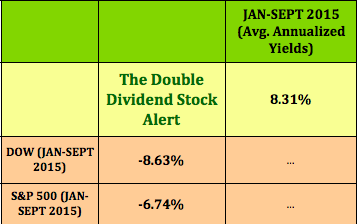

Does Your Portfolio Need More Protection In This Volatile Market?

Check out our returns so far in 2015:

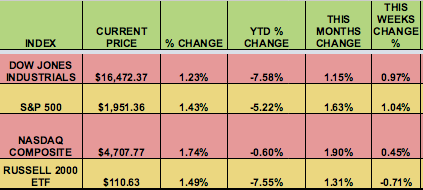

Markets: Friday’s topsy turvy big rally sent three out of four indexes into the positive territory for the week, as investors went bargain hunting, after the weak Sept. US Payrolls Report sent the market down in the morning.

Friday had the largest single-day price swings in four years for the S&P 500 and the Dow Jones Industrial Average. Investors snatched up beaten-down basic materials and healthcare stocks, in particular.

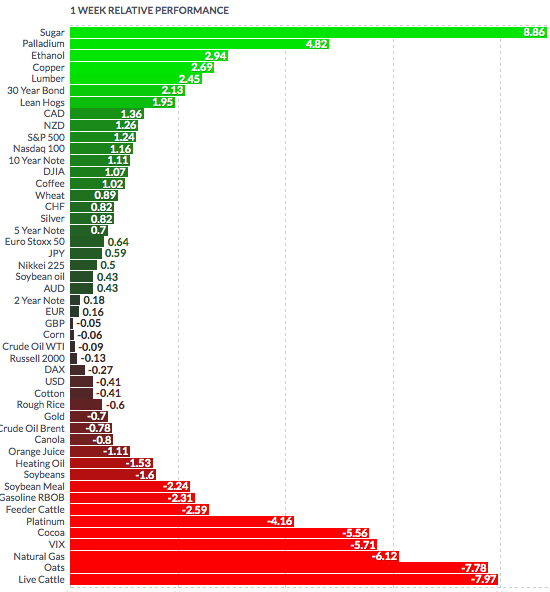

Volatility: After rising as high as 28.33 on Monday’s big down day, the VIX ended down -12% this week, after Friday’s turnaround rally.

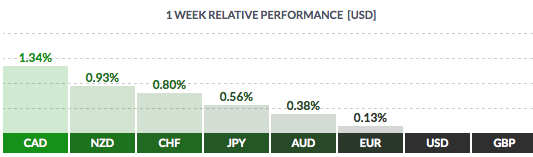

Currency: The US dollar fell vs. most other major currencies, influenced by the weak payrolls report.

Market Breadth: 21 of the Dow 30 stocks rose this week vs. 16 last week. 63% of the S&P 500 rose this week vs. 33% last week.

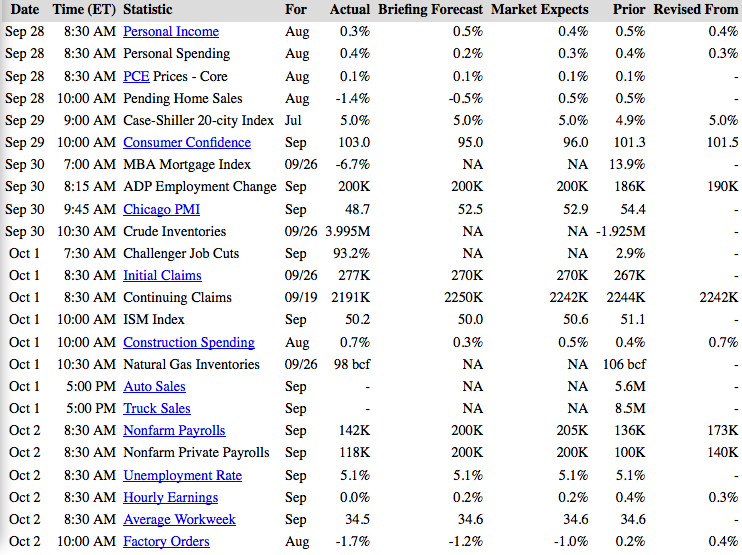

US Economic News: The US added just 142,000 jobs in Sept., and the two previous months were revised downward by 59,000. The US Unemployment rate stayed at 5.1%.

The US has added an average of 198,000 jobs per month so far in 2015, down from the 2014 average of 260,000/month. Job gains occurred in healthcare and information, with mining continuing to lose jobs.

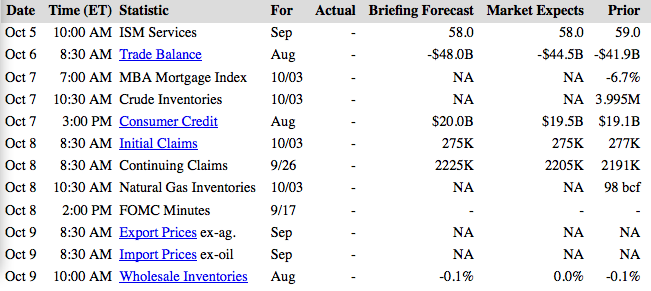

Week Ahead Highlights: It’ll be a quiet week for US economic data. Q3 Earnings season starts, with Alcoa (NYSE:AA), traditionally the first company to report its results, scheduled to announce its third quarter earnings after the market closes on Oct. 8. Investors are pinning hopes for further market rallies on a good Q3 earnings season. Corporate earnings are expected to fall by 4.1% overall, according to Thomson Reuters data. That figure is skewed, however, by an expected 65% fall in energy sector results.

Next Week’s US Economic Reports:

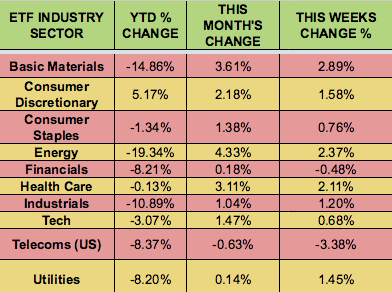

Sectors & Futures:

Basic Materials led this week, as telecoms and financials trailed.