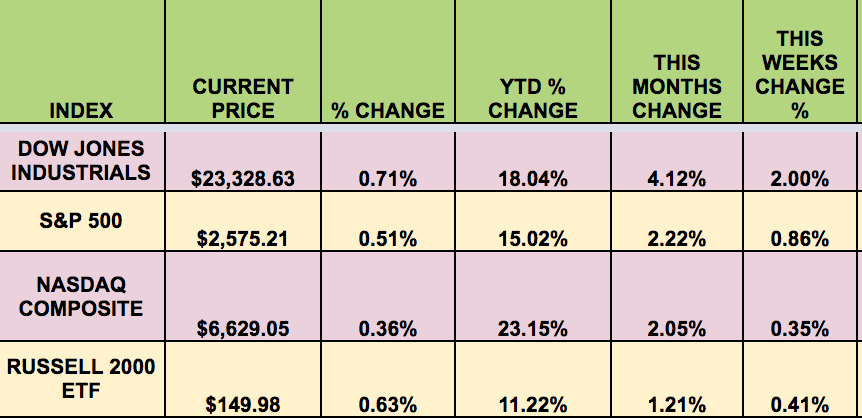

Markets: The market rallied again this week, as the S&P 500 closed at a new all-time high every day for the 1st time since 1998. The market rallied after the Senate passed a budget blueprint that paved the way for the administration’s proposed tax cut plan.

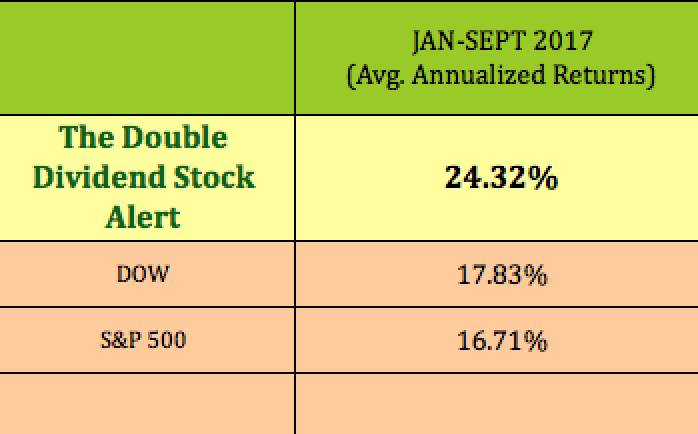

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: MVC Capital Inc (NYSE:MVC), Enduro Royalty Trust (NYSE:NDRO), Pembina Pipeline Corp (NYSE:PBA).

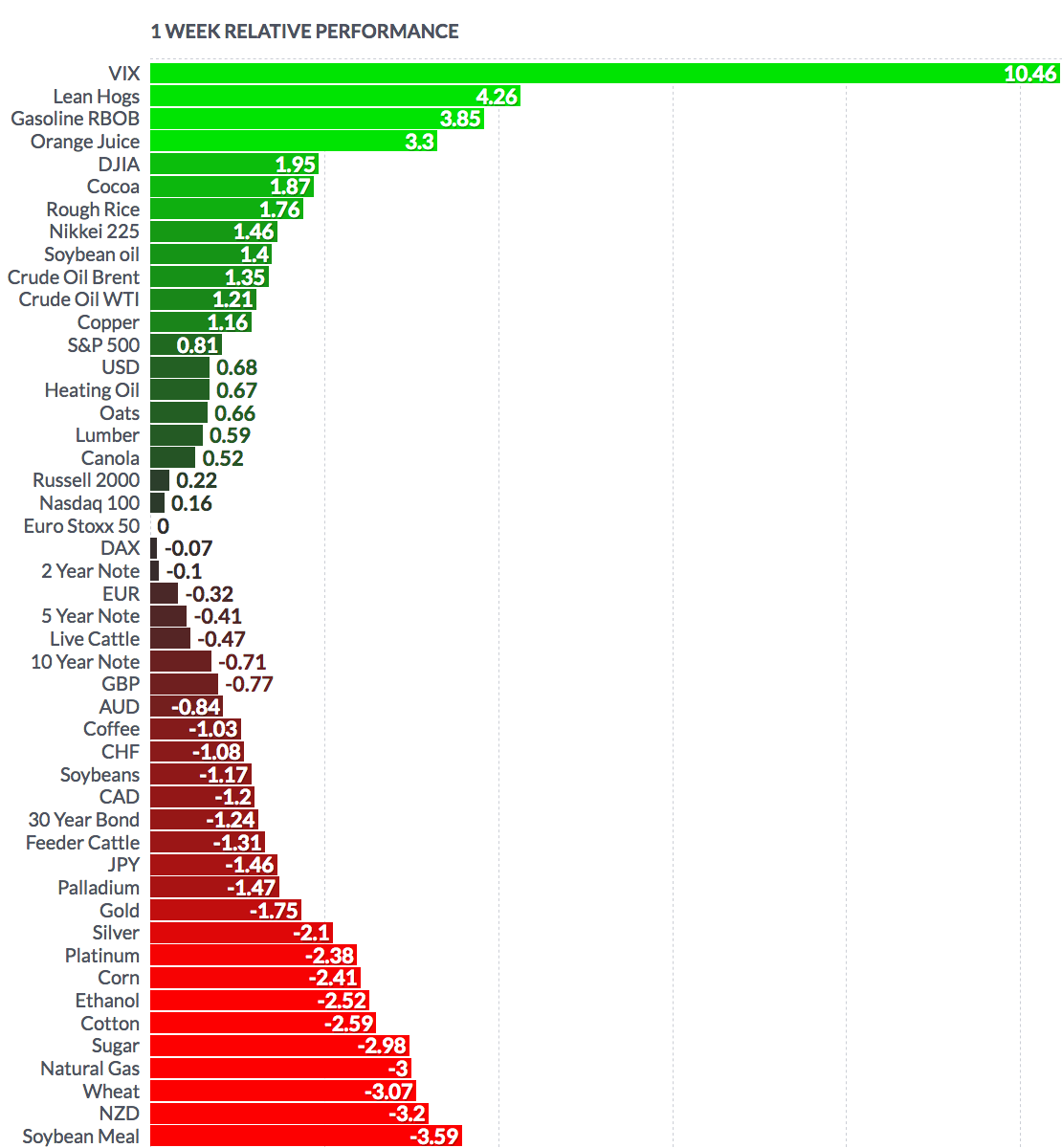

Volatility: The VIX was up 3.7% this week, and finished at $9.97.

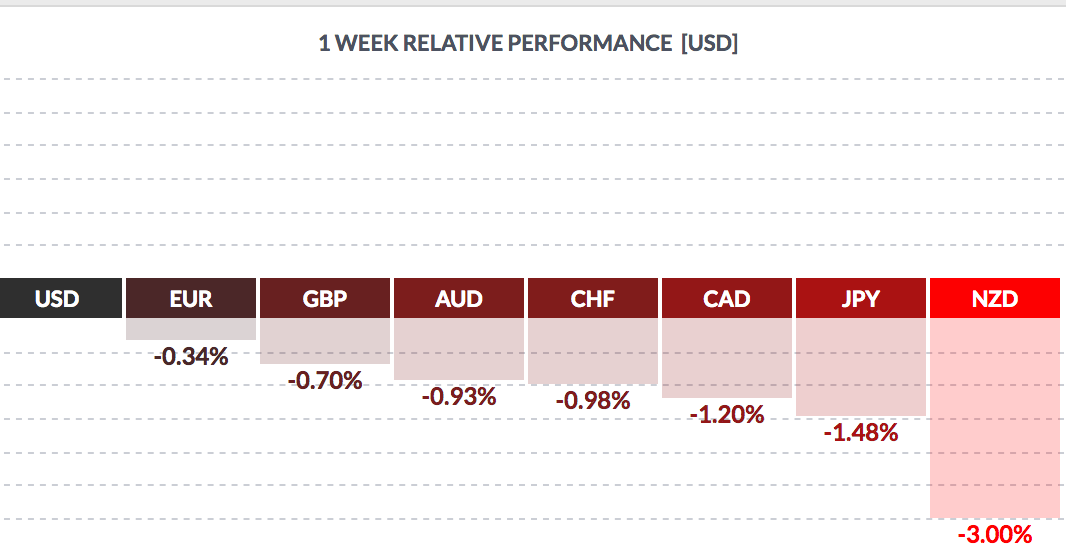

Currency: The US Dollar rose vs. most major currencies this week.

Market Breadth: 23 of the DOW 30 stocks rose this week, vs. 20 last week. 69% of the S&P 500 rose, vs. 60% last week. Economic News:

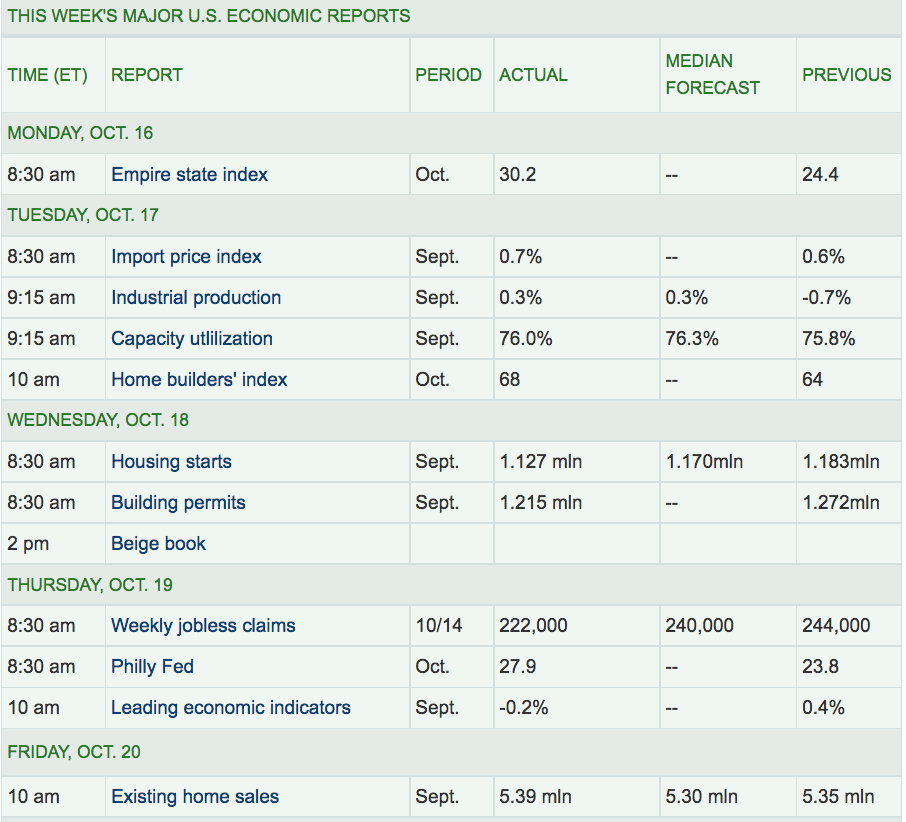

Housing stocks were also strong on Friday, as Existing Home sales surprised to the upside. The Philly Fed Index also rose higher than forecasts.

Week Ahead Highlights: Q3 Earnings season rolls on, with 12 DOW stocks reporting, including Pfizer (NYSE:PFE), Exxon Mobil (NYSE:XOM), Chevron (NYSE:CVX), Coca-Cola Company (NYSE:KO), Visa Inc (NYSE:V), and Boeing (NYSE:BA). 37% of the S&P 500 will be reporting also.

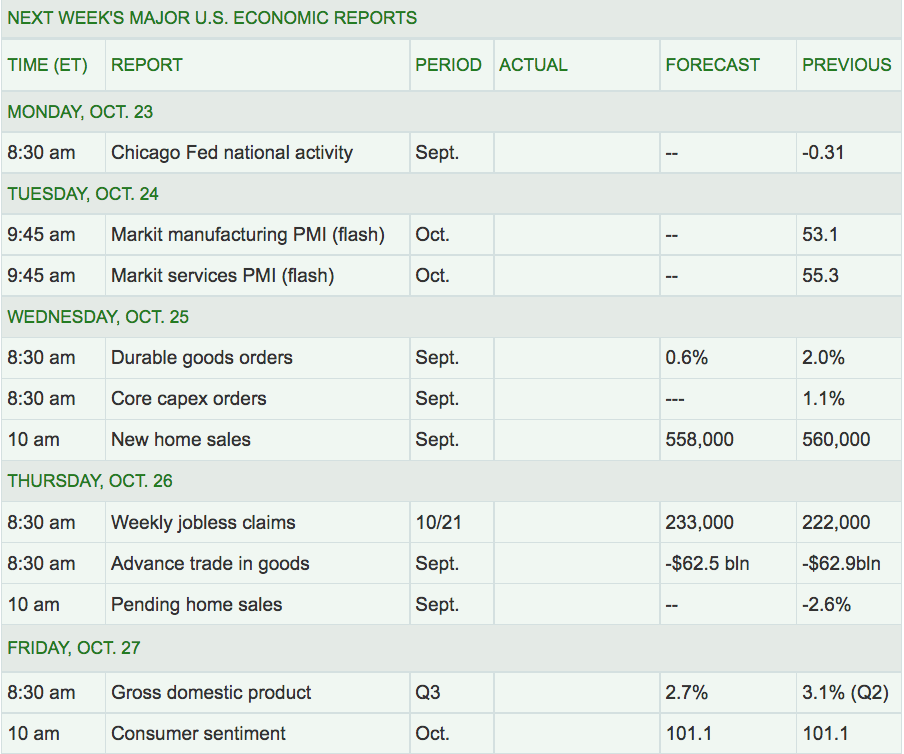

Next Week’s US Economic Reports: There will be multiple Housing-related reports due out again next week, along with a Q3 GDP report, and a Consumer Sentiment report due out on Friday.

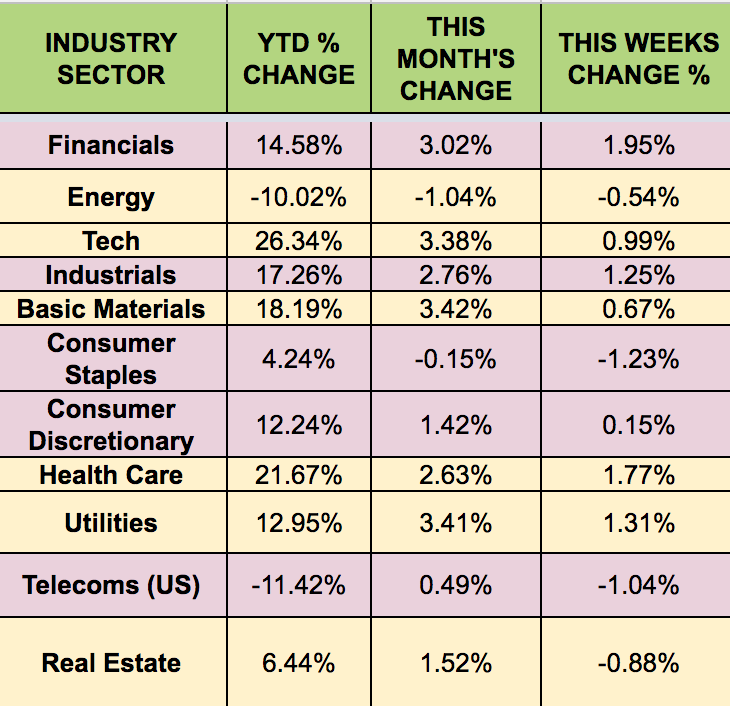

Sectors: Financials and Industrials led this week, with Telecoms and Staples trailing.

Futures: Natural Gas futures fell 3%, and WTI Crude futures rose 1.2% this week.

“Oil prices climbed Monday to settle at their highest level in nearly three weeks as tensions in the Middle East raised concerns about global crude supplies. Iraqi forces reportedly seized the city of Kirkuk and its surrounding oil fields from Kurdish forces Monday.

Uncertainty surrounding the survival of the Iran nuclear deal also boosted prices.” (Source: MarketPulse)