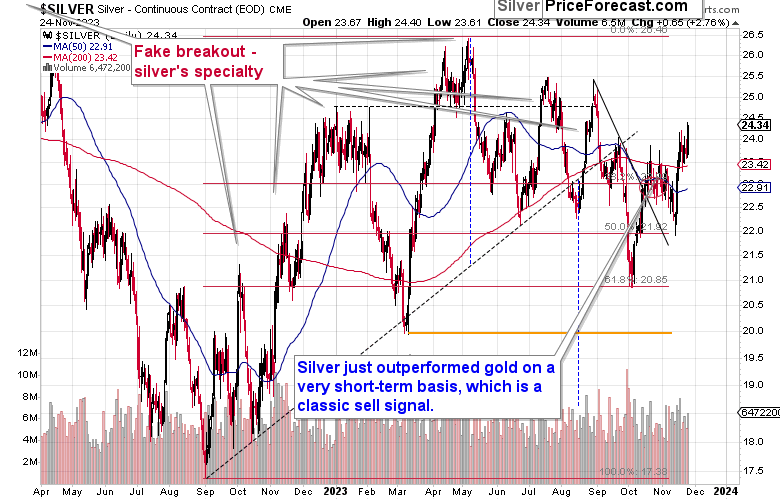

Silver just shot up, and given what the stock market is doing, it makes perfect sense.

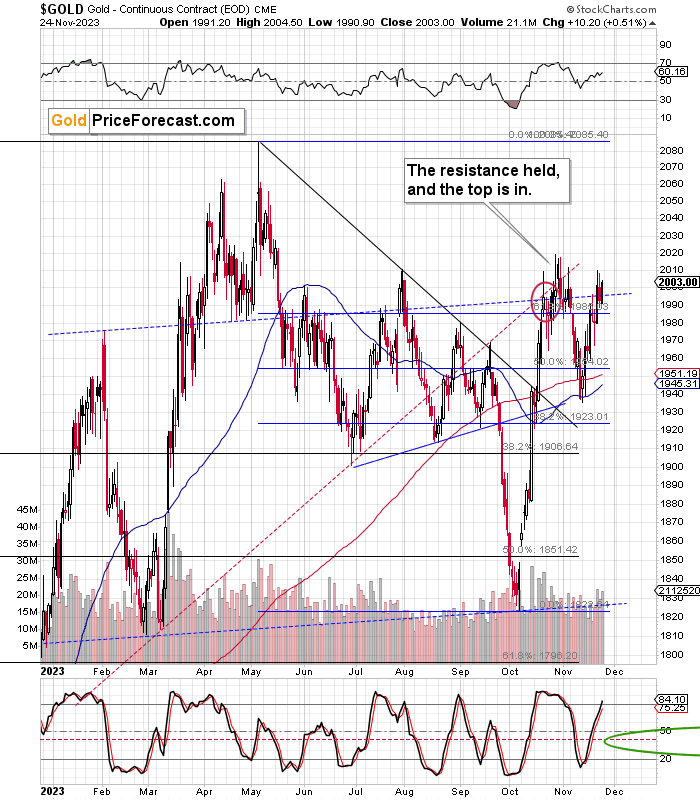

Namely, it’s most likely the final part of the rally in them both, and the same is the case for gold and mining stocks.

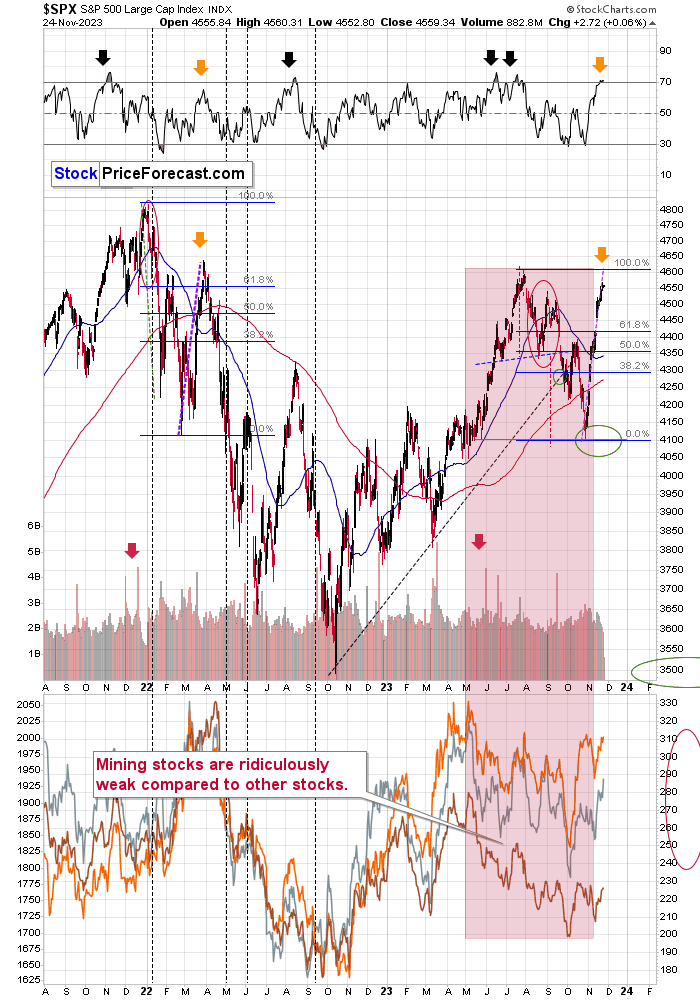

Starting with the stock market, it’s still the case that the shares are following their early-2022 path.

What I wrote about it previously, remains up-to-date:

Stocks soared recently. It is usually the case that people associate rallies with bullishness and declines with bearishness. Incorrectly so – bullish and bearish are terms that are about the future and forecasts, whereas a rally or a decline are terms that refer to the past – something that already happened.

Does the fact that a price moved higher make it likely to go higher in the future? No.

In fact, a price can’t form a top, without a prior rally.

What does matter is an entire set if indications and context in which a given rally or a decline took place.

In the current situation, the rally in stocks is very much aligned with the same kind of action that we saw in early 2022, which also took place right after the concern about the military conflict peaked. Both rallies were sharp. In fact, they are almost identical in terms of sharpness. I marked the 2022 rally with a purple, dashed line, and I copied it into the current situation. It turns out that the moves are extremely similar.

In relative terms, the current move up is bigger, but in absolute terms, the current move is smaller. It’s a tough call to say which analogy is more important, so overall, we can say that it seems that stocks have either rallied as much (approximately) as they did in 2022, or they are about to top.

Interestingly, if the 2022 rally is repeated to the letter, the S&P 500 Index would be likely to top at its previous 2023 top. Either way, the top seems to be either in or at hand.

And you know what happened to the prices of mining stocks when stocks rallied back close to their yearly highs?

Almost nothing.

Mining stocks almost completely ignored stocks’ rally! This is particularly visible when you focus on the shaded area. At the same time stocks rallied substantially, while miners plunged.

This extreme weakness is a bearish sign for the miners on their own, but it’s also a sign that when stocks finally do decline (again, any day now), then miners are likely to magnify those declines and decline in a truly profound manner.

As stocks moved higher exactly as they did in 2022, the bearish implications of the analogy remain intact. A confirmed breakout to new yearly highs would make things bullish for stocks, but that simply wasn’t the case.

Moving to silver, those who have been following my analyses and/or the precious metals for some time know that when silver soars relative to gold, it’s likely time to buckle up and prepare for a price drop. That’s simply what the silver market does.

The silver market is considerably smaller than the gold market, and it’s more popular among individual investors (compared to the interest from institutions), which means that as the investment public gets excited, it’s likely to push the silver market more than the gold market. And when does the investment public get particularly excited? That’s right – at the tops or very close to them.

That’s exactly what we saw. Silver moved above its recent highs even though gold didn’t.

In gold’s case, it’s just another attempt to move above the rising, dashed resistance line that’s parallel to the one connecting the March and October bottoms. The previous attempt to break above this line was invalidated, so it’s likely that it will also fail this time.

Consequently, it doesn’t seem to be a good idea to blindly follow the latest immediate-term move in gold and silver. Those moves higher are likely tricky, just like silver’s sudden upswings usually are.