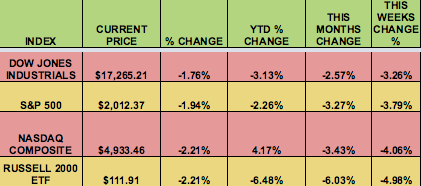

Markets: The market had its worst week since August, as falling crude oil prices added to investors’ uneasiness about next week’s Fed meeting, which is widely expected to result in the 1st rate hike by the Fed in almost 10 years.

The Russell 2000 small caps had their worst week since May 2012, falling almost 5%.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week:

N:ARR, N:NMFC, O:TICC, O:HCAP, N:RWT, OFT, O:TCPC, O:GLAD, O:GAIN, O:GOOD, O:HRZN, O:WHF, N:FSIC, N:LVS.

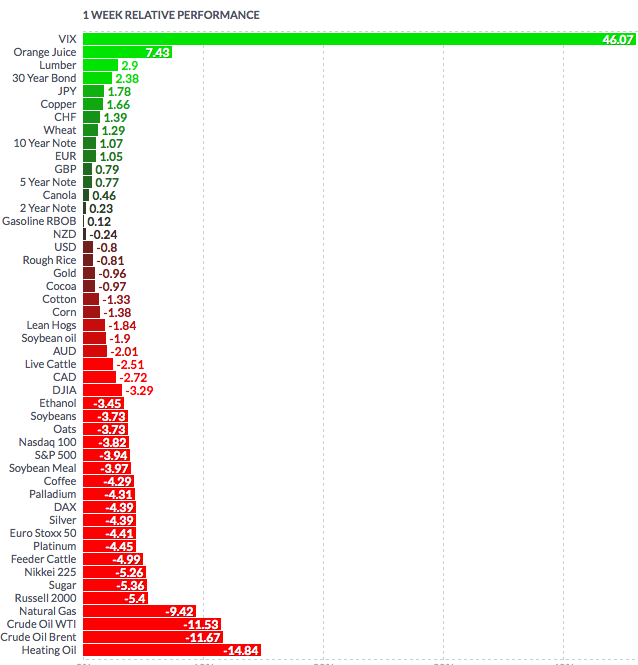

Volatility: The VIX rose 65% this week, finishing at $24.39, its highest close since Sept. 30.

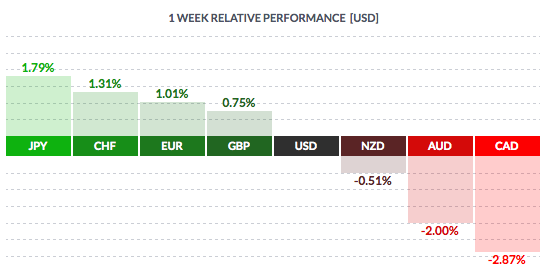

Currency: The US dollar fell this week vs. most major currencies, except the Aussie dollar and the loonie.

Market Breadth: NONE of the Dow 30 stocks rose this week, vs. 21 last week. 8% of the S&P 500 rose this week, vs. 49% last week.

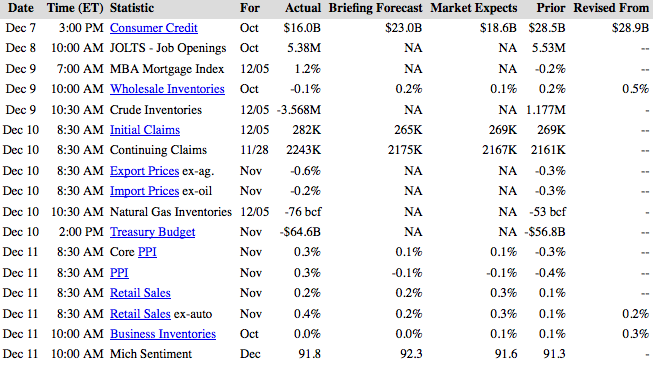

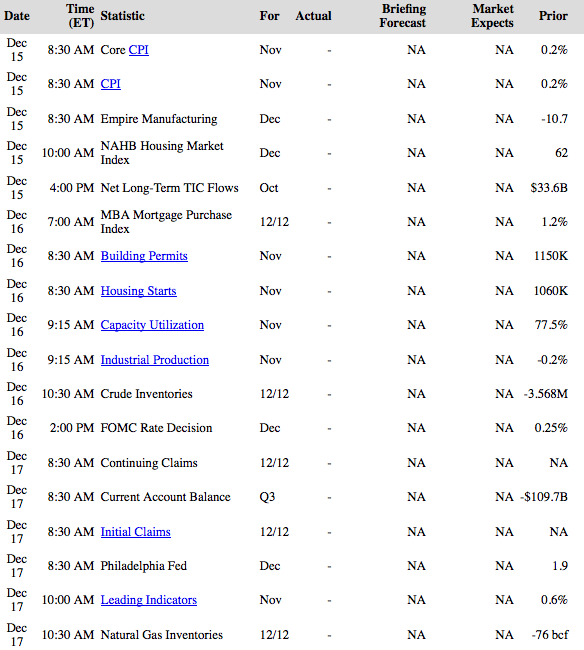

US Economic News: Initial Claims were higher than expected…Core Retail Sales surprised to the upside.

Week Ahead Highlights: All eyes will be on the Fed, as it convenes its meeting on rates on Tues- Wed. The Fed is expected to announce its 1st rate hike in nearly a decade. If the Fed statement appears hawkish, implying multiple rate hikes in the near future, markets may see more volatility.

Next Week’s US Economic Reports:

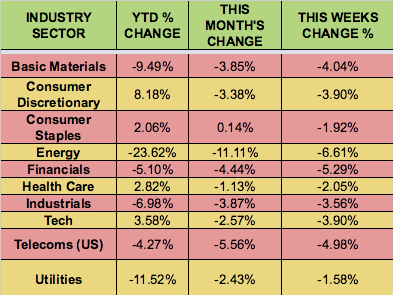

Sectors and Futures:

Utilities fell the least this week, as Energy trailed, in the wake of more declines in crude oil.

OJ led this week, with Heating Oil trailing: