**NEW** As part of the ongoing process to offer new and up-to-date information regarding seasonal and technical investing, we are adding a section to the daily reports that details the stocks that are entering their period of seasonal strength, based on average historical start dates. Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

-

No stocks identified for today

The Markets

With the Christmas holiday week upon us, commentary will be limited. We will continue to publish Stocks Entering Period of Seasonal Strength and Seasonal Charts of Companies Reporting Earnings, if any, throughout the holiday season. Happy Holidays to all of our readers!

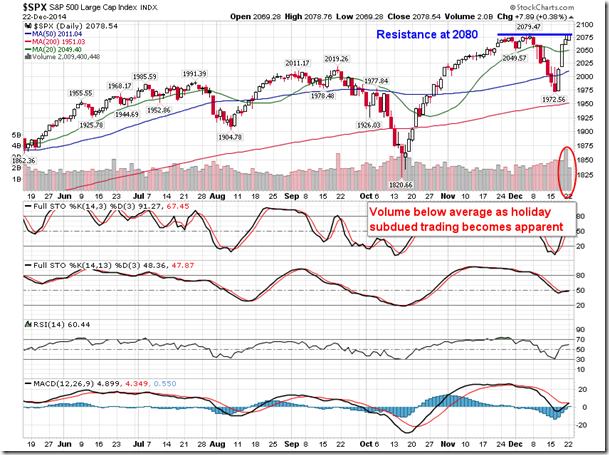

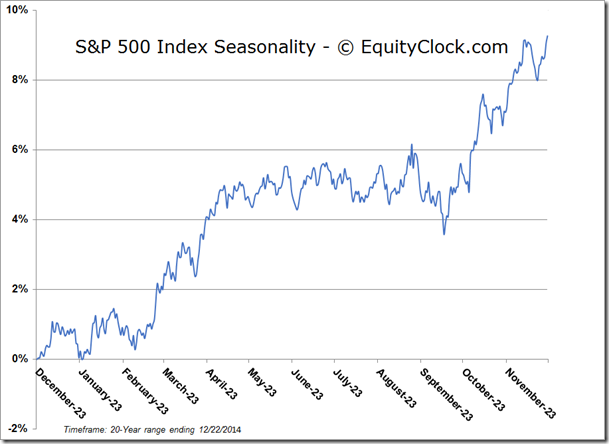

The S&P 500 Index is once again at the doorstep of new all-time highs as the Santa Claus rally continues. The benchmark is pushing up against resistance at 2080, following a positive intermediate trend, as indicated by the direction of the 50-day moving average. Volume on Monday was 20% below the 10-day average as the holiday trading environment that is typical at this time of year becomes apparent. The Santa Claus rally period, which has so far net investors a whopping 4.5% (according to the S&P 500 Index) since beginning on December 16th, continues through to the first two trading days of the new year.

Sentiment on Monday, as gauged by the put-call ratio, ended bullish at 0.75.

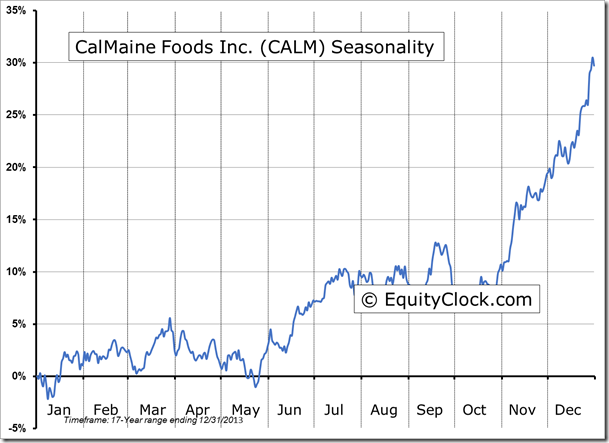

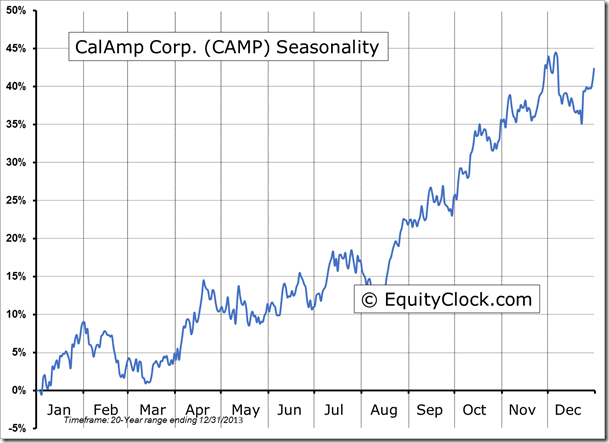

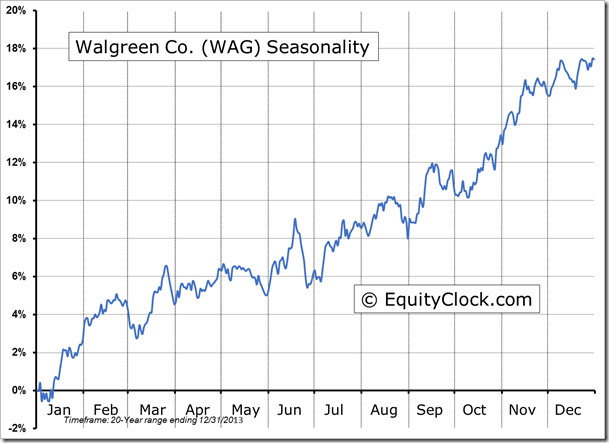

Seasonal charts of companies reporting earnings today:

S&P 500 Index

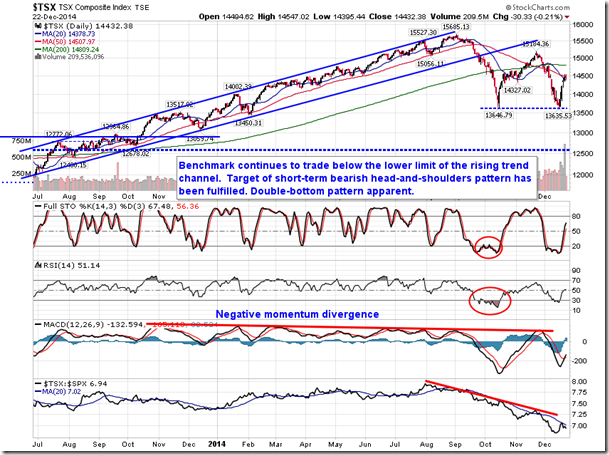

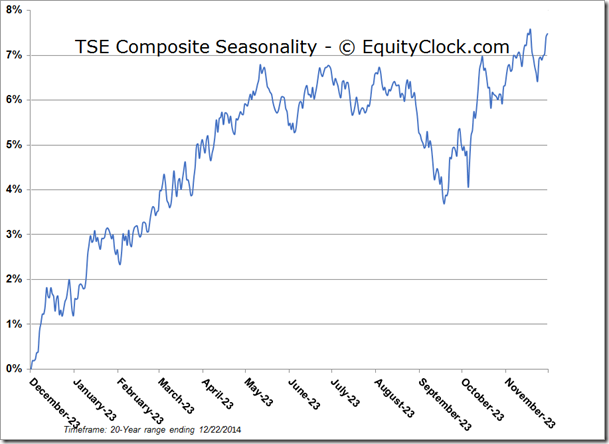

TSE Composite

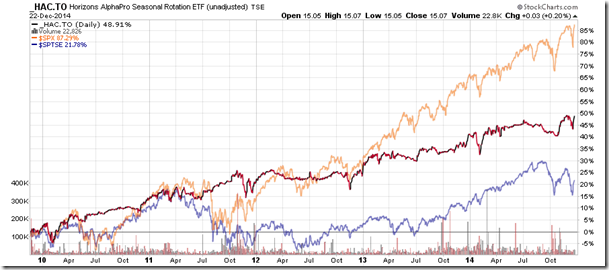

Horizons Seasonal Rotation ETF (TO:HAC)

- Closing Market Value: $15.07 (up 0.20%)

- Closing NAV/Unit: $15.09 (up 0.41%)

Performance*

| 2014 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 5.52% | 50.9% |

* performance calculated on Closing NAV/Unit as provided by custodian