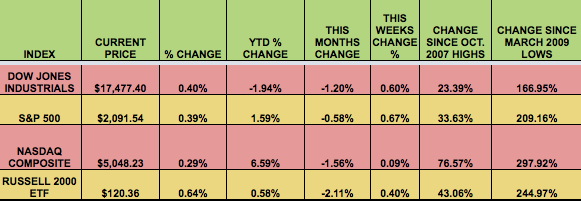

Markets: After a topsy-turvy week, the market managed to eke out small gains. China’s 3% currency devaluation and slowdown fears sent markets reeling early in the week. Crude oil hit its lowest point in 6 years, and has many Energy mavens calling for a low.

Volatility: After rising as high as on Wednesday’s big seesaw day, the VIX closed the week down 4%, at 12.89.

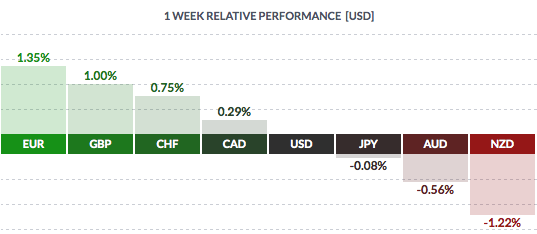

Currency: The US dollar gained vs. the Aussie and NZ dollars, and fell vs. most other major currencies.

Market Breadth: 6 DOW 30 stocks rose this week, vs. 5 last week. 53% of the S&P 500 rose this week, vs. 38% last week.

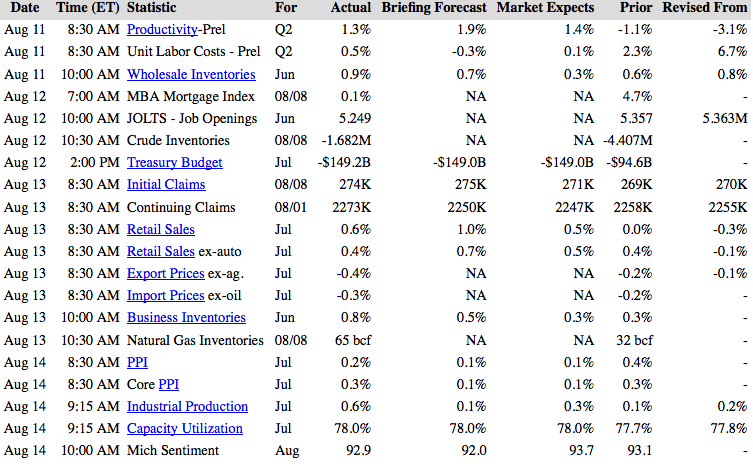

US Economic News: The 4-week avg. for Unemployment Claims is at its lowest since 2000. Core Producer Prices remain stubbornly low, rising only .6% in July, vs. an .8% rise in June, much lower than the Fed’s 2% inflation target, leading more economists to predict a December Fed rate hike, vs. September.

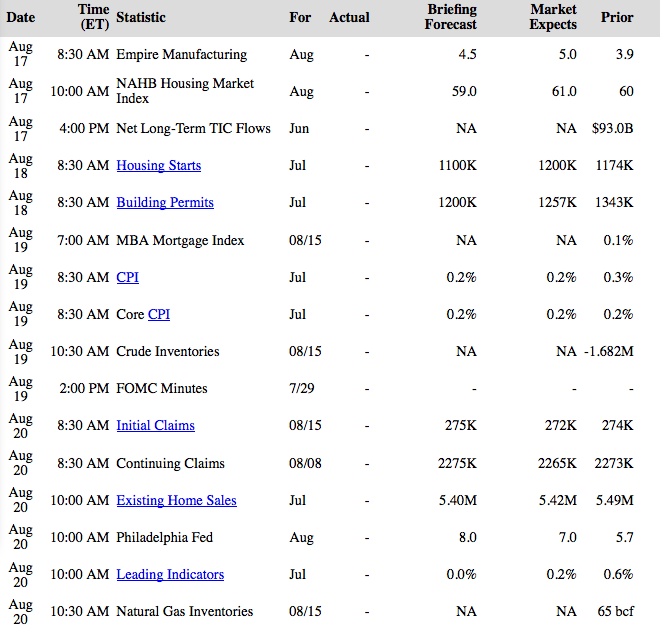

Week Ahead Highlights: Investors will be parsing the minutes on Wednesday, from the Fed’s last meeting, for further clues about future rate hike timing. Housing data will be in the spotlight – Housing Starts, Permits, and Existing Home Sales reports will be released.

Next Week’s US Economic Reports:

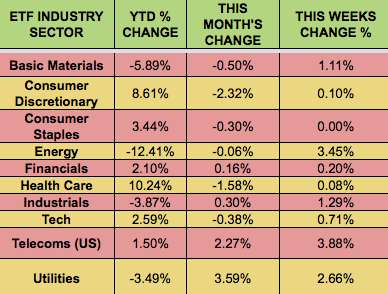

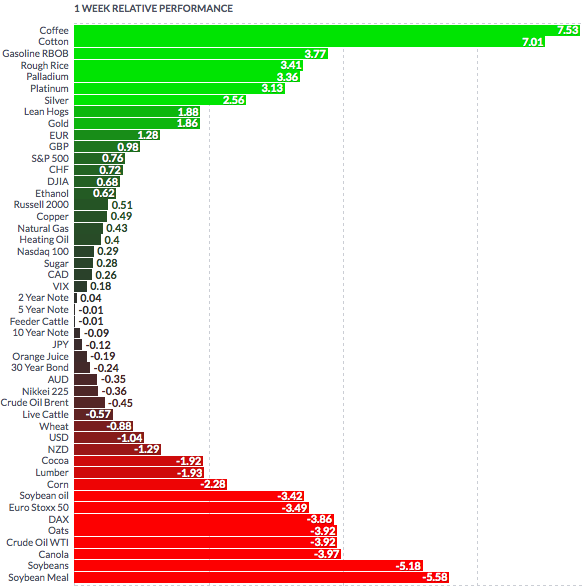

Sectors and Futures:

Telecoms led, while Consumer Staples trailed this week: