Stock Market News: March 23, 2019

Markets:

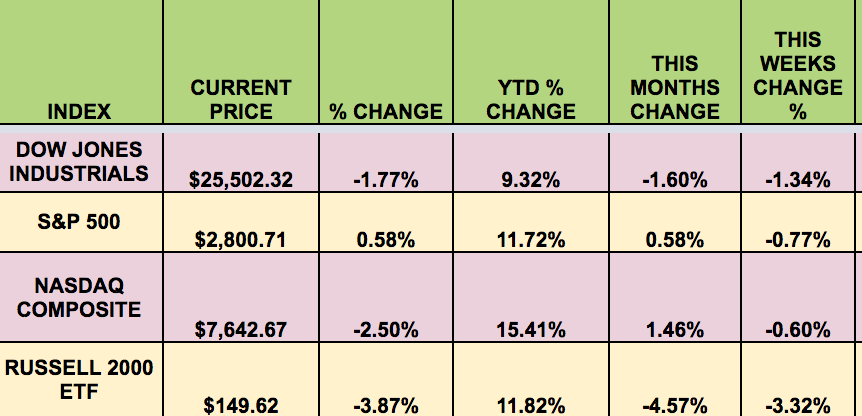

It was a down week for the market, with all 4 indexes posting their biggest one-day percentage declines since Jan. 3 on Friday. The RUSSELL small caps were hit the worst, losing -3.32%, while the NASDAQ held up the best, losing -.60%.

“Weak factory data from the United States and Europe led to an inversion of U.S. Treasury yields, fueling fears of a global economic downturn.

Earlier in the week, the U.S. Federal Reserve concluded its two-day monetary policy meeting with a statement that forecast no additional interest rate hikes in 2019 on signs of economic softness, a dovish shift that took the markets by surprise”.

High Dividend Stocks

These high yield stocks go ex-dividend next week – ACRE, RPAI, BGS, CGBD, NHI, PLYM, SCM, TRP, CBL, CXW, JCAP.

Volatility:

The VIX rose 2.7% this week, ending the week at $16.48, its highest point in a month.

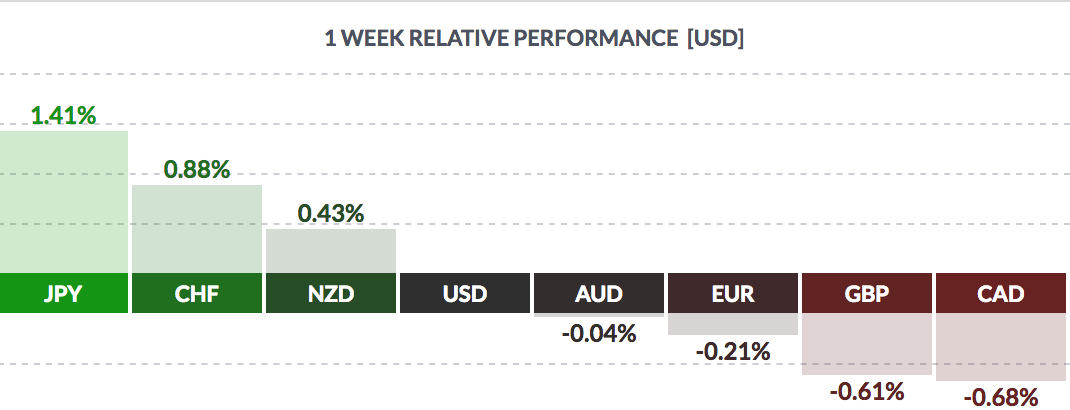

FOREX:

The USD fell vs. the yen and the Swiss franc, and rose vs. most other major currencies this week.

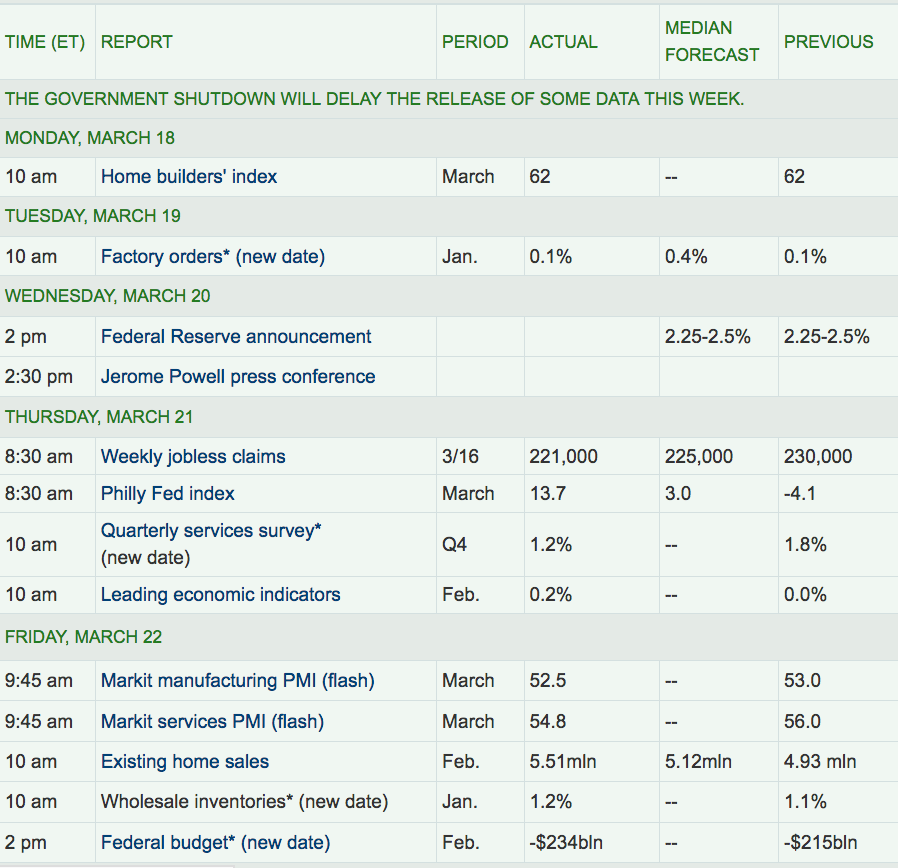

Economic News:

“The Federal Reserve doesn’t see any interest rate hikes coming in 2019. Patient means that we see no need to rush to judgment,” Fed Chairman Jerome Powell said, adding it could be “some time” before the jobs and inflation outlooks provide a reason to change policy. Treasury yields dropped to the lowest in over a year. The central bank’s unexpected move to scrap its forecast for rate hikes this year has led to increased bets that a cut will happen.” (Bloomberg)

“New orders for U.S.-made goods rose less than expected in January and shipments fell for a fourth straight month, offering more evidence of a slowdown in manufacturing activity. Factory goods orders edged up 0.1 percent, the Commerce Department said on Tuesday, held back by decreases in orders for computers and electronic products, after rising by the same margin in December.” (Reuters)

The PMI Index registered 52.5 for February, down slightly, but this was its lowest point to three years.

Week Ahead Highlights:

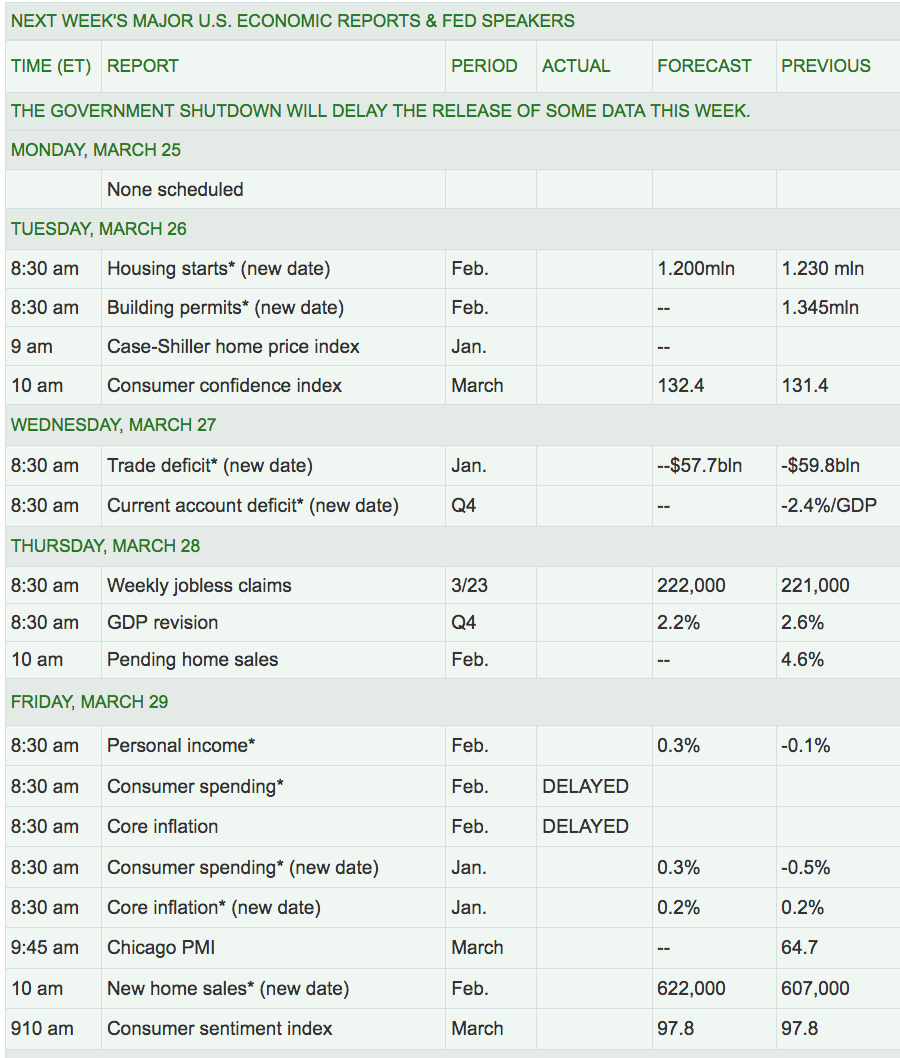

There will be a host of housing reports coming out next week, which should move home-builder stocks.

Next Week’s US Economic Reports:

SECTORS:

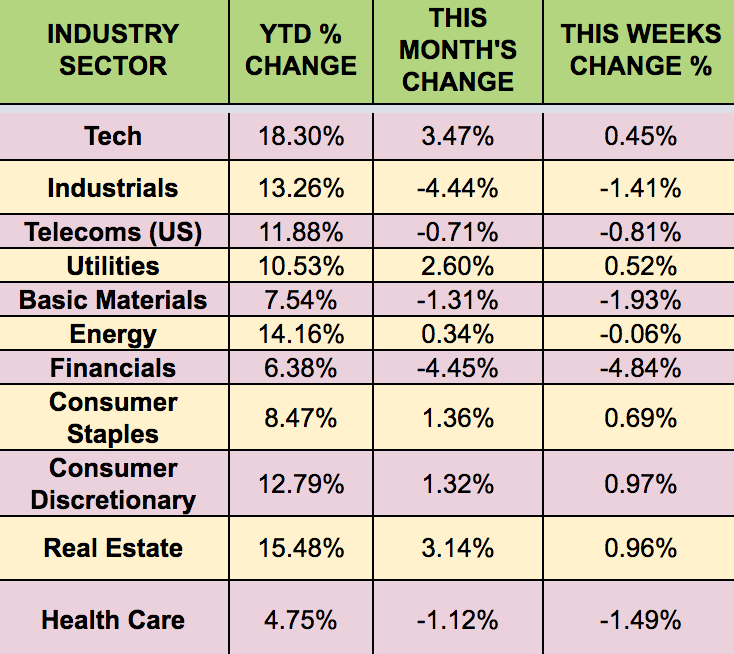

Consumer Discretionary, Staples, Real Estate, and Utilities were the leading sectors this week, with Financials lagging, as the dovish Fed statement backed off of more rate hikes for 2019.

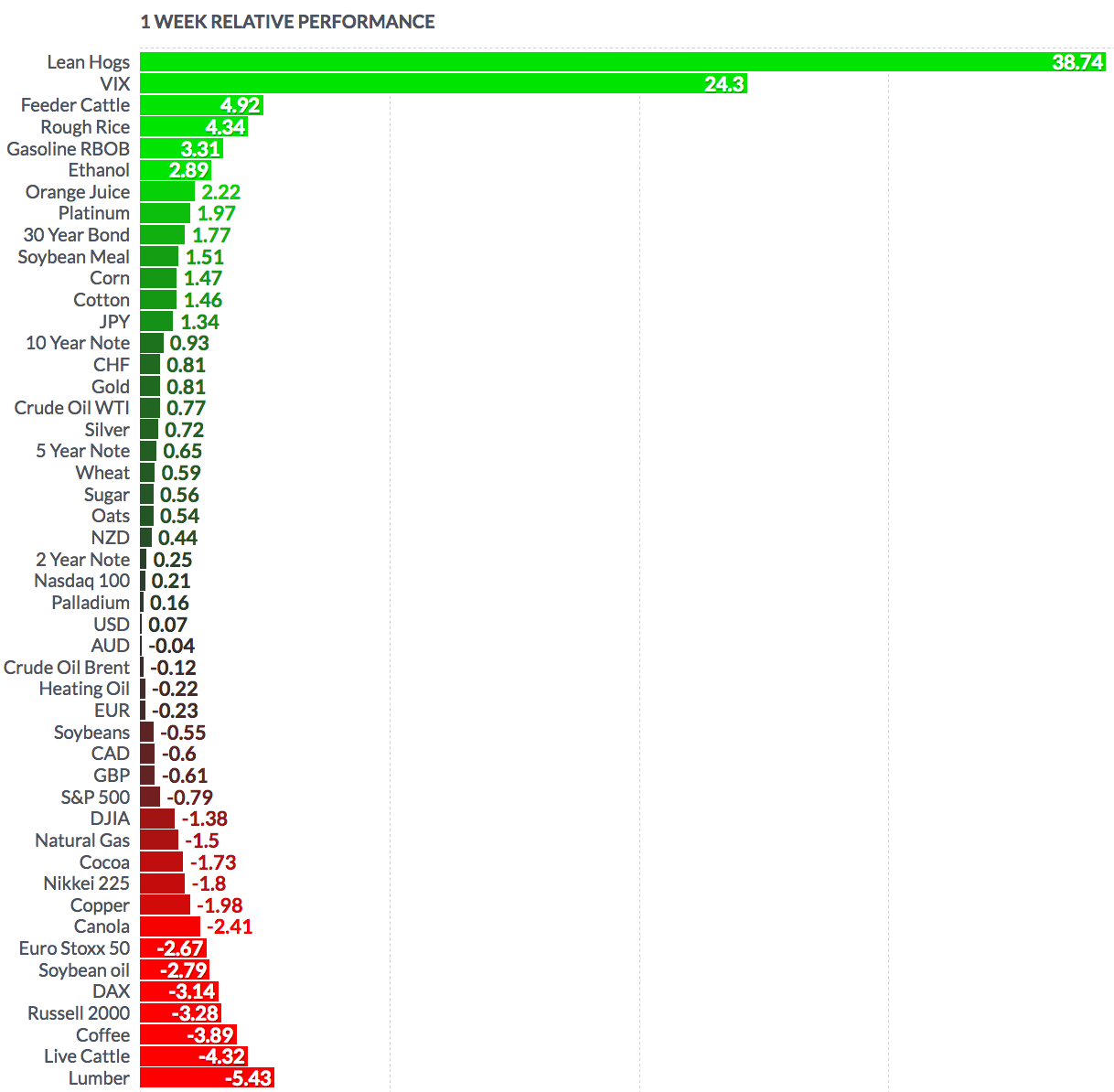

FUTURES:

WTI Crude rose .77% this week, finishing the week at $58.97, while Natural Gas fell -1.5%.