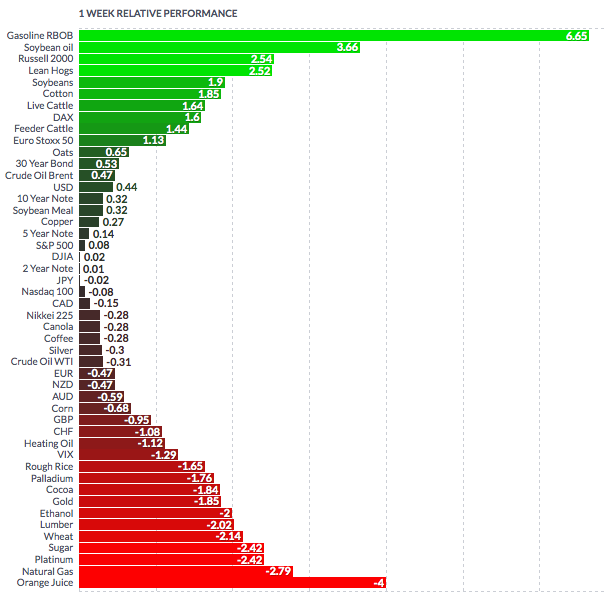

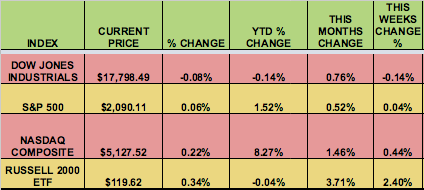

Markets: Small caps continued to break out of their slump this week, with the Russell 2000 leading again. It was a holiday-shortened week, with very low trading volume.

Volatility: The VIX dropped 2.2% in this relatively quiet week, ending at $15.12.

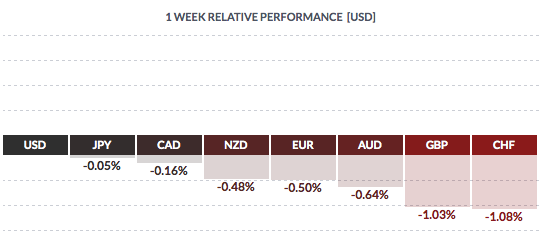

Currency: The US dollar rose vs. most foreign currencies this week.

Market Breadth: 13 of the Dow 30 stocks rose this week, vs. 25 last week. 59% of the S&P 500 rose this week, vs. 78% last week.

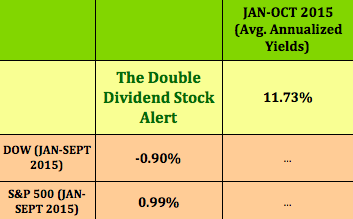

Dividend Stocks Update: These high dividend stocks are going ex-dividend this coming week: N:TAL, N:WPG, N:WSR, N:KRO, O:NAVI, O:PDLI, N:TDW, O:OXBR, N:QUAD, N:GNL

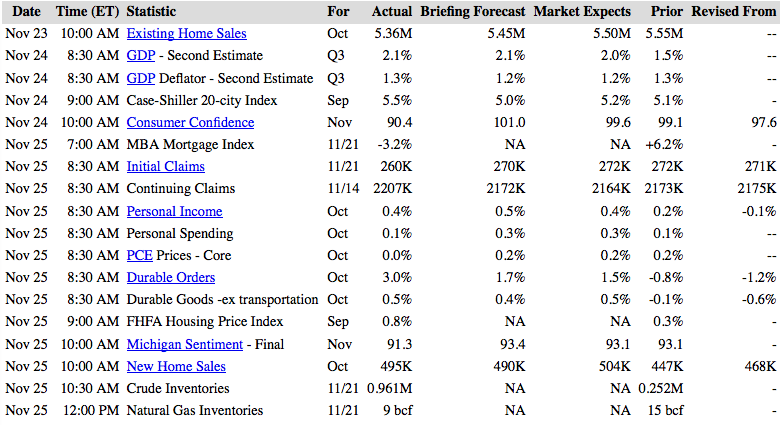

US Economic News: Home prices hit their highest mark in 13 months in October. Q3 GDP growth was raised to 2.1% from 1.5%. Business investment jumped in Oct., rising 1.3%. Consumer Confidence hit a 13-month low of 90.4

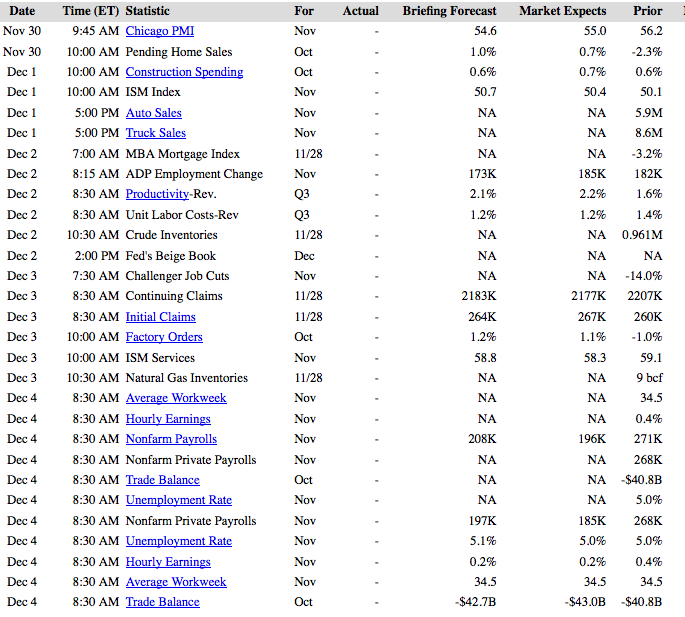

Week Ahead Highlights: It’ll be a big week for data and potential market-moving events – On Thursday, the ECB meets, and may announce fresh stimulus. On Friday, OPEC meets, and its decision will probably move crude oil prices. Also on Friday, the Non-Farm Payrolls report and Unemployment figure comes out, which will definitely affect the Fed’s thinking as to whether or not to move rates up at its upcoming mid-December meeting. Retailers will also be in focus, as investors parse through winners and losers from Black Friday.

Next Week’s US Economic Reports:

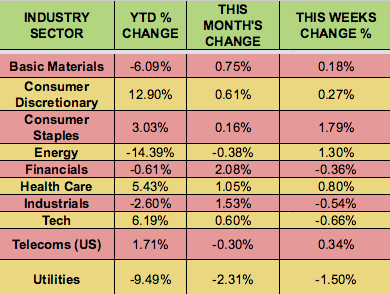

Sectors and Futures:

Consumer Staples led this week, as Utilities trailed.