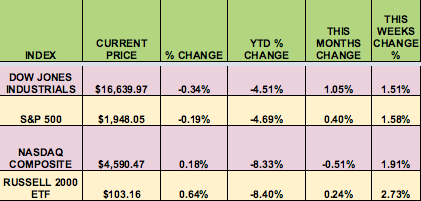

Markets: The S&P has had its best 2-week run in a year, registering another solid gain this week. It was “risk on” again this week, with small caps leading.

Thus far in the Q4 earnings season, companies lowering guidance have outnumbered companies raising guidance by 3 to 1. 63% of reporting companies beat earnings estimates – the highest reading since Q4 2010. The 52% revenue beat rate was an improvement over Q3’s 47% figure, and close to the high end of the range from the preceding 3 quarters.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: O:BGCP, N:WSR, N:BGS, N:HSBC, N:KRO, N:VTR, N:GNL, N:WY.

Volatility: The VIX fell 3.5% this week, finishing at $19.81.

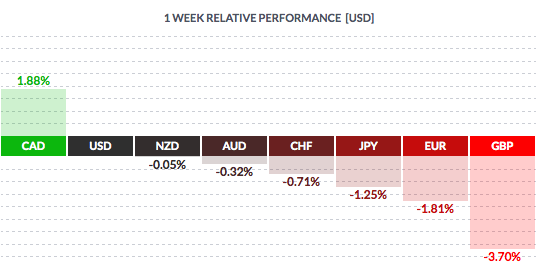

Currency: The US dollar rose vs. most major currencies, except the loonie.

Market Breadth: 22 of the DOW 30 stocks rose this week, vs. 28 last week. 81% of the S&P 500 rose this week, vs. 96% last week.

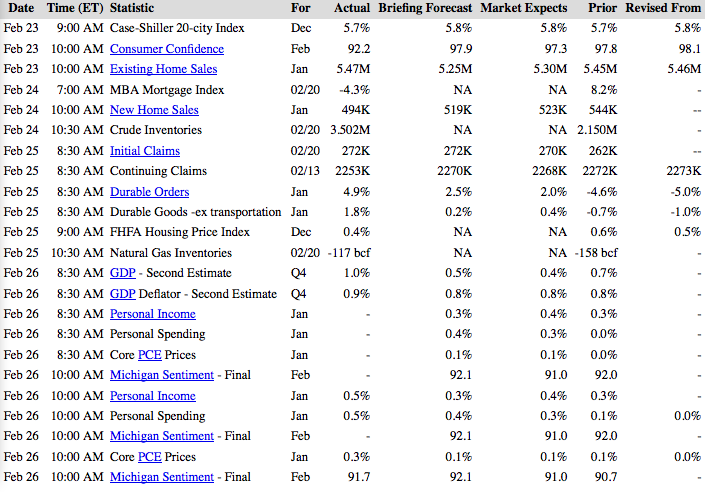

US Economic News: Mortgage rates are near a 13-month low at 3.62%. Durable Goods hit their best level since Spring 2015.

Consumer Confidence fell far below forecasts, to 92.2. Q4 GDP was revised upward, to 1%.

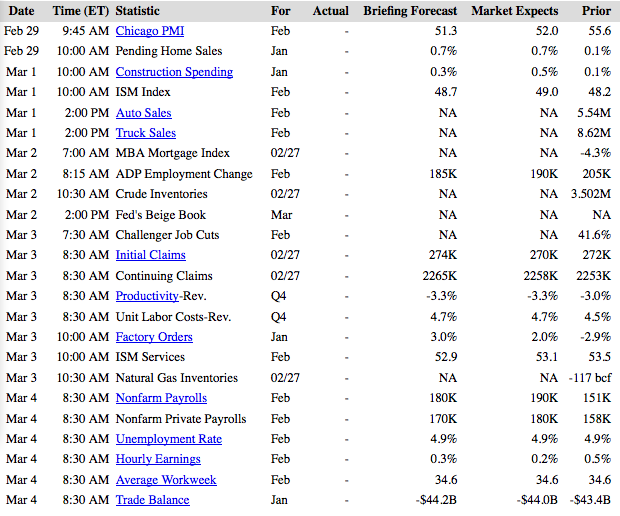

Week Ahead Highlights: The Non-Farm Payroll Report for Feb. comes out next Friday – investors will be looking for more signs of a strengthening economy. Politics may also increase volatility, as the Super Tuesday nominating contests occur next week.

Next Week’s US Economic Reports:

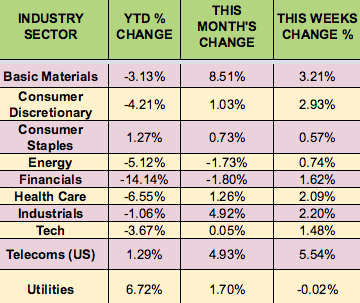

Sectors and Futures:

Telecoms led this week, as Utilities trailed.

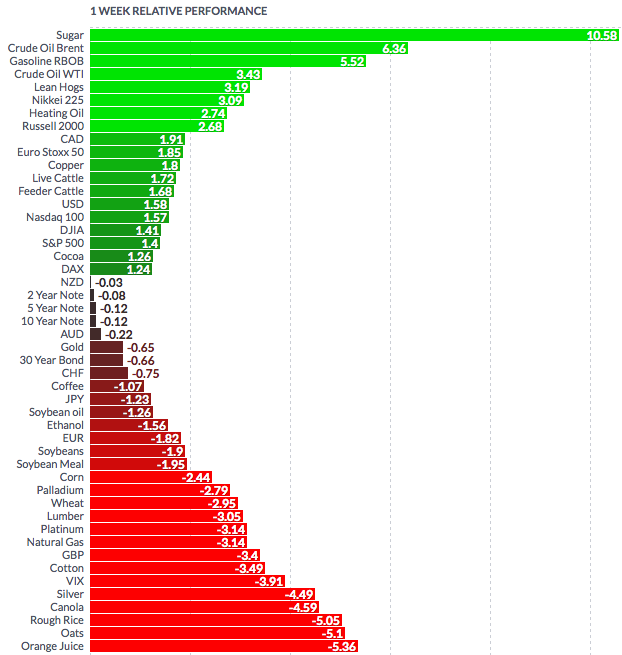

Sugar and crude oil led this week, with OJ trailing. Crude has gained 25% since Feb. 11th:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI