Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

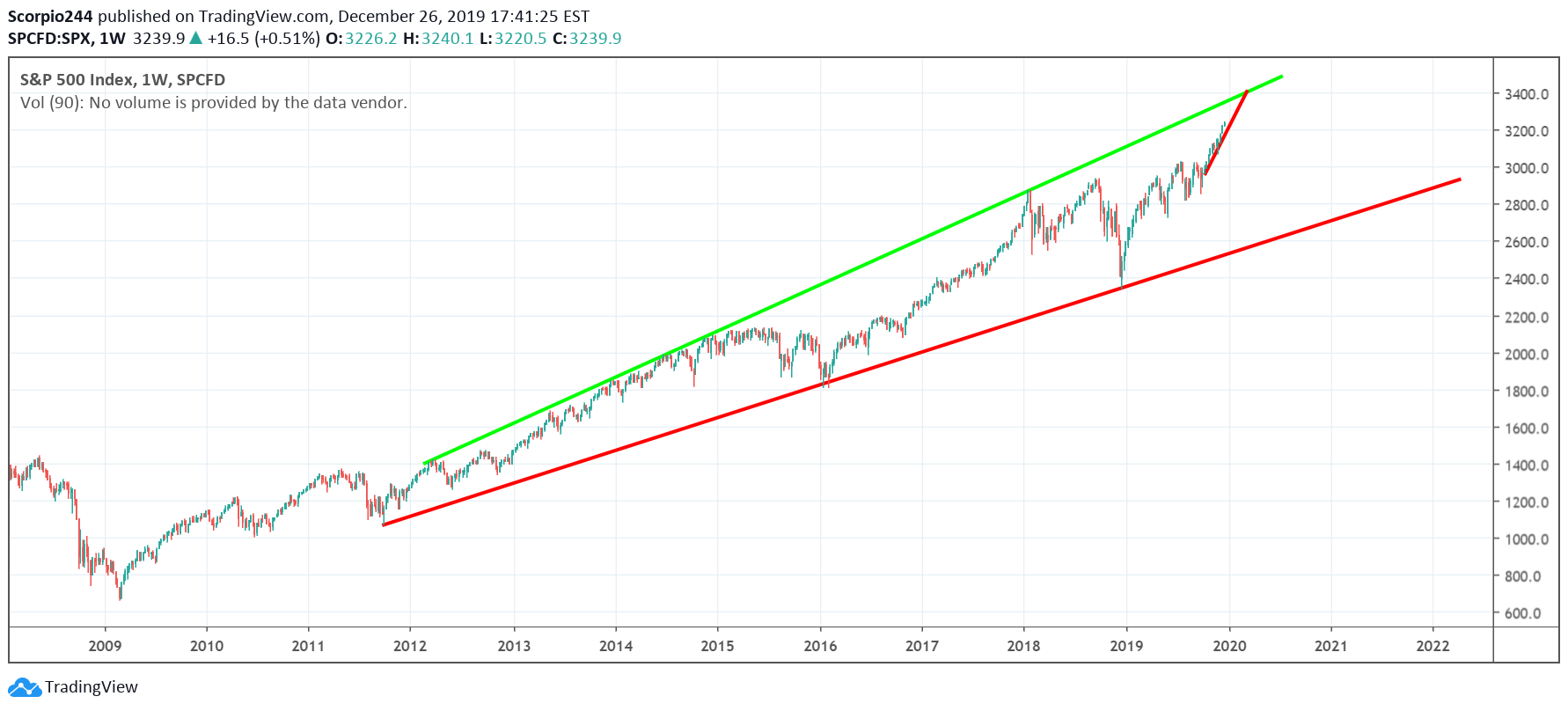

S&P 500

Stocks continue to march higher with no end in sight. By many indications, the market is getting extraordinarily overbought, and it worries me for what will come once it decides to turn lower.

However, here is a new thought. If we are entering a period like I think we are beginning, which is the eventual rise to around 3,600 on the S&P 500, the path the market is likely to take becomes more linear, and that means pullbacks, and the sharp, and violent moves of the past will dissipate. It means pullbacks will be short-lived and in the 2-3% range, and not in the 8-10% range. It will be something that resembles 2017, with no 10% correction, or perhaps a period like 2012 to 2015.

When looking at the chart, it seems apparent that the S&P 500 has only one thing in mind, and that is to rise to 3,400.

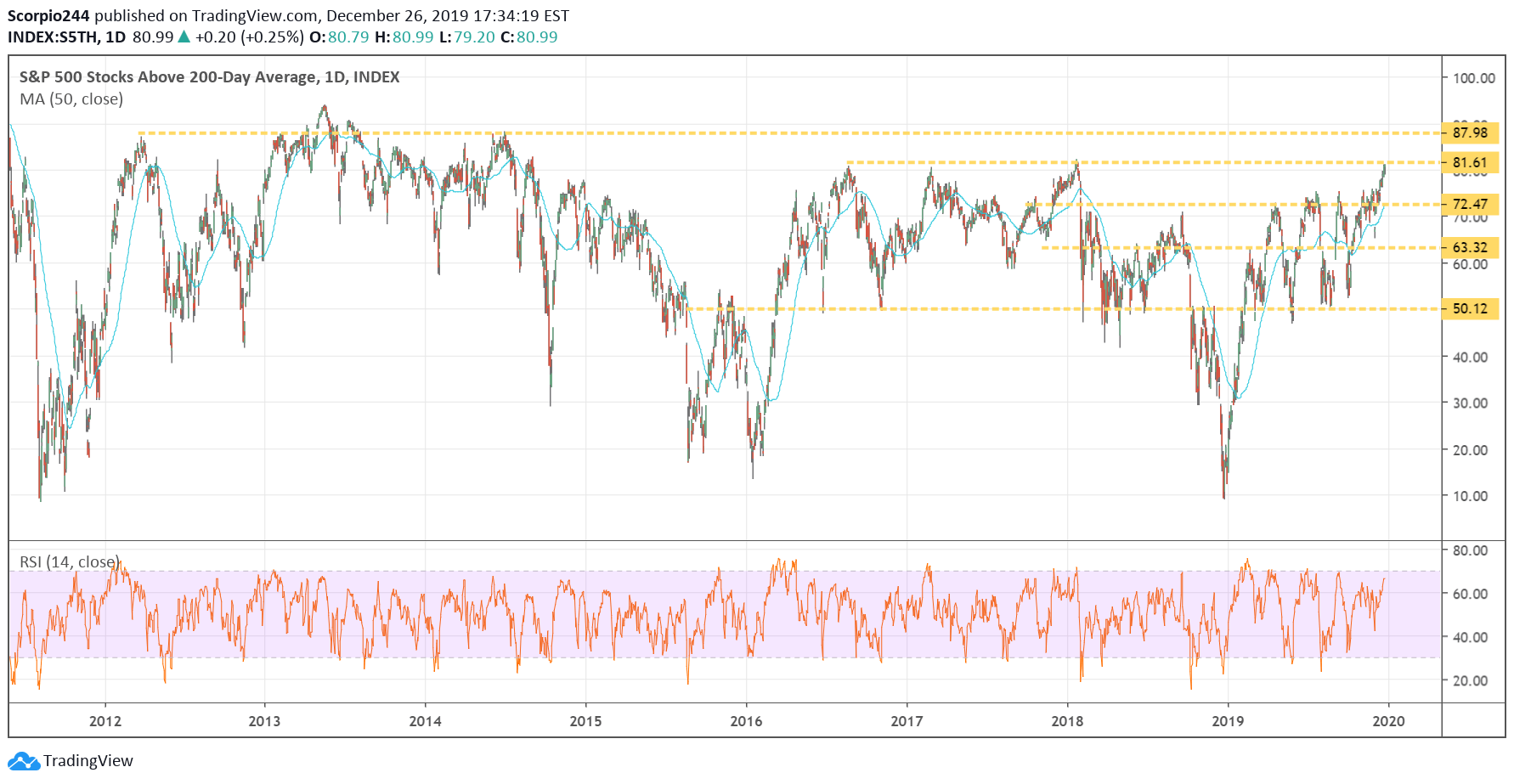

It also means that the number of stock trading above their 50 and 200 day moving averages will remain more elevated as well, where they peak around 88 to 90%. What it means is that the market may still have much further to rise and that a pullback may merely not becoming.

It means that the rally may simply carry into the start of 2020.

Apple

Apple (NASDAQ:AAPL) is up to $291, and I have no idea what happens now. I love the fact that the stock is going up, but it is not easy figuring out where it goes next. Based on the prior patterns, it would seem that Apple is due to consolidate now around this $291 region, meaning trade sideways.

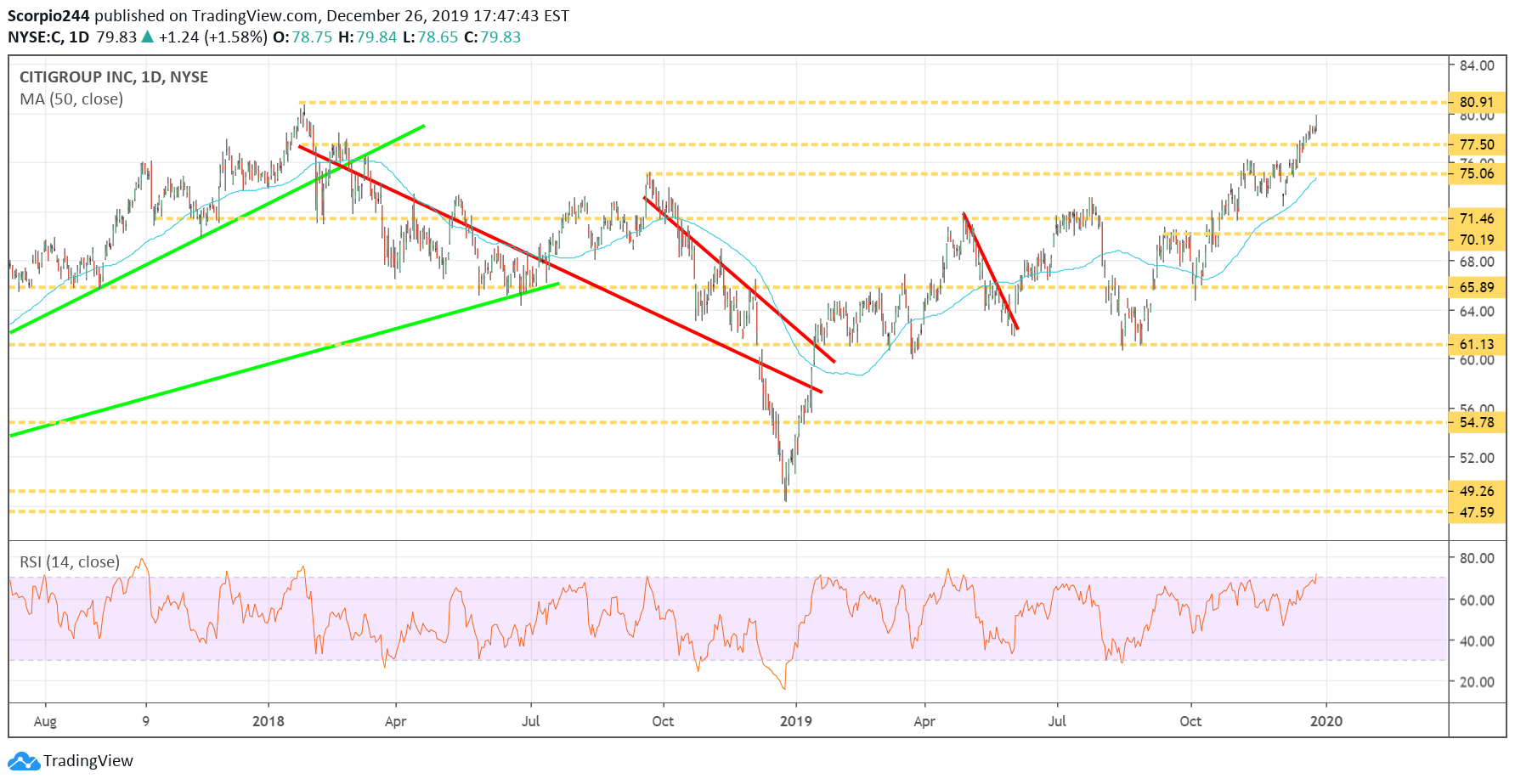

Citigroup

Citigroup (NYSE:C) appears to be heading towards $81.

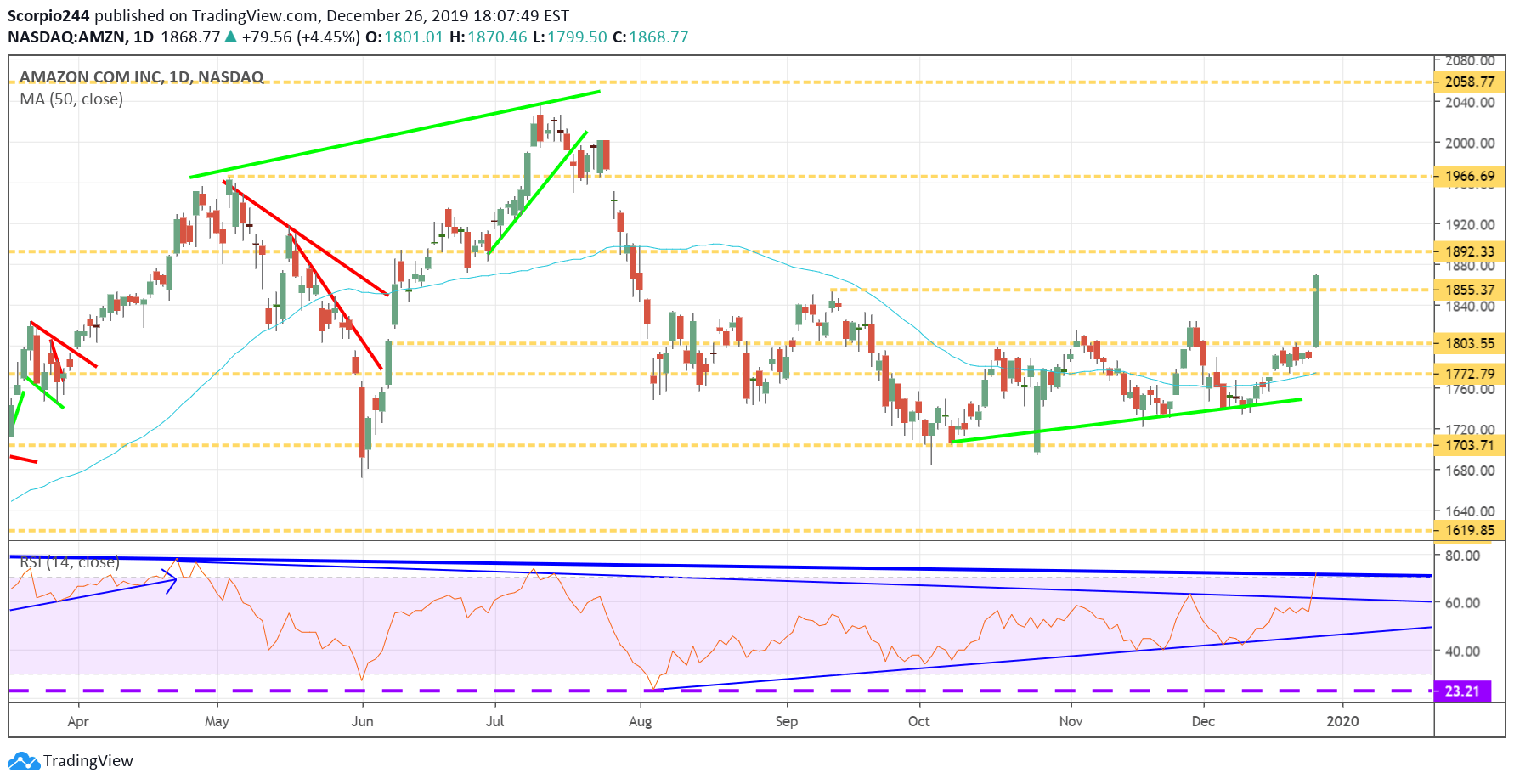

Amazon

Amazon (NASDAQ:AMZN) rose sharply today, and that bullish option betting I saw a few weeks back appears to have been the correct bet. I wrote this on December 9 when the shares were $1750 – Amazon Is Seeing Bullish Betting, Suggesting 7% Increase

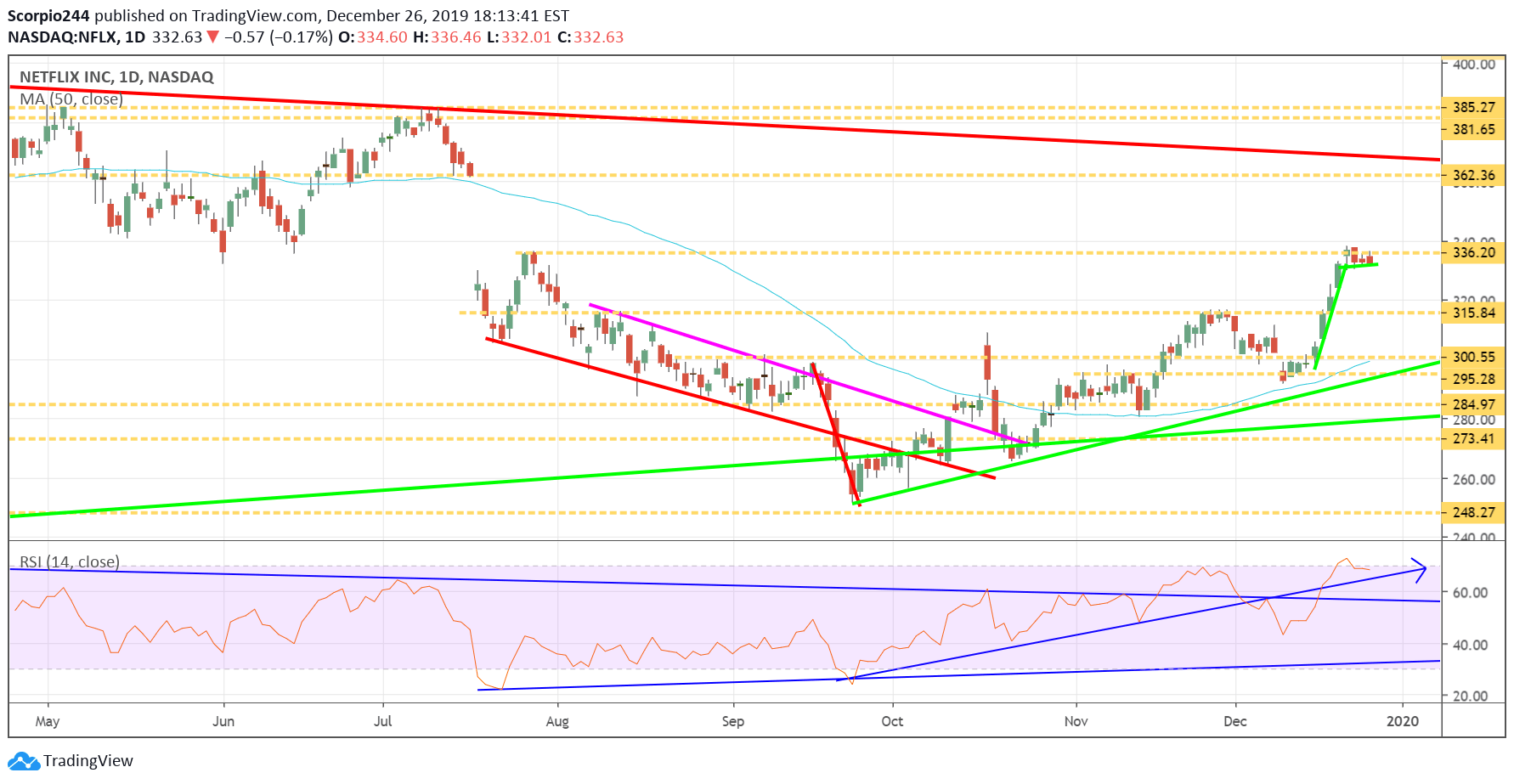

Netflix

Netflix (NASDAQ:NFLX) has been consolidating around $336, and now it may be getting ready to make that push to $362.

