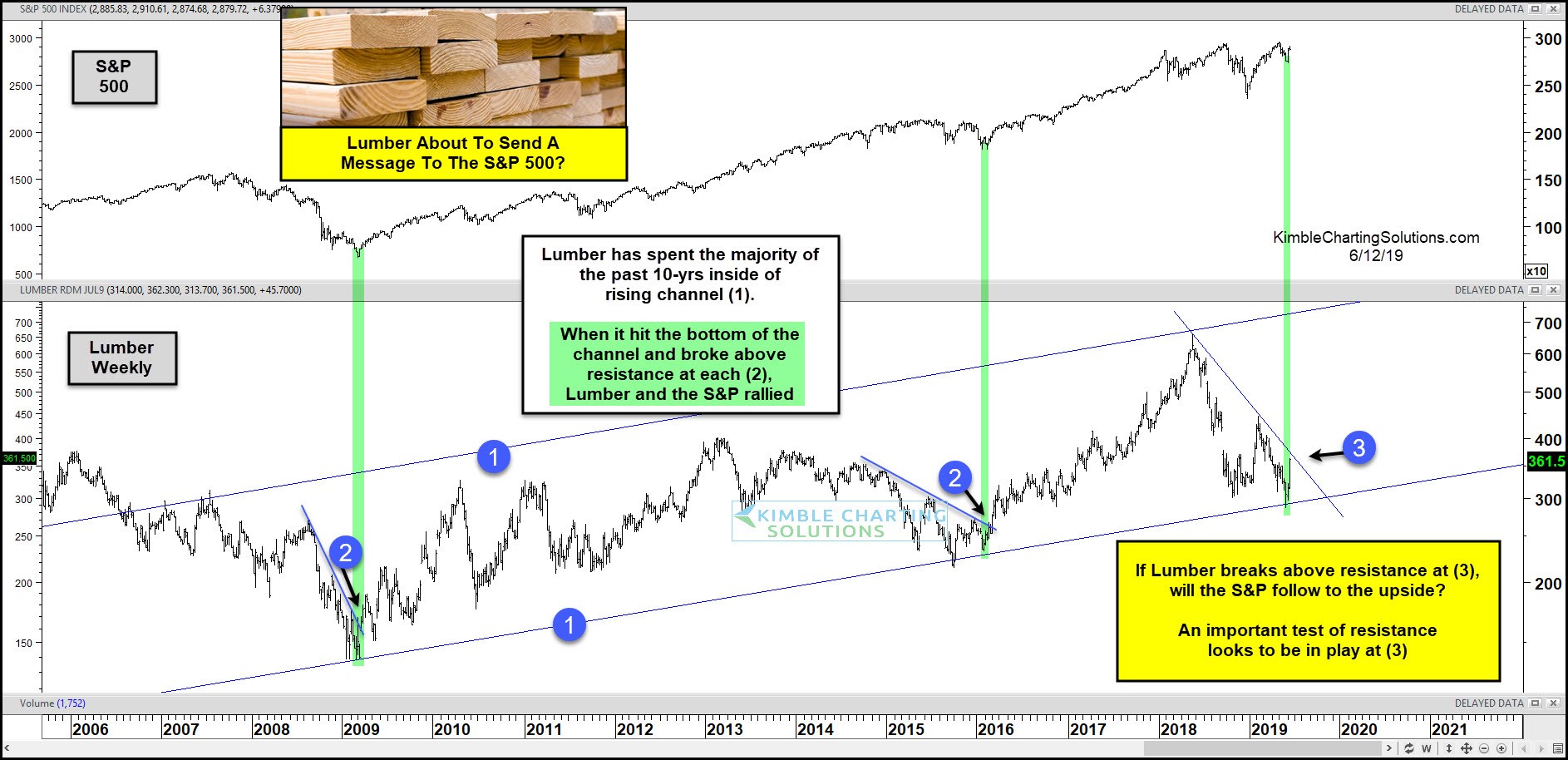

For the past decade, lumber prices have traded within a broad rising trend channel.

See (1) on the weekly lumber chart above. Recently, lumber hit the bottom of that channel and began to bounce higher. This could be good news for the S&P 500 and stock-market bulls.

The past two times that lumber bounced off the lower channel and broke out above its short-term declining trend line (2), it sent a bullish signal for both lumber and the S&P 500.

Currently, lumber is testing its short-term declining trend line (3) and that may send an important message to the S&P 500 once again.

So all you stock bulls who are hoping for a breakout at (3), stay tuned.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.