Markets: The market fell this week, reacting to more uncertainty in DC, and a scandal in Brazil. The market fell over 1% on Wednesday, for only the 2nd time in 2017, as the promise of tax reform seemed to fade further into the future.

The SPDR Russell Small Cap Index (NYSE:SMD) trailed, and even the NASDAQ pulled back.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Nokia (HE:NOKIA) Corp ADR (NYSE:NOK), RAIT Financial Trust (NYSE:RAS), Brookfield Renewable Energy Partners LP (NYSE:BEP), Exelon Corp (NYSE:EXC) Unit (NYSE:EXCU), Independence Realty Trust (NYSE:IRT), JMP Group (NYSE:JMP), MTBCP, S&T Bancorp (NASDAQ:STBA), Stellus Capital Investment (NYSE:SCM), Tpg Speclty (NYSE:TSLX).

Volatility: After rising as high as $15.51 on Thursday, the VIX rose 16% this week, finishing at $12.04.

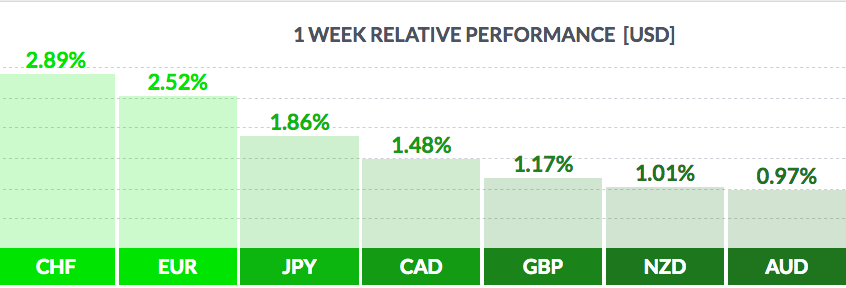

Currency: The $ fell vs. most major currencies this week, with more uncertainty surrounding the new administration in DC. This was the Dollar’s worst week since July ’16:

Market Breadth: 12 of the DOW 30 stocks rose this week, vs. 14 last week, and 44% of the S&P 500 rose, vs. 52% last week.

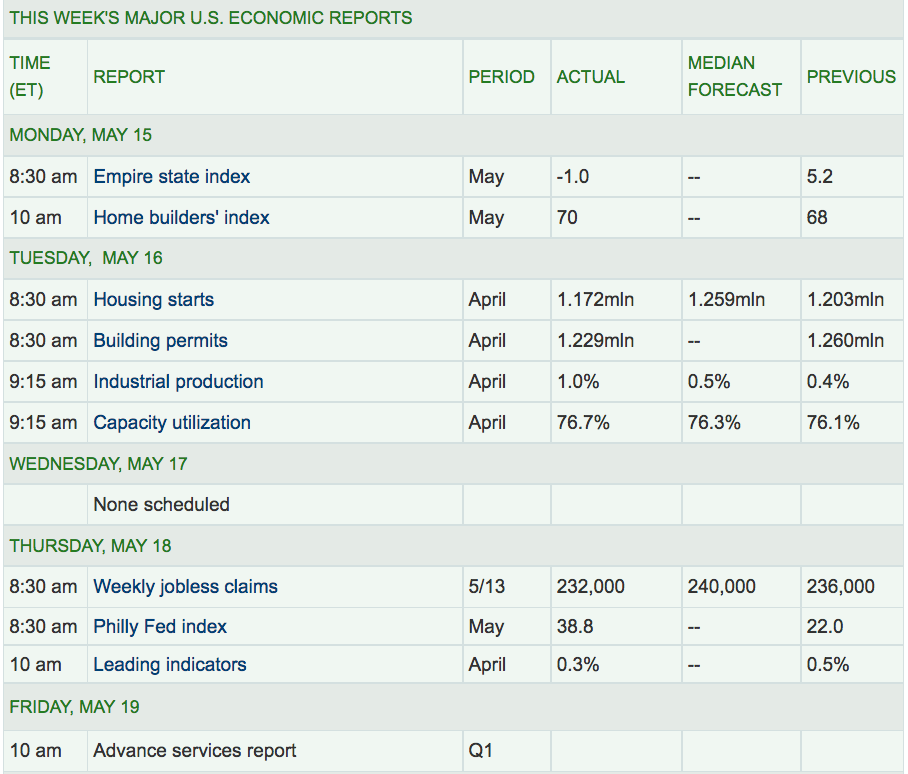

US Economic News: Housing Starts and Building Permits both declined vs. the previous month, but Industrial Production and Capacity Utilization both rose.

2017 Healthcare Update: 2 Healthcare Dividend Stocks With Low Debt

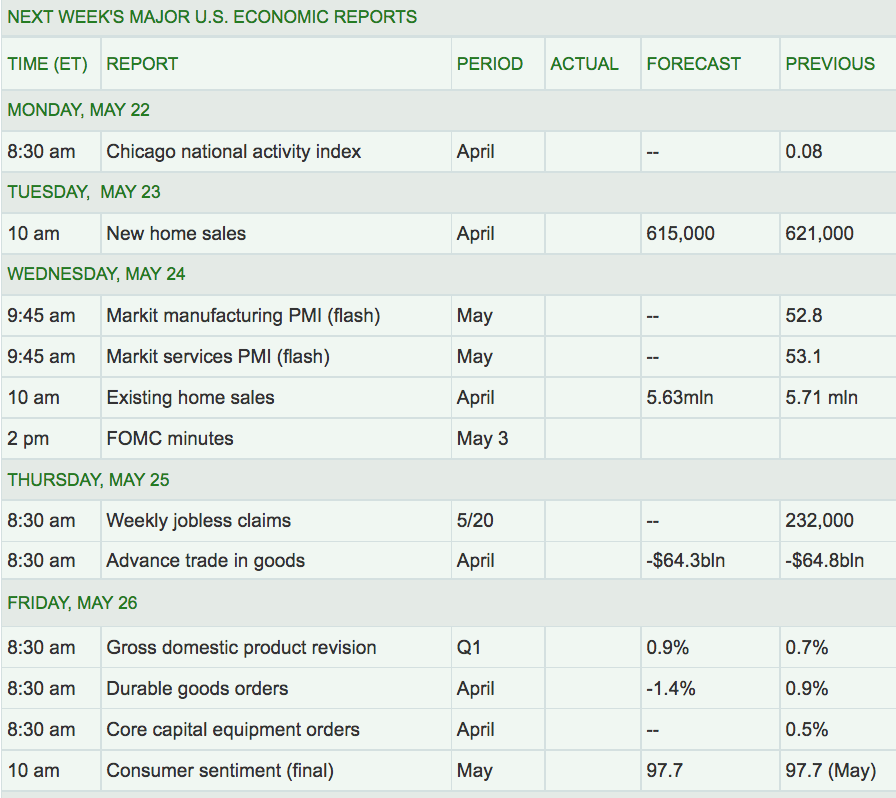

Week Ahead Highlights: Investors will be parsing the Fed’s minutes, for clues on future rate hikes and other tightening moves. More housing data comes out, with New and Existing Home Sales reports due on Tuesday and Wednesday. Consumer Sentiment for May gets its final number on Friday.

Consumer stocks Lowe’s Companies (NYSE:LOW) and Tiffany (NYSE:TIF) report earnings.

5/20/17 alert: Saudi Arabia’s energy minister said yesterday that OPEC and Russia had agreed to extend production cuts for another 9 months, through Q1 ’18. This announcement should lift certain Energy-related stocks this week.

This Week’s US Economic Reports:

(Source: MarketWatch)

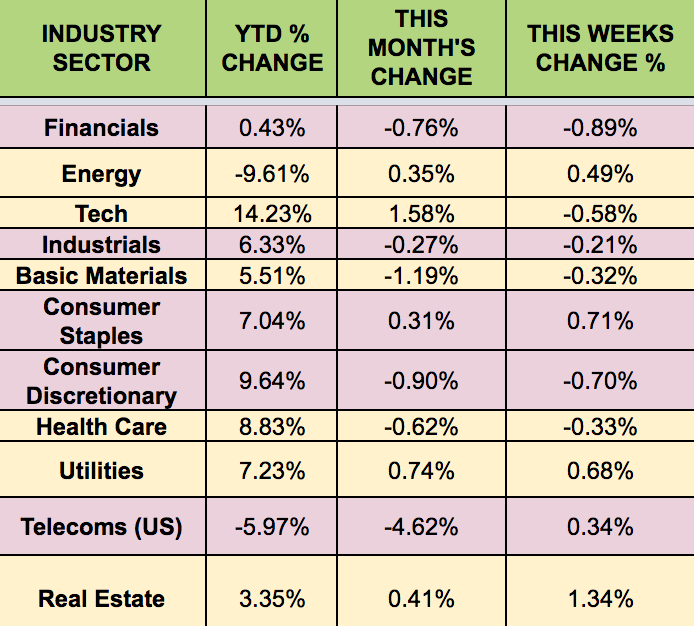

Sectors & Futures: Real Estate led this week, while Financials trailed.

Crude oil gained 5.65%, but natural gas futures fell -5.2%. Heating oil futures led last week, while OJ trailed.