Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook is neutral, and our short-term outlook is neutral. Our medium-term outlook remains neutral, following S&P 500 index breakout above last year's all-time high:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): neutral

The main U.S. stock market indexes gained between 0.4% and 1.4% on Wednesday, as investors reacted to U.S. presidential elections outcome, following very sharp overnight futures sell-off. The S&P 500 index broke above the resistance level of 2,150-2,160, marked by previous local highs.

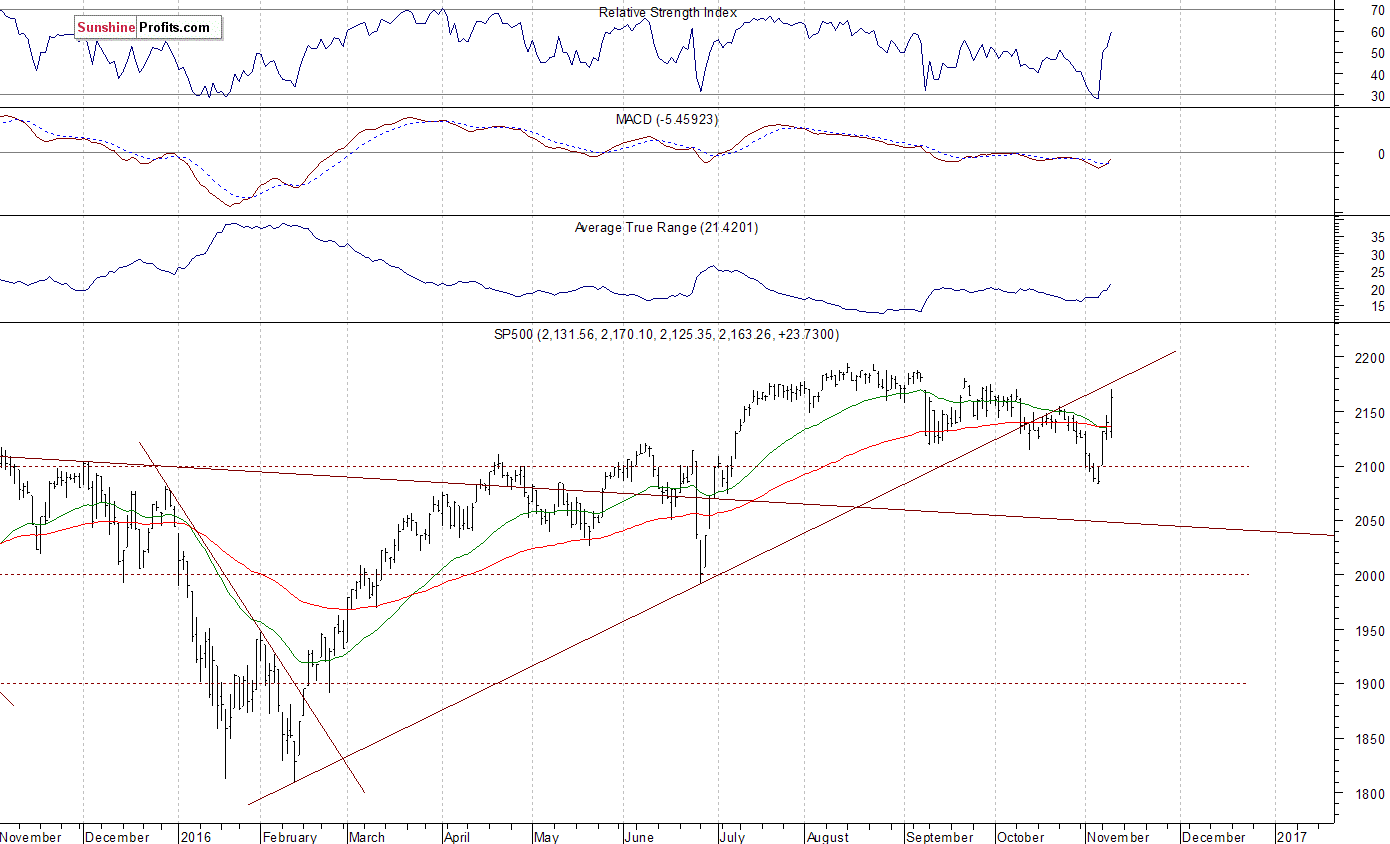

The next resistance level is at 2,180-2,200, marked by record high. On the other hand, support level is at 2,100-2,120, marked by previous resistance level. The next important level of support remains at around 2,080, marked by recent local lows, as we can see on the daily chart:

Expectations before the opening of today's trading session are positive, with index futures currently up 0.6-0.8%. The European stock market indexes have gained 0.6-1.1% so far. Investors will now wait for the Initial Claims number release at 8:30 a.m.

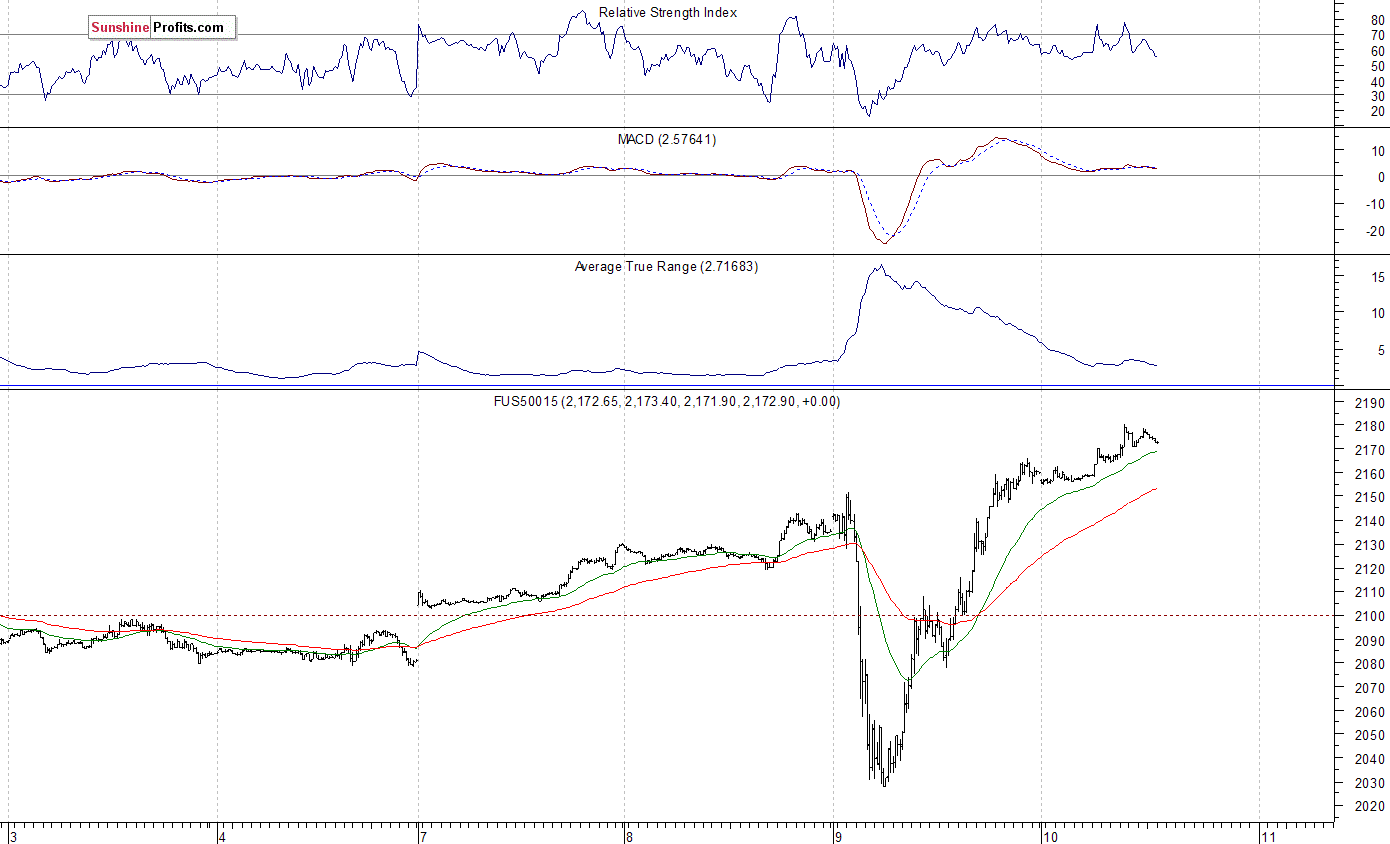

The S&P 500 futures contract trades within an intraday uptrend, as it extends its yesterday's rally. The nearest important level of resistance is at around 2,180-2,200, marked by previous consolidation along record highs. On the other hand, support level remains at 2,150, among others:

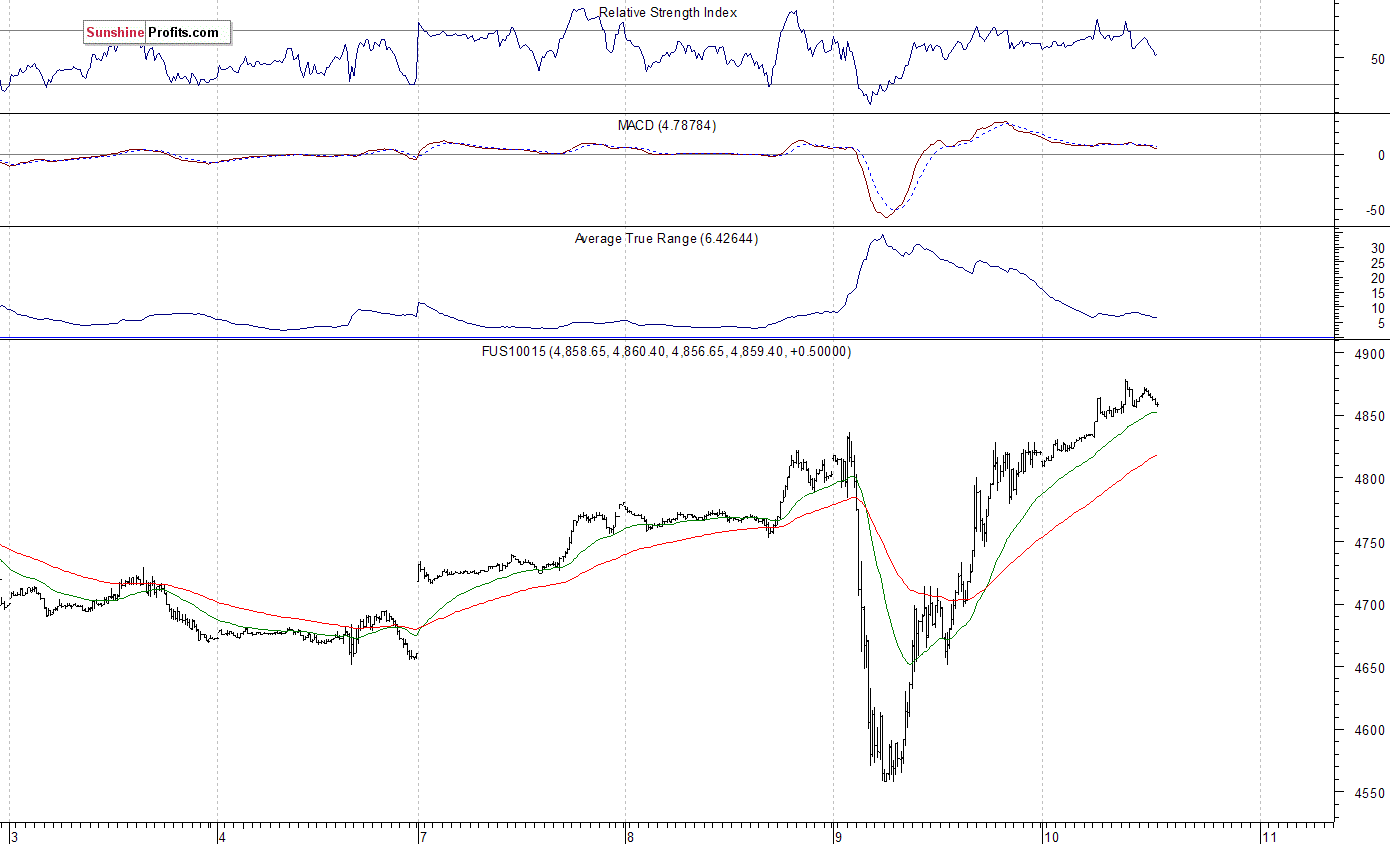

The technology Nasdaq 100 futures follows a similar path, as it currently trades within an intraday uptrend, extending its yesterday's rally. The nearest important level of resistance is at 4,880-4,900. On the other hand, support level is at 4,780-4,800, marked by short-term consolidation, as the 15-minute chart shows:

Concluding, the broad stock market (S&P 500 index futures contract) was very volatile yesterday, as investors reacted to the U.S. presidential election news. Stocks extended their short-term uptrend, as the S&P 500 index got closer to record high again. We decided to close our profitable short position (opened on July 18 at 2,162 - S&P 500 index) at the opening of last week's Friday's trading session - the average opening price of the S&P 500 index was at 2,085.

Overall, we gained 77 index points on that over three-month-long speculative short trade following June - July rally off "Brexit" low. Currently, we prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.