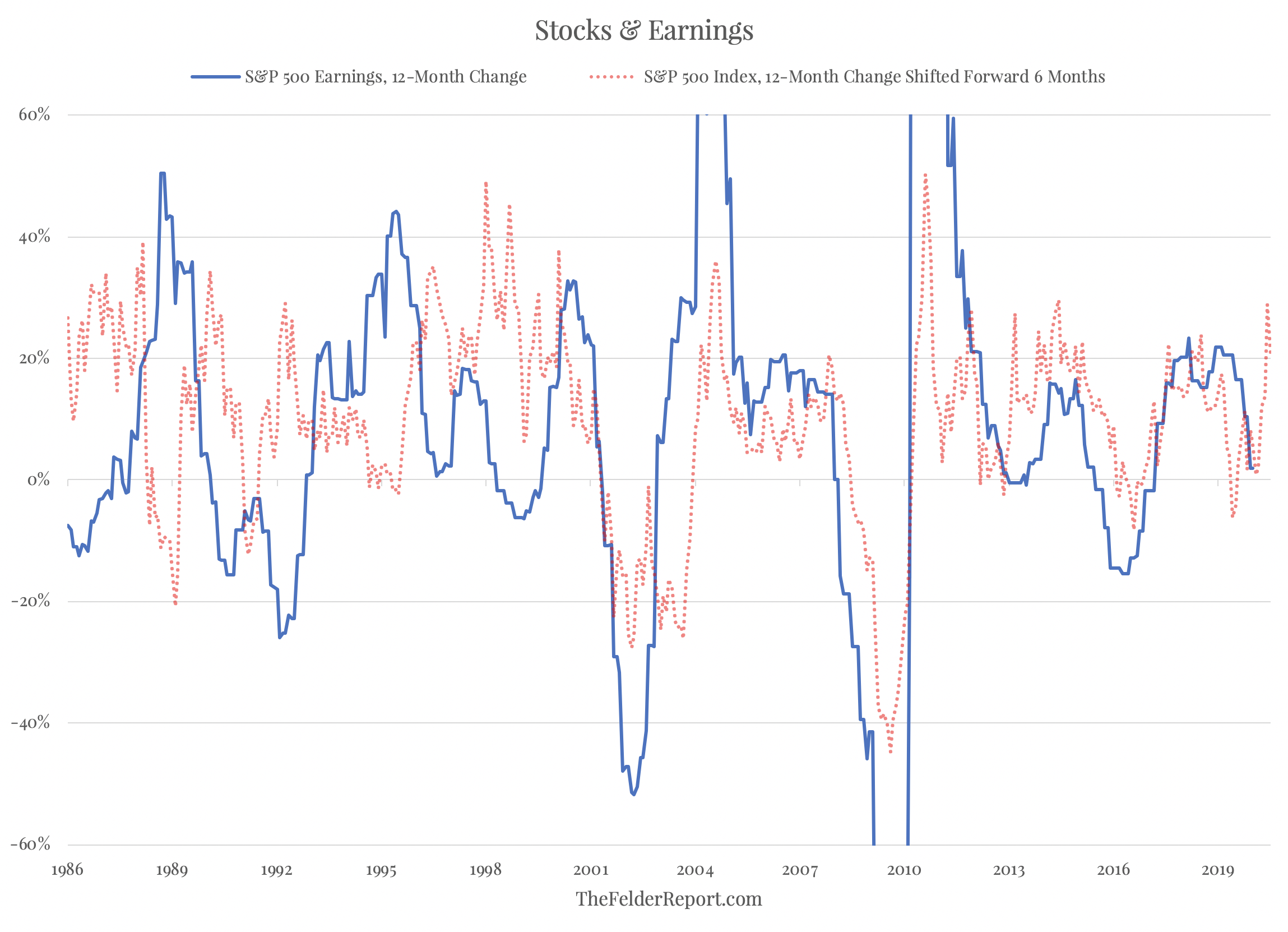

It’s true that stock prices don’t discount the past, they discount the future. While the relationship is not perfect, they, in fact, lead earnings by about six months. There is, however, a great deal of noise at times with stocks suggesting earnings growth or earnings declines that don’t materialize and stocks quickly change course to reflect the direction of their underlying fundamentals. Last year’s rally clearly implies a major rebound in year-over-year earnings growth over the next few months from about 0% to nearly 30%.

