Markets: Weak US and Chinese economic data, and falling crude oil prices pushed the market down this week.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week:

N:APU, O:AHGP, N:ARR, N:NRT, N:PER, N:SE, N:IP, N:UMH, O:CLCT

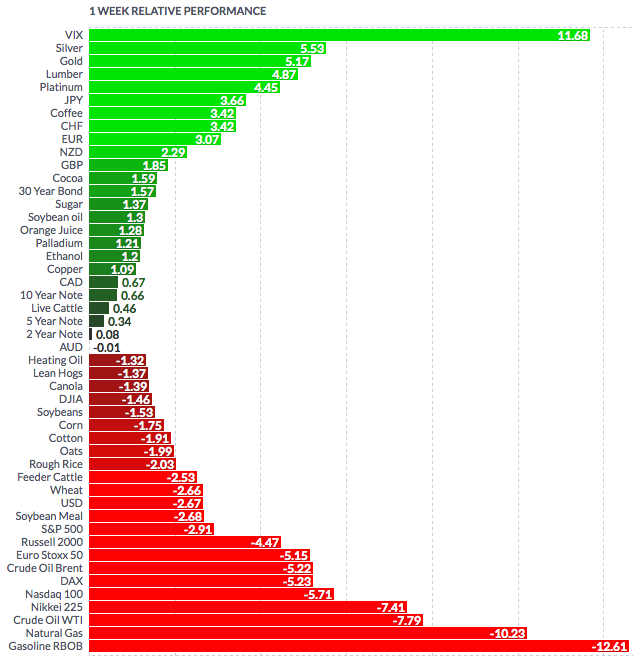

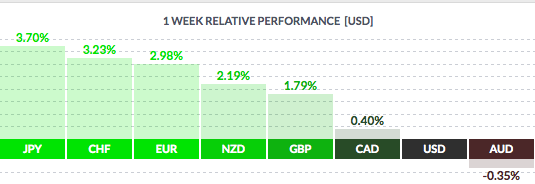

Volatility: The VIX rose 16% this week, finishing at $23.38. Currency: The US dollar fell vs. most major currencies, except the Aussie.

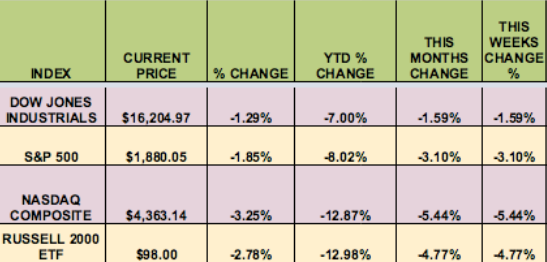

Market Breadth: 10 of the Dow 30 stocks rose this week, vs. 23 last week. 30% of the S&P 500 rose this week, vs. 73% last week.

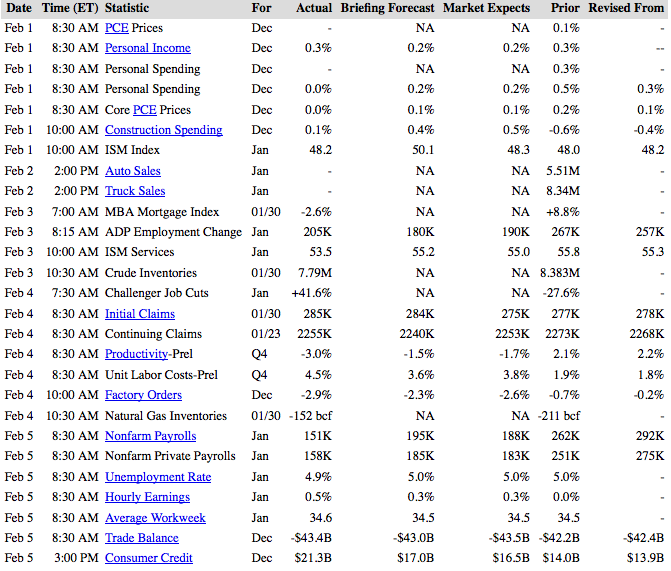

US Economic News: January US Non-Farm Payrolls disappointed, at only 151K, vs. 262K jobs created in December. There were job gains in Retail, Food Service, Healthcare, and Manufacturing. Transportation, Mining, Warehousing, and private Educational Services lost jobs.

The Unemployment Rate slipped down to 4.9%, the lowest figure in 8 years. Wages rose .5%, in evidence of a further tightening jobs market.

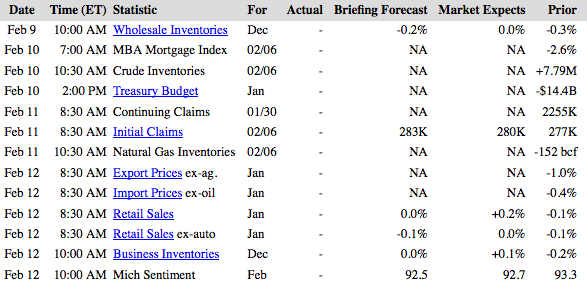

Week Ahead Highlights: It’ll be a light data week, with Consumer Sentiment coming out on Friday. Earning seasons continues, with several consumer goods companies reporting – Disney (N:DIS), Hasbro (O:HAS), Reynolds American (N:RAI), Coke (O:COKE), Whole Foods (O:WFM), Pepsi (N:PEP), Kellogg (N:K), and Molson (N:TAP). Tech giant Cisco (O:CSCO) will also report.

Next Week’s US Economic Reports:

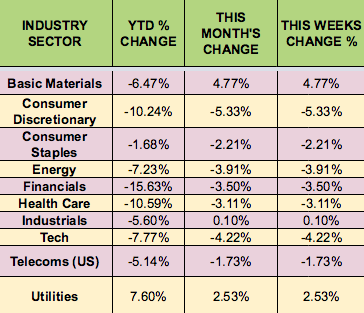

Sectors and Futures:

Utilities stocks led this week, as the Consumer Discretionary sector trailed.

Silver futures led this week, with Gasoline trailing: