Stocks

Stock markets show growth after the release of strong data for China and Japan as their respective PMIs were better than expected, which supported the optimistic mood of the market. China’s blue-chip index China A50 updated yearly highs, adding 5.3% during the rally since last Friday.

Futures on the US S&P 500 returned to 2860 – an October highs area – following the positive Asian markets dynamics and hopes for the progress in trade negotiations with China.

Technical analysis suggests that growth momentum may last in the near future: growth correction was relatively recent, RSI is far from overbought, MA (50) crossed MA (200) from the bottom up and is below the level of quotations.

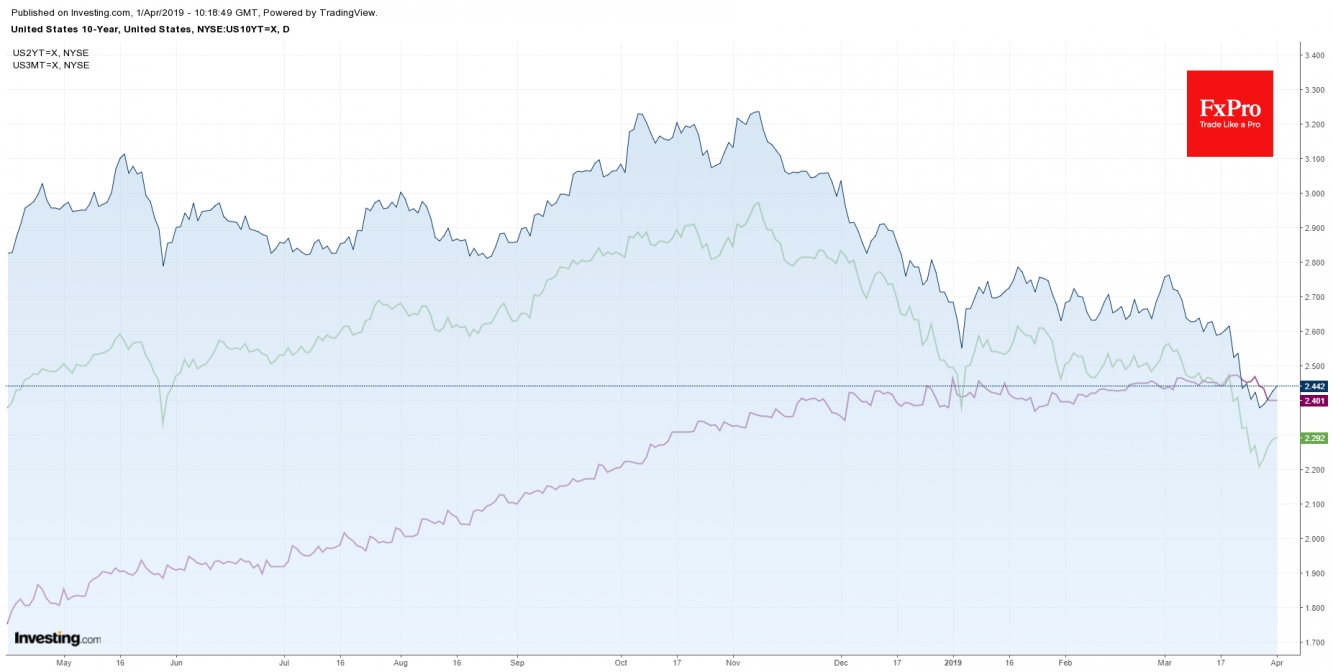

Bonds

The US government bonds yield with a maturity of more than two years has turned to growth since last week, which is a positive signal of risk appetite on the markets.

The U.S. 10-year treasury yield rose to 2.45% after a decline to two-year lows of 2.34% last week. Low rates at the long end of the yield curve were associated by investors with expectations of business sentiment worsening, which put pressure on the markets.

EUR/USD turned to growth last Friday at levels near 1.1200. The demand growth for risky assets strengthens purchases. However, the pair remains generally in a down channel from January amid weak data. At the same time, the Eurozone continues to publish weak statistics. The regional manufacturing PMI showed a decline to a minimum level for 6 years. Inflation remains far from normal levels, heightening the ECB’s concerns.

