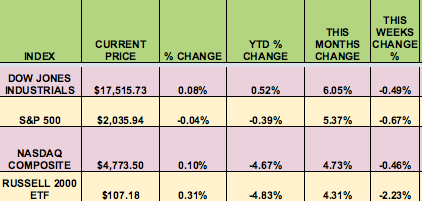

Markets: The market took a breather in this shortened week, held back by the Brussels attack, a pullback in crude oil, and hawkish Rate comments by some Fed officials, who upped expectations for more interest rate hikes in coming months than investors expected. This snapped a 5-week rally.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: NYSE:AHH, NYSE:CBL, NYSE:ACRE, NYSE:AHT, NYSE:BXMT, NYSE:CIM, NYSE:CLNY, NYSE:CLDT, NYSE:CMO, NYSE:GSBD, FULL, NYSE:JMP, NYSE:LXP, NYSE:NHI, NASDAQ:PSEC, NYSE:STAG, NYSE:RLJ, NASDAQ:STB, NASDAQ:TAXI, NYSE:TWO, AFC, NYSE:CXW, NYSE:WSR, NYSE:CIO

Volatility: The VIX rose 5.13% this week, finishing at $14.74.

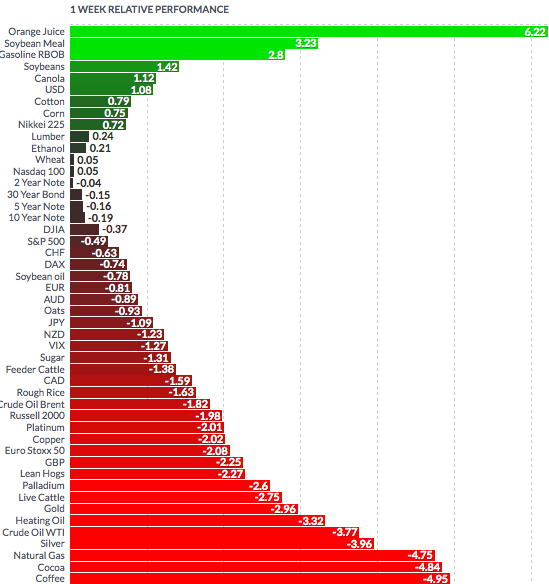

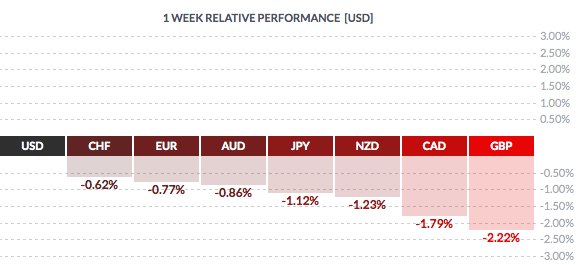

Currency: The US dollar rose vs. most major currencies this week, which put pressure on Basic Materials prices.

Market Breadth: 16 of the DOW 30 stocks rose this week, vs. 26 last week. 36% of the S&P 500 rose this week, vs. 76% last week.

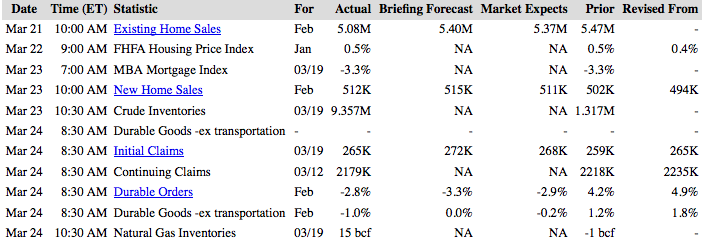

US Economic News: Existing Home Sales came in below forecasts, as did Durable Goods ex-Transportation.

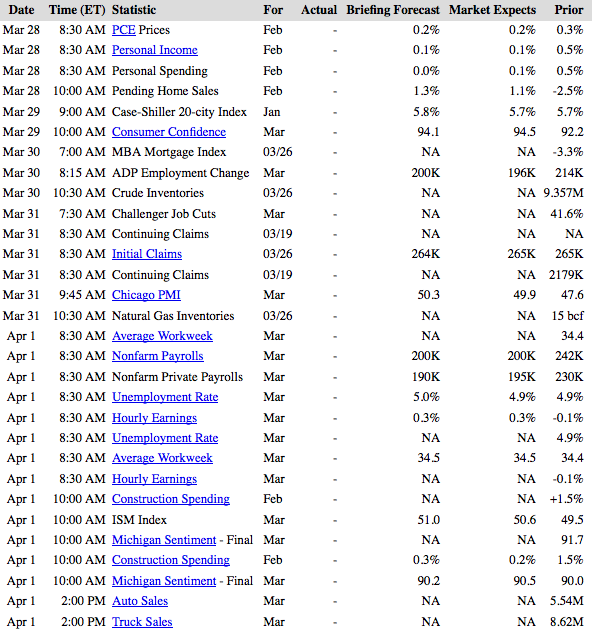

Week Ahead Highlights: It’s a big data week ahead, with the Non-Farm Payrolls Report due out on Friday am, plus Consumer Confidence, and Pending Home Sales, among many other reports. Fed Chief Yellen speaks on Tuesday.

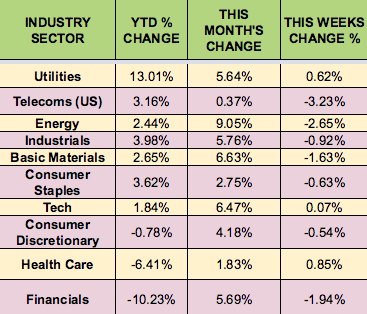

Sectors and Futures:

Healthcare led this week for the 1st time in quite awhile, as, surprisingly, Telecoms trailed.

OJ led this week, with coffee trailing, in a mixed up breakfast trade: