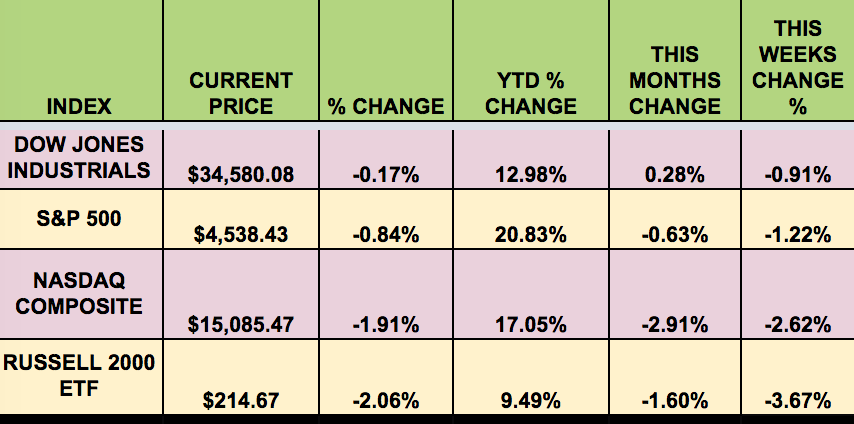

Market Indexes: It was a volatile week, with all 4 indexes retreating, as the market was rocked by hawkish comments from the Fed, the uncertainty of the Omnicom virus variant, and a weaker than expected jobs report, although the unemployment rate plunged to a 21-month low of 4.2%.

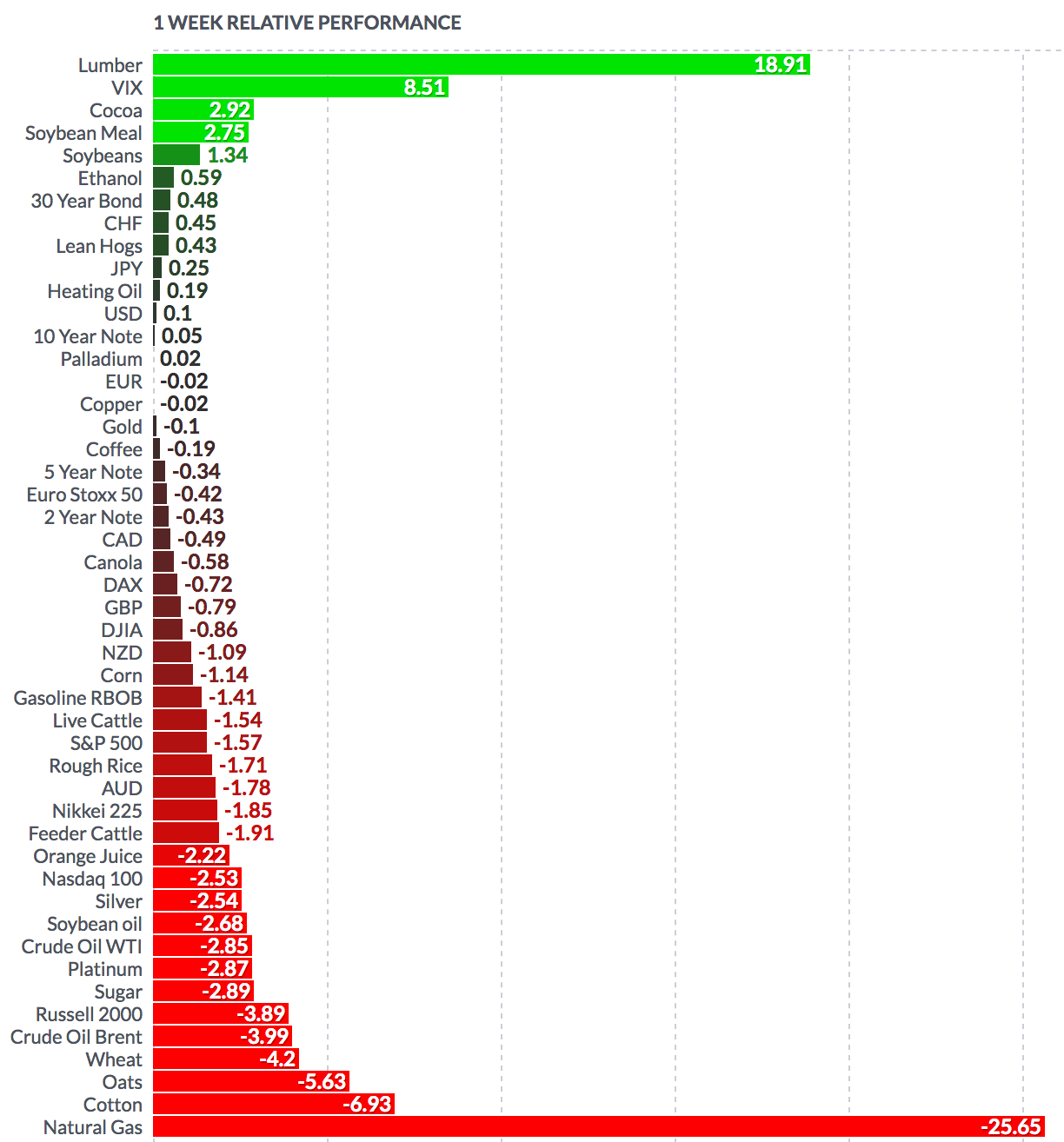

Volatility: The VIX rose 7.5% this week, ending the week at $30.76, its first close above $30 since January.

High Dividend Stocks: These high dividend stocks go ex-dividend this coming week: Penns Woods Bancorp (NASDAQ:PWOD), Sixth Street Specialty Lending (NYSE:TSLX), Medical Properties Trust (NYSE:MPW), Golub Capital BDC (NASDAQ:GBDC), Williams Companies (NYSE:WMB), Universal Insurance Holdings (NYSE:UVE), UWM Holdings (NYSE:UWMC), Eagle Point Cred (NYSE:ECC).

Market Breadth: 3 DJIA stocks rose this past week, vs. 5 the week before last. 11% of the S&P 500 rose, vs. 17% the week before last.

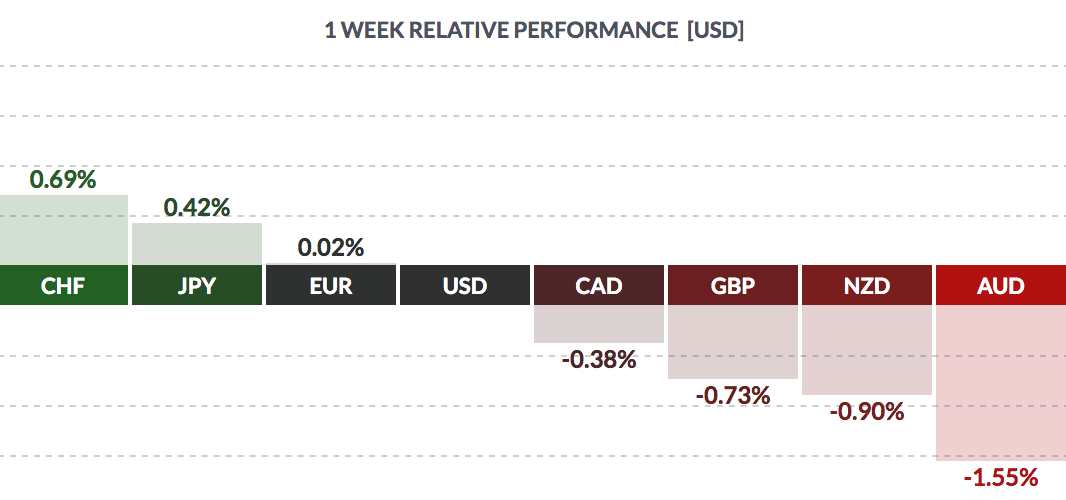

FOREX: The US $ gained vs. the pound, the Loonie, and the Aussie and NZ $ again last week, and fell vs. the yen, Swiss franc, and the euro.

Economic News

“Jerome H. Powell, the Federal Reserve chair, signaled that the central bank is growing more wary of high—and stubborn—inflation, and that it could speed up its plan to withdraw economic support as soon as its meeting in December as it tries to make sure that rapid price gains do not last.

"The Fed had been buying $120 billion in government-backed securities each month for much of the pandemic to bolster the economy by keeping money flowing in financial markets. In November, officials announced plans to slow those purchases by $15 billion per month. That would have ended the program mid-way through 2022. But Mr. Powell signaled on Tuesday that the process could speed up, cutting down on how much juice the Fed will add to demand in upcoming months.

'“At this point, the economy is very strong, and inflationary pressures are high,” Mr. Powell said during a hearing before the Senate Banking Committee. “It is therefore appropriate in my view to consider wrapping up the taper of our asset purchases, which we actually announced at our November meeting, perhaps a few months sooner.”

"Mr. Powell said that the Fed will discuss slowing bond purchase faster “at our upcoming meeting in a couple of weeks” — stressing that between now and then, the Fed will get a better sense of the new Omicron variant of the coronavirus, a fresh labor market report and a new reading on consumer price inflation.

"The Fed’s next two-day policy meeting will take place Dec. 14-15.” (NY Times)

Reuters reported:

“The survey of businesses showed non-farm payrolls increased by 210,000 jobs last month. Data for October was revised up to show employment rising by 546,000 jobs instead of 531,000 as previously reported. That left employment 3.9 million jobs below its peak in February 2020.

'Don’t be fooled by the measly payroll jobs gain this month because the economy’s engines are actually in overdrive as shown by the plunge in joblessness," said Christopher Rupkey, chief economist at FWDBONDS in New York. “While that still indicates that the economy is about 10 months away from closing the total payrolls employment gap, the unemployment rate is closing at a relatively rapid rate to the Federal Reserve’s estimate of full unemployment,” said Brian Bethune, professor of practice at Boston College.”

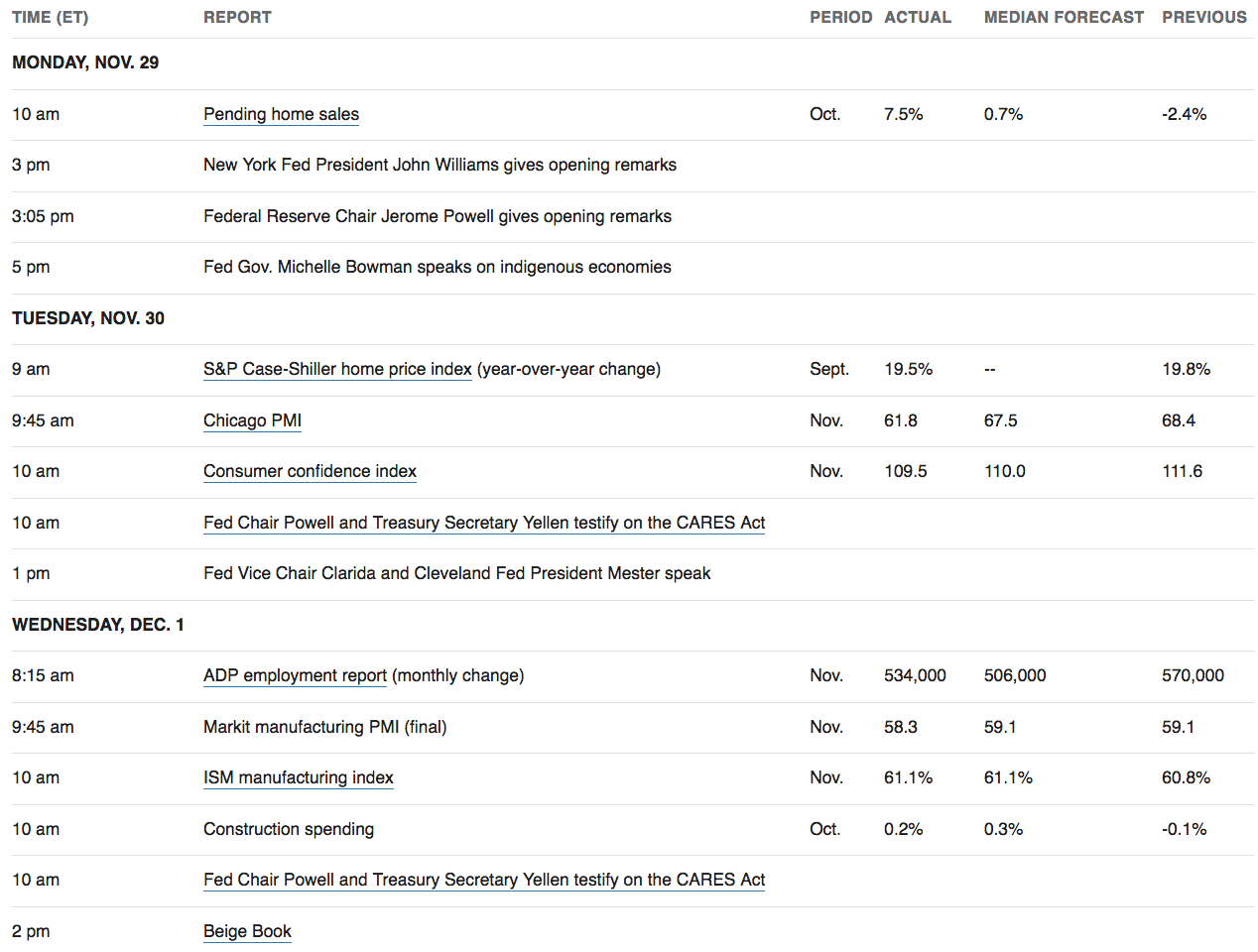

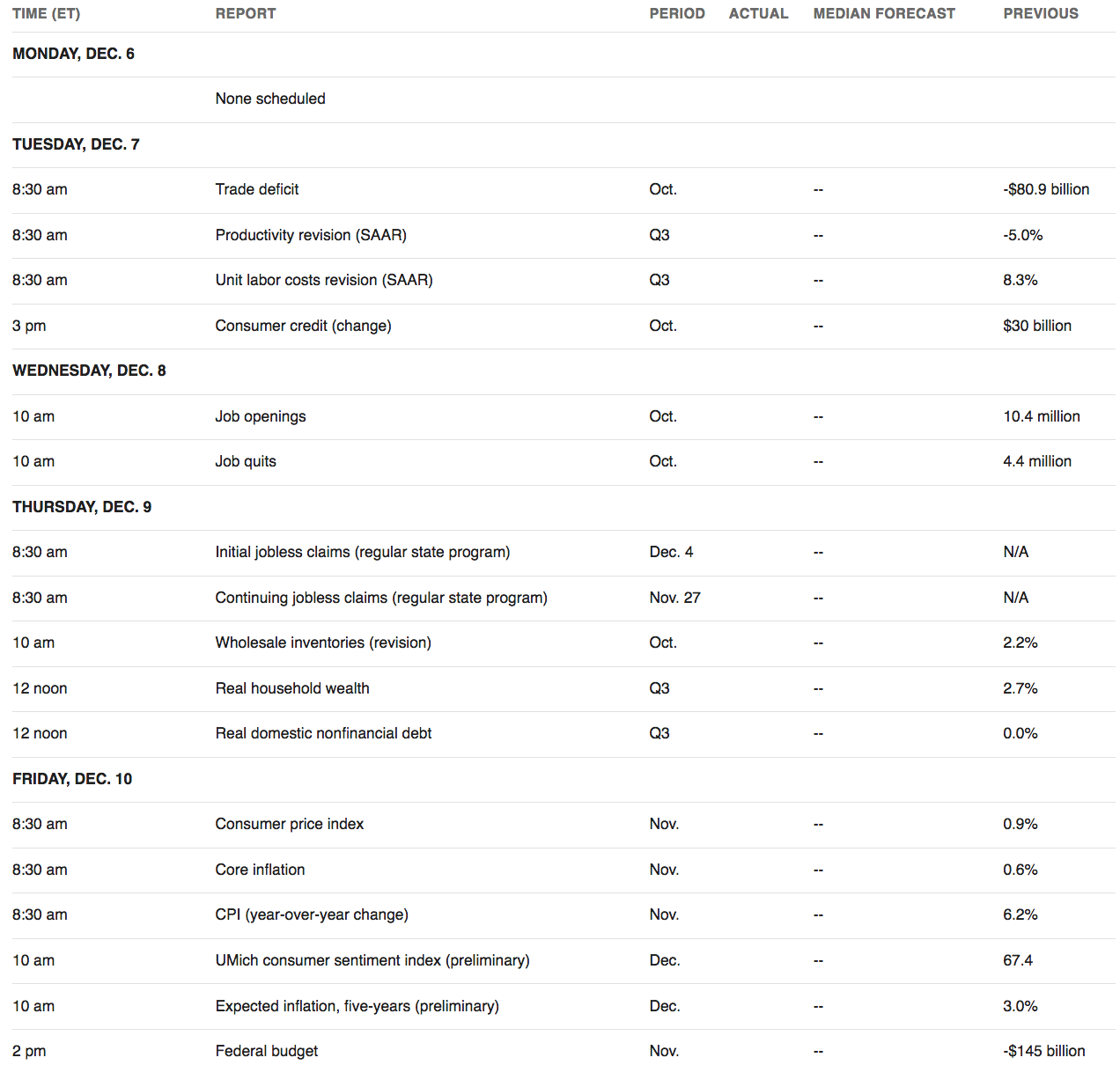

Week Ahead Highlights: There will be several consumer and inflation-related reports due out this coming week.

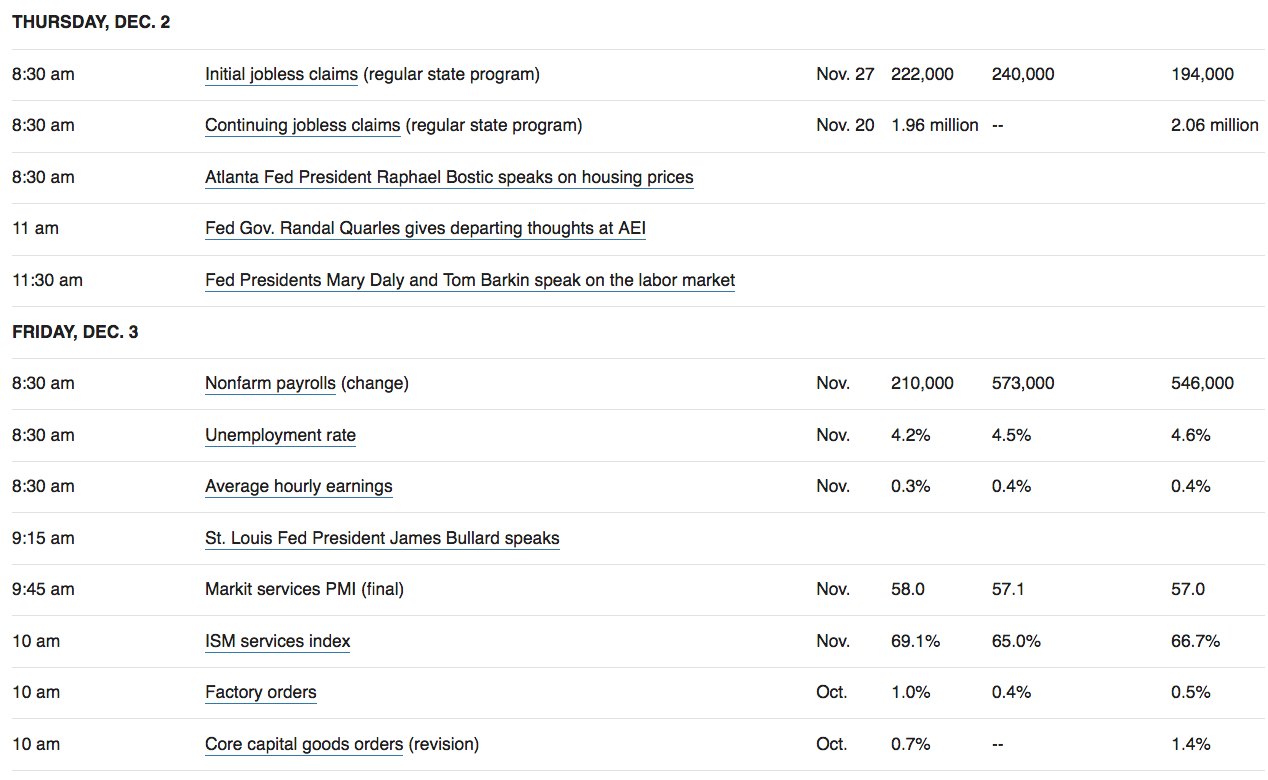

The New Week’s US Economic Reports:

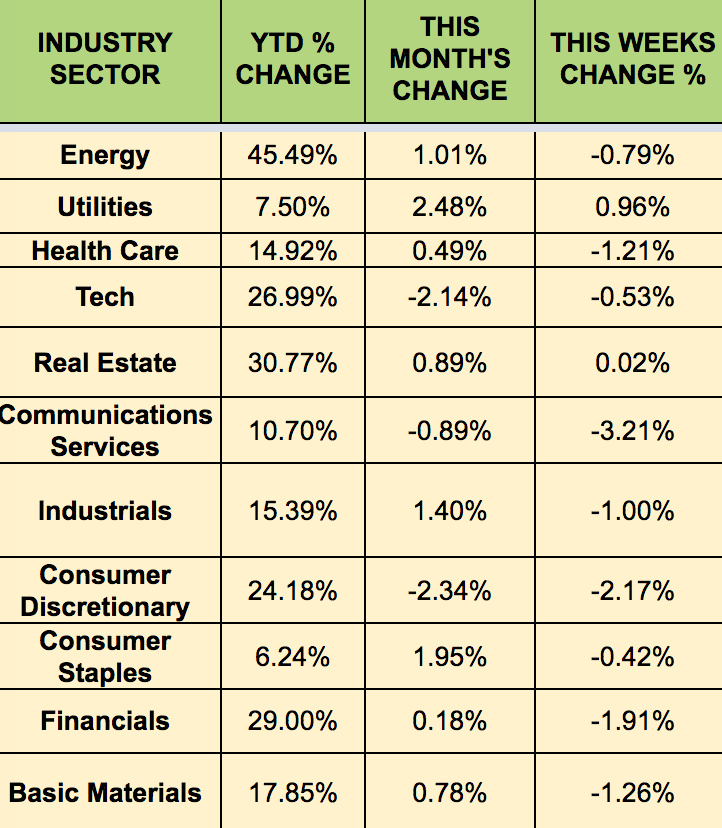

Sectors: Utilities led the week, with Communications Services lagging. Energy remains the leading sector in 2021.

Futures: WTI Crude fell -2.85% this week, ending at $66.55.