Stocks finished lower on Monday, with a good portion of the decline coming in the final 10 minutes, when a nearly $2 billion sell imbalance was posted for the closing cross. Meanwhile, the VIX was higher while rates and spreads rose. The dollar took a break following a colossal move last week.

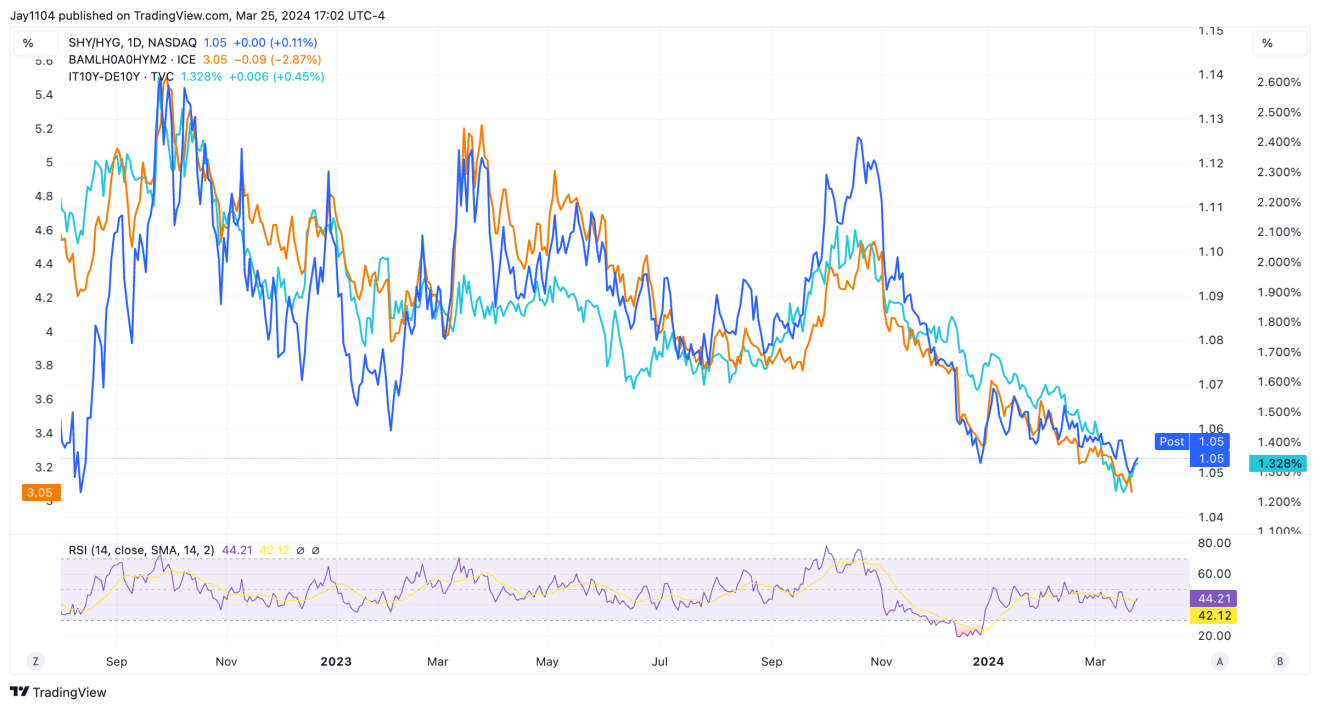

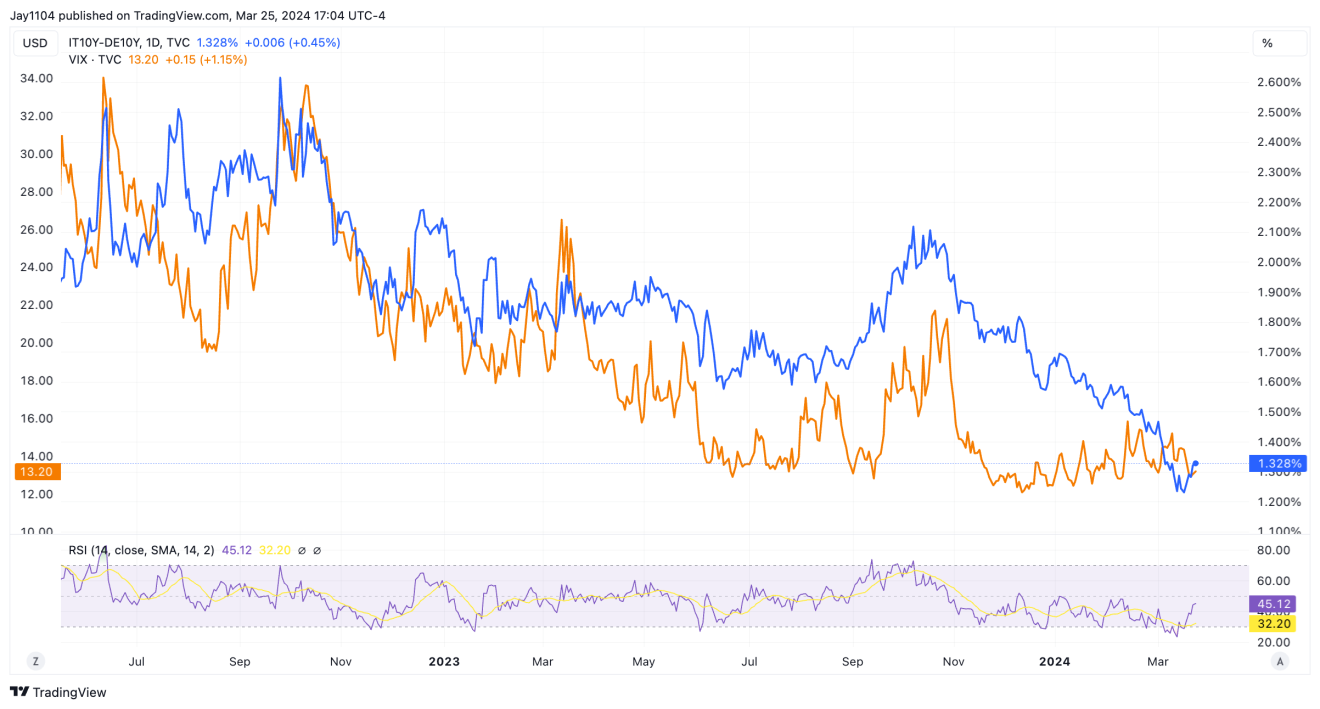

One spread to watch here is the difference between the Italy 10-Year and Germany 10-Year rates because the spread has contracted a lot since October. Now, it appears to be breaking a short-term downtrend, and the RSI shows signs of turning higher, which could indicate that a widening of this spread is starting.

This spread is a good gauge for risk. When it falls, just like any spread, it indicates a feeling of no worries in the market, and when