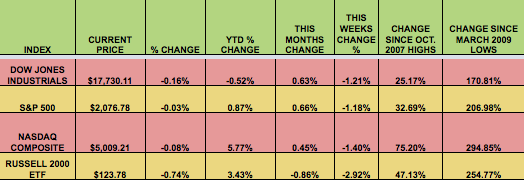

Markets: It was another down week for the market, and June was a down month, as the S&P put in its worst 1st half since 2010. Investors remained skittish this week, facing the uncertainty ahead of the Greek bailout referendum on Sunday. The table below shows July performance for the month.

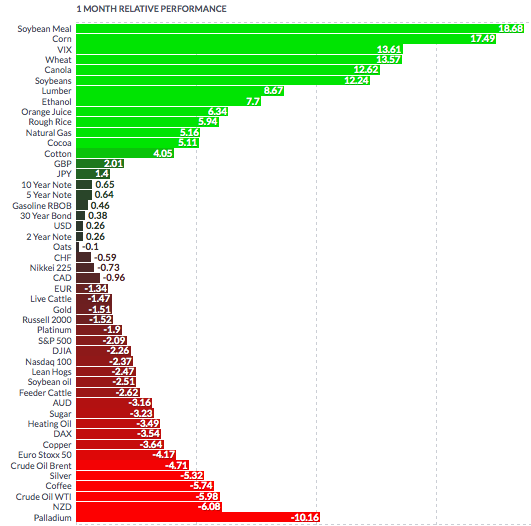

Volatility: The VIX rose as high as 19.80, before closing the week at 16.89, rising 20.47%.

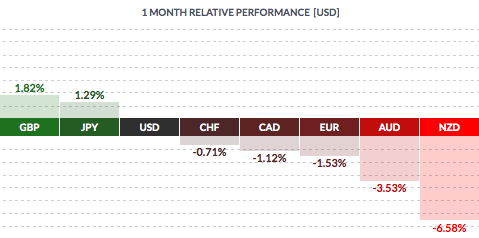

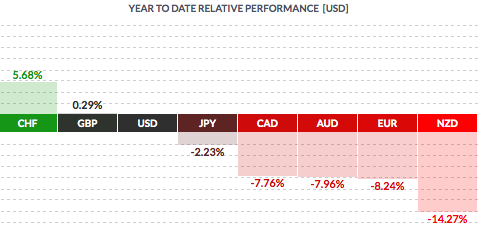

Currency: The dollar fell vs. the yen and pound sterling, and gained vs. most other major currencies in June.

Year-to-date, the dollar gained vs. most major currencies, except the pound and the Swiss franc.

Market Breadth: 6 out of 30 DOW stocks rose this week, vs. 10 last week. 26% of S&P 500 stocks rose this week, vs. 32% last week. 6 out of 30 DOW stocks also rose this month, while 33% of S&P 500 stocks rose for the month.

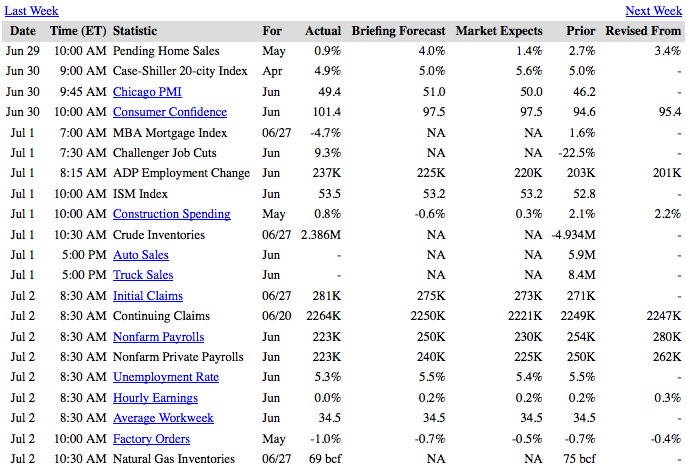

US Economic News: The US added 223K jobs in June. Employment gains in April and May combined were 60,000 lower than previously reported. Over the past 3 months, job gains have averaged 221,000 per month. In June, job gains occurred in professional and business services, health care, retail trade, financial activities, and in transportation and warehousing.

The Unemployment Rate fell to 5.3%, the lowest since the Spring of 2008. Pending Home Sales hit a 9-year high. 30-year Mortgage rates rose to an average of 4.08%, the highest since October.

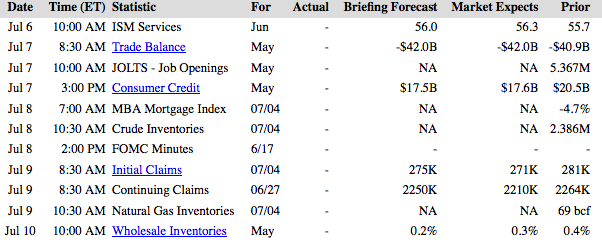

Week Ahead Highlights:

(Reuters) Alcoa (NYSE:AA) will kick off Q2 Earnings results season next week. Investors are eyeing a 3% projected drop in benchmark S&P 500 earnings from a year ago, which would be the first profit decline since the third quarter of 2009, according to Thomson Reuters data. However, a similarly dismal forecast from analysts for first-quarter earnings proved overly pessimistic, and S&P 500 companies ended up with a profit gain of 2.2 %.

U.S. companies themselves have offered dismal outlooks for earnings, often blaming a strong dollar, with negative forecasts for the second quarter outpacing positive ones by a ratio of 4-to-1, compared with 5.7- to-1 in the first quarter. The lower Q2 forecasts give companies a lowered bar, which should be easier to beat. There was some stability in the second quarter with the dollar and oil, which may translate into positive earnings surprises for multinationals and the energy sector.

Next Week’s US Economic Reports:

Sectors and Futures:

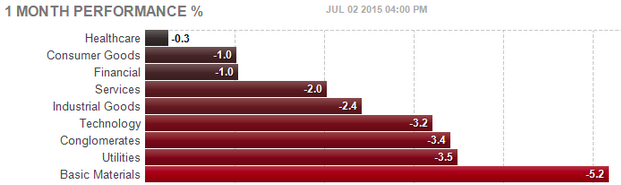

Healthcare led in June, while Basic Materials stocks trailed.