by Eli Wright

NVIDIA (NASDAQ:NVDA), which manufactures graphic, mobile and automotive computing chips, was the S&P 500’s biggest gainer last week, moving up 12.08%. That's just the icing on its current year-to-date performance: shares of NVDA are up an astounding 205%, from $32.30 where it started 2016, to $100.41, its record-high close before the weekend.

With just two more weeks until the end of 2016, we're certain NVIDIA will be at the top of many publications' “Stocks of the Year” lists.

NVIDIA is perhaps one of the few tech companies which even in a crowded sector, appears able to sustain monumental growth. That goes some way toward justifying its share price.

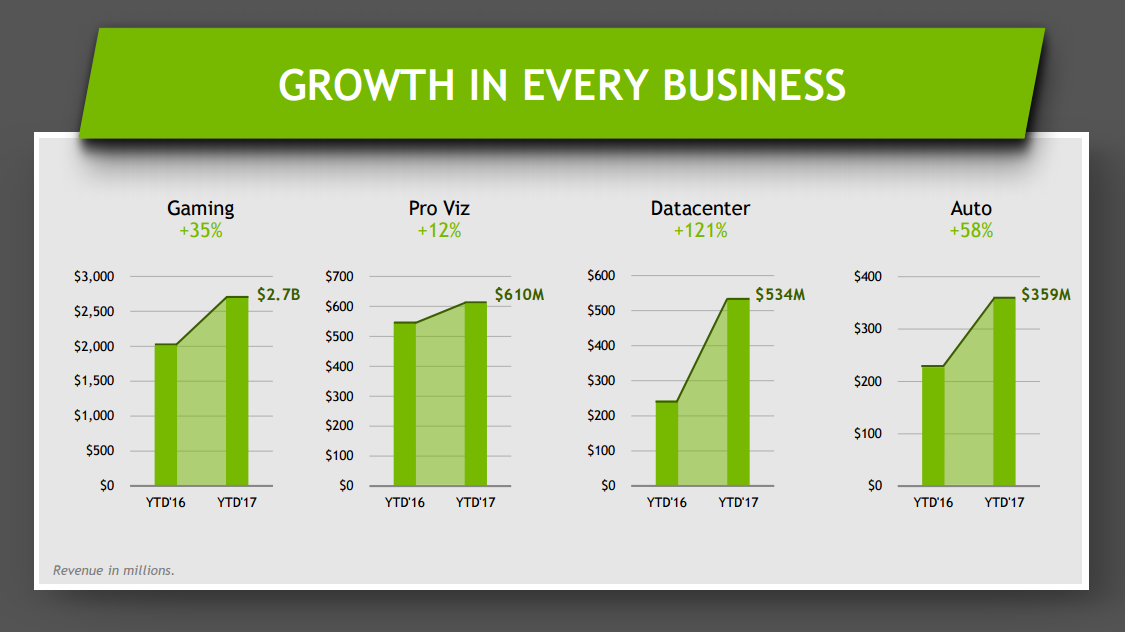

Indeed, in their Q3 2017 earnings report, released on October 30, 2016, NVIDIA showed sizeable improvement in virtually every segment of their business YTD:

- Their Gaming segment, a leader in the PC gaming, as well as in eSports, GeForce, and Nintendo Switch, grew by 35% YTD

- Their Pro Viz segment, which includes virtual reality and augmented reality technologies that the company hopes will redefine gaming, film, communication, education, healthcare and other industries, grew 12% YTD.

- Their Datacenter division, which includes GPUs especially suited to scientific applications and heavy algorithm calculation applicable for artificial intelligence and robotics, grew 121% YTD.

- Their Auto segment, which includes the Drive PX2, their leading supercomputer for cars—currently installed in every new Tesla (NASDAQ:TSLA) vehicle, along with partnerships with Baidu (NASDAQ:BIDU) and TomTom (AS:TOM2) on cloud-to-car mapping systems, grew 58%.

Looking at the technicals, NVIDIA has been on a sharp upward trajectory since early 2016, but it's been moving higher for the past three years now...up 539.96% over that time. And since resistance keeps pushing higher, it’s difficult to predict when or where the stock might peak.

Much of this massive growth is already priced in: NVIDIA's P/E of 51.5 is more than three times that of the average S&P 500 stock and significantly higher than its peers. In comparison, Intel (NASDAQ:INTC) and Qualcomm (NASDAQ:QCOM) have P/E ratios of 17. Texas Instruments' (NASDAQ:TXN) P/E comes in at 23.2 and NXP Semiconductors' (NASDAQ:NXPI) is 33.7.

As Jefferies analyst Marc Lipacis said last week, after the company hosted NVIDIA's CEO and CFO for investor meetings:

“We left [the] meetings thinking that the GPU Compute market will grow faster than we originally expected, and that NVIDIA's platform strategy uniquely positions it to capture outsized returns from these markets.”

How can one not like the stock? Still, at new all-time high prices, we'd suggest a bit of caution. It might be prudent to wait for the next, small retracement, perhaps until the share price moves closer to analysts' average 12-month consensus estimate of $89.24 (which would represent an 11% dip), before jumping wholeheartedly onto the NVIDIA bandwagon.