Investing.com’s stocks of the week

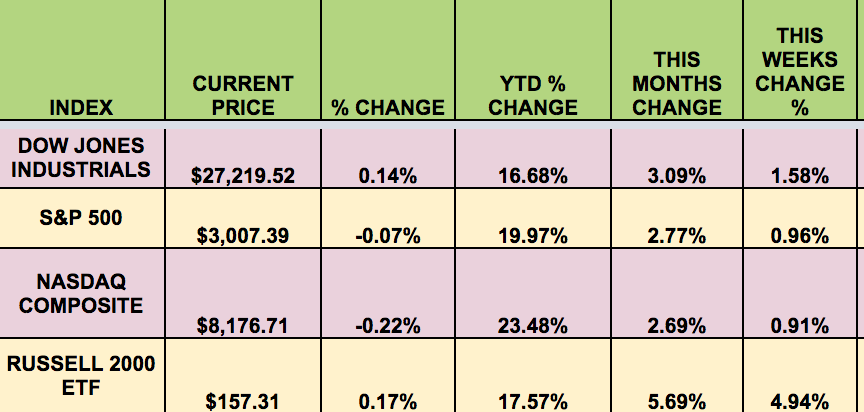

Market Indexes:

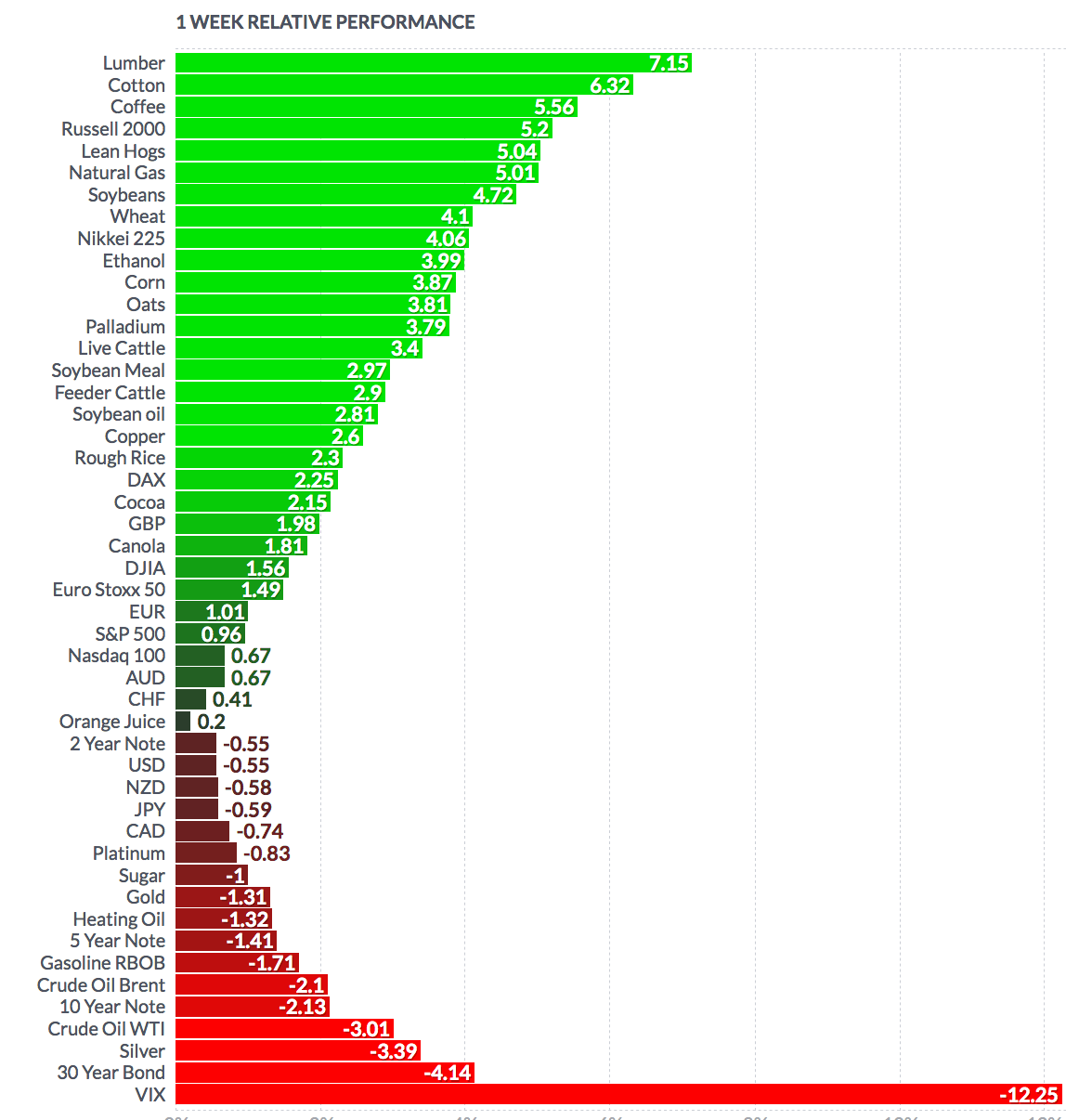

It was a strong week for the market, especially small caps, which rose nearly 5%.

“Treasuries extended their September tumble, sending the benchmark 10-year yield to its highest level since early August, amid stronger-than-expected U.S. economic data.

Bonds fell after August retail sales and the September University of Michigan consumer sentiment index increased more than forecast, buoying confidence in the economic expansion. Yields across the curve rose, with the 10-year climbing more than 12 basis points to 1.90%, up from a three-year low of 1.43% early this month.

The spread between 2-year and 10-year yields, considered a recession indicator when it inverts, as it did in August for the first time since 2007, widened back above 9 basis points.

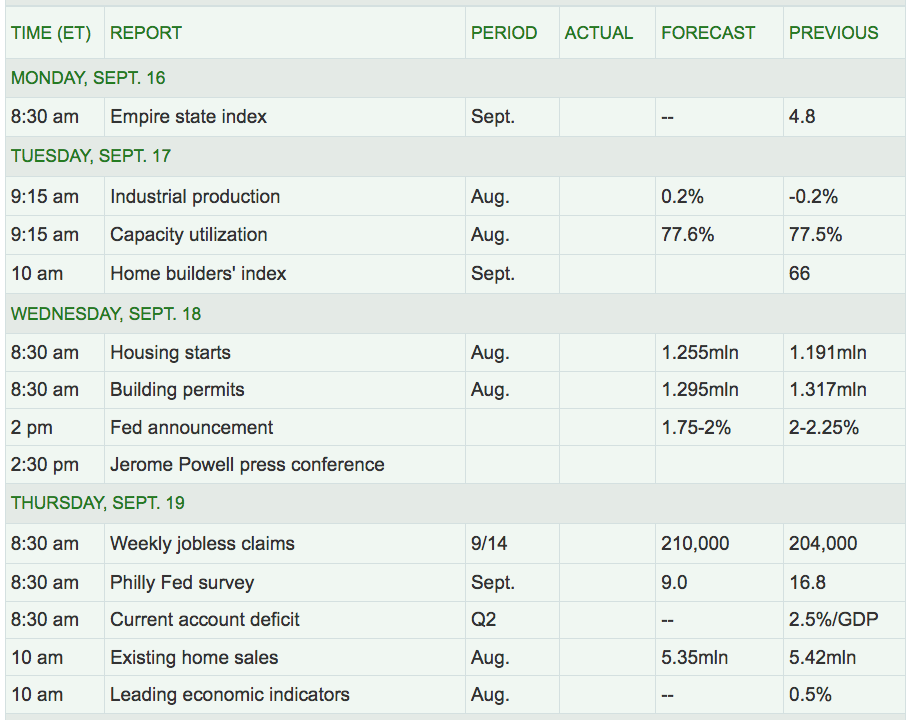

The decline in Treasuries comes as some central-bank officials are re-evaluating the effectiveness of easing efforts ahead of the Federal Reserve’s Sept. 18 meeting. Odds of a quarter-point rate cut, which futures had fully priced in for weeks, slipped to reflect a small chance of no change. Helping fuel the move, top European Central Bank officials questioned the quantitative-easing plan unveiled Thursday.” (Bloomberg)

This Week’s Option Trades

We added 2 covered call and 2 put-selling trades for mega cap tech stock Facebook, (NASDAQ:FB), to our Covered Calls Table and to our Cash Secured Puts Table this week.

There are several Covered Call trades with annualized yields north of 20%, including MKC, STX, T, and others.

Volatility

The VIX fell -8.4% this week, ending the week at $13.74, after reaching over $16.30 on Tuesday.

High Dividend Stocks

These high yield stocks go ex-dividend next week: GAIN, GLAD, GOOD, PNNT, TLRD, FSK, SLRC, DBI, NEWT, RPT, SUNS, OFS.

Market Breadth

20 out of 30 DOW stocks rose this week, vs. 25 last week. 67% of the S&P 500 rose, vs. 85% last week.

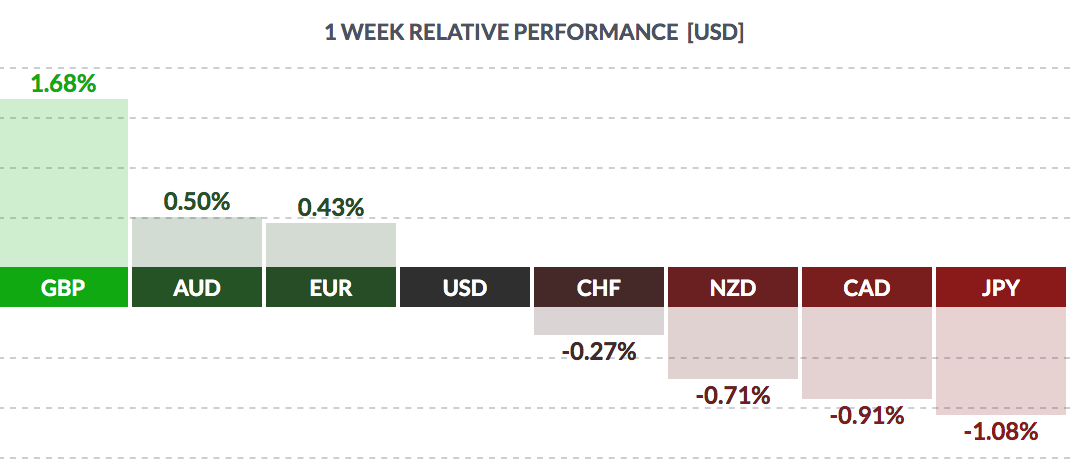

FOREX

The USD fell versus the pound, euro, and Aussie, but rose versus the Swiss franc, New Zealand dollar, the Loonie, and theyen.

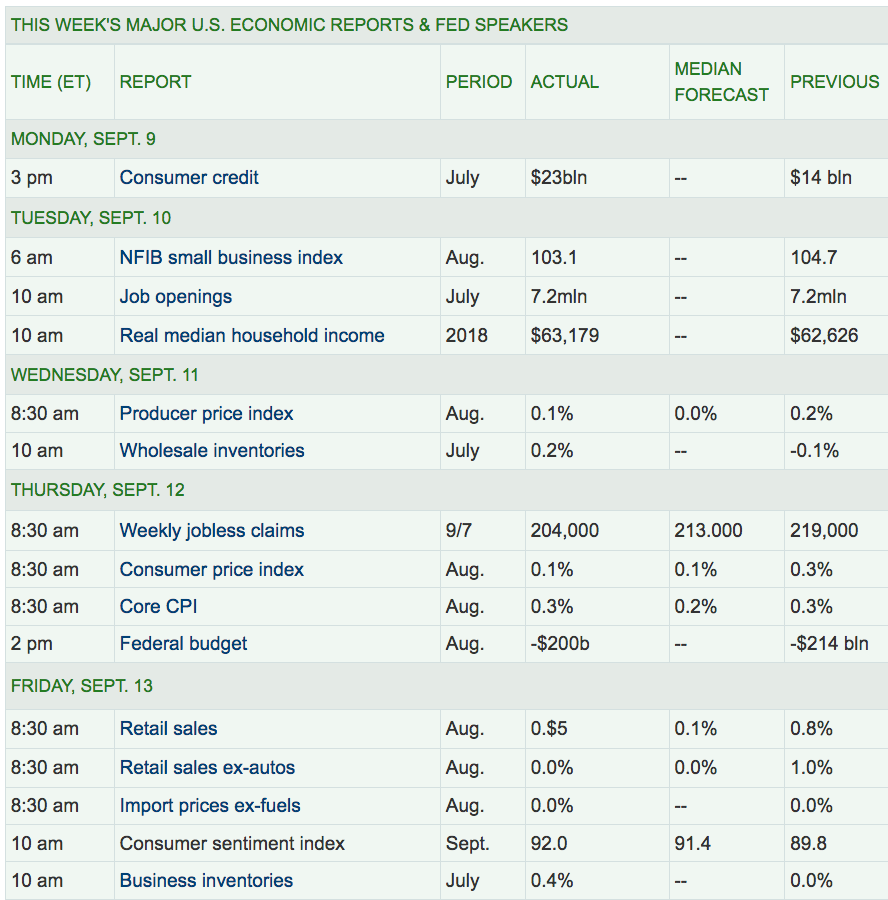

Economic Reports:

“China has released a list of 16 US imports that will be exempted from tariffs in the ongoing trade war between the world’s two largest economies. They include anti-cancer drugs and animal feed. But with more than 5,000 products on it, the list of goods that are still subject to extra taxes is much longer.

Nevertheless, some analysts view the move as a friendly gesture by China ahead of talks with the US. “The exemption could be seen as a gesture of sincerity towards the US ahead of negotiations in October but is probably more a means of supporting the economy,” ING’s China economist Iris Pang wrote in a note.” (BBC)

“U.S. underlying consumer prices increased solidly in August, leading to the largest annual gain in a year, but rising inflation is unlikely to deter the Federal Reserve from cutting interest rates again next week to support a slowing economy. The Labor Department said its consumer price index excluding the volatile food and energy components gained 0.3% for a third straight month. The so-called core CPI was boosted by a surge in healthcare costs and increases in prices for airline tickets, recreation and used cars and trucks.

In the 12 months through August, the core CPI increased 2.4%, the most since July 2018, after climbing 2.2% in July.” (Reuters)

Week Ahead Highlights: All eyes will be on the Fed, as it announces its interest rate decision on Wednesday.

Next Week’s US Economic Reports:

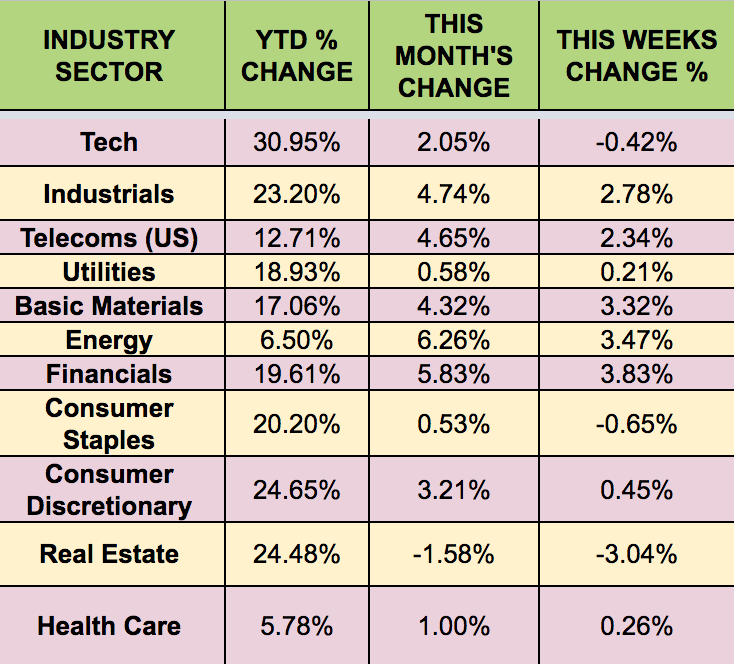

Sectors: Financials and Energy stocks led this week, with Real Estate lagging, as interest rates rose.

Futures

WTI Crude fell -3.01% this week, ending at $54.82. Natural Gas rose again, up 5.01%.