Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Markets:

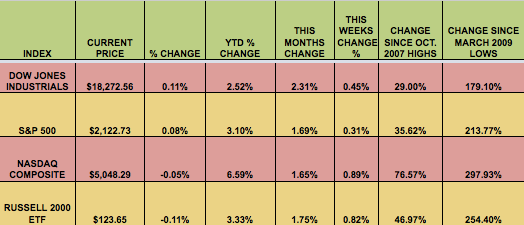

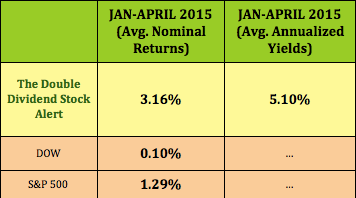

The indexes eked out a small gain this week, with the S&P 500 hitting a new intraday all-time high, of 2123.89, and an all-time closing high of 2,122.73. Tepid economic data served to dampen investors’ enthusiasm, as US markets continued to stay range-bound, as they have over the past 3 months.

Volatility fell 3.7% this week, ending at 12.38.

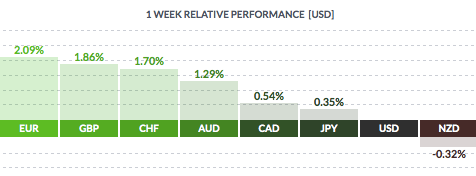

The US dollar again fell vs. most major currencies, except the New Zealand dollar:

Market Breadth: This week, 20 out of 30 Dow Jones stocks rose, vs. 24 last week. 60% of the S&P 500 rose, vs. 59% last week.

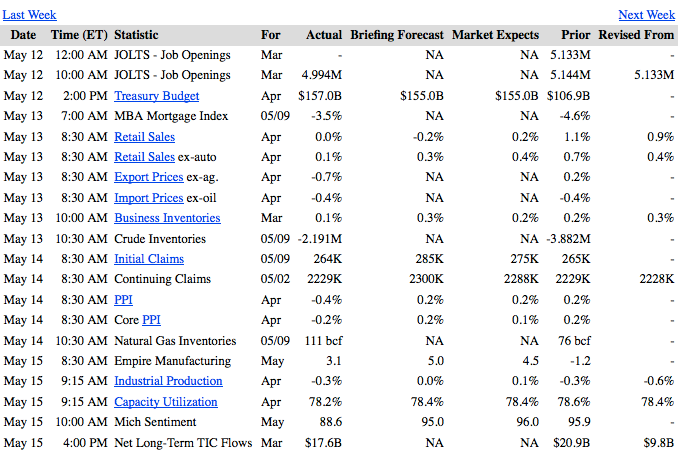

US Economic News: U.S. consumer sentiment fell more than expected in May and was at its lowest since October. Industrial Output also disappointed again. Unemployment Claims’ 4-week avg. continued to hover near April 2000 lows.

e)

e)

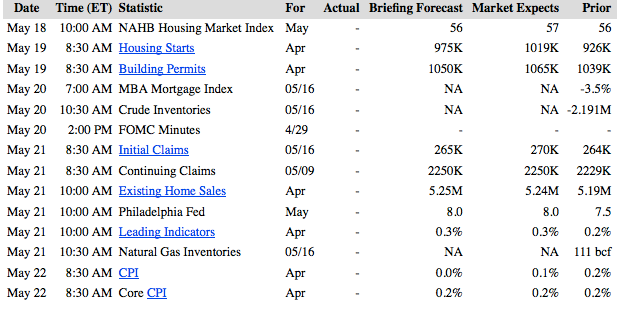

Week Ahead Highlights: (Reuters) Investors will watch for any change in the economic outlook from housing data and remarks by various Federal Reserve speakers next week, while retailers will take over on the earnings front, (Walmart (NYSE:WMT) reports Tuesday), as the first-quarter reporting season trickles to its end. Housing starts are expected to have risen in April to a seasonally adjusted annual pace of 1.02 million units from 926,000 in March.

The highlight comes at the end of the week with Fed Chair Janet Yellen speaking on the economic outlook on Friday. Any hint of a downgrade to the economy could signal a delay in monetary policy tightening; central bank watchers now expect the Fed to begin raising interest rates in September.

Next Week’s US Economic Reports:

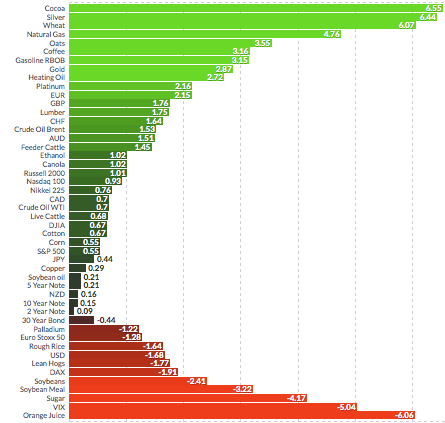

Sectors & Commodities:

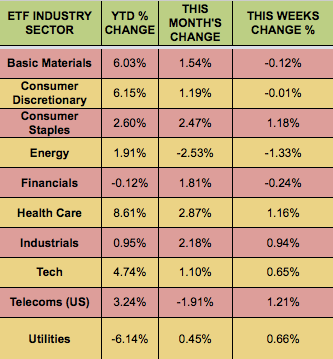

Telecoms led this week, as Energy lagged.