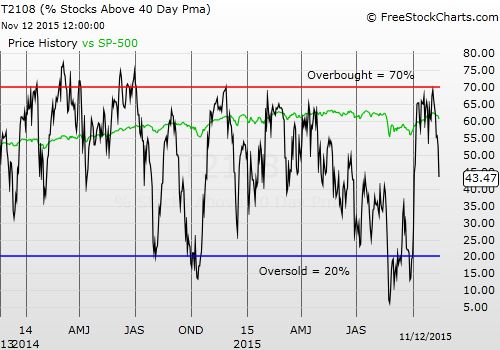

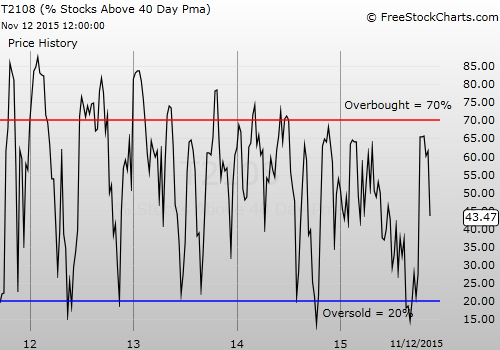

T2108 Status: 43.5%

T2107 Status: 27.7%

VIX Status: 18.4

General (Short-term) Trading Call: bearish

Active T2108 periods: Day #29 over 20%, Day #28 over 30%, Day #28 over 40% (overperiod), Day #1 below 50% (underperiod), Day #3 under 60%, Day #343 under 70%.

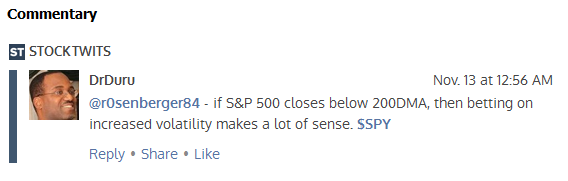

I have been writing this week about the deteriorating underlying technicals of the stock market. Thursday’s 1.4% drop in the S&P 500 (N:SPY) caused a breakdown of 200-day moving average (DMA) support and confirmed all the red flags. Accordingly, I have changed the short-term trading call from “slightly bearish” to bearish.

200DMA support gives way for the S&P 500

Note that I am still not aggressively bearish because the 50DMA is now turning upward and SHOULD provide strong support absent a definitive negative catalyst. The next assessment will likely depend on how well the S&P 500 trades around its 50DMA.

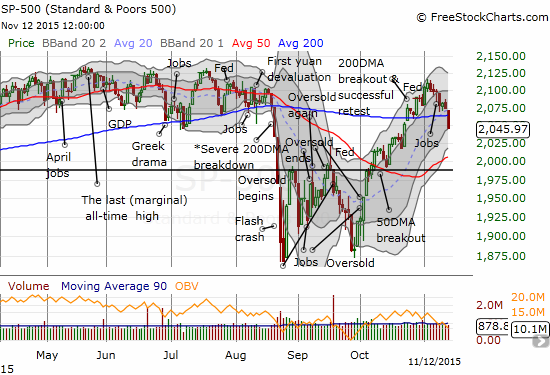

Accompanying the breakdown was a plunge in T2108. The percentage of stocks trading above their respective 40DMAs plunged from 52.6% to 43.5%. This drop completes and confirms the end of a month long range for T2108.

T2108 breaks down after a month-long tease churning just below the overbought threshold

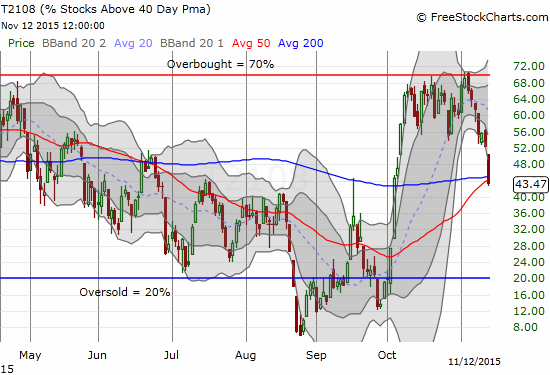

The volatility index, the VIX, joined the bum-rush by breaking out to a 5-week high. I did NOT use this occasion to fade volatility as I often do. Besides, there is no imminent meeting of the Federal Reserve to help grease the skids for volatility. That will be a trade for mid-December.

The volatility index, the VIX, is breaking out above the 15.35 pivot and looks ready for another quick run-up

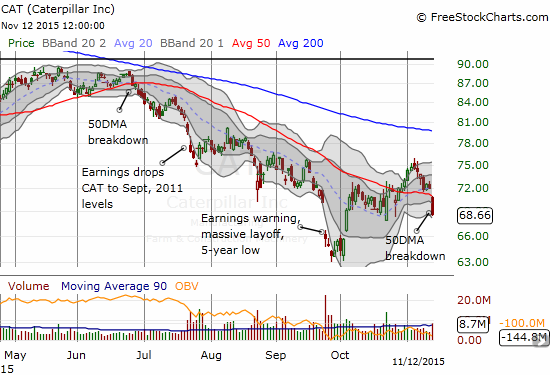

The number one confirmation of a bearish turn of events comes from Caterpillar (N:CAT), my favorite hedge against bullishness. CAT lost 4.5% on its way through a gap down and very bearish 50DMA breakdown. Note what happened after the last 50DMA breakdown in June.

Caterpillar (CAT) breaks down again. Another down day puts recent lows into play.

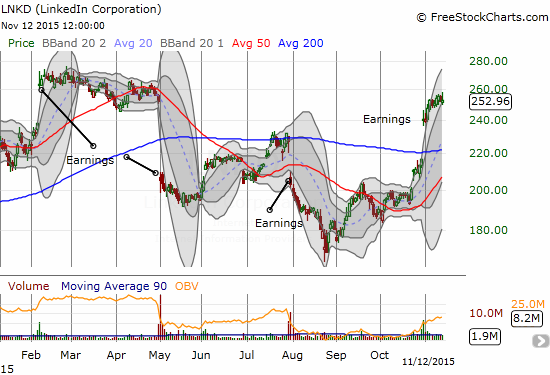

Given my change in trading call, I finally sold my call spread on LinkedIn Corporation (N:LNKD). It is part of a small group of tech-related stocks that have diverged from the market to form a very thin spear of leaders trying to cajole the market higher.

A VERY choppy year for LinkedIn (LNKD). I still like buying its dips.

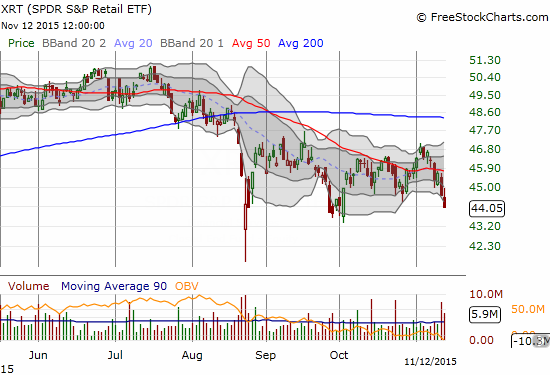

Retail is another sector that has suddenly started to suffer. Once again, we should all take pause to note how the discount on oil is NOT providing a notable boost in the prospects for many retail companies. Wal-Mart (N:WMT) made a big splash this earnings season with a massive post-earnings loss. Surprisingly, value investors have yet to commit and the stock is down another 5% since earnings. At that time, WMT helped the SPDR S&P Retail ETF (XRT) fail at 50DMA resistance. XRT attempted a meager rally soon thereafter but is now trading at a near 6-week low. It even looks ready for an extended run of losses.

SPDR S&P Retail ETF (XRT) never participated much in the S&P 500’s big bounce from oversold conditions. Overall, it still looks very weak.

I noticed in after-hours trading Nordstrom (N:JWN) fell 20% after reporting earnings. See below for a chart of what happened to Macy`s Inc (N:M) after it reported earnings this week. The CEO was on-air blaming unseasonably warm weather in the Northeast for a shortfall in winter shopping. The irony in these excuses is that we are quick to celebrate the benefits of lower oil prices, so why not celebrate the “dividend” consumers get for not having to spend as much money on fall/winter gear? Of course, part of the reason is that we EXPECT/want consumers to spend the oil savings on retail goods…

Macy’s (M) has had a very rough second half

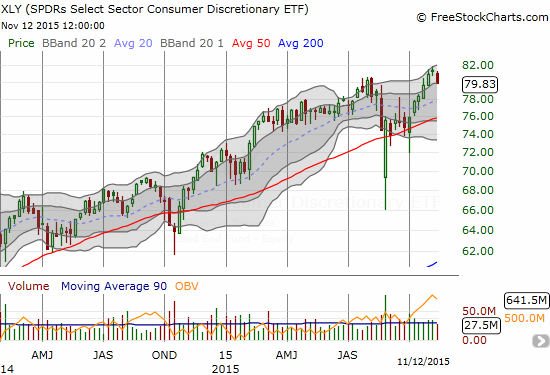

Outside of tech, there are of course still some sectors doing well or at least hanging in there on the year. For example, consumer discretionary as a whole is actually doing well where retail specifically is not.

This weekly chart shows that Consumer Discretionary Select Sector SPDR (N:XLY) managed to record new all-time highs during the bounce from oversold conditions. This is very strong performance relative to the S&P 500.

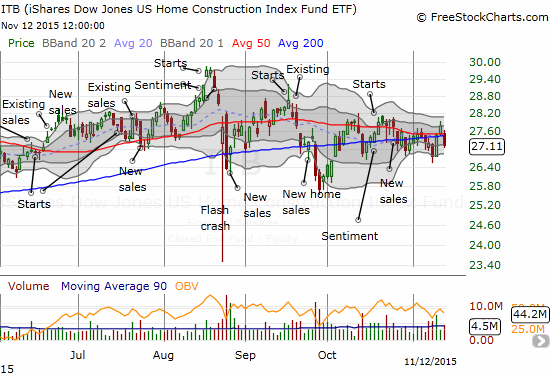

Finally, homebuilders, in the form of the iShares US Home Construction (N:ITB), has kept to a tight trading range nearly all year. This week, ITB was helped by a very strong report from DR Horton Inc. (N:DHI). Those gains are now on sharp retreat. I am still bullish on ITB and many of its components, but I am more cautious than ever right now. I will continue to buy dips and sell some rallies.

The iShares US Home Construction (ITB) is still stuck in a trading range that has lasted through most of 2015.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

Full disclosure: short CAT, long ITB call options