Market Indexes:

