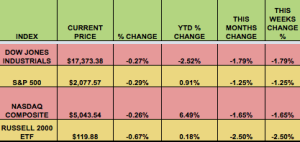

Markets: A solid non-farm payrolls report sent markets down again on Friday, as the possibility of the Fed’s 1st rate hike in over 6-years loomed larger in investors’ minds. The Dow has suffered its worst losing streak in 4 years, falling 7 sessions in a row.

Volatility: The VIX rose 10.5% this week, ending at 13.39, and reaching a high point of 14.58.

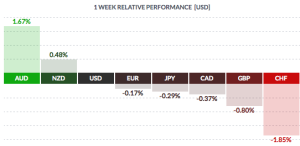

Currency: The US dollar rose vs. most major currencies, on the back of the solid payrolls report. Oddly, it fell vs. commodity-rich Australia and New Zealand.

Market Breadth: 5 of 30 DOW stocks rose this week, vs. 23 last week. 38% of the S&P 500 rose this week, vs. 71% last week.

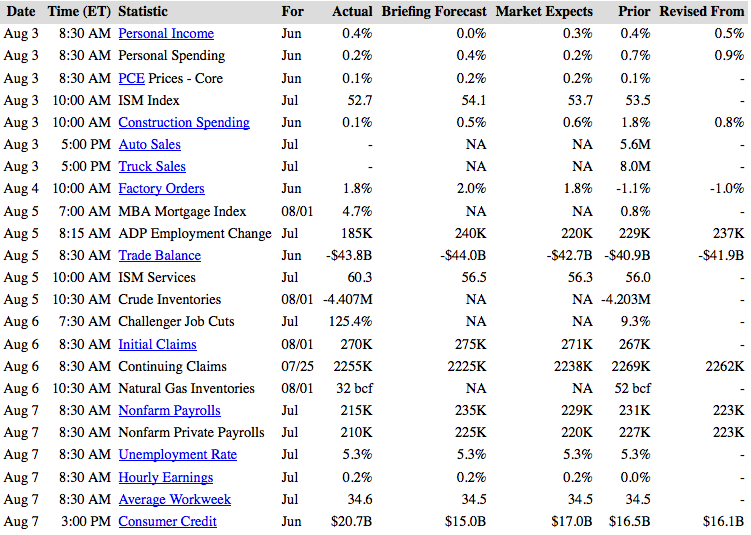

US Economic News: The US added 215,000 jobs in July, and May & June figures were increased by a total of 14,000 jobs. Job gains occurred in retail trade, health care, professional and technical services, and financial activities.

Jobless Claims are still hovering near 40-year lows, with firing down, and the average claims remaining below 300K since March, which is the longest stretch since 1972.

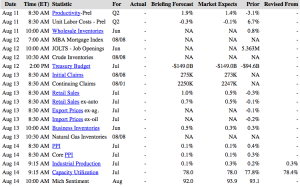

Week Ahead Highlights: The OPEC carterl releases its monthly report on Tuesday, which could rattle Energy markets. On Thursday, retail sales are expected to rise a solid 0.6% in July vs. June, due to strength in vehicle sales.

Next Week’s US Economic Reports:

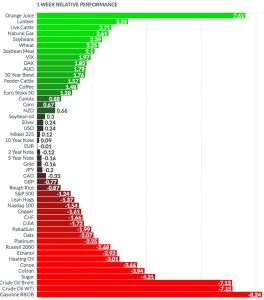

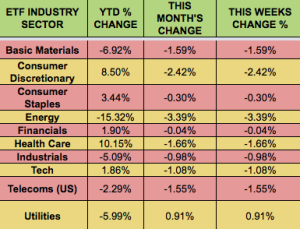

Sectors & Futures: Defensive utility stocks led this week, while beaten-up energy stocks lagged.

Crude oil futures closed at their lowest in 4-months on Friday, as a rising dollar put pressure on commodities.