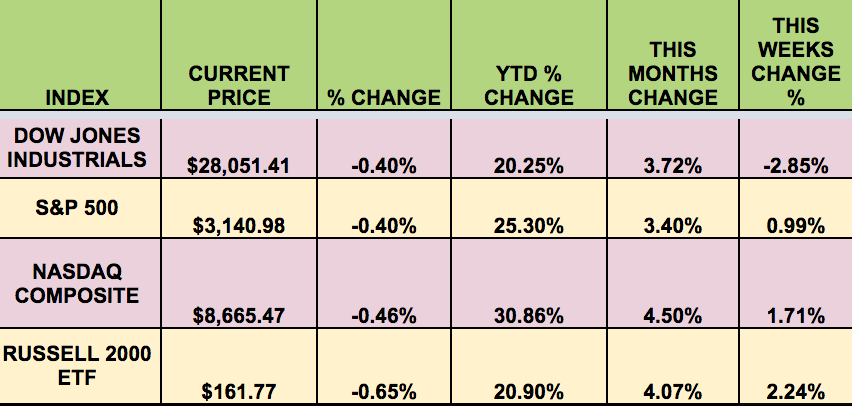

Market Indexes: The market declined this week, after 5 straight weeks of gains, with small caps trailing.

Volatility: The VIX rose 2.3% this week, ending the week at $12.62.

High Dividend Stocks: These high yield stocks go ex-dividend next week: ITUB, WSR, FUN, SLB, FDUS, OUT, SNR, AFIN.

Market Breadth: 23 out of 30 DOW stocks rose this week, vs. 13 last week. 80% of the S&P 500 rose, vs. 42% last week.

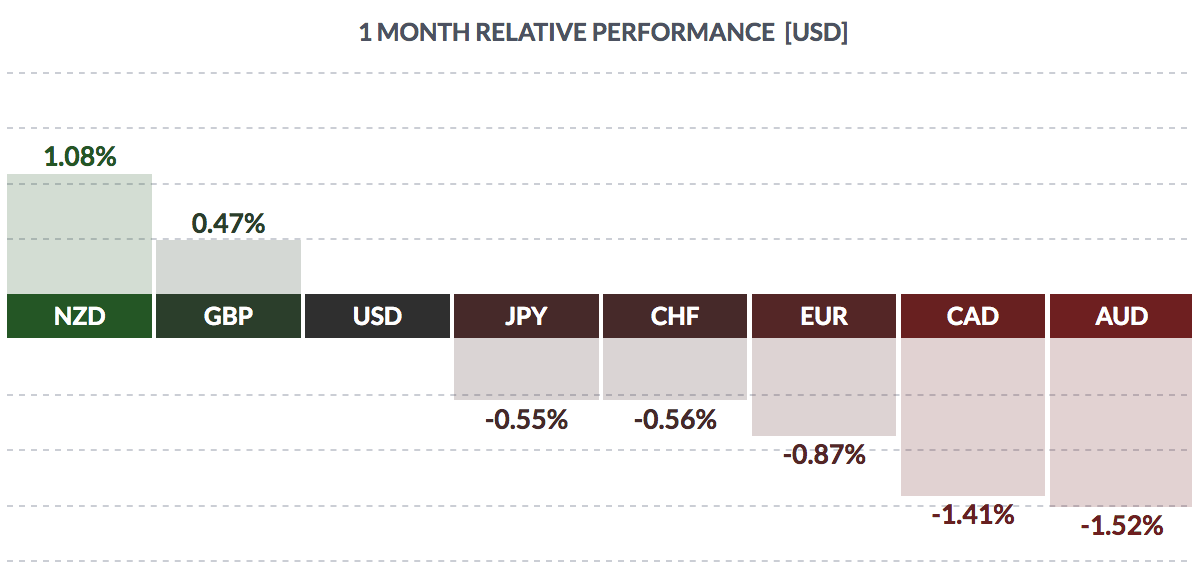

FOREX: The USD rose vs. most major currencies in November, except the pound and New Zealand dollar.

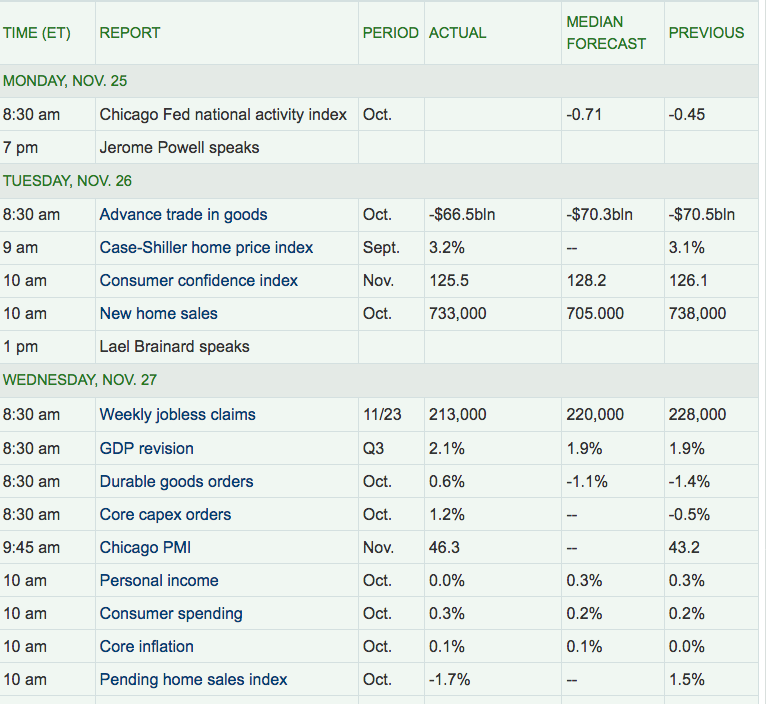

This Week’s Economic Reports: The second estimate of Q3 ’19 US GDP was raised to 2.1%, vs. the previous 1.9% estimate, which averts a technical recession for now.

“Heavy snow in parts of the northern U.S. could prevent some farmers from harvesting the rest of their corn and soybeans until 2020 in the latest weather-related blow to growers. Flooding from torrential rains delayed spring seeding and prompted record amounts of acres to go unplanted. As of Sunday, the U.S. corn harvest was just 84% completed, the slowest rate in a decade. If crops are abandoned in fields until the spring, that’s likely to further tighten supplies at a time when cash prices are already on the rise.

The wet weather that’s plaguing farmers is also having a knock-off effect on other markets. For example, high-moisture content in grain contributed to shortages of propane, which is used to dry corn and heat homes. And it’s not just corn and soybean seeing woes. There will be fewer harvested acres of crops including spring wheat, sugar beets and potatoes amid the wet weather.” (Bloomberg)

“Contracts to buy previously owned U.S. homes fell unexpectedly in October, with new contract signings down in three of the four U.S. regions. The National Association of Realtors said on Wednesday its pending home sales index, based on contracts signed last month, decreased 1.7% to a reading of 106.7.

Economists polled by Reuters had forecast pending home sales rising 0.8% last month. Pending home contracts are seen as a forward-looking indicator of the health of the housing market because they become sales one to two months later. Compared with one year ago, pending sales were up 4.4%.” (Reuters)

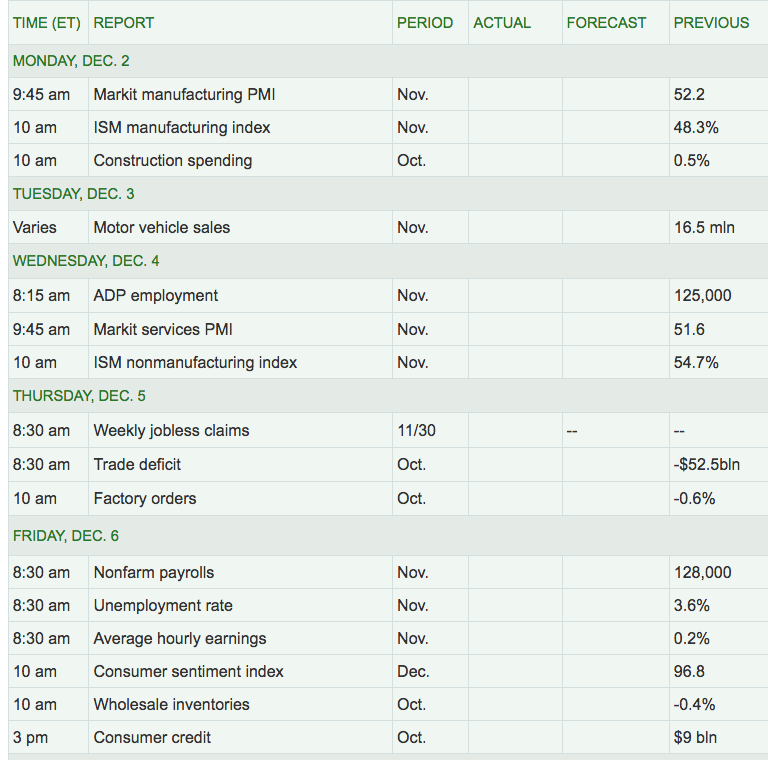

Week Ahead Highlights: The Non-Farm Payrolls report will come out on Friday am. There will also be mfg. and services reports due out for November.

Next Week’s US Economic Reports:

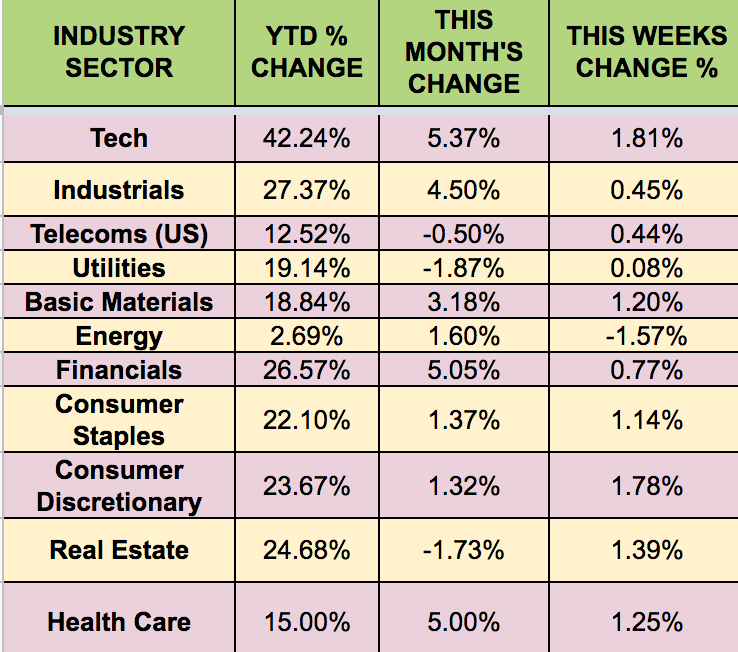

Sectors: Tech, Financials and Healthcare led in November with Utilities and Real Estate lagging.

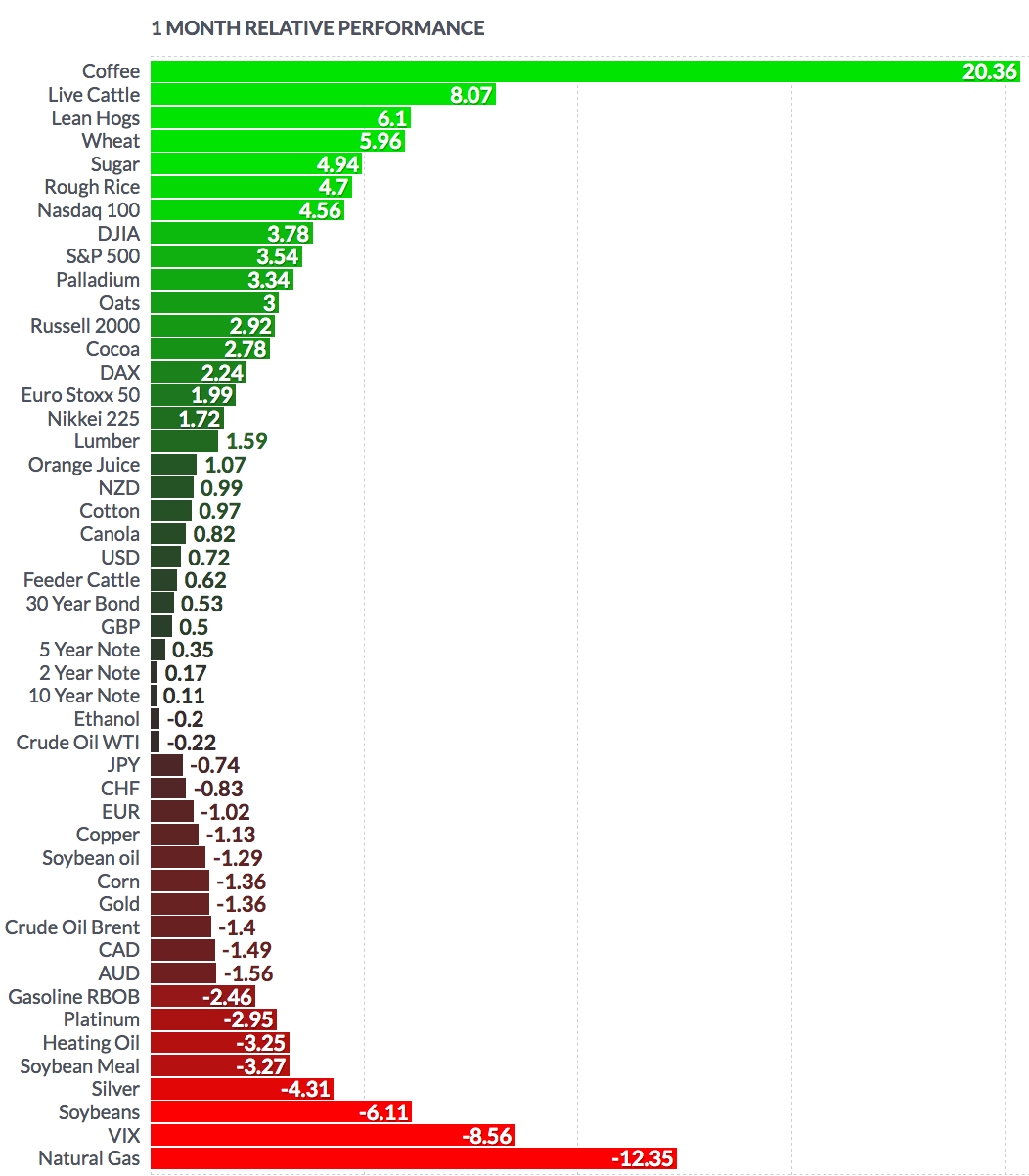

Futures: WTI Crude fell .22% in November, finishing at $55.42, while Natural Gas fell 12.35%.