Stock markets continued sliding yesterday, with weak German retail sales and slowing factory activity in the Eurozone due to high inflation, perhaps prompting some market participants to add to bets that the ECB needs to act faster than previously anticipated. Yesterday, we also had a BoC decision, with the bank delivering another double hike and reiterating its willingness to act more forcefully if needed.

Tightening Expectations Keep Driving the Markets, BoC Stays Hawkish

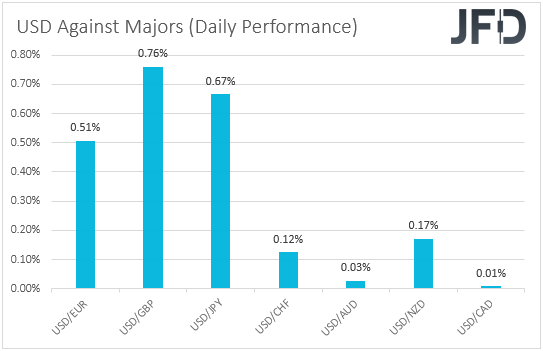

The US dollar traded higher against all but two of the other major currencies on Wednesday and during the Asian session Thursday. It gained the most versus GBP, JPY, and EUR, in that order, and the least versus NZD and CHF. The greenback did not lose against any other major currency, but it was found virtually unchanged against AUD and CAD.

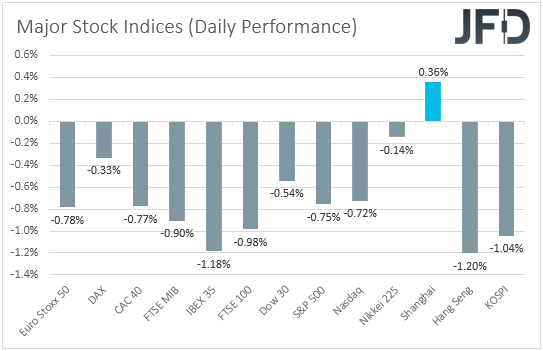

So, the fact that the US dollar strengthened as much as the Aussie and the Lonnie, at a time when the yen tumbled, presents a blurry picture with regards to the broader market sentiment. But, the equity world paints a clearer picture. EU and US shares traded lower, with the negative investor appetite rolling into the Asian session today. Only China’s Shanghai Composite traded in the green.

For the second day in a row, the market reaction confirms our view that the latest recovery in equities may not have been meant to last for long. Inflation fears and expectations over faster tightening by major central banks, especially the ECB and the Fed, rose again after Eurozone inflation accelerated by more than anticipated and after Fed Governor Waller clearly said that they should not stop lifting rates until inflation comes down.

What may have encouraged some more selling during the European session may have been the weak German retail sales and slowing factory activity in the Eurozone. This enhanced worries over an economic slowdown due to high inflation and may have prompted participants to add to their bets over faster and larger rate hikes by the ECB.

Indeed, according to media reports, some analysts believe that the bank will deliver a double hike at one of its upcoming gatherings, if not in July, maybe in September. Yes, faster rate hikes will weigh on the economy at first, but in our view, the consequences are unlikely to be as big as a recession triggered by extremely high inflation. With inflation coming down in a controllable manner, consumption could accelerate again and help the economy’s engines to restart.

Having said all that, though, we repeat that we don’t expect the ECB to hike as fast as the Fed and the BoC. Remember that the Fed is expected to keep delivering double hikes, with very recent comments suggesting that there may not be a break after summer.

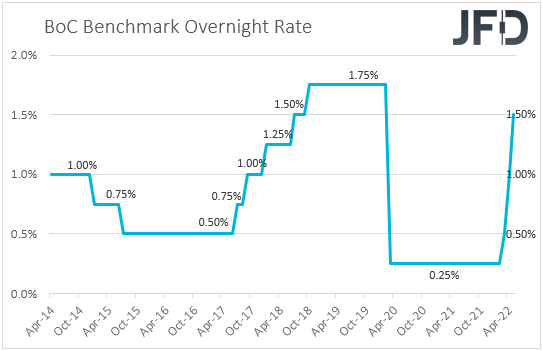

With regards to the BoC, it met yesterday. The bank hiked by 50bps as well, its second double hike in a row, taking its benchmark rate to 1.5%. That said, this was largely anticipated and fully priced in. So, in our view, the most important takeaway from this gathering was that the bank reiterated its willingness to “act more forcefully if needed.”

This may be why the Canadian dollar did not lose ground against the US dollar and instead traded virtually unchanged. In our view, with the BoC standing next to the Fed in terms of hawkishness, we would expect the Loonie to keep adding to gains for a while more.

But if the sentiment was hurt and equities slid, why was the yen among the main losers? In our view, this is because of monetary policy divergence speculation resurfacing again. As a safe haven, the yen has recently gained some ground on fears of an economic slowdown, but now, the focus has shifted to which central banks are likely to lift interest rates faster. And with the BoJ committed to staying ultra-loose, the yen has come back under selling interest.

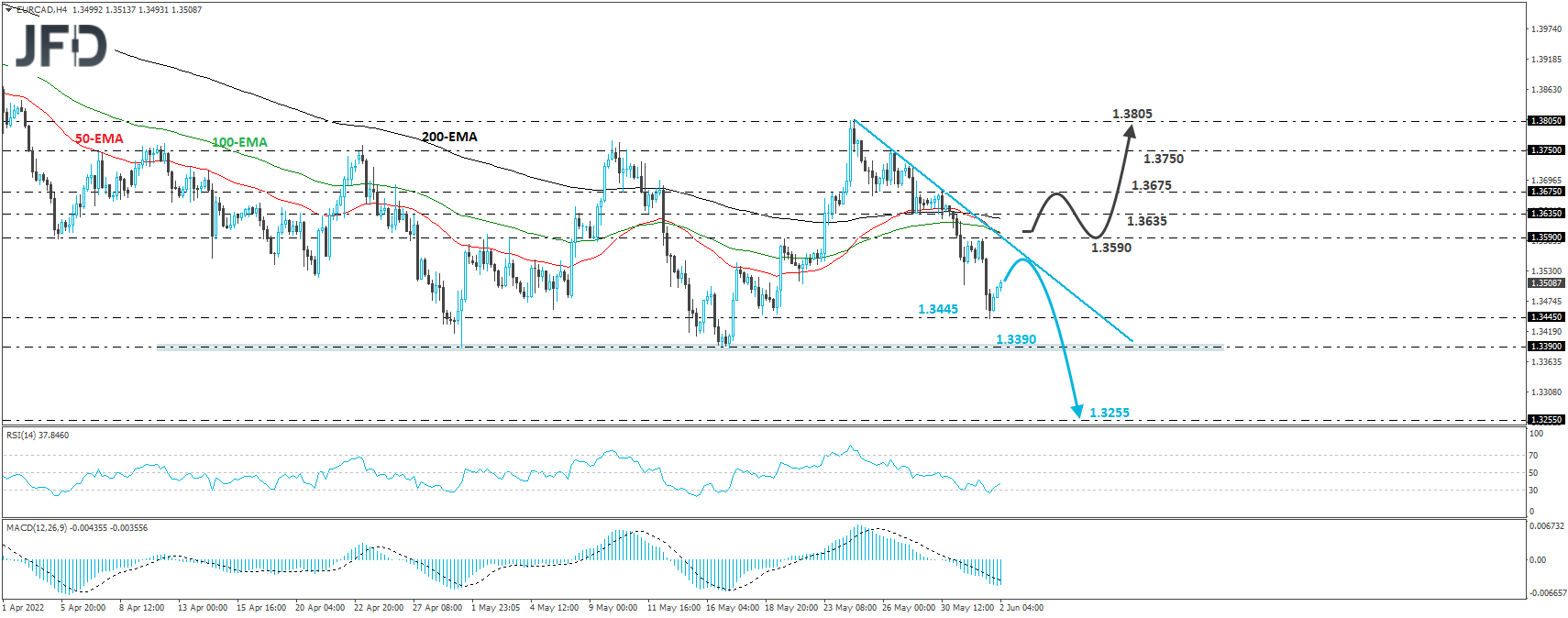

EUR/CAD – Technical Outlook

EUR/CAD traded lower yesterday after it hit resistance at the 1.3590 zone. The slide was stopped by the 1.3445 barrier, slightly below the lows of May 18 and 19, and then the rate rebounded. However, it is still trading below the downside resistance line drawn from the high of May 24, which keeps the short-term outlook still negative.

We believe that the bears will retake charge soon, perhaps from near that downside line, and push the rate back down to the 1.3445 zone. A lower break would confirm a forthcoming lower low and may target the key support area of 1.3390, marked by the lows of Apr. 29 and May 17, but the break of that zone may carry larger bearish implications. Such a break may set the stage for declines to the 1.3255 territory, marked by the inside swing high of Apr. 24, 2015.

On the upside, we would like to see the recovery extending above the 1.3590 zone before we start examining a bullish reversal. This could confirm the break above the aforementioned downside line and may initially target the 1.3635 level or the 1.3575 barrier, marked by the high of May 30. Another break above that level could carry extensions towards the peak of May 26, at 1.3750. After that, we have the high of May 24, at around 1.3805.

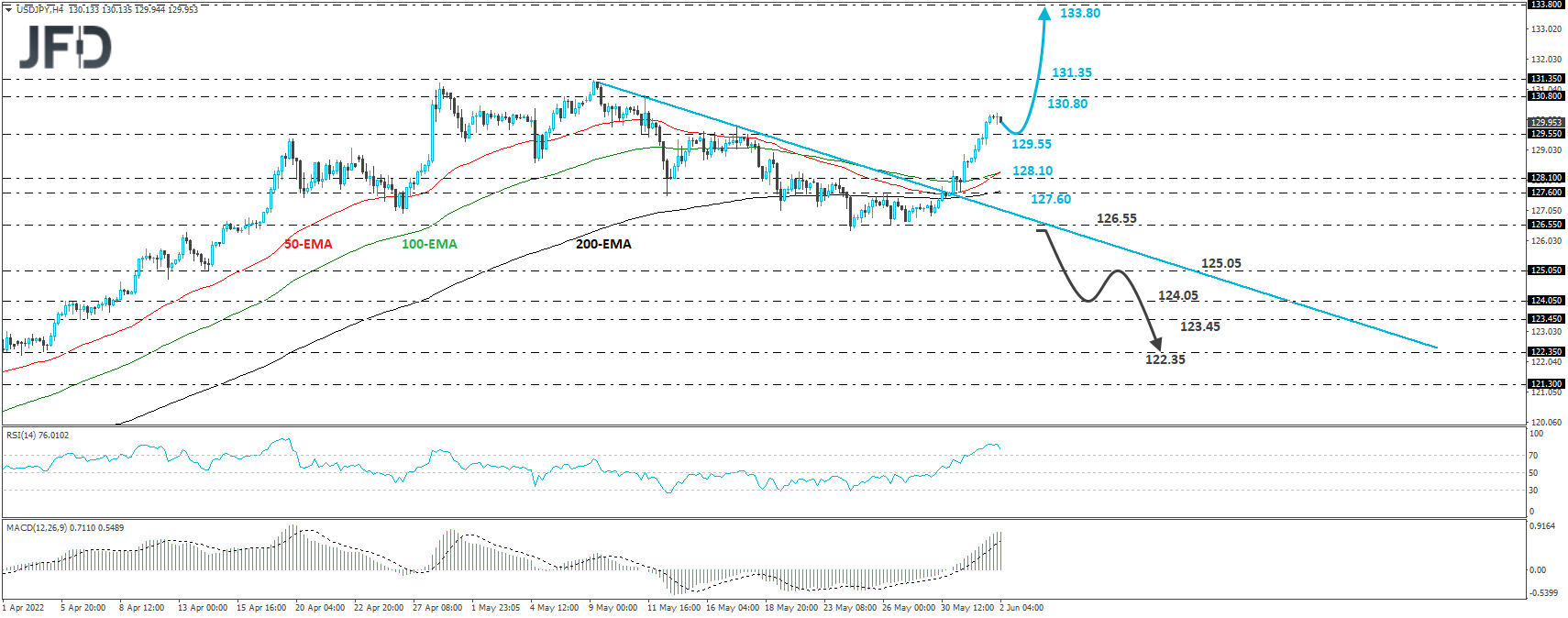

USD/JPY – Technical Outlook

USD/JPY has been flying since Monday, while on Tuesday, it crossed above the downside resistance line taken from the high of May 9. This was the result of market participants removing from the table bets that the FOMC may take a break after the summer, which could widen even more the monetary policy divergence with the BoJ.

We believe that the bulls will stay in charge and perhaps target the 130.80 or 131.35 zones soon, marked by the highs of May 11th and 9th, respectively. If they don’t stop there, they will enter territories last tested in 2002, with the next possible resistance zone perhaps being the high of March of that year, at around 133.80.

We will reexamine the bearish case upon a break below 126.55, a hurdle that stopped the bears between May 24th and 30th. This will confirm a forthcoming lower low on the 4-hour and daily charts and may initially pave the way towards the low of Apr. 14, at 125.05. A break lower could aim for the 124.05 or 123.45 zones, marked by the inside swing high of Apr. 6 and the low of Apr. 7. Another break, below 123.45, could extend the fall towards the low of Apr. 5, at 122.35.

As for Today’s Events

We will pay extra attention to the US ADP employment report for May, ahead of Friday’s official employment report. Though not a major market mover and not a perfect gauge of the NFPs, it is the best we have.

Expectations are for the private sector to have added 280k jobs during the month after adding 247k in April. This is positive, and although the forecast for the NFPs is for a slowdown, the actual figure is expected at 320k, which in our view, taking into account the continuous tightening of the US labor market, is still a decent number.