The coronavirus and economic slowdown fears continued dominating headlines in the recent days. Our last week’s Stock Pick Update has been released at the local high of stock market’s dead-cat-bounce upward correction. Then the broad stock market resumed its downtrend, and on Monday it basically crashed following Friday’s OPEC meeting negative oil news. Let’s check which stocks could magnify S&P 500’s gains in case it rallies, and which stocks would be likely to decline the most if S&P plunges. Here are our stock picks for the Wednesday, March 11 – Tuesday, March 17 period.

The S&P 500 index has lost 5.37% since last Wednesday’s open. But our five long and five short stock picks were flat, as they lost 0.19% in the same period! So our stock picks have been relatively much stronger than the broad stock market for the third time in a row. Our short stock picks gained 11.96% and they outperformed the index on the short side again. Long stock picks lost 12.34%, but the whole ten-stock-picks portfolio performed incredibly well in time of a stock market’s big sell-off.

If stocks were in a more prolonged downward correction, being able to profit anyway, would be extremely valuable. Of course, it’s not the point of our Stock Pick Updates to forecast where the general stock market is likely to move, but rather to provide you with stocks that are likely to generate profits regardless of what the S&P does.

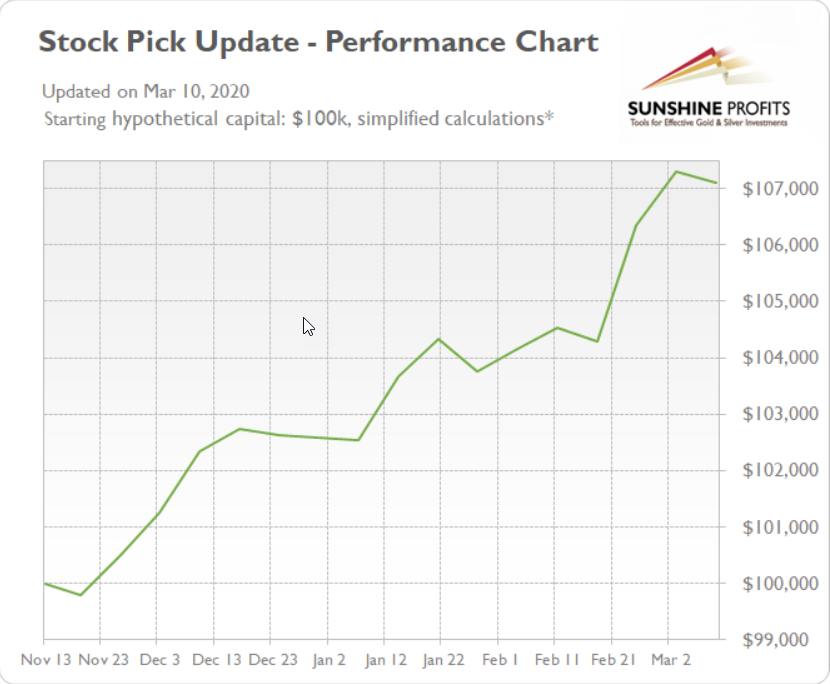

This means that our overall stock-picking performance can be summarized on the chart below. The assumptions are: starting with $100k, no leverage used. The data before Dec 24, 2019 comes from our internal tests and data after that can be verified by individual Stock Pick Updates posted on our website.

Below we include statistics and the details of our three recent updates:

-

Mar 10, 2020

Long Picks (Mar 4 open – Mar 10 close % change): VNO (-8.94%), WBA (+4.26%), PFE (NYSE:PFE) (-1.45%), NBL (-40.68%), JPM (-14.92%)

Short Picks (Mar 4 open – Mar 10 close % change): APA (-57.45%), PGR (-0.09%), ROK (-9.59%), EQIX (-2.51%), KR (+9.84%)

Average long result: -12.34%, average short result: 11.96%

Total profit (average): -0.19% -

Mar 3, 2020

Long Picks (Feb 26 open – Mar 3 close % change): BKR (-11.98%), MMM (-2.89%), PFE (+0.18%), EXR (-0.96%), WEC (-2.91%)

Short Picks (Feb 26 open – Mar 3 close % change): MAA (-4.20%), EIX (-9.01%), CLX (-0.02%), OKE (-7.87%), CMI (-6.54%)

Average long result: -3.72%, average short result: +5.53%

Total profit (average): +0.91% -

Feb 25, 2020

Long Picks (Feb 19 open – Feb 25 close % change): XEC (-7.66%), BSX (-5.67%), NUE (-5.31%), PEG (-2.69%), SPG (-2.59%)

Short Picks (Feb 19 open – Feb 25 close % change): AEE (-3.55%), CBRE (-8.58%), INTC (-10.03%), SLB (-13.40%), A (-7.97%)

Average long result: -4.78%, average short result: +8.71%

Total profit (average): +1.97%

The broad stock market has reached historically high levels recently. The breathtaking correction in December of 2018 was followed by the record-breaking comeback rally. The late October – early November breakout led to another leg higher, as the S&P 500 index broke above 3,300 mark. But the recent sell-off suggests that investors should prepare for volatility. If the market reverses higher, which stocks are going to beat the index? And if it continues lower from here, which stocks are about to outperform on the short side?

We will provide stock trading ideas based on our in-depth technical and fundamental analysis, but since the main point of this publication is to provide the top 5 long and top 5 short candidates (our opinion, not an investment advice) for this week, we will focus solely on the technicals. The latter are simply more useful in case of short-term trades.

We will assume the following: the stocks will be bought or sold short on the opening of today’s trading session (March 11) and sold or bought back on the closing of the next Tuesday’s trading session (March 17).

First, we will take a look at the recent performance by sector. It may show us which sector is likely to perform best in the near future and which sector is likely to lag. Then, we will select our buy and sell stock picks.

There are eleven stock market sectors: Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Technology, Communications Services, Utilities and Real Estate. They are further divided into industries, but we will just stick with these main sectors of the stock market.

We will analyze them and their relative performance by looking at the Select Sector SPDR ETFs.

Based on that, we chose our top 3 long and top 3 short candidates using trend-following approach, and top 2 long and top 2 short candidates using contrarian approach:

Trend-following approach

-

buys: 1 x Consumer Staples, 1 x Utilities, 1 x Real Estate

-

sells: 1 x Energy, 1 x Financials, 1 x Industrials

Contrarian approach (betting against the recent trend):

-

buys: 1 x Energy, 1 x Financials

-

sells: 1 x Consumer Staples, 1 x Utilities

Trend-following approach

Top 3 Buy Candidates

(charts courtesy of stockcharts.com)

Consumer Staples

- Archer-Daniels-Midland Company (NYSE:ADM)

-

Potential rising wedge bottoming pattern

-

Technically oversold – short-term upward correction play

-

Positive divergence between the price and RSI indicator

-

Resistance level of $39-40 (upside profit target level)

Utilities

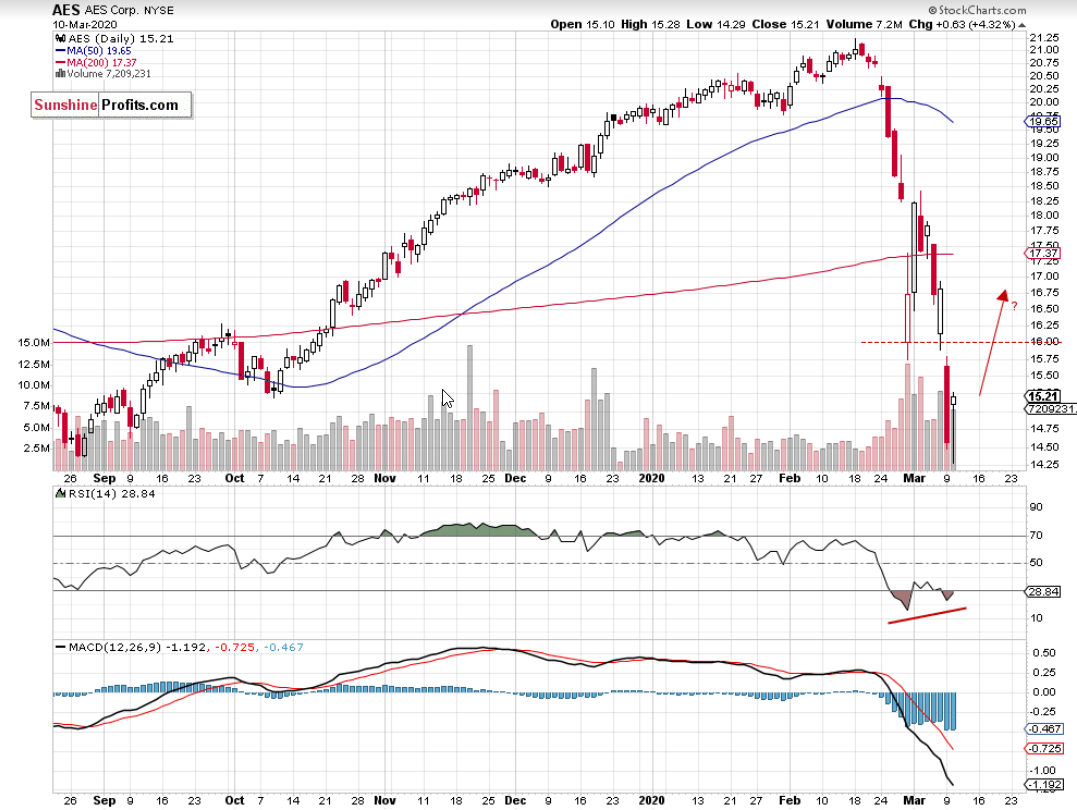

- The AES Corporation (NYSE:AES)

-

Technically oversold – short-term upward correction play

-

Positive divergence between the price and RSI indicator

-

Potential resistance level at $16

Real Estate

- Simon Property Group Inc (NYSE:SPG)

-

Potential upward reversal pattern – upward correction play

-

The resistance levels of $120 and $130

Summing up, the above trend-following long stock picks are just a part of our whole Stock Pick Update. The Consumer Staples, Utilities and Real Estate sectors were the strongest since February 11. And they have lost less than the S&P 500 index in the same period. So that part of our ten long and short stock picks is meant to outperform in the coming days if the broad stock market acts similarly as it did before.