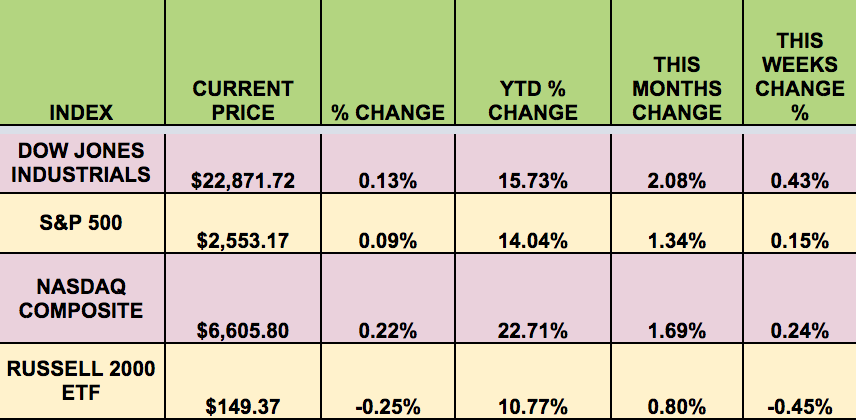

Markets: The market rallied again this week, as the S&P 500, Dow Jones Industrial Average, and Russell 2000 all made new all-time highs, although the Russell small caps index fell for the week.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Compass Diversified Holdings (NYSE:CODI), Harvest Capital Credit (NASDAQ:HCAP), Horizon Technology Finance (NASDAQ:HRZN), PennantPark Floating Rate Capital(NASDAQ:PFLT), American Capital (NASDAQ:ACSF), Capitala Finance (NASDAQ:CPTA).

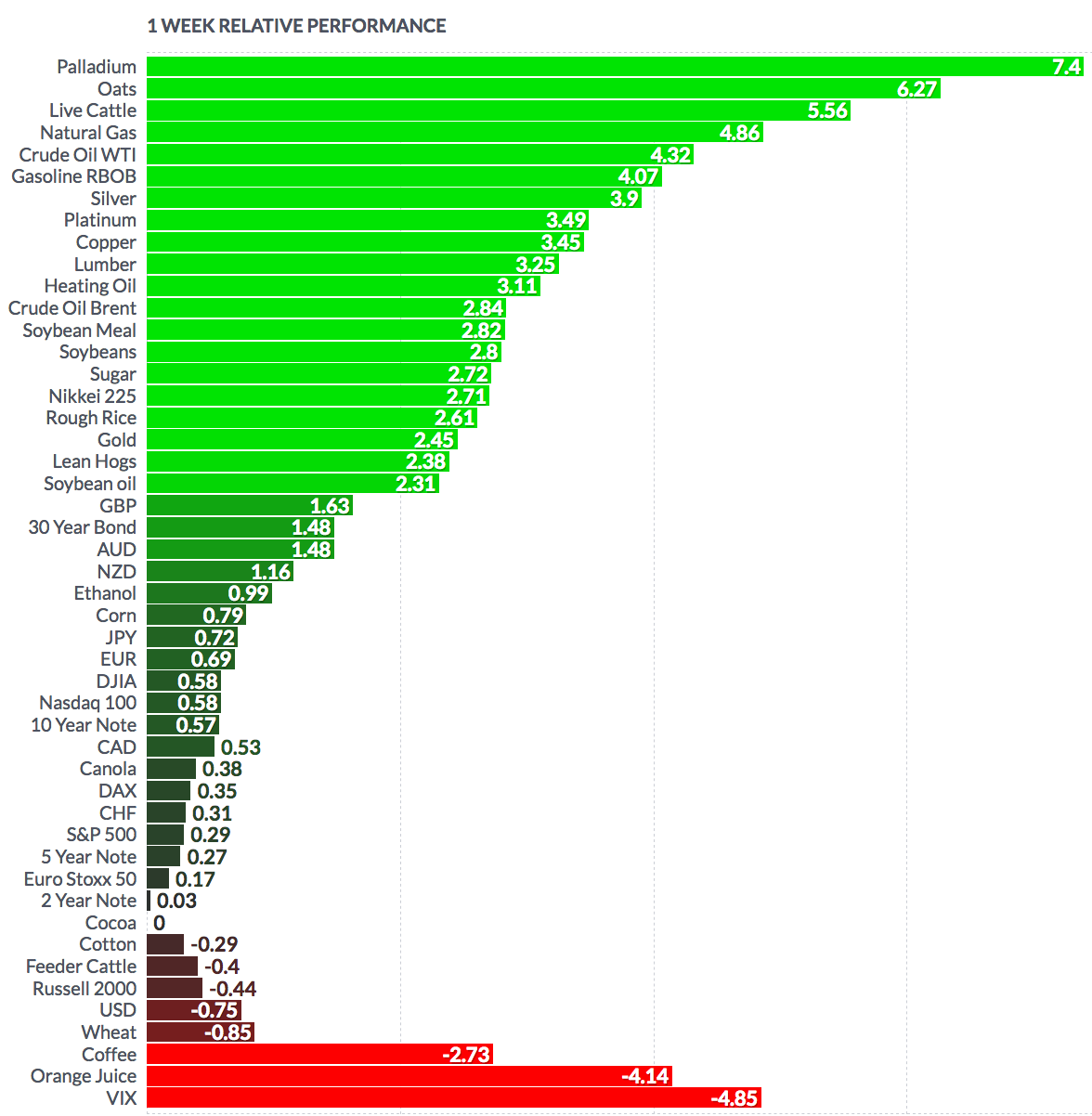

Volatility: The VIX was flat this week, and finished at $9.61.

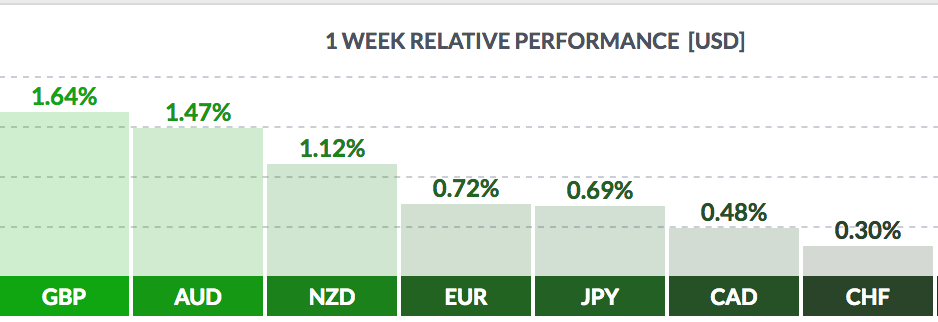

Currency: The USD fell vs. most major currencies this week.

Market Breadth: 20 of the Dow 30 stocks rose this week, vs. 27 last week. 60% of the S&P 500 rose, vs. 72% last week.

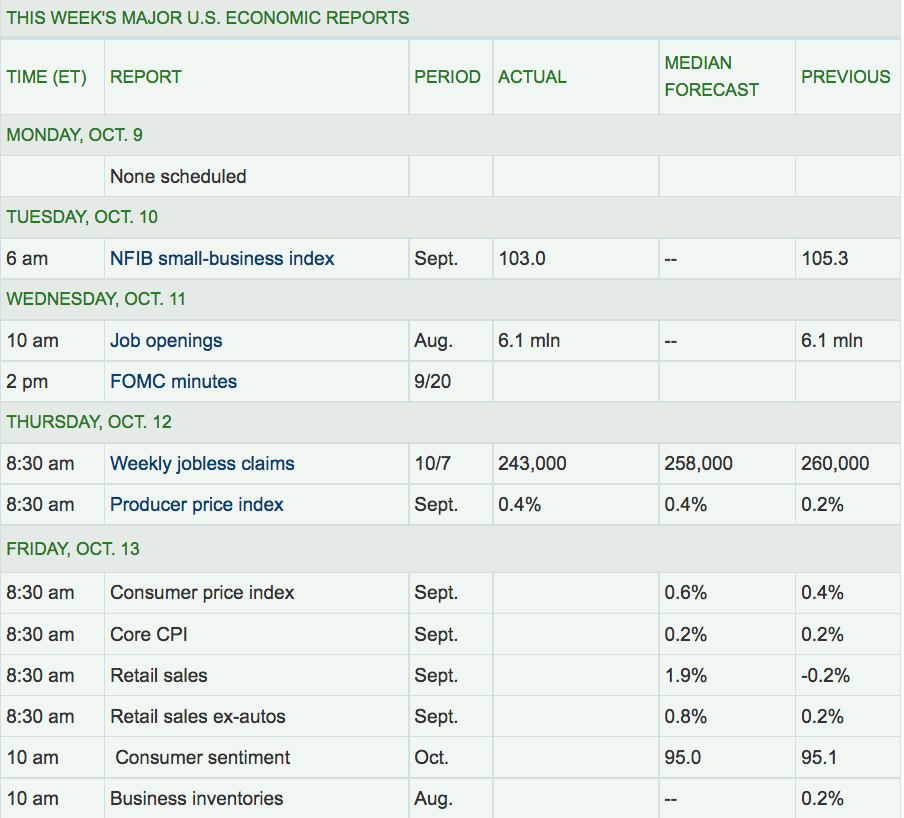

Economic News:

“A U.S. government report showed that domestic crude stockpiles fell for a third week in a row.”

‘Stronger refining activity, ongoing subdued Gulf Coast imports and robust crude exports have encouraged a counter-seasonal draw,’ Matt Smith, director of commodity research at ClipperData, told MarketWatch.In more price-bearish news, however, the International Energy Agency reported Thursday that global oil supply rose in September, while demand growth slowed.”

The US E.I.A. showed that domestic crude supplies fell by 2.8 million barrels for the week ended Oct. 6, which was well above the forecast for a decline of 400,000 barrels by analysts.

The EIA also forecasted this week that US oil production would average 9.9 million barrels a day in 2018, which would mark the highest annual average production in U.S. history.

The agency also said that OPEC and other producers outside the group, including Russia, have largely held to an agreement to withhold almost 2% of global oil supply from the market. The IEA estimated that OPECs compliance with the deal stood at 86% in 2017.” (Source: MarketWatch)

The Commerce Department said retail sales rose 1.6% last month, with spending likely to have been lifted by demand for building materials and cars following hurricanes Harvey and Irma.Retail sales were also boosted by higher spending at service stations, reflecting higher fuel prices. (Source:BBC)

Consumer Sentiment rose from 95 to 1.01, higher than forecasts.

Week Ahead Highlights: Q3 Earnings Season heats up next week, with 9 Dow stocks reporting, including bellwether General Electric (NYSE:GE), IBM (NYSE:IBM), Goldman Sachs (NYSE:GS), Procter & Gamble (NYSE:PG), and Johnson & Johnson (NYSE:JNJ). 12% of the S&P 500 will be reporting also.

“AT&T (NYSE:T) fell more than 4% after the company said its third-quarter results took a hit from the string of hurricanes and that it lost 90,000 video subscribers in the quarter. A note from Guggenheim raising concerns over subscriber losses at Disney and Viacom also sent those 2 media giants down on Thursday.” (Source:Reuters)

JPMorgan Chase (NYSE:JPM) beat Wall Streets third-quarter profit expectations on Thursday, with loan growth and higher interest rates more than offsetting weakness in its markets-related unit.(Source:Reuters)

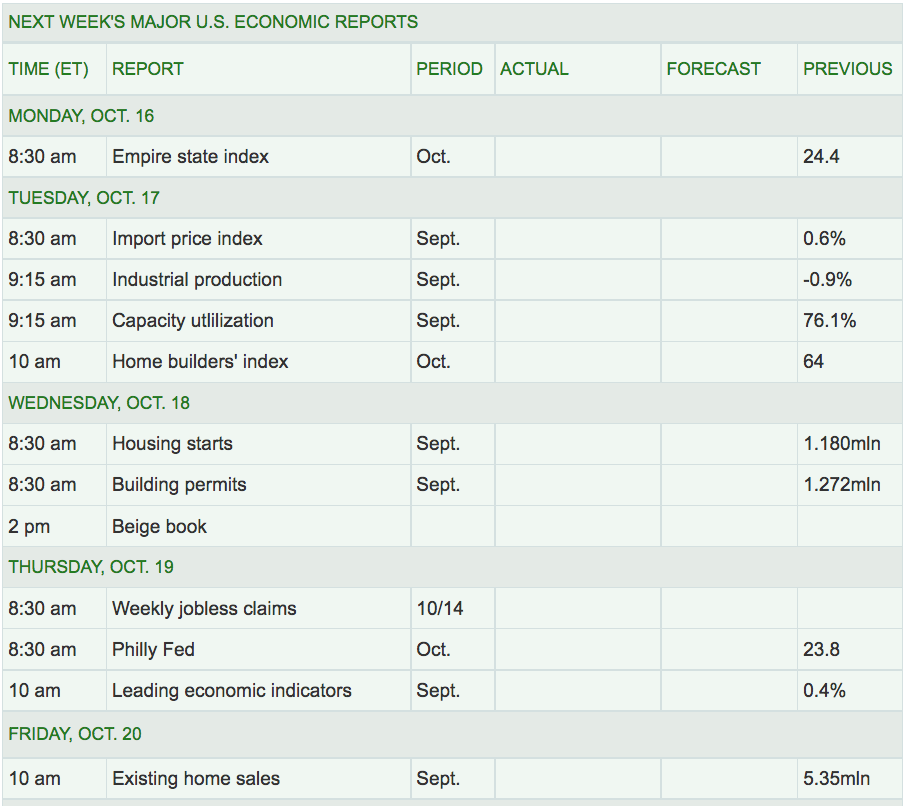

Next Week’s US Economic Reports: There will be multiple Housing-related reports due out next week, in addition to several Industrial reports.

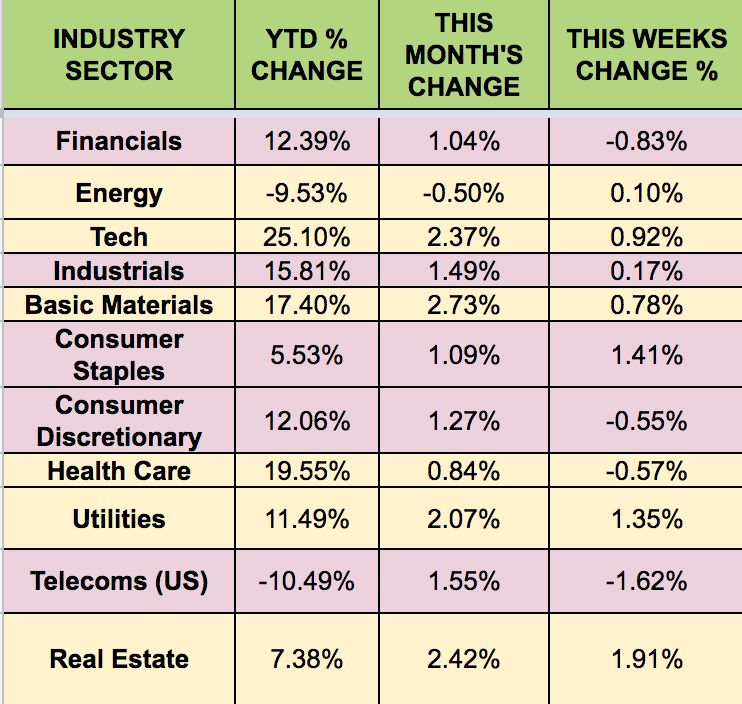

Sectors: Real Estate and Staples led this week, with Telecoms and Financials trailing.

Futures: Natural Gas futures rose 4.86%, and WTI Crude futures rose 4.3% this week.