- Wall Street headed for weekly slump amid China trade war fears

- Dollar stages dramatic reversal on safety bids but gold loses out

- Euro slips after ECB decision, yen steady but off week’s highs

Rate Cut Optimism Turns to Gloom

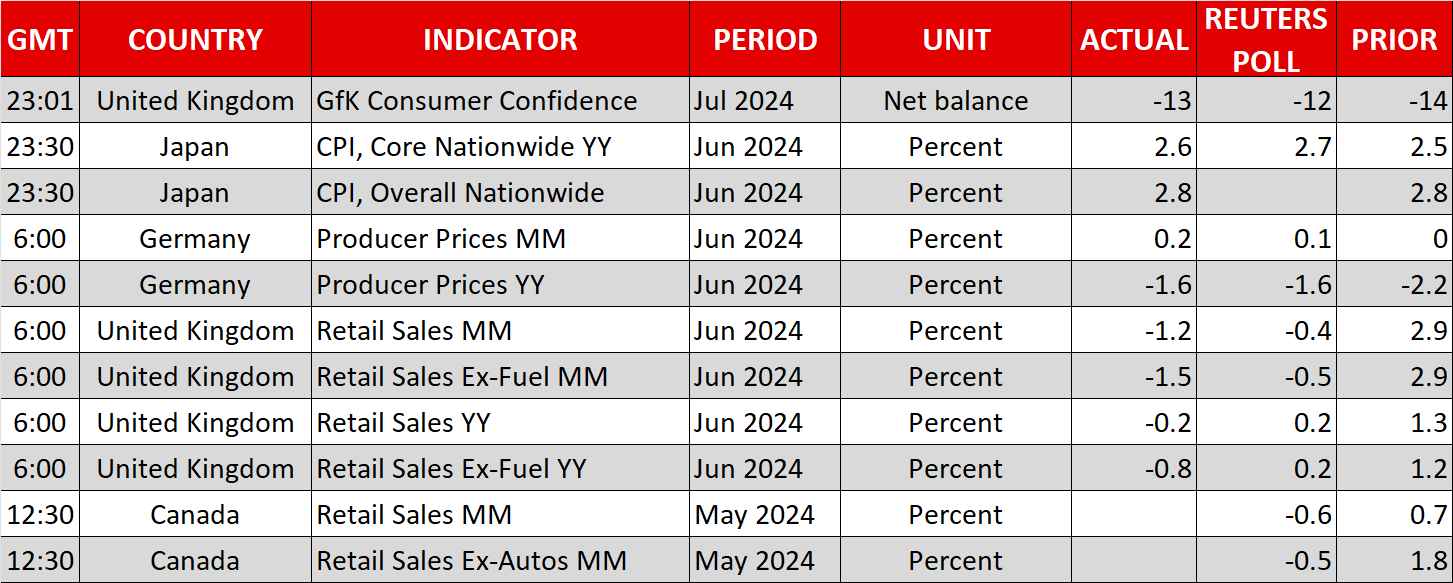

Equity markets were mostly in the red on Friday, adding to the weekly losses after a torrid week that began with optimism that a Fed rate cut is nearing but ended on heightened fears of a fresh trade standoff between China and the US.

It’s easy to interpret this panic as the market’s reaction to Trump’s increased prospects of winning the November presidential election.

After all, Trump’s campaign is proposing to slap tariffs of at least 60% on all imports from China. But it is the current administration’s plan to tighten the rules for all chipmakers that use US technology to sell to China that seems to have sparked this week’s rout.

Tech Stocks Take the Brunt of the Selloff

The Nasdaq is the worst hit, as the tech heavyweights were already looking overstretched ahead of their earnings releases and had additionally come under pressure from the rotation out of tech to small-caps and to companies benefiting from the Trump trade.

But yesterday’s better-than-expected earnings by Netflix (NASDAQ:NFLX) may help ease the panic and revive optimism ahead of next week’s results by Tesla (NASDAQ:TSLA) and Google parent Alphabet (NASDAQ:GOOGL).

China Pessimism Adds to Global Risk-Off

For equity markets globally, a second Trump presidency is seen much more of a lose-lose situation as Trump wants to impose a 10% tariff on all imports.

Adding to the gloom is the disappointment from China’s Third Plenum that ended without any major policy announcements to shore up consumers or the beleaguered property market.

An IT outage affecting airlines, banks and several other businesses also hurt sentiment.

Hong Kong’s Hang Seng index is one of the week’s worst performers, although shares in mainland China bucked the trend on suspected ETF purchases by the Chinese government.

Gold and Dollar in 180-Degree Turn

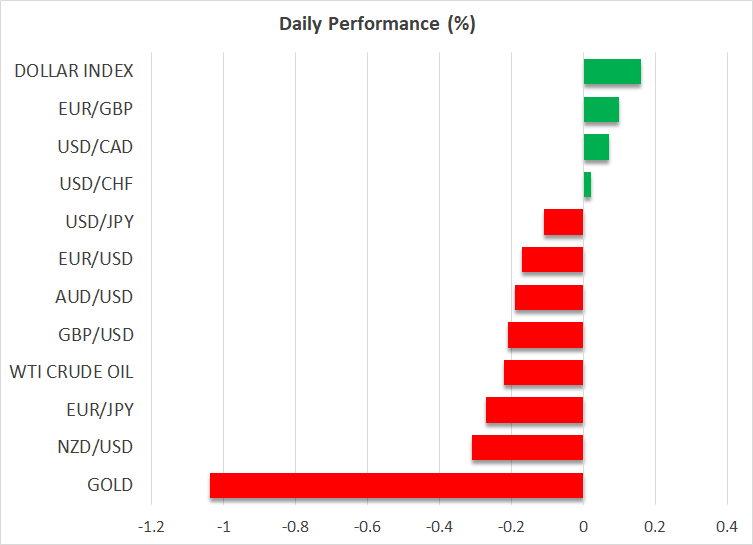

As for the US dollar, it’s been a roller-coaster ride, having slid at the start of the week on dovish Fed rhetoric but then reversing sharply higher on the back of the safe-haven flows as risk aversion set in. The greenback is on track the finish the week with small gains.

Gold, on the other hand, has surged to new all-time highs. Although some safety flows did go in the precious metal’s direction in the aftermath of Trump’s shooting, the current risk-off trade seems to be mostly benefiting the world’s favorite reserve currency.

Euro on the Backfoot, Yen Fares Somewhat Better

Elsewhere, the euro extended its losses for a second day following the ECB’s policy meeting yesterday where as expected, interest rates were kept on hold.

However, whilst President Lagarde did not commit to any rate cut decision for the September meeting, she sounded downbeat about the Eurozone’s growth outlook.

For investors, this was enough to reinforce expectations that further cuts are likely later in the year.

The yen was another currency giving up some of its weekly gains but its losses were more contained and it may yet manage to end the day slightly up on the week.

The Bank of Japan is thought to have intervened on at least two occasions this month and fears of further intervention are keeping traders on their toes.