My Trading Journal for the Stock Market Today:

When the market has a long one-day pullback that is 6 points in total, and for once in the past 13 trading sessions, the Dow Jones Industrial Average fails to rally at all, traders have to go back to their playbook and pull out the Trump Stock Rally play yet again. With the speech well received by anyone not wearing white in the audience last night, the stock market is ready to rally again... Bigly!

Even the biotechs, which Trump was not too kind to, is trying to stage a rally of its own this morning. Steel companies like US Steel (X) are rallying no doubt on the pipeline comments from last night as is Harley-Davidson Inc (NYSE:HOG) over fair trade.

Interesting side note in regards to the S&P 500 (SPX) is that it has literally traded in less than a 1% trading range now for 50 straight trading sessions. The previous record was 35 straight. Today it has a chance to end this streak. I mean think about that, for almost a quarter of a year, the stock market hasn't even had a low-to-high range of more than 1%. Unheard of!

Also, worth pointing out is that Stocks, Bonds and Volatility all finished higher in February. If you have a stock in the portfolio that hasn't moved in the last 30 days, or hasn't been trending higher, you have to ask yourself why your are still holding the stock?

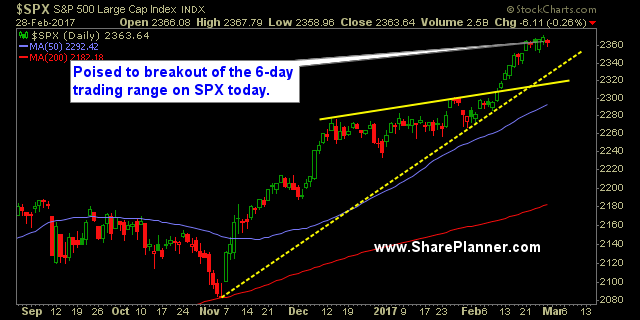

S&P 500 Chart

Current Stock Trading Portfolio Balance:

- 5 long positions, continuing to tighten the stop-losses on them all.

Recent Stock Trade Closeouts:

- JP Morgan Chase (NYSE:JPM): Long at 87.21, closed at 89.67 for a 2.8% profit.

- Chevron (NYSE:CVX): Short at 110.03, covered at 111.85 for a 1.6% loss.

- ProShares UltraPro Short S&P500 (NYSE:SPXU): Long at $17.31, closed at $17.22 for a 0.5% loss.

- Flex Technologies (FLEX): Long at $15.62, closed at $16.57 for a 6.1% profit.

- Broadcom (NASDAQ:AVGO): Long at $208.30, closed at $210.89 for a 1.2% profit.

- Baidu Inc (NASDAQ:BIDU): Long at $174.70, closed at $187.00 for a 7.0% profit.

- Ollies Bargain Outlet Holdings Inc (NASDAQ:OLLI): Long at 33.20, closed at $32.50 for a 2.1% loss.

- SPXU: Long at $17.58, closed at $17.24 for a 1.9% loss.

- Gold Miners ETF (NYSE:GDX): Long at $25.22, closed at $25.04 for a -0.7% loss.

- Corning Incorporated (NYSE:GLW): Long at $26.98, closed at $27.45 for a 1.7% profit.

- Illinois Tool Works (NYSE:ITW): Long at $127.74, closed at $129.86 for a 1.7% profit.

- Marriott International Inc (NASDAQ:MAR): Long at $86.16, closed at $87.51 for a 1.6% profit.

- Microsoft (NASDAQ:MSFT): Long at $63.45, closed at $64.09 for a 1% profit.