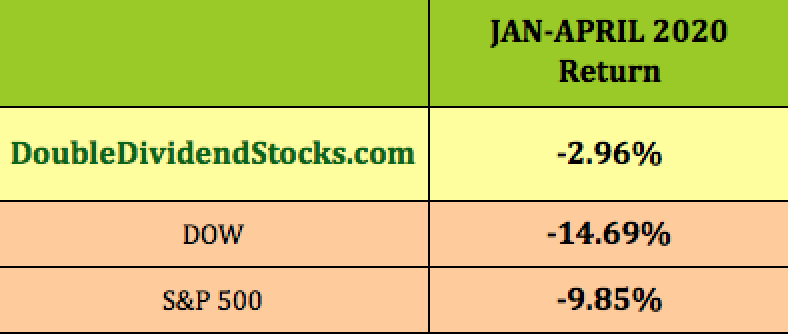

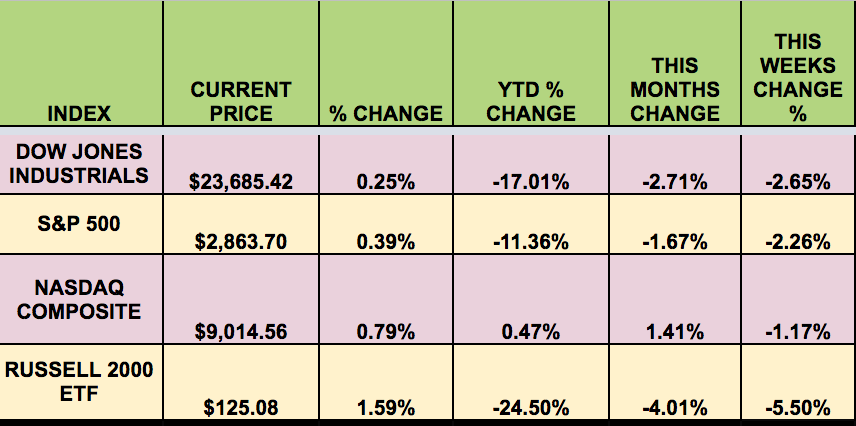

Market Indexes:

The market fell this week, pressured by negative economic news, and a ramping up of US-China rhetoric. Small caps took the biggest hit, losing -5.5%, followed by the DOW and SPY) both losing over -2%. The NASDAQ was once again the most resilient index, and continues to lead by a wide margin in 2020.

Volatility:

The VIX rose 14% this week, ending at $31.89, vs. $27.98 last week.

High Dividend Stocks:

These high yield stocks go ex-dividend next week: ENBL, IEP, MFC, WELL, AEG, DK, MPC, SXC.

Market Breadth:

7 out of 30 DOW stocks rose this week, vs. 5 last week. 17% of the S&P 500 rose, vs. 30% last week.

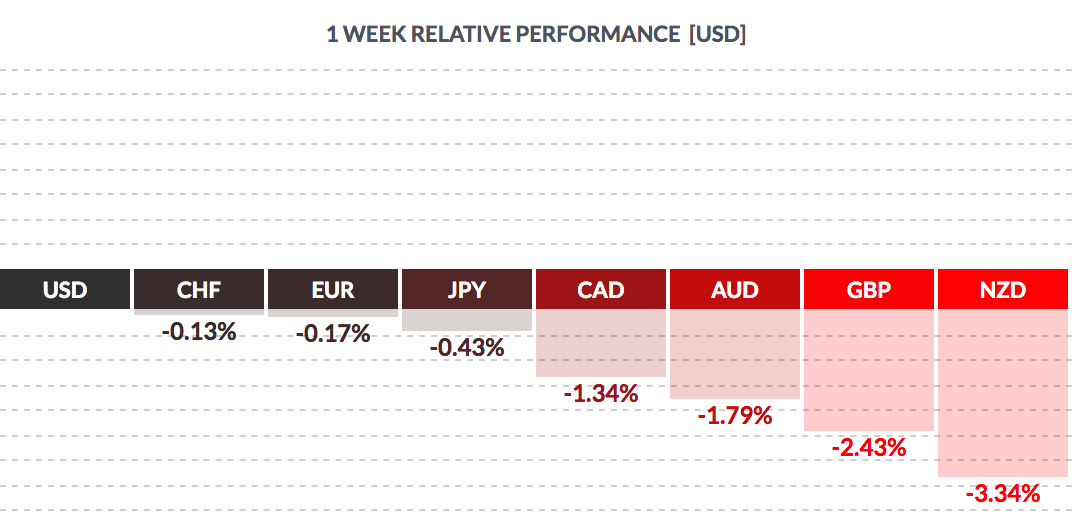

FOREX:

The USD fell vs. the Swiss franc, the yen, and the euro, and rose vs the pound, and the Aussie, New Zealand dollar, and Canadian dollar this week.

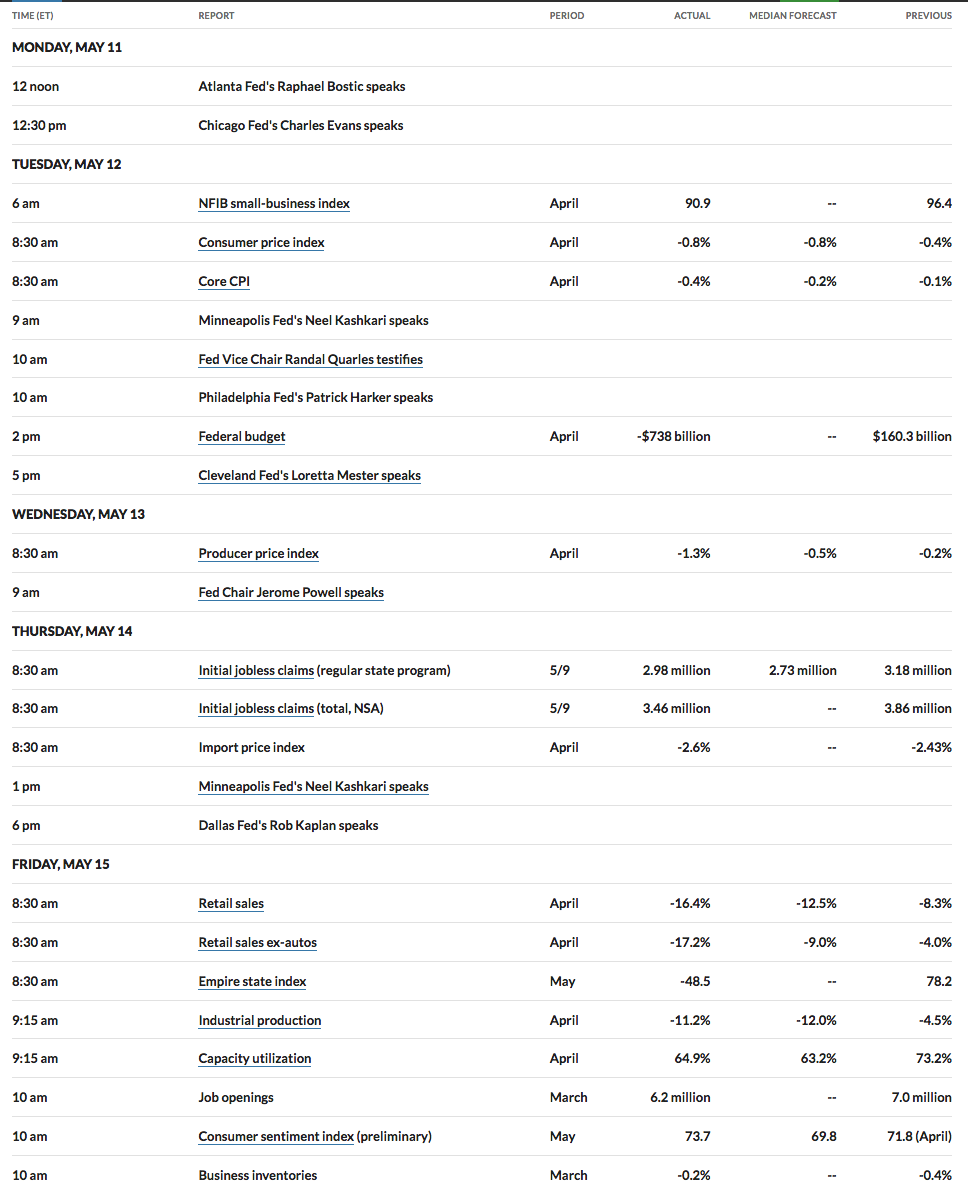

Economic News:

“Initial claims for state unemployment benefits totaled a seasonally adjusted 2.981 million for the week ended May 9, the Labor Department said on Thursday. While that was down from 3.176 million in the prior week and marked the sixth straight weekly drop, claims remain astoundingly high. Claims have been gradually decreasing since hitting a record 6.867 million in the week ended March 28.” (Reuters)

“U.S. consumer prices dropped by the most since the Great Recession in April, weighed down by a plunge in demand for gasoline and services including airline travel as Americans stayed home during the coronavirus crisis. The consumer price index tumbled 0.8% last month after falling 0.4% in March. That was the largest decline since December 2008 when the economy was in the throes of a recession, and marked the second straight monthly decrease in the CPI.

Gasoline prices plunged 20.6%, the largest decline since November 2008, after tumbling 10.5% in March. Cheaper gasoline offset a 1.5% surge in food prices last month, which was the largest gain since January 1990, after a 0.3% rise in March.

Prices for food consumed at home accelerated 2.6%, the largest advance since February 1974, amid broad gains in all six major grocery store food groups.” (Reuters)

“The United States on Tuesday reported a record $738 billion budget deficit in April as an explosion in government spending and a shrinking of revenues amid the novel coronavirus pandemic pushed it deeply into the red. The Treasury Department said the budget deficit in April was the first to reflect the enormity of government spending that has been authorized to try to mitigate the economic impact of the crisis. The previous record budget deficit for any month was $235 billion in February 2020. The fiscal year-to-date deficit surged to $1.48 trillion compared to a $531 billion deficit in the comparable period in 2019, blasting past the previous monthly deficit record of $870 billion in April 2011.

The primary reason for a reduction in receipts was the deferral of certain individual and business taxes from April, as well as changes to tax laws passed in recent legislation, Treasury said. More than 33 million Americans have filed for unemployment benefits since March 21, which equates to roughly one in five jobs. That has also cratered the U.S. government’s revenue base.” (Reuters)

-JPMorgan Chase reported that average weekly credit card spending per household was more than $300 lower in April 2020 than in April 2019. Average household credit-card spending fell 40% year-over-year by the end of March.

“U.S. retail sales endured a second straight month of record declines in April as the novel coronavirus pandemic kept Americans at home, putting the economy on track for its biggest contraction in the second quarter since the Great Depression. Retail sales plunged 16.4% last month, the biggest decline since the government started tracking the series in 1992, with only online merchants reporting an increase in receipts, Commerce Department data showed.” (Reuters)

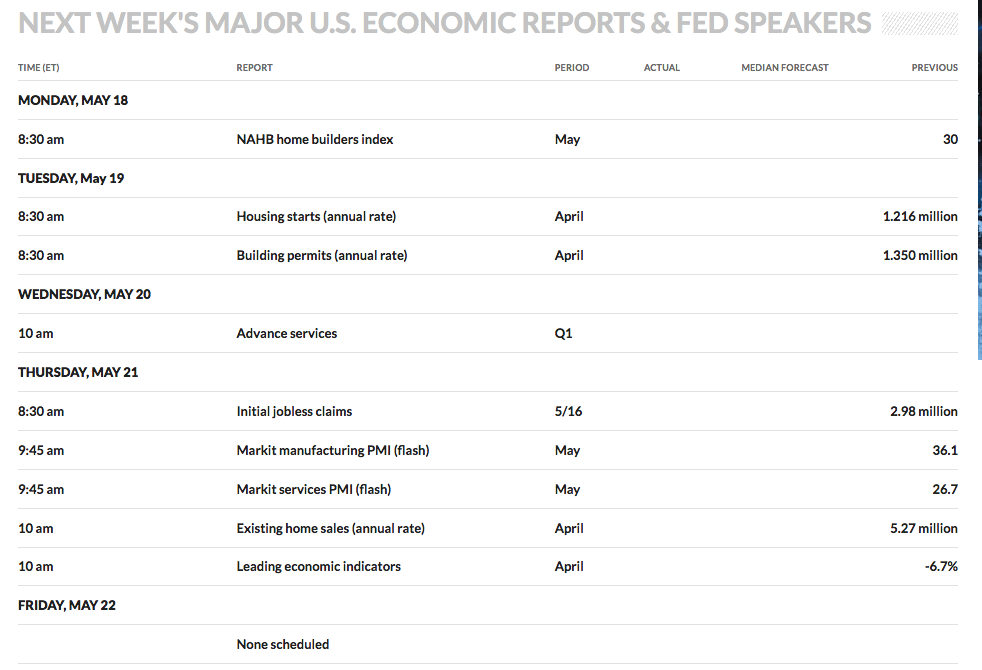

Week Ahead Highlights:

There will be several Housing-related reports due out next week. Home Depot (NYSE:HD) and Walmart (NYSE:WMT) will report earnings.

Next Week’s US Economic Reports:

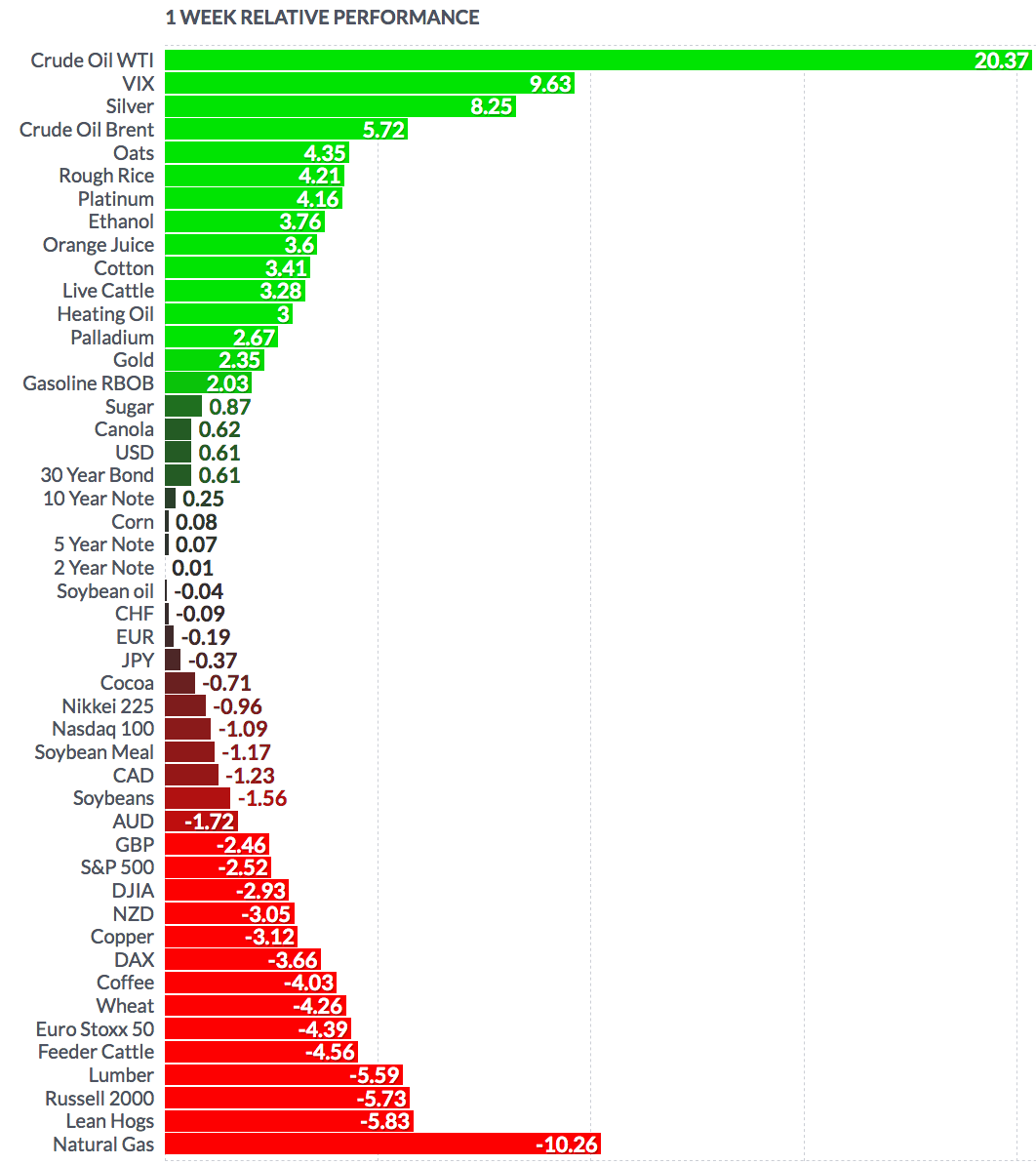

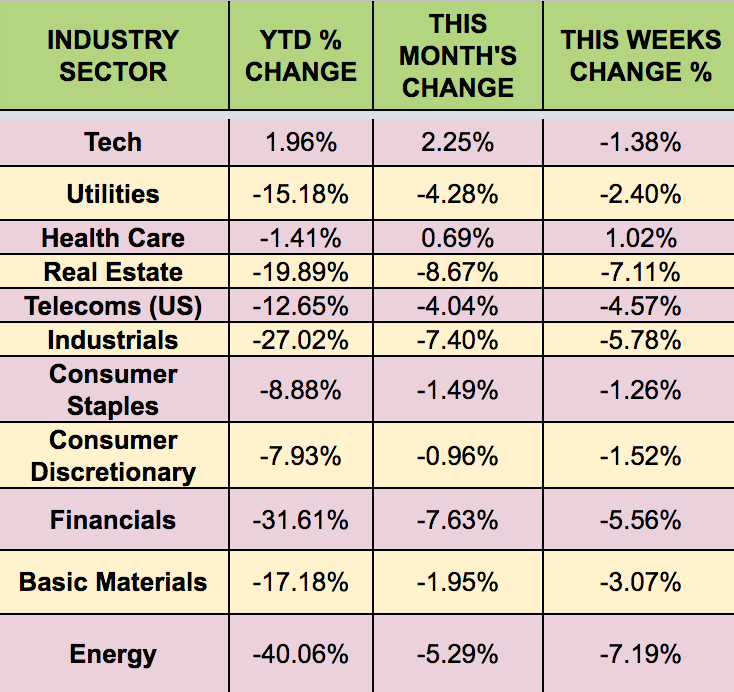

Sectors:

Healthcare led this week, with Real Estate and Energy lagging.

Futures:

Oil rose this week, aided by Saudi Arabia saying it would cut production by an additional million barrels a day, starting in June.

WTI Crude crude rose 20.37% this week, on lower production output and production cuts by oil majors. It ended the week at $29.78.