The broad stock market has slightly extended its uptrend in the last five trading days (May 27 - June 2) again. More than two months ago on March 23, the S&P 500 index sold off to new medium-term low of 2,191.86. It was a stunning 35.4% below February 19 record high of 3,393.52. The coronavirus and economic slowdown fears have erased more than a third of the broad stock market value. Then we saw a huge come-back rally, as the index got back firmly above 3,000 mark. However, the index remains 10.1% below the February 19 record high of 3,393.52.

The S&P500 index has gained 2.16% since last Wednesday's open. In the same period of time our five long and five short stock picks have lost 0.49%. Stock picks were relatively weaker than the broad stock market last week. Our long stock picks have gained 1.58%, so they have basically followed the market. However, short stock picks have resulted in a loss of 2.55%. The overall results remain relatively better than the S&P500 index over the last months.

If stocks were in a prolonged downtrend, being able to profit anyway, would be extremely valuable. Of course, it's not the point of our Stock Pick Updates to forecast where the general stock market is likely to move, but rather to provide you with stocks that are likely to generate profits regardless of what the S&P500 does.

Let's check which stocks could magnify S&P's gains in case it rallies, and which stocks would be likely to decline the most if S&P500 plunges. Here are our stock picks for the Wednesday, June 3 - Tuesday, June 9 period.

We will assume the following: the stocks will be bought or sold short on the opening of today's trading session (June 3) and sold or bought back on the closing of the next Tuesday's trading session (June 9).

Top 3 Stock Candidates

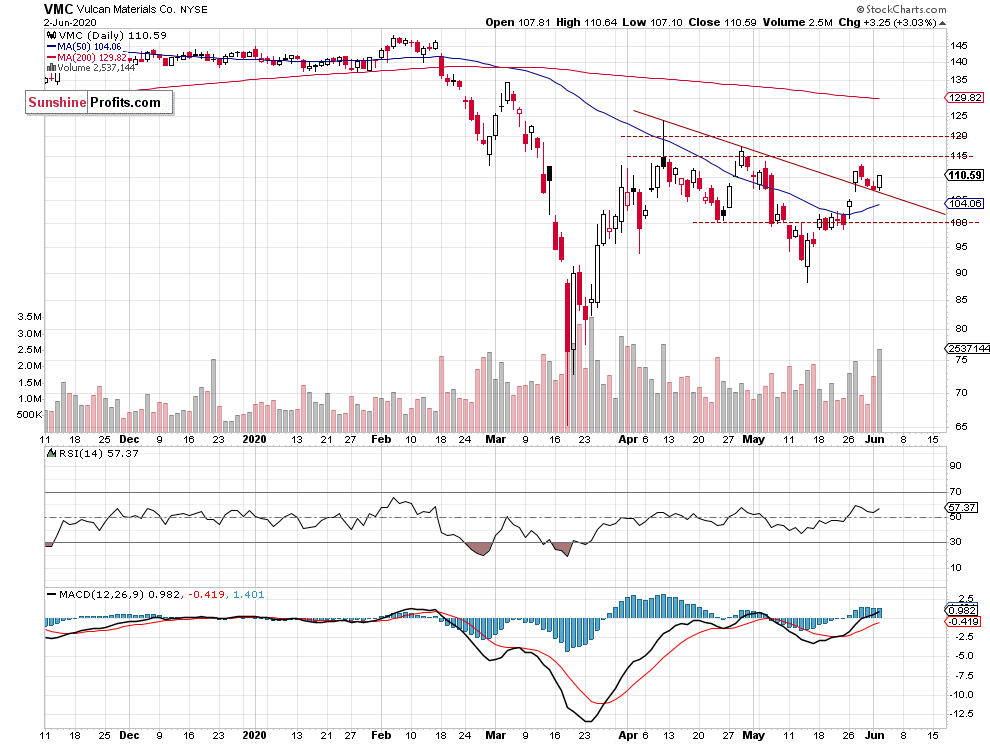

1. Vulcan Materials - Materials

- Vulcan Materials (NYSE:VMC) stock trades above its two-month-long downward trend line

- Potential breakout above bull flag pattern

- The resistance level of $115-120 (upside profit target level)

2. Discovery - Communication Services

- Discovery (NASDAQ:DISCA) stock trades above its downward trend line

- Upside profit target level of $22-23

- The support level remains at $17-18

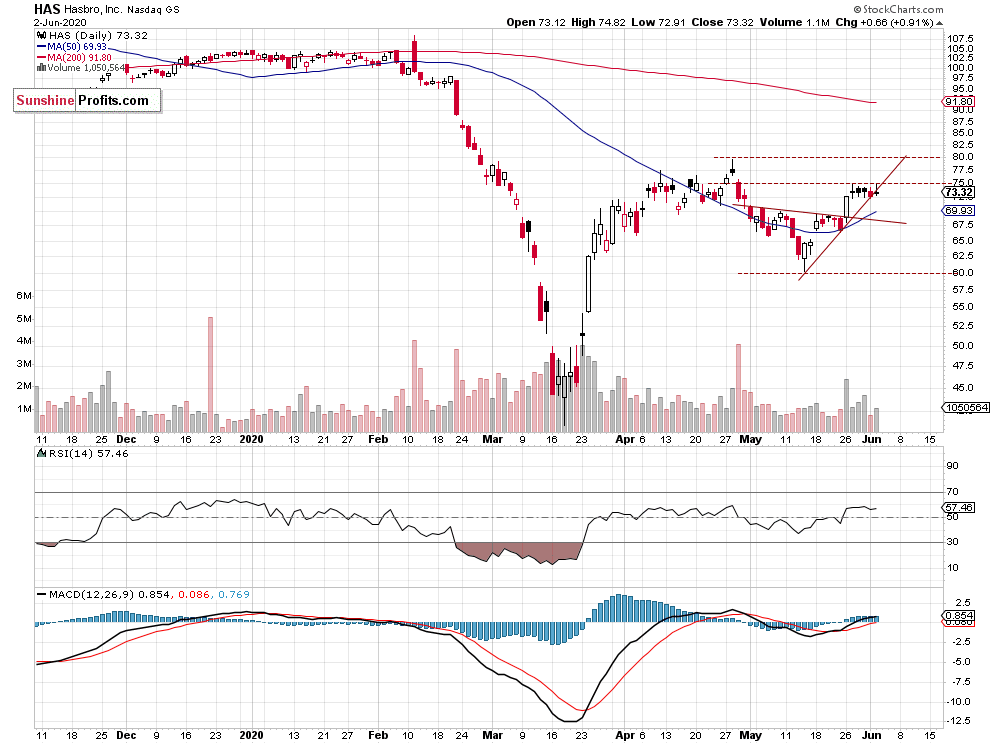

3. Hasbro - Consumer Discretionary

- The market trades along its short-term upward trend line following breaking above the resistance level of $70

- The resistance levels of Hasbro (NASDAQ:HAS) $80 (upside profit target)

- The support level remains at $60

Summing up, the above trend-following long stock picks are just a part of our whole Stock Pick Update. The Materials, Communication Services and Consumer Discretionary sectors were relatively the strongest in the last 30 days. And they all have gained more than the S&P 500 index in the same period. So that part of our ten long and short stock picks is meant to outperform in the coming days if the broad stock market acts similarly as it did before.