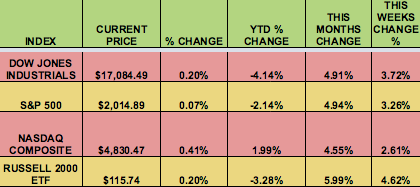

Markets: The S&P 500 had a weekly gain of 3.3%, its best week since Dec. 2014, as investors regained some optimism after the heavy volatility since late August on global growth concerns U.S. interest rate uncertainty. The Dow was up for 6 straight days, also its best performance since December 2014.

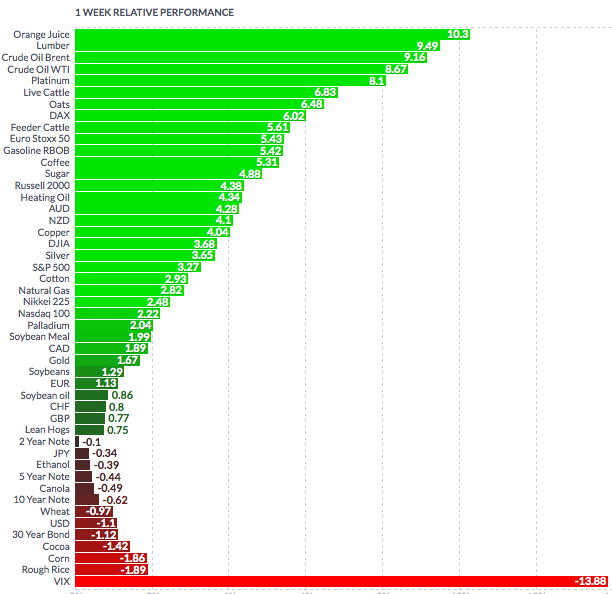

Volatility: The VIX fell 19%, to end the week at 17.08, its lowest close since August 19th.

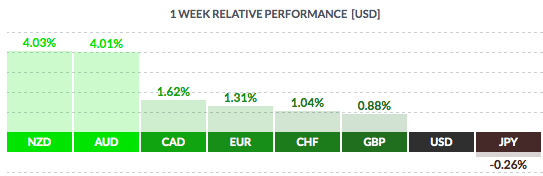

Currency: The dollar fell vs. most other currencies, except the yen.

Market Breadth: 29 of the DOW 30 stocks rose this week, vs. 21 last week. 88% of the S&P 500 rose this week, vs. 63% last week. Advancing issues outnumbered decliners on the NYSE by 1,726 to 1,318, for a 1.31-to-1 ratio on the upside. On the Nasdaq, 1,516 issues rose and 1,233 fell for a 1.23-to-1 ratio favoring advancers.

US Economic News: The House of Representatives passed a bill on Friday to lift the U.S.’s ban on oil exports. Supporters in the Senate are also planning a vote. If it passes both houses of Congress, it should be very supportive to US Energy stocks.

Week Ahead Highlights:

Financial stocks will be in focus next week as Goldman Sachs (NYSE:GS), Bank of America (NYSE:BAC), Wells Fargo (NYSE:WFC), Citigroup (NYSE:C), and other heavyweights report Q3 earnings.

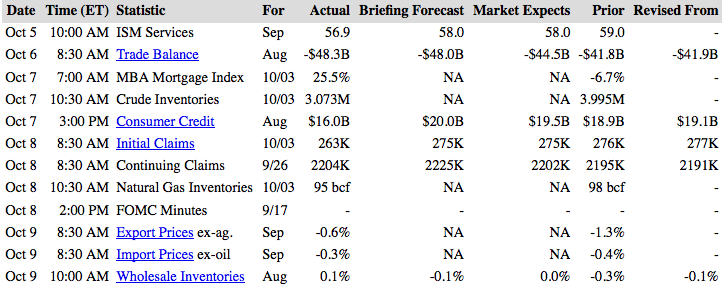

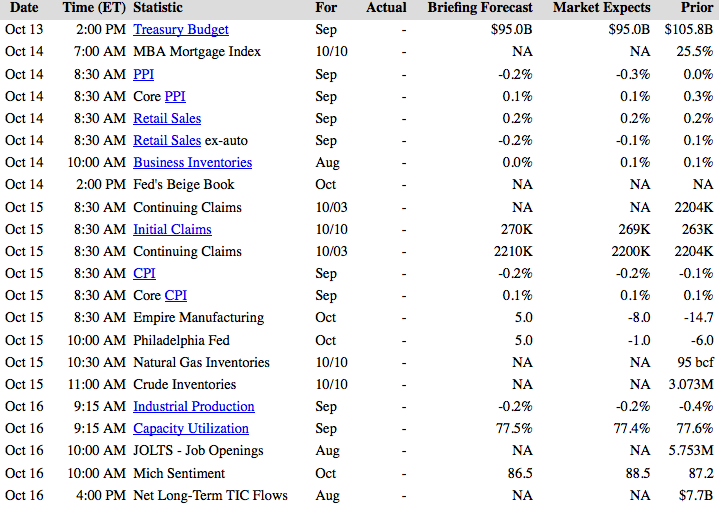

Next Week’s US Economic Reports:

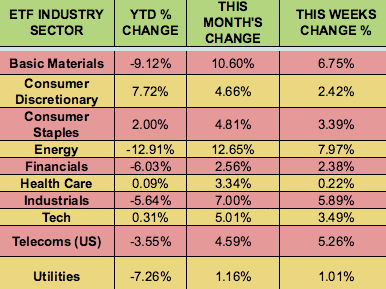

Sectors and Futures:

Oil and Basic Materials led this week, as crude oil had its biggest 1-week gains in 6 years. Healthcare trailed again, dragged down by biotechs.

OJ led this week, with Rough Rice trailing: