Markets:

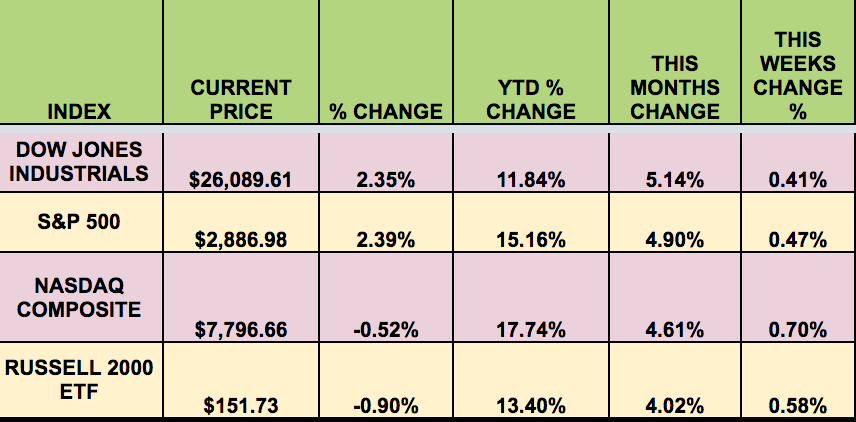

Market indexes rose slightly this week, caught between potential future rate cut hopes and trade war jitters. Additionally, the attacks on oil tankers in the Strait of Hormuz pushed up oil.

“Hong Kong police fired rubber bullets and tear gas at demonstrators who threw plastic bottles on Wednesday as protests against an extradition bill that would allow people to be sent to mainland China for trial descended into violent chaos. Civil Human Rights Front, which organized a protest on Sunday that it estimated saw more than a million people take to the streets in protest against the extradition bill, accused police of using unnecessary violence.” (Reuters)

High Dividend Stocks:

These high yield stocks go ex-dividend next week: BKCC, TLRD, FSK, GAIN, GLAD, GOOD, STX, CPTA, SLRC, OFS, GCAP.

Market Breadth:

19 out of 30 DOW stocks rose this week, vs. 30 last week. 41% of the S&P 500 rose, vs. 96% last week.

Volatility:

The VIX fell 6.25% this week, ending the week at $15.28.

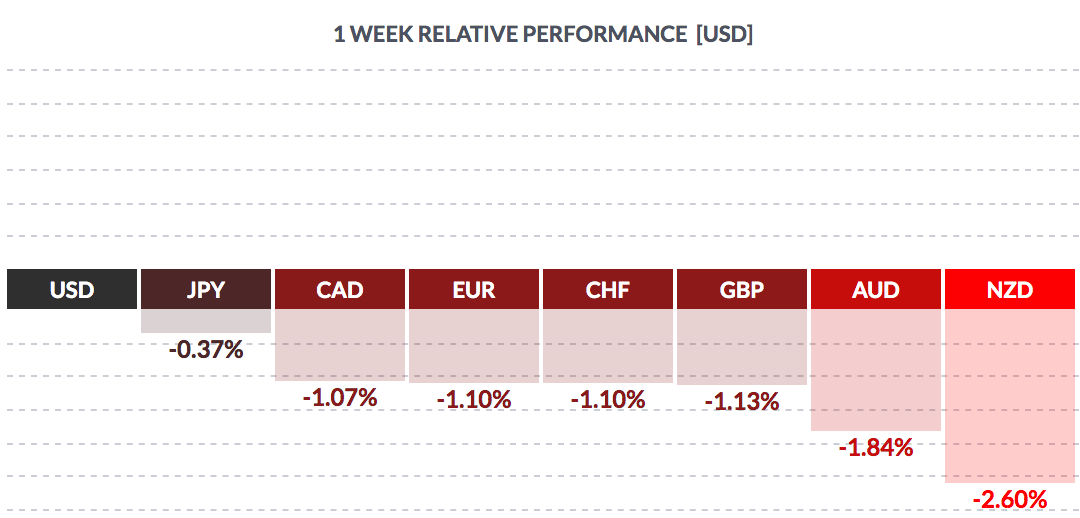

FOREX:

The USD rose versus most major currencies this week.

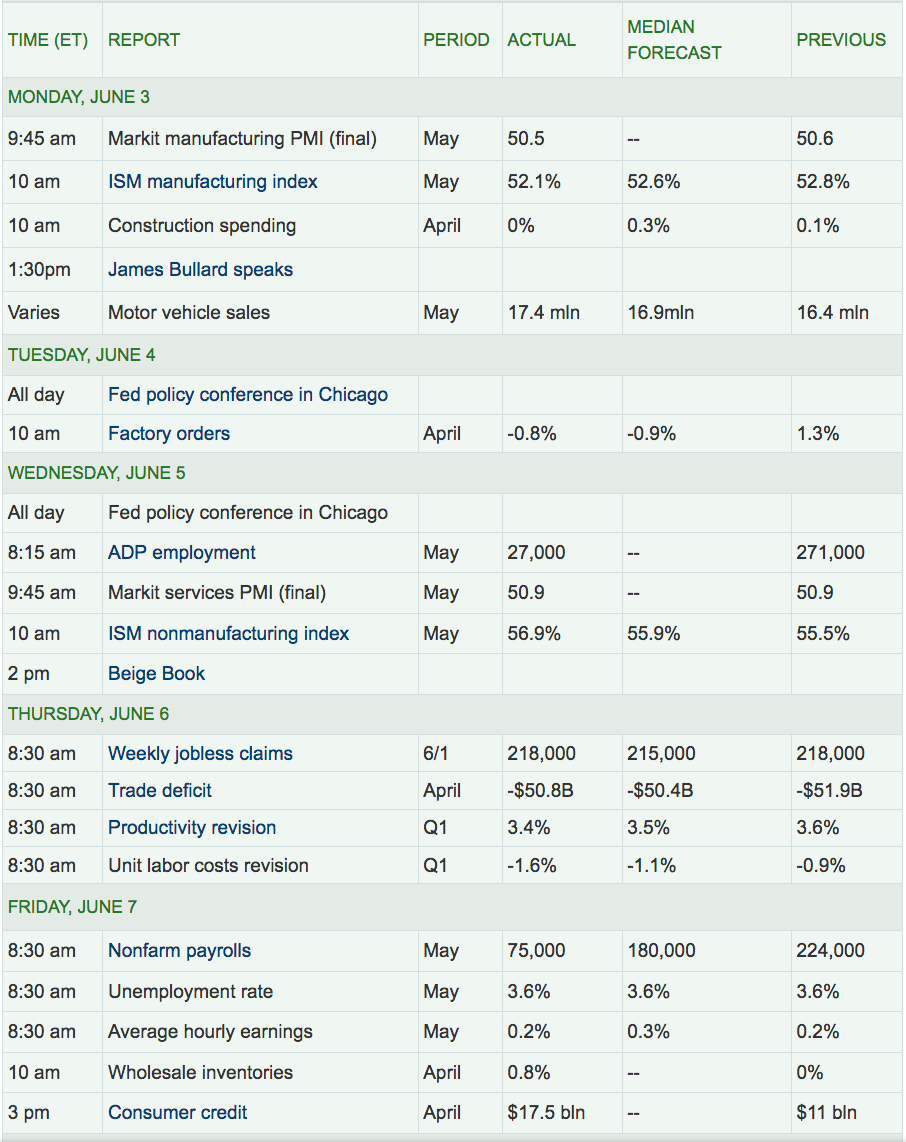

Economic News:

“Falling gasoline and used-vehicle prices held inflation in check in May and inflation pressures more broadly eased again, potentially making it easier for the Federal Reserve to reduce the cost of borrowing soon if the U.S. economy weakens any further. The consumer price index rose a scant 0.1% in April. It was the smallest increase since January. More notably, the increase in the cost of living over the past 12 months slowed to 1.8% from 2%. The rate of inflation has tapered off from nearly 3% since last summer.” (MarketWatch)

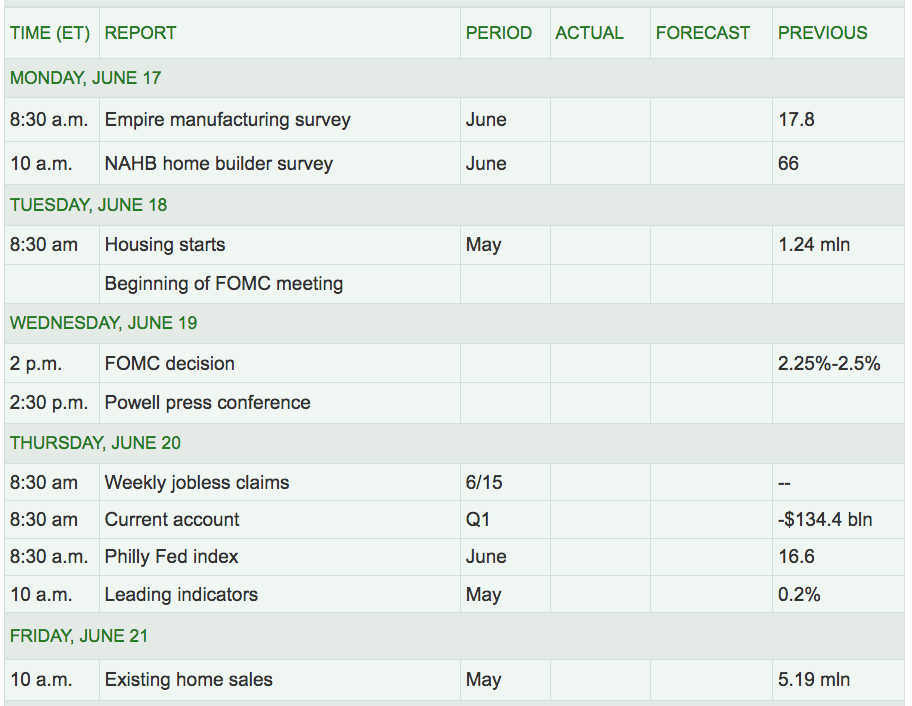

Week Ahead Highlights:

All eyes will be on the Fed, which holds its FOMC meeting on Tues-Wed. The market now sees a much stronger chance of 2 rate cuts in 2019, with the first one possibly coming at next week’s meeting.

Next Week’s US Economic Reports:

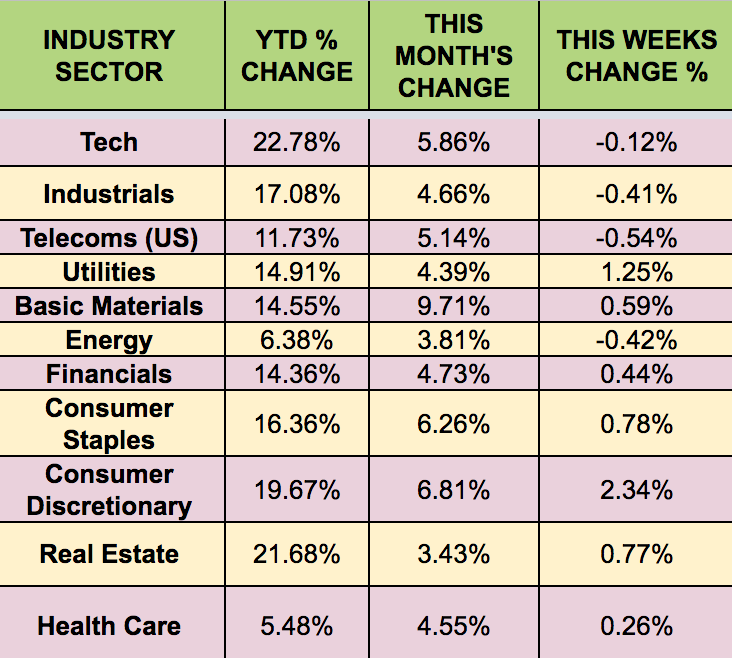

Sectors:

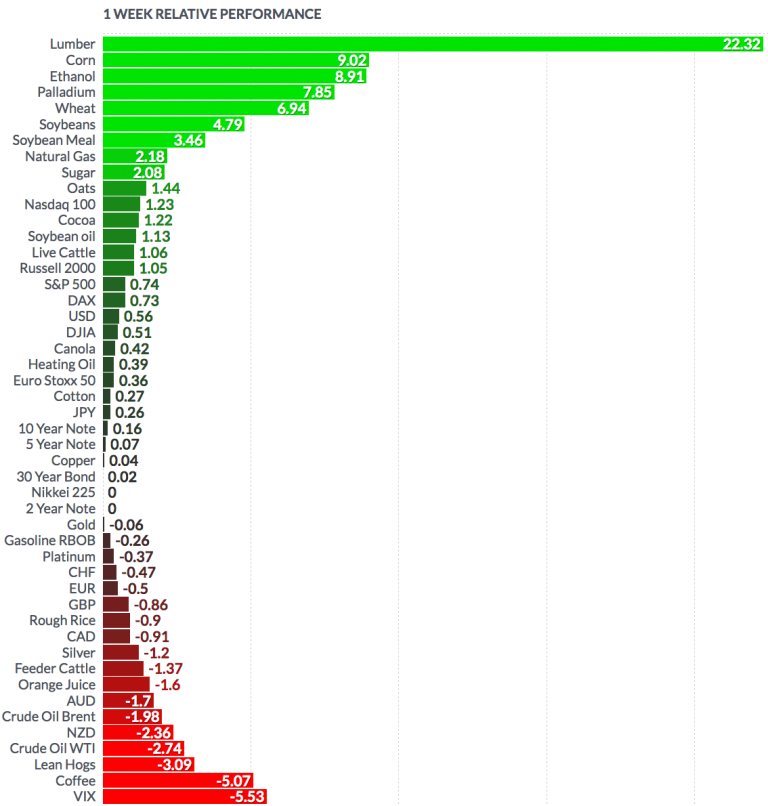

Basic Materials led this week, up 9%, with Real Estate lagging.

Futures:

WTI Crude fell 2.74% this week, finishing the week at $52.51, while Natural Gas rose 2.18%.

“The Strait of Hormuz, the world’s most important oil chokepoint, is notoriously tiny. On Thursday, Japan was stuck right in the middle of it. Early in the day, two tankers were reportedly attacked in the Gulf of Oman, which leads into the Strait of Hormuz: a tiny water passage that links the energy giants in the Persian Gulf to the energy-hungry Asian markets. Iran is on one side of the Strait; Oman’s on the other. The strait’s importance can’t be overstated:~40% of the world’s oil passes through it. Both the tankers were bound for Japan. Thursday’s attack followed reports last month from Saudi Arabia that several oil tankers in the region had been sabotaged. (It’s unclear who’s responsible for any of the incidents.)” (Fortune)