Upcoming US Events for Today:

- ADP Employment Report for July will be released at 8:15am. The market expects 235,000 versus 281,000 previous.

- GDP for the Second Quarter will be released at 8:30am. The market expects a quarter-over-quarter increase of 3.1% versus a decline of 2.9% previous.

- Weekly Crude Inventories will be released at 10:30am.

- FOMC Meeting Announcement will be released at 2:00pm EST.

Upcoming International Events for Today:

- Euro-Zone Economic Sentiment for July will be released at 5:00am EST. The market expects 102.0, consistent with the previous report. Industrial Sentiment is expected to show –4.5 versus –4.3 previous. Consumer Sentiment is expected to show –8.4 versus –7.5 previous.

- German CPI for July will be released at 8:00am EST. The market expects a year-over-year increase of 0.9% versus an increase of 1.0% previous.

- Canadian PPI for June will be released at 8:30am EST. The market expects a month-over-month increase of 0.2% versus a decline of 0.5% previous.

The Markets

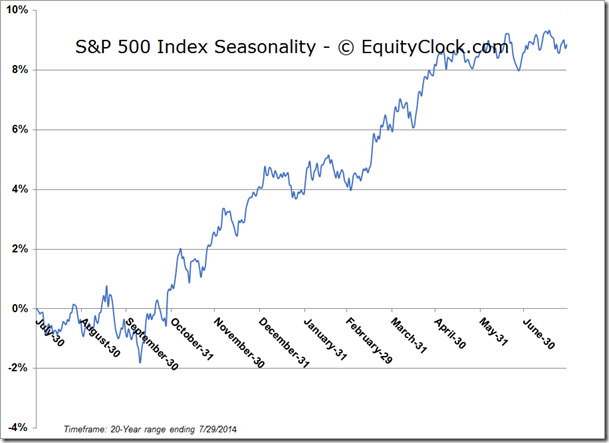

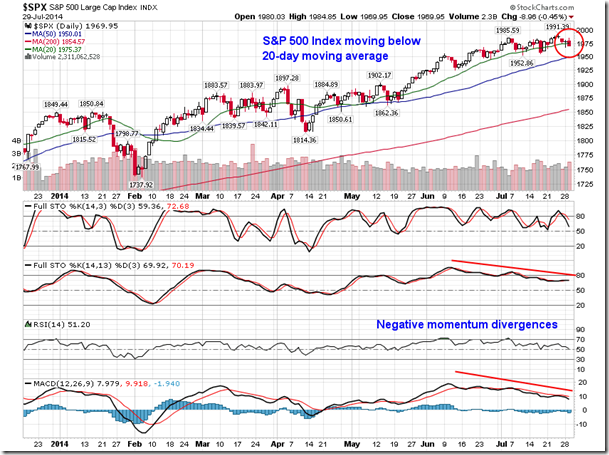

Stocks ended lower on Tuesday as investors reacted to new US sanctions against Russia. The S&P 500 Index closed below the rising 20-day moving average, a level that has supported the benchmark since breaking out in mid-May. Momentum indicators for the large-cap index have gradually been trending lower since mid-June as investors show signs of upside exhaustion. The Volatility Index (VIX) ended higher by almost 6%, respecting the heightened geopolitical risks attributed to the situation between Ukraine and Russia. The VIX has jumped over 25% since the lows charted in June, following the familiar seasonal pattern that sees a rise in volatility between the start of July and the middle of October. With earnings season moving into the rear-view mirror, economic data and hints from the Fed will move back into focus. Economic activity during Third Quarter typically remains stagnant ahead of the always important Fourth Quarter, which is dominated by consumer and business spending prior to the close of the year.

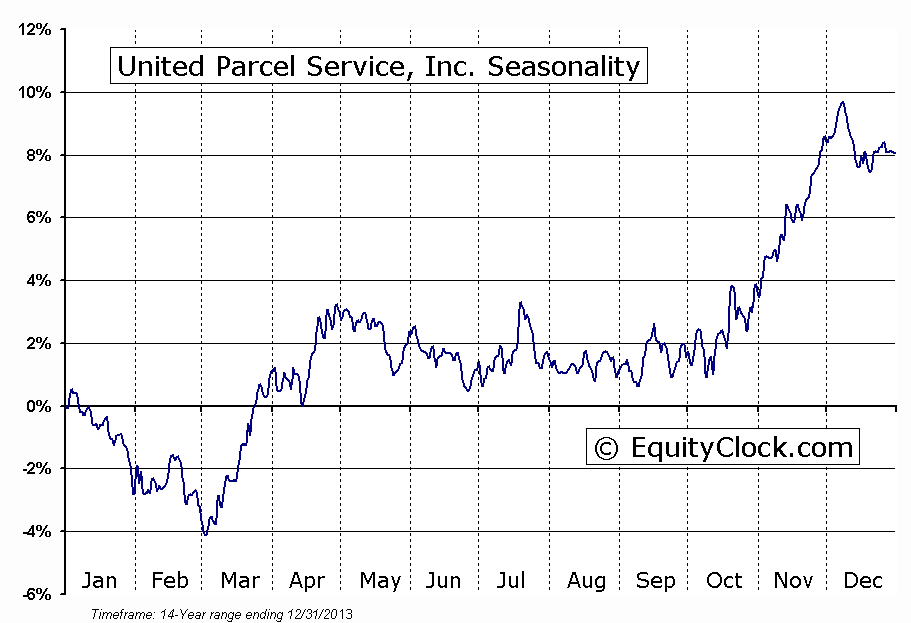

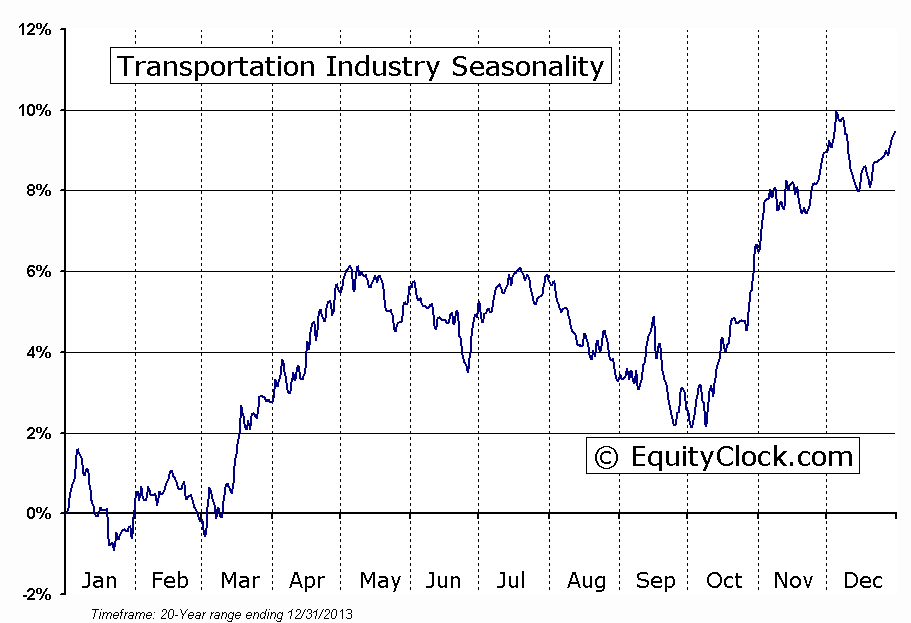

Among the top movers during Tuesday’s session were Transportation and Telecom stocks, both moving in opposing directions as investors reacted to fundamental events released before the opening bell. Transportation stocks weakened following disappointing earnings from United Parcel Service Inc (NYSE:UPS), which fell by 3.7%. As a result, the price of the Dow Jones Transportation broke firmly below its rising 20-day moving average, a level that has supported the short-term trend since April. Momentum indicators have been negatively diverging from price since June, suggesting waning upside strength. Transportation stocks seasonally weaken between the end of July and the beginning of October, declining by almost 4%, on average, over the period.

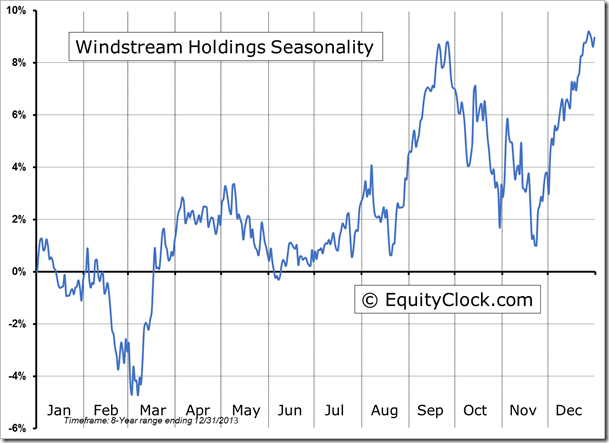

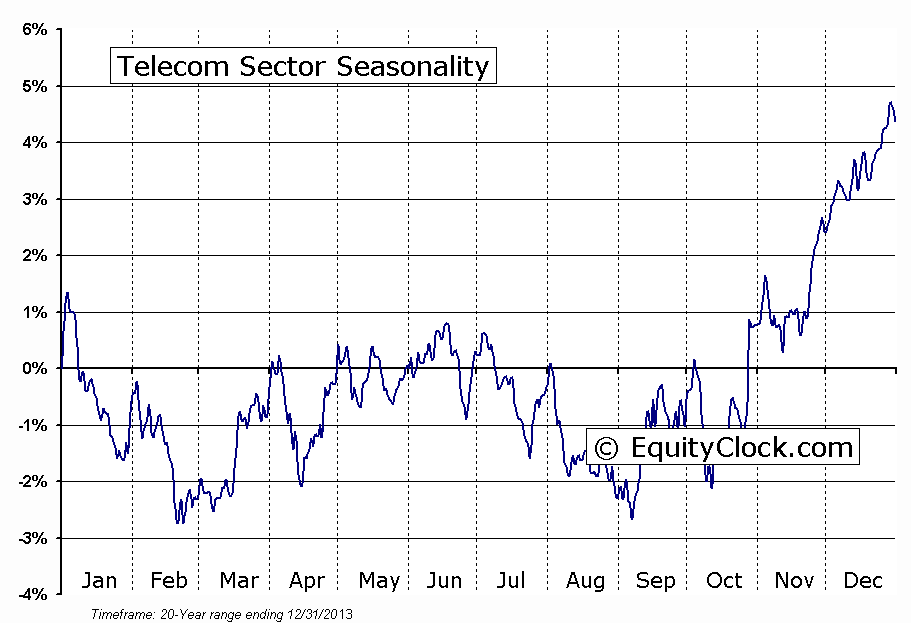

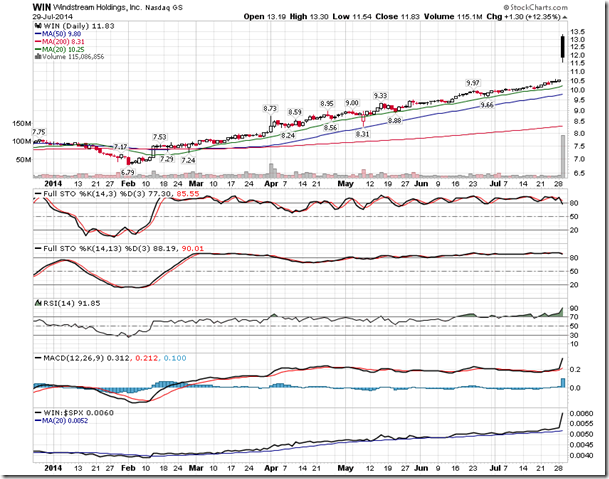

On the flip side were Telecom stocks, which gained following news that Windstream Holdings (NASDAQ:WIN) filed to spin off assets into a tax efficient real estate investment trust. Shares of WIN jumped over 12%, propelling the Telecom ETF (iShares US Telecommunications (NYSE:IYZ)) higher by 3.22%. Momentum indicators for the Telecom ETF have been trending higher since May, suggesting growing upside strength prior to Tuesday’s breakout. Seasonally, telecom stocks enter a period of seasonal strength in August/September as investors take advantage of the appealing yields that equities in this sector offer in order to hedge against rising volatility, which persists through to October. The diverging paths between Transportation and Telecom stocks just adds to the recent trend of risk aversion that has become apparent within the equity and bond markets, potentially a leading indicator that broad market weakness is soon to follow.

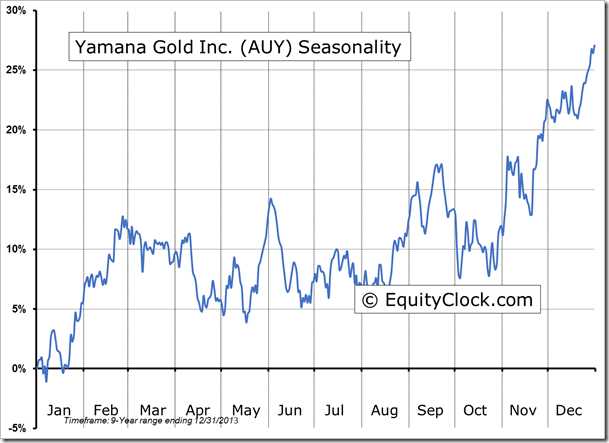

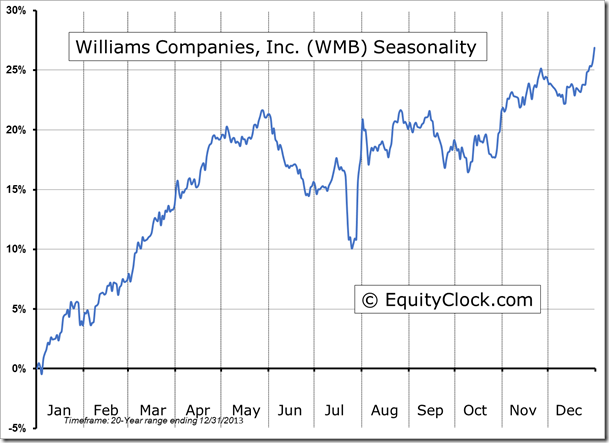

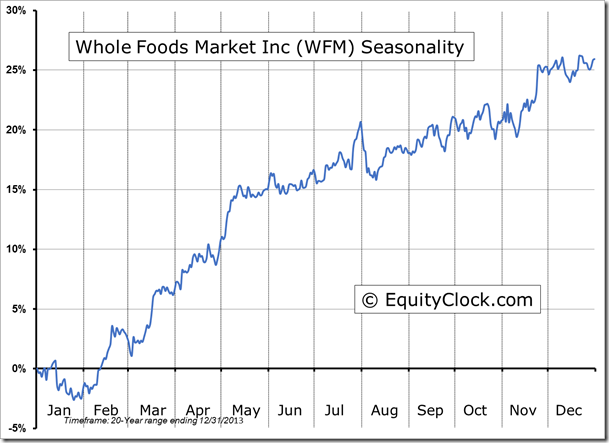

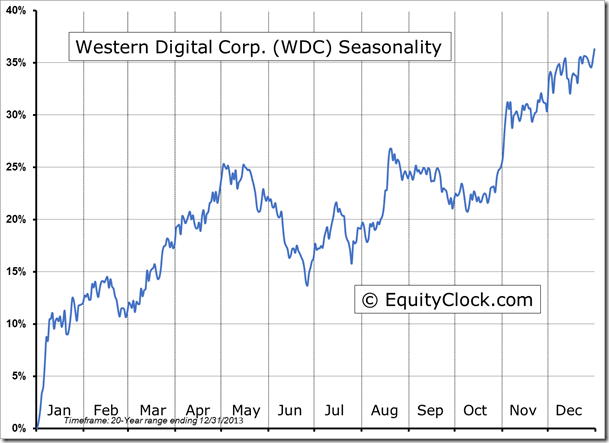

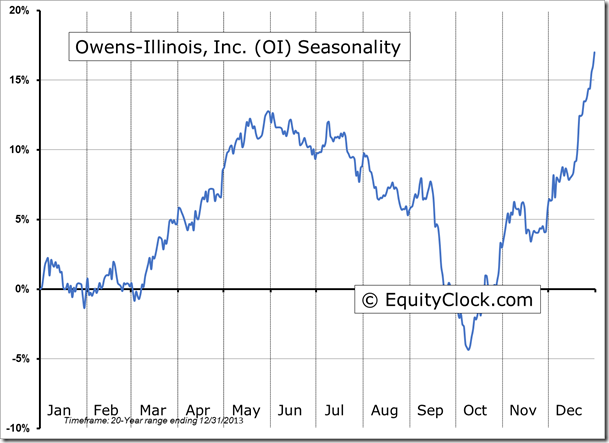

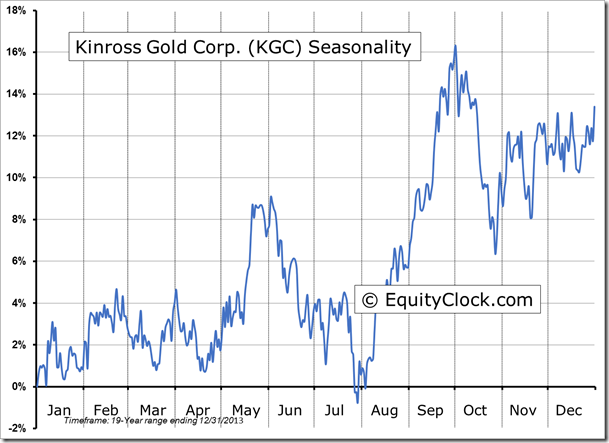

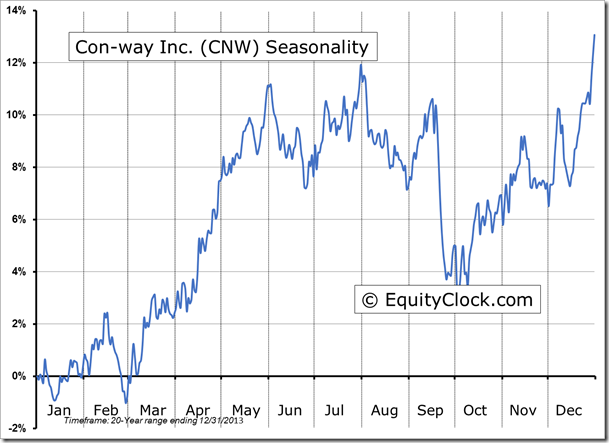

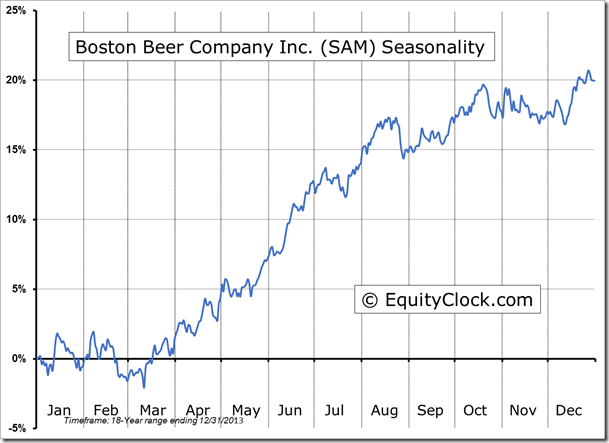

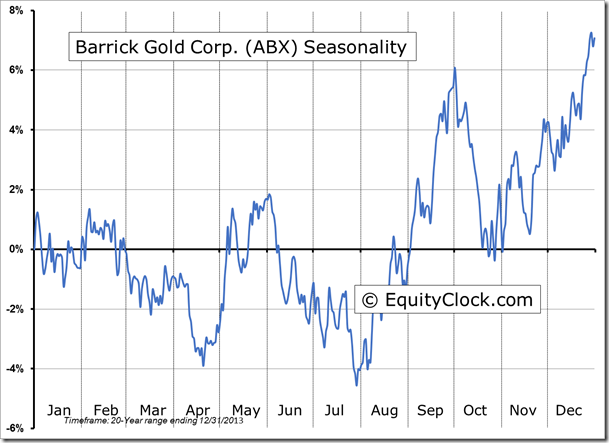

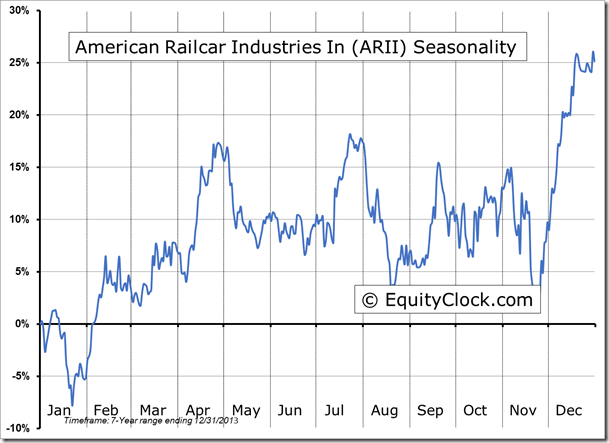

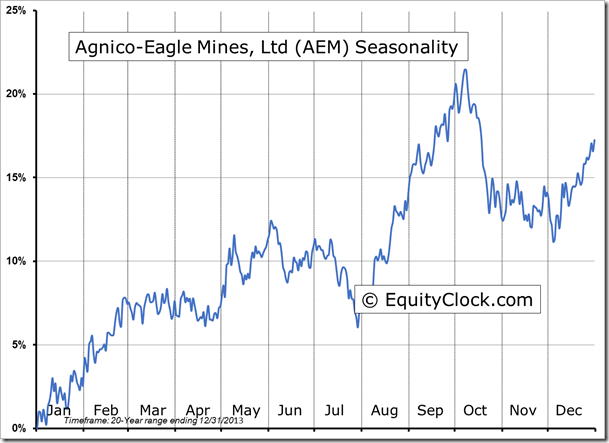

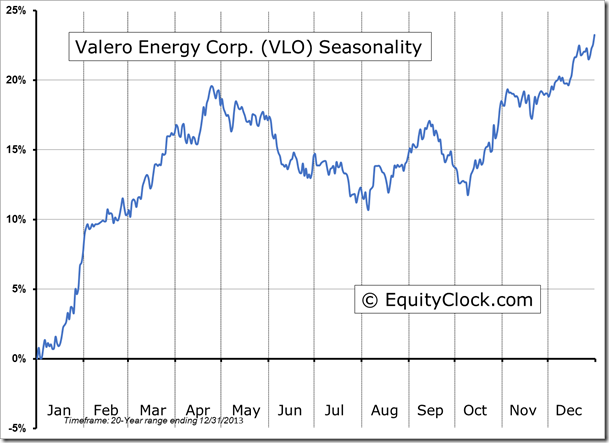

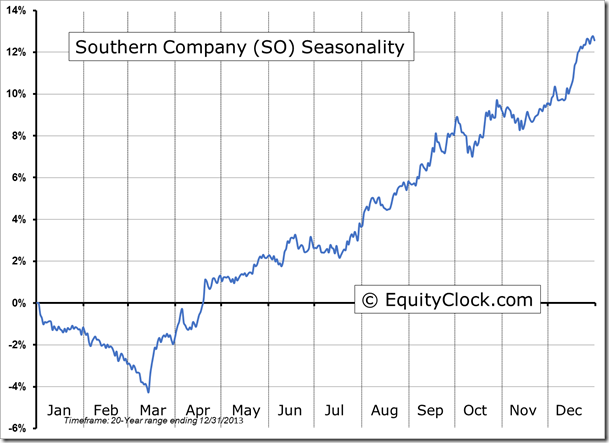

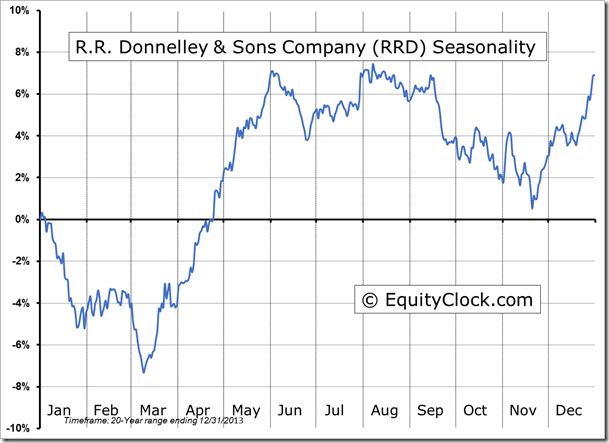

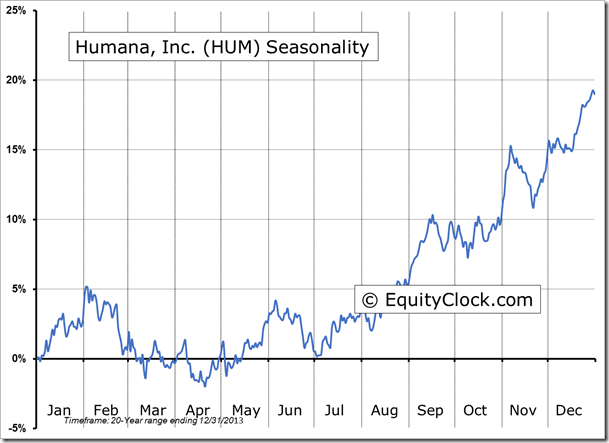

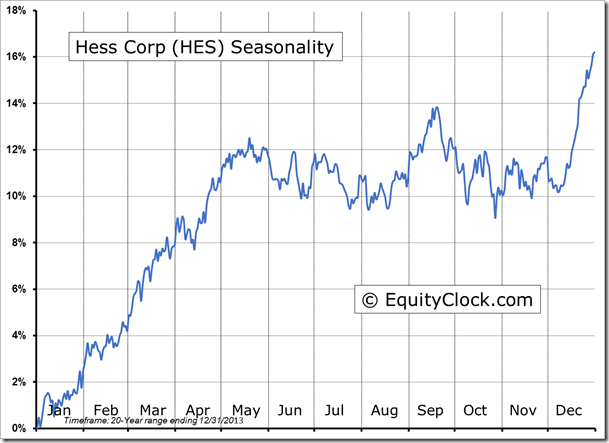

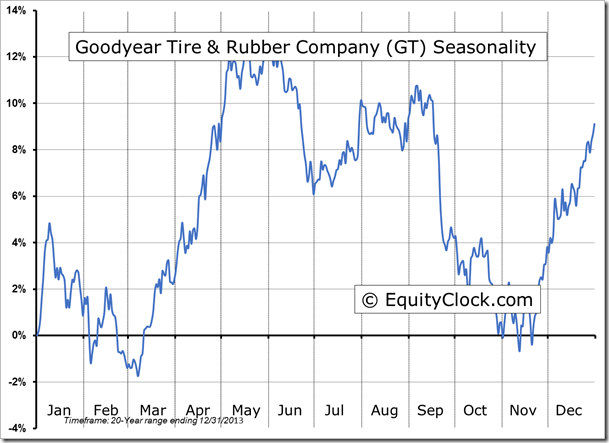

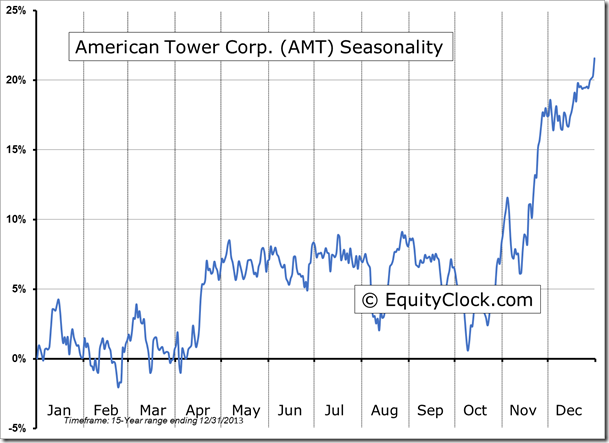

Seasonal charts of companies reporting earnings today:

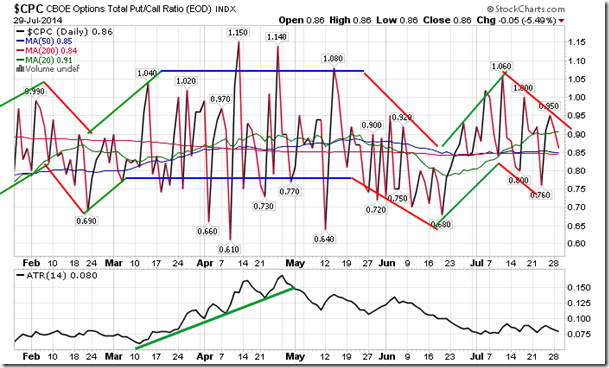

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.86.

S&P 500 Index

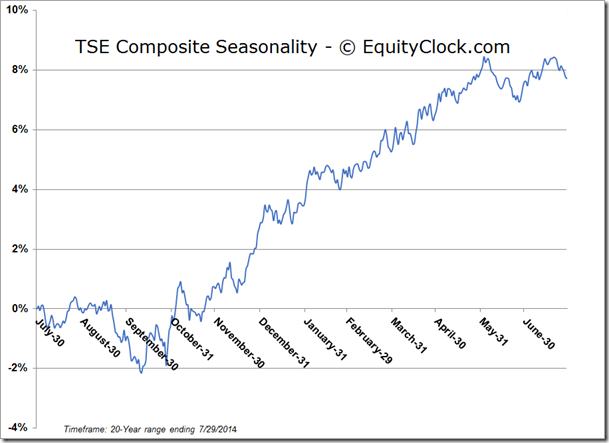

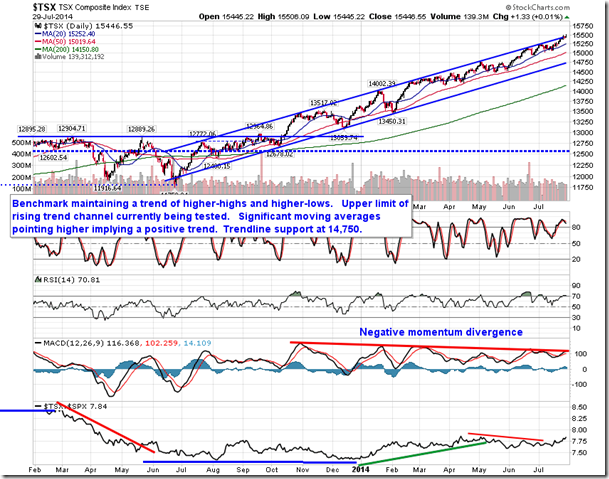

TSE Composite

Horizons Seasonal Rotation ETF (TO:HAC)

- Closing Market Value: $14.69 (down 0.07%)

- Closing NAV/Unit: $14.68 (down 0.15%)

Performance*

| 2014 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 2.66% | 46.8% |

* performance calculated on Closing NAV/Unit as provided by custodian