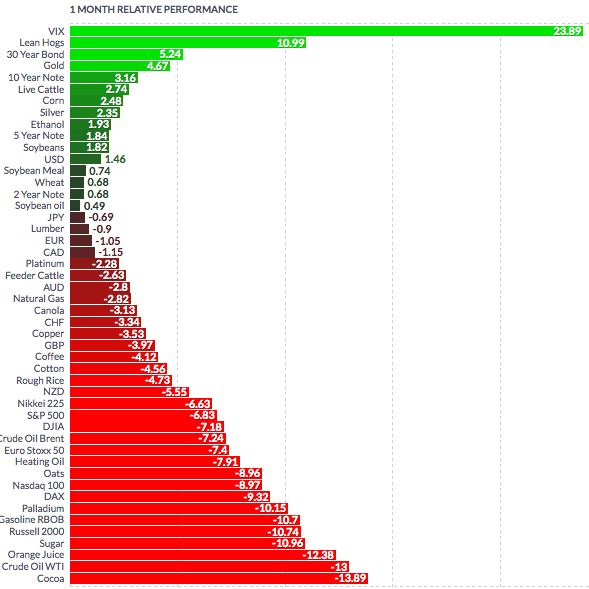

The Double Dividend Stock Alert: 7.21% Avg. Annualized Yields

DOW JONES 30: -2.23%

S&P 500: -0.73%

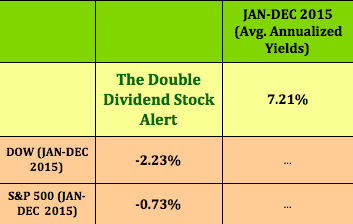

Markets: The major indexes staged a huge rally on Friday, narrowing their monthly losses, in what was the worst January for the market since 2009. The Bank of Japan unexpectedly lowered rates, (they’re now negative), and strong earnings from Microsoft (O:MSFT), sparked a rally in Tech shares Friday. Friday’s weak US GDP report also strengthened investors’ conviction that the Fed won’t raise rates again in April.

Dividend Stocks Update – These high dividend stocks go ex-dividend this coming week: N:KNOP, N:WSR, N:MPLX, N:GNL.

Volatility: The VIX fell 9.6 % this week, finishing at $20.20. However, VX futures rose nearly 24% this month.

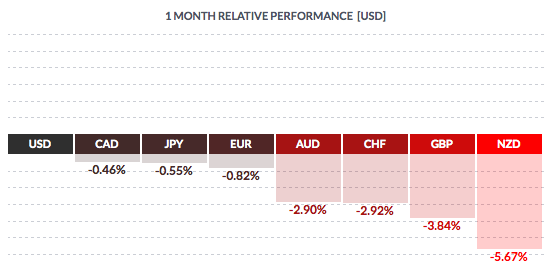

Currency: The US dollar rose vs. the Swiss franc, the pound, and the Aussie and NZ dollars, in January, but fell vs. the euro, yen, and the loonie.

Market Breadth: 23 of the DOW 30 stocks rose this week, vs. 8 last week. 73% of the S&P 500 rose this week, vs. 44% last week. Only 5 of the DOW 30 stocks rose in January, while 20% of the S&P 500 rose.

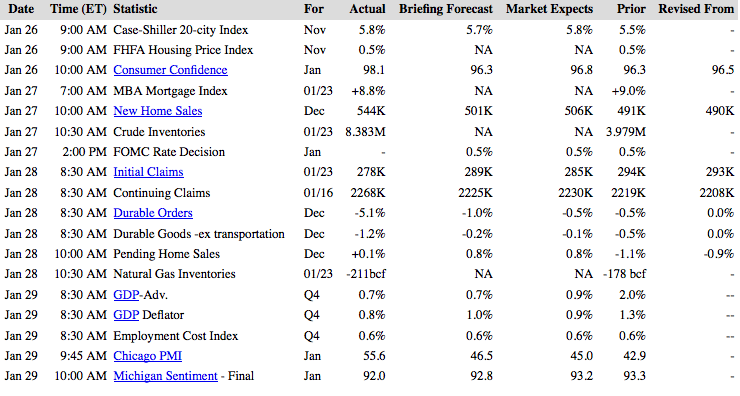

US Economic News: New Home Sales jumped in December, logging their biggest gain since July 2014. US GDP for the 4th quarter is now estimated to have grown at just .7%, vs. 2% in Q3 2015.

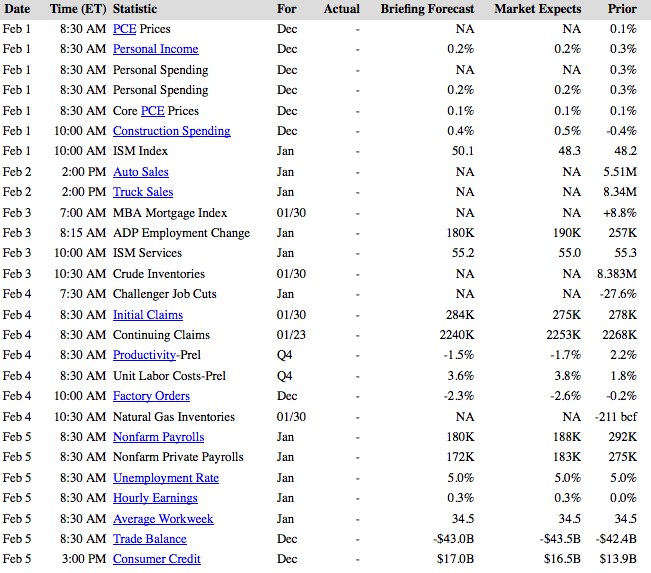

Week Ahead Highlights: The Non-Farm Payrolls report due out on Friday will close a week that includes key data on factory activity and construction spending, car sales, services sector growth and inflation. The number of jobs created in January is expected to have declined to 180K, vs. the 292K created in December.

Earnings – A wide swath of major companies will report, from oil giant Exxon (N:XOM), to tech goliath Alphabet (O:GOOGL), Dow Chemical (N:DOW), and several major Pharma firms.

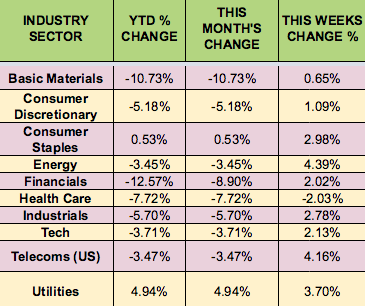

Sectors and Futures:

Energy and Telecoms led this week, as Healthcare trailed. Utilities led in January, with Financials trailing.

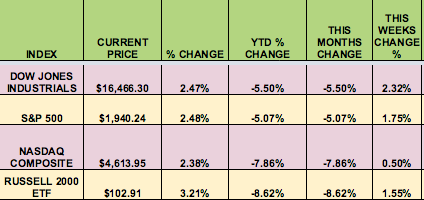

The VIX and Lean Hogs led this month, with cocoa and crude trailing: