Just a few weeks ago, newsletter advisor sentiment in the weekly Investors Intelligence (II) survey showed optimism at its lowest point since around the November 2016 presidential election. However, the percentage of self-described "bullish" advisors has increased over the past four weeks -- sending up a stock market sentiment signal we haven't seen in nearly eight months.

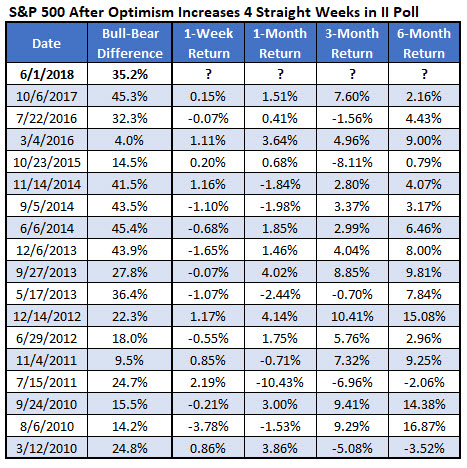

The last time II optimism increased four weeks in a row was early October 2017 -- eight months ago. Prior to that, you'd have to go all the way back to July 2016 for a signal, per Schaeffer's Senior Quantitative Analyst Rocky White. During the current bull market (since 2010), there have been 17 of these four-week optimism spikes.

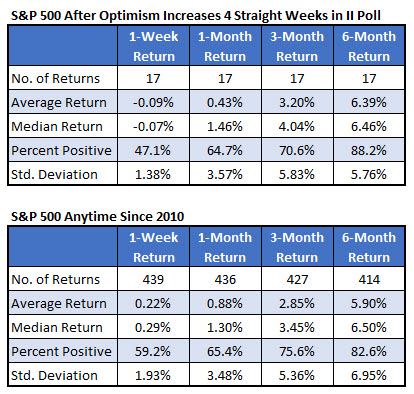

However, if recent history is any indicator, the S&P 500 Index (SPX) could underperform in the short term. Following these four-week spikes in II bulls, the SPX went on to average a one-week drop of 0.09%, and was higher less than half the time. That's compared to an average anytime one-week gain of 0.22%, with a win rate of 59.2%, looking at SPX data since 2010.

One month after these signals, the SPX was up by 0.43% and higher 64.7% of the time. Still, that's not even half the index's average anytime one-month gain of 0.88%. Three and six months later, though, the S&P tends to return to normal, even slightly outperforming its anytime returns.

It should also be noted that the stock market could be facing additional short-term headwinds, if past is prologue. For instance, the S&P 500 tends to struggle during Fed weeks -- and subsequently run into Fed Day resistance -- with the central bank highly expected to raise interest rates next Wednesday, June 13. And let's not forget that the expected U.S.-North Korea meeting on Tuesday, June 12, could also determine the market's near-term trajectory. Plus, June in general tends to be a sluggish month for the stock market, so the SPX could also face some seasonality speed bumps.