What might the 2020 stock bubble be telling us? When mega-cap tech stars handily surpass earnings expectations, but still plummet?

Perhaps there is some recognition of effervescent valuations. Warren Buffett’s indicator, market-cap-to-GDP, shows the disconnect between tech stock pricing and economic reality. Today’s prices may be more insane than the prices from the dot-com days.

However, tech stock overvaluation is not the pin that may have popped the balloon. We’ve seen ridiculous valuations before—99th percentile valuations for price-to-sales (P/S), price-to-earnings (P/E), price-to-book (P/B), the Q ratio, regression, as well as market-cap-to-GDP.

The stock balloon is endangered because federal government stimulus has been delayed by partisan political games. Money printing stimulus from the Federal Reserve and federal government transfers/direct payments are what 2020 stocks require to succeed. (More cowbell… gotta have more cowbell.)

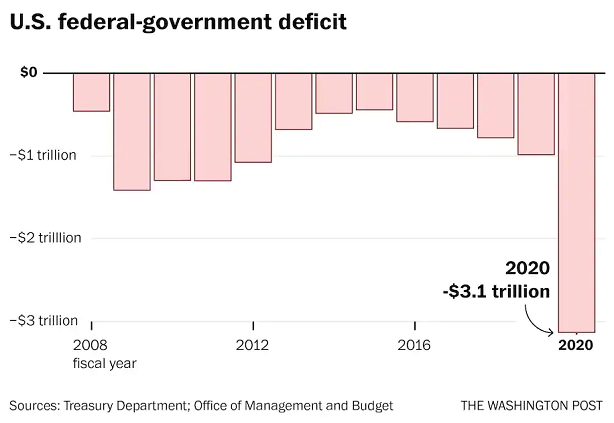

We’ve already seen $3 trillion of money printing (a.k.a. “liquidity”) make its way into stocks.

And, for the reported benefit of consumers as well as small businesses, we have seen the government rack up $3 trillion in additional debt.

The 2020 stock bubble expected that Americans would see $2 trillion more in deficit spending by now. Yet political leaders would rather get clarity on the election outcome (e.g., Senate, presidency, etc.) before committing to the next package.

Unfortunately, stock market investors are getting antsy about the timing of the next round of stimulus. Truth be known, it is an addiction that will be very hard to break.

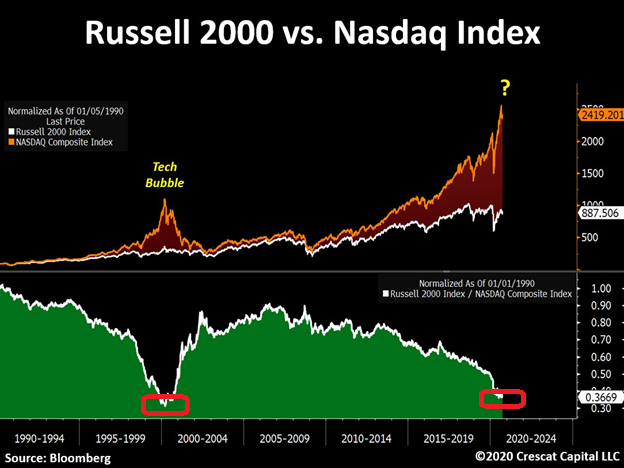

Keep in mind, most of the hullabaloo over stimulus has benefited the NASDAQ 100 (NASDAQ:QQQ) more than anything else. It has sent the prices on Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Google (NASDAQ:GOOGL), Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) through the proverbial roof.

Yet the companies beneath mega-cap glory? Those public corporations whose shares are listed on the Russell 2000? Not so terrific.

Grab a gander at the chart below. It shows that the relative strength of the Russell 2000 in relation to the NASDAQ has rarely been this far out of whack. Once again, you’d have to revisit the 2000 tech wreck to find a similar circumstance.