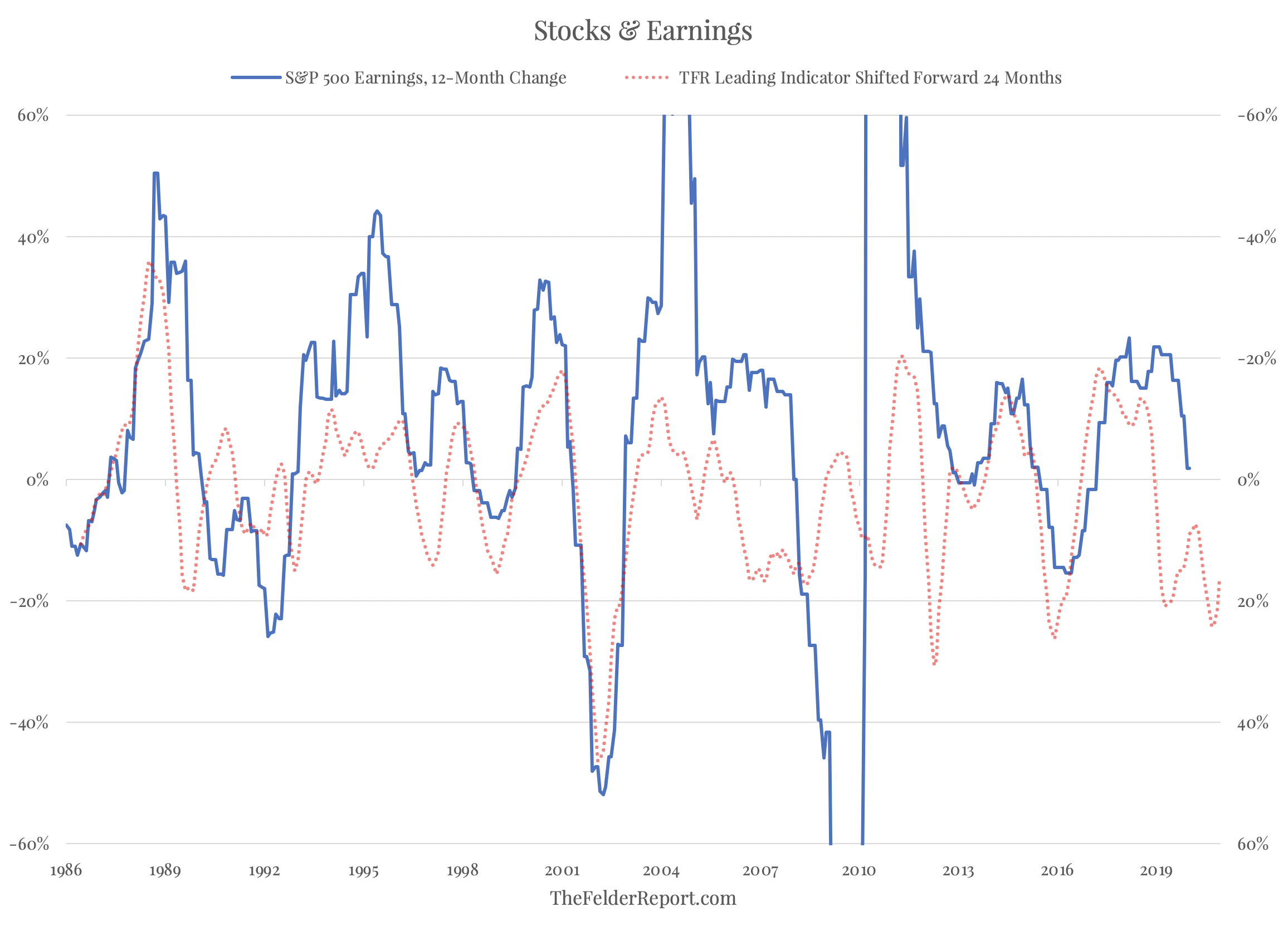

One reason this may turn out to be another example of noise rather than signal is that leading indicators for earnings like the direction of the dollar, oil prices and interest rates suggest earnings will actually decline this year by as much as 20% rather than rise that much or more as stock prices seem to suggest.

Should these leading indicators prove to be right and stock prices wrong, it would leave a pretty sizable air pocket beneath the indexes. So, as it could help to adjudicate this debate, this earnings season we are now approaching and, more specifically, the guidance companies provide for the rest of the year could be more important than most.