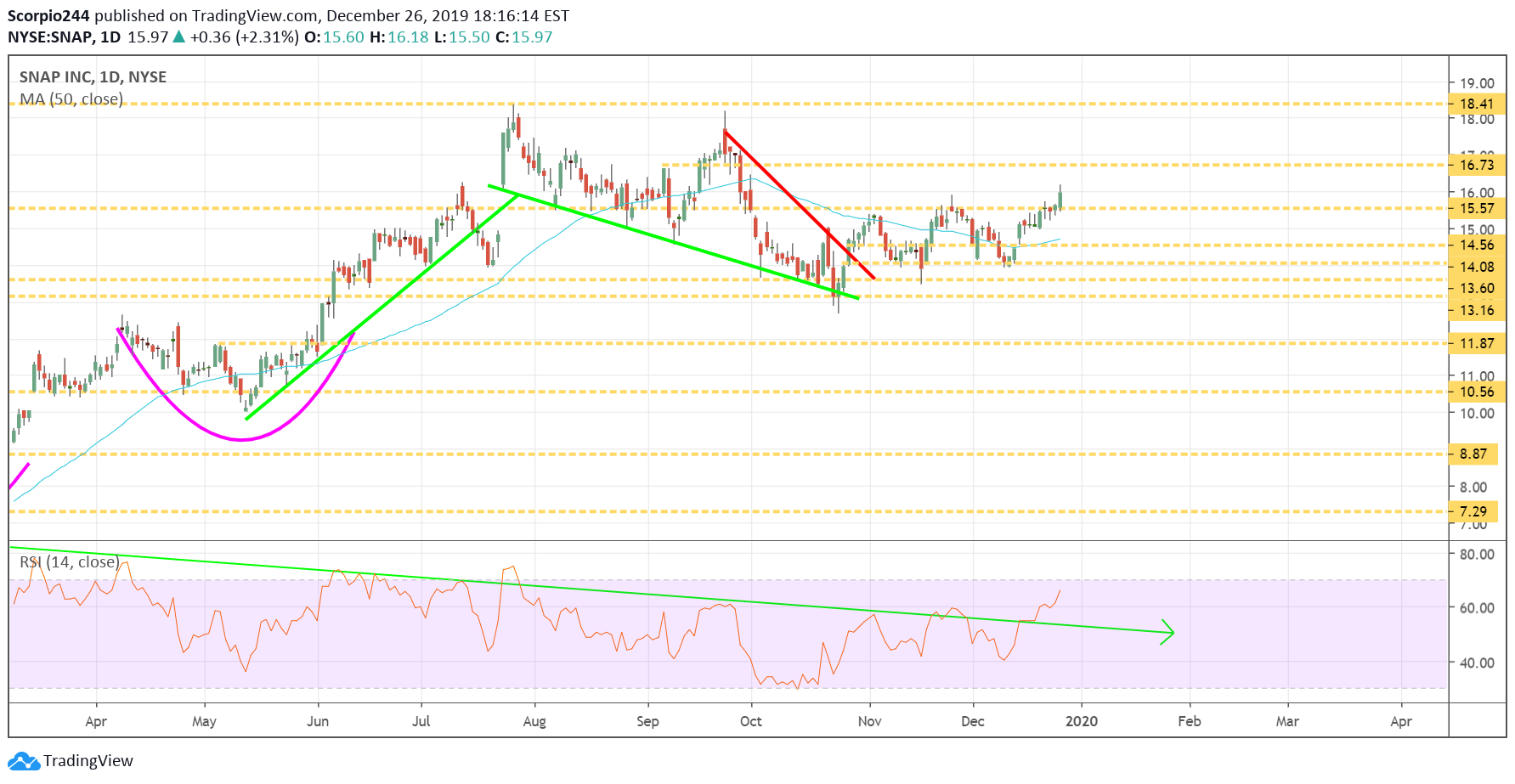

Snap

Snap (NYSE:SNAP) also had a good day rising above resistance at $15.50, and now the stock could be on a path to $16.75.