it rises, a feeling of nervousness. It is also sometimes a good leading indicator for high-yield credit spreads here in the US, and the ratio of the SHY/HYG or the BofA High Yield OAS Index tends to follow this spread between German and Italian bonds.

Widening spreads are also associated with a rising VIX index.

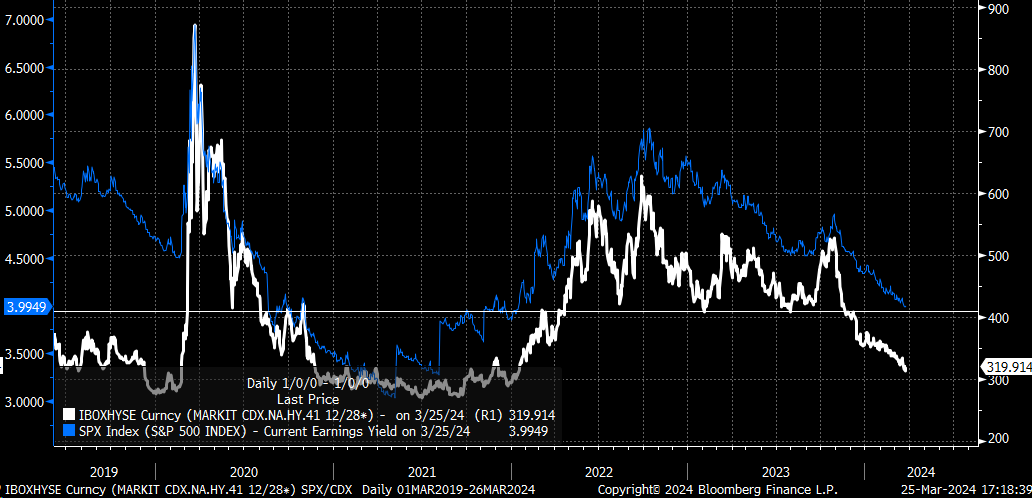

When you piece all of this together, it explains why stocks were lower. As we know, when spreads widen, the earnings yield of the S&P 500 rises with it.

So, while this may seem silly to some, or that it doesn’t matter, these credit spreads are probably more than any AI narrative the media can come up with because, at the end of the day, when these credit spreads start to widen, financial conditions tigthen, and liquidity is removed from the market. Keep an eye on them.