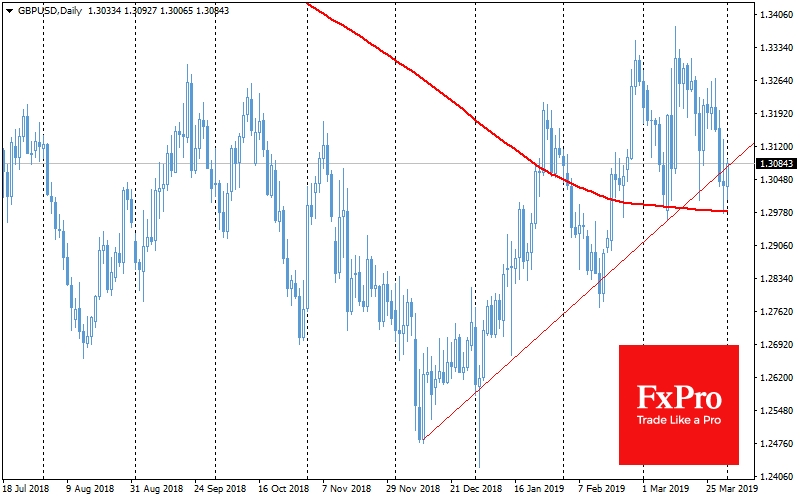

GBP/USD fell on Friday from 1.3130 to 1.2980 after the latest news about Brexit. The probability of a chaotic Britain exit from the EU on April 12 increased after another refusal of the British Parliament to support the existing deal. The pair is partially recovering due to the overall positive in the markets, but remains vulnerable, as the British Parliament will vote on various Brexit options on Monday at 7:00 pm GMT. Technically, GBP/USD managed to stay above the MA level (200). A break below can open the way to a further decline while maintaining positions above this level demonstrates the prevalence of positive sentiment.

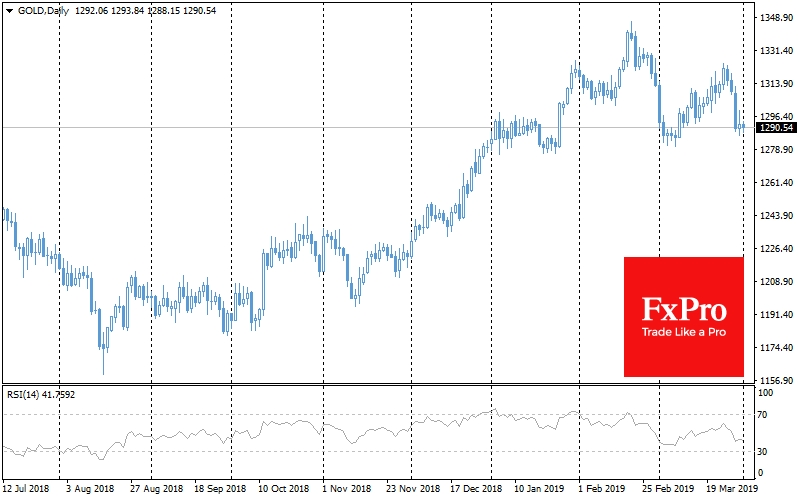

Gold is trading near $1290, being under pressure from the beginning of last week. The most severe blow to gold occurred on Thursday when it lost 1.5%. Seasonal factors and increased demand for risks are locally against gold. A fall below 1280 – the previous consolidation area of January and March – can open the way to a decline to 1250, near which MA (200) passes.

Japan and China have shown growth above expectations, bringing the issue of the oil market balance to the surface. Brent crude quotes reached a high of $68.60 on Monday from November 2018, on expectations of developing countries consumption growth, while OPEC + continues to restrict production, and the number of drilling rigs in the United States is falling, in spite of the growth in prices in the last 3 months.

Alexander Kuptsikevich, the FxPro analyst