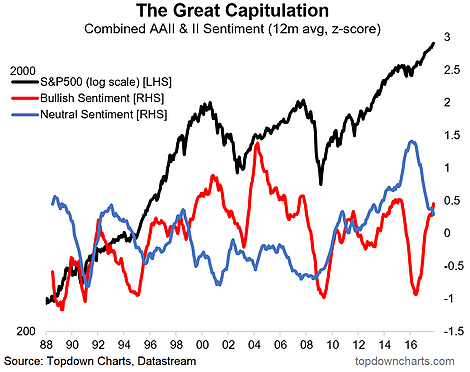

Funny things can happen when you mix human psychology with greed and constant stimulus. The seemingly straight-line march upward in the S&P 500 has triggered a rise in bullish sentiment as a great migration is underway from neutral sentiment to bullish sentiment.

When investors are faced with almost consistently rising stock prices, and the constant news/noise from social media, blogs, and traditional media, it reinforces the bullish sentiment and engages a positive feedback loop - also referred to as an awakening of animal spirits.

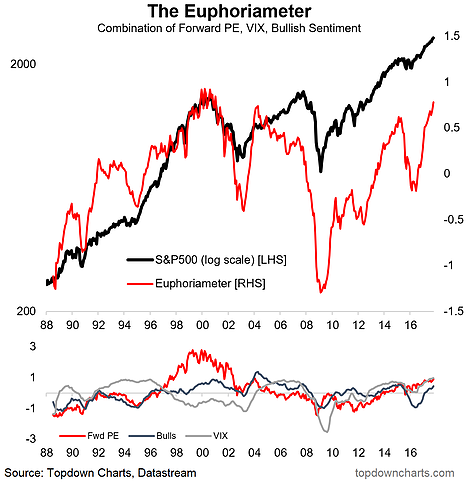

Measuring sentiment can be difficult as there are many different gauges and metrics and sources of info. We've taken the approach of bringing in surveyed sentiment, risk pricing, and valuations to give a holistic view of stockmarket confidence which we call The Euphoriameter. As it turns out the October reading of this indicator has reached not only a new post-crisis high, but has actually moved to levels last seen during the height of the dot com boom.

For newer participants in the market, take note because this is what a real bull market looks and feels like, and while it may continue higher for longer (that important point about animal spirits), the higher confidence rises, the greater the expectations, the bigger the scope is for disappointment. Until then euphoria is the dominant mood of the market at this point.

We're told that markets don't go up in a straight line... but what happens when they basically do just that? Bullish sentiment rises, that's what. We're seeing a great migration from neutral to bullish sentiment.

The Euphoriameter has moved up to levels last seen during the dot com boom of the late 1990's.