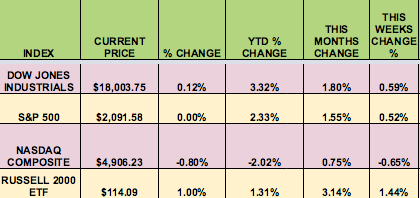

Markets: It was a mixed week – not so good for Tech, or defensive sectors, such as Utilities and Consumer Staples. Meanwhile, investors plowed back into small caps, sending the Russell 2000 up 1.44% on the week. Tech giant Microsoft (NASDAQ:MSFT) fell nearly 7% for the week, punished for underwhelming results. Google (NASDAQ:GOOGL) was also down, over 5% this week. United Health, American Express (NYSE:AXP) and Disney (NYSE:DIS) were the 3 biggest gainers in the Dow, while 4 out of the top 10 gainers in the S&P 500 were independent oil and gas firms: Murphy Oil (NYSE:MUR), Southwest Energy (NYSE:SWN), Devon Energy (NYSE:DVN), and Noble Energy (NYSE:NBL).

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: ING Groep NV (NYSE:ING), Prospect Capital Corporation (NASDAQ:PSEC), Stag Industrial Inc (NYSE:STAG), Student Transportation Inc. (NASDAQ:STB), Whitestone REIT (NYSE:WSR).

Volatility: The VIX 19% this week, finishing at $16.20.

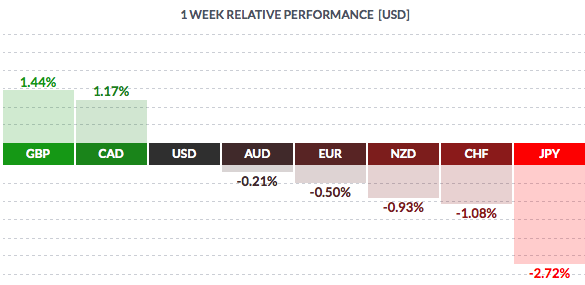

Currency: The dollar had a strong week, rising vs. most major currencies, except the British pound and the Canadian loonie. Oddly, this didn’t seem to hold back Basic Materials, which rose 2.5% on the week.

Market Breadth: 15 of the DOW 30 stocks rose this week, vs. 24 last week. 58% of the S&P 500 rose this week, vs. 75% last week.

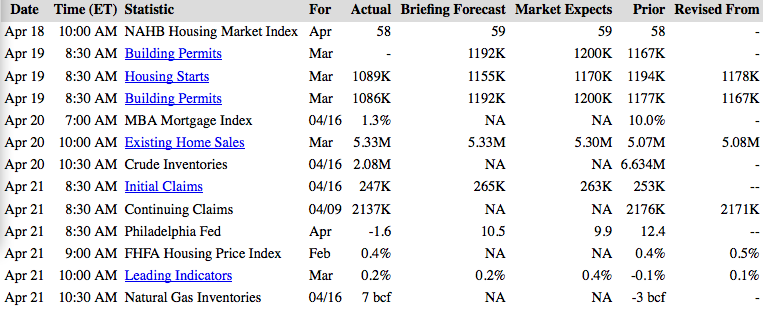

US Economic News: In another sign of a strengthening labor market. Initial Jobless Claims fell to their lowest there is a much larger working population today than in 1973. Continuing Claims hit their lowest since 2000. Housing Starts and Building Permits surprised to the downside, as the supply of homes continues be below normal long term 6-month averages. Continuing low rates are certainly helping buyers snap up homes – the avg. 30-year rate is back where it was 1 year ago, at 3.83%.

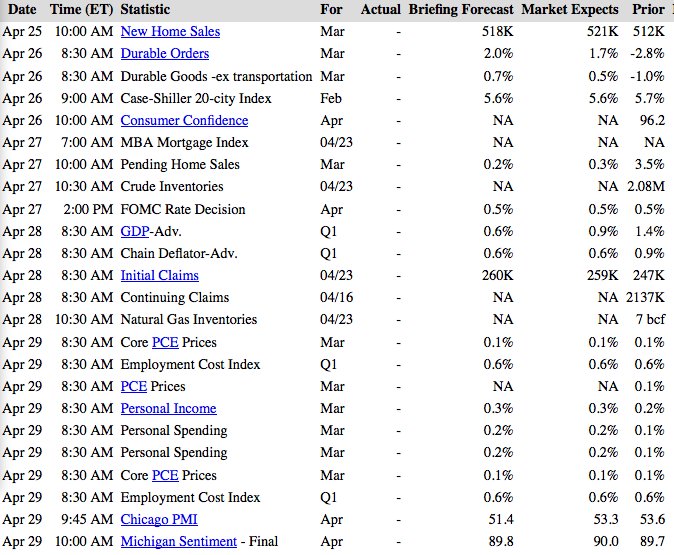

Week Ahead Highlights: The FED holds its rate meeting on Tues-Wed. Very few market watchers are predicting a rate hike. In fact, the Fed futures market is forecasting less than a 20% chance that the Fed will raise rates at its June meeting either. It’ll be a data-heavy week, with more Housing reports out, a Q1 GDP estimate, and Consumer Sentiment as well.

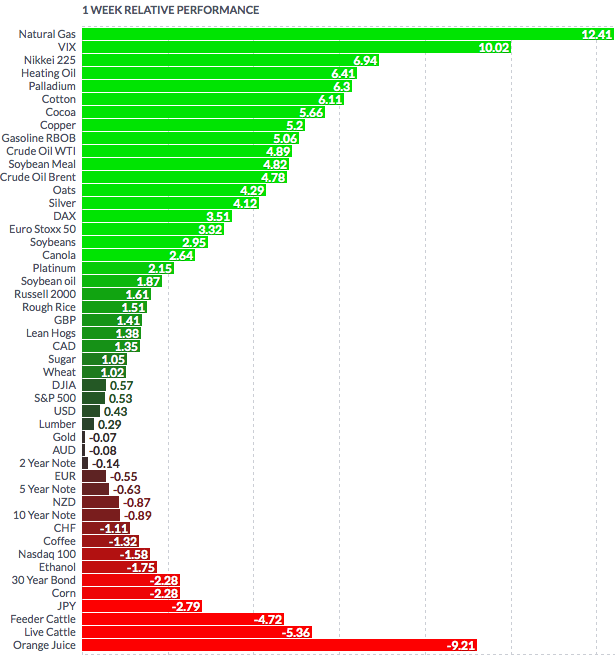

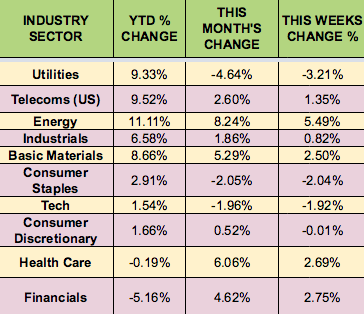

Sectors and Futures:

Surprisingly, Energy stocks led this week, ignoring the lack of an OPEC production freeze agreement at last Sunday’s meeting. Utilities trailed.

Natural Gas led this week, with OJ trailing: