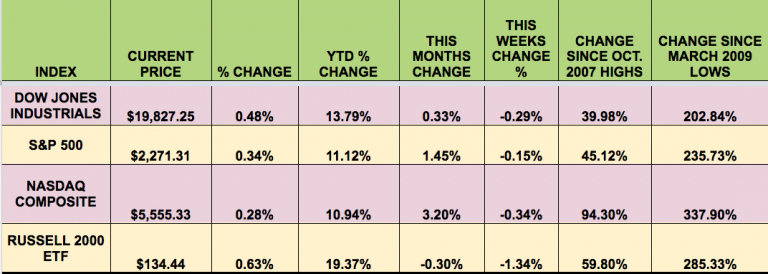

Markets: All 4 indexes pulled back this week, as the market took a breather, in anticipation of a regime change in DC.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: CLDT (NYSE:CLDT), PAA (NYSE:PAA), STB (NASDAQ:STB), STAG (NYSE:STAG), PSEC (NASDAQ:PSEC), SAR (NYSE:SAR).

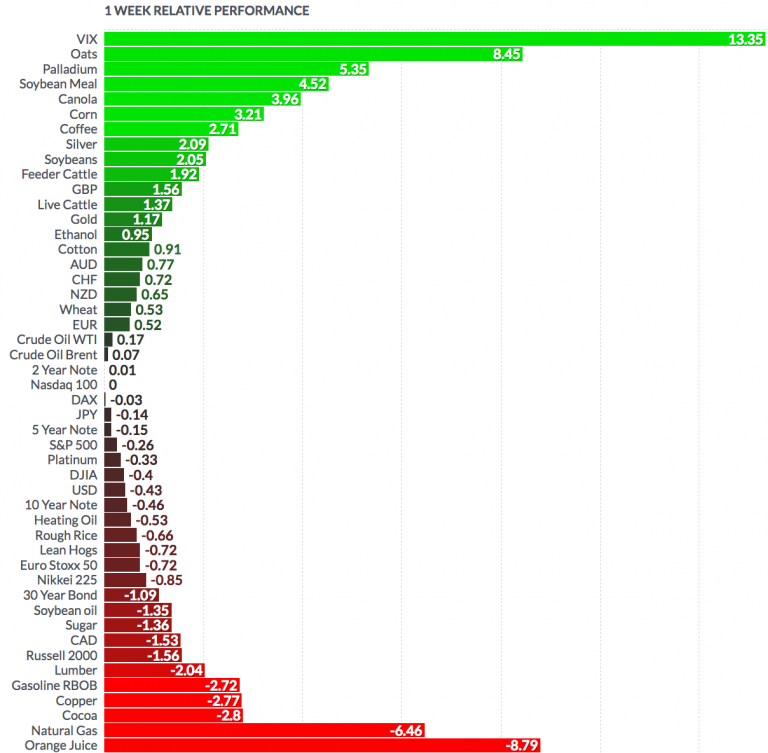

Volatility: The VIX rose slightly, up 2.8% this week, finishing at $11.54.

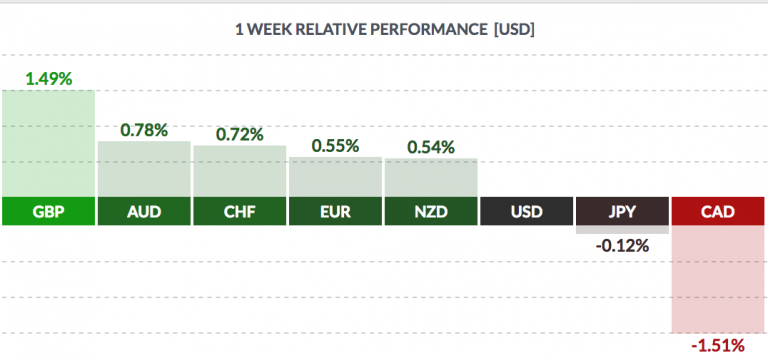

Currency: The USD pulled back again vs. most major currencies for the 3rd straight week, except the Canadian loonie:

Market Breadth: 18 of the DOW 30 stocks rose this week, vs. 9 last week. 52% of the S&P 500 rose, vs. 46% last week.

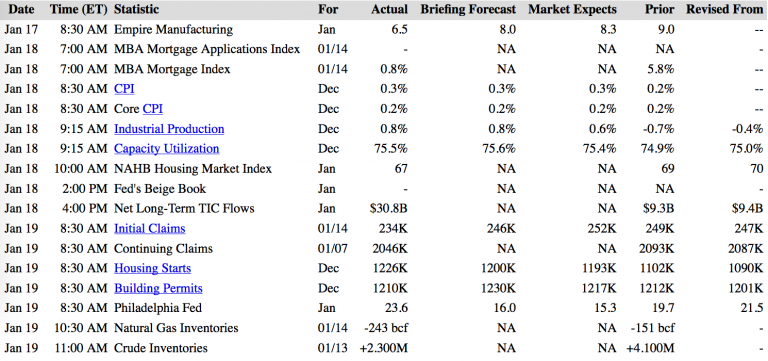

US Economic News: lndustrial Production rose .8% in Dec, better than forecasts. Core CPI stayed tame, at 0.2%. Initial Claims fell to 234K. Housing Starts rose 11.3%. In Europe, the ECB left its low rates and asset buying program intact.

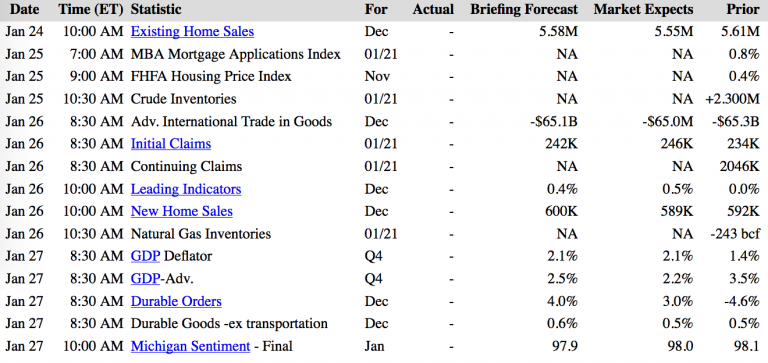

Week Ahead Highlights: Housing will be in the spotlight, with New Home and Existing Home Sales reports due out. Q4 earnings season rolls on, with 12 out of 15 DOW stocks reporting, including Intel (NASDAQ:INTC), Microsoft (NASDAQ:MSFT), Chevron (NYSE:CVX), J&J, and Verizon (NYSE:VZ). 28% of the S&P 500 will report, with Alphabet (NASDAQ:GOOGL), Dow, Bristol-Myer (NYSE:BMY), and AT&T (NYSE:T) among them.

S&P 500 companies are expected on average to grow their earnings by 6.3% in the December quarter and 13.6% in the March quarter, according to Thomson Reuters I/B/E/S.

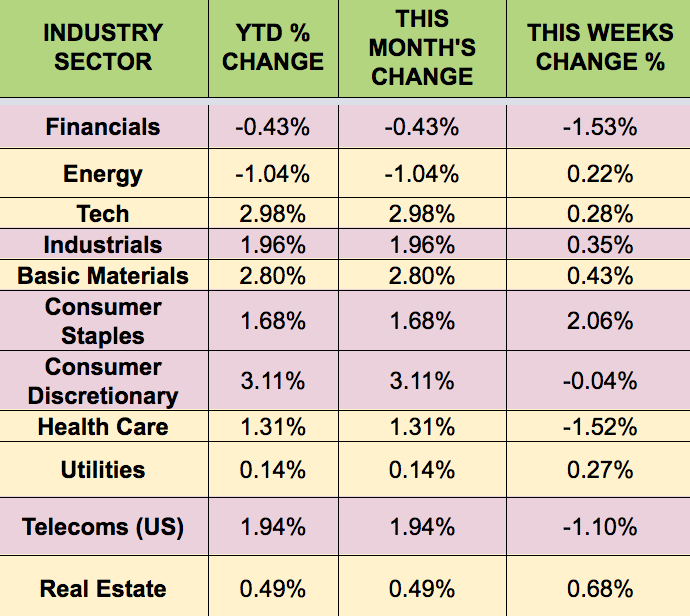

Sectors and Futures: Normally stodgy Consumer Staples led this week, as Financials faded, due to jawboning about slower rate hikes.

Oats futures led this week, while OJ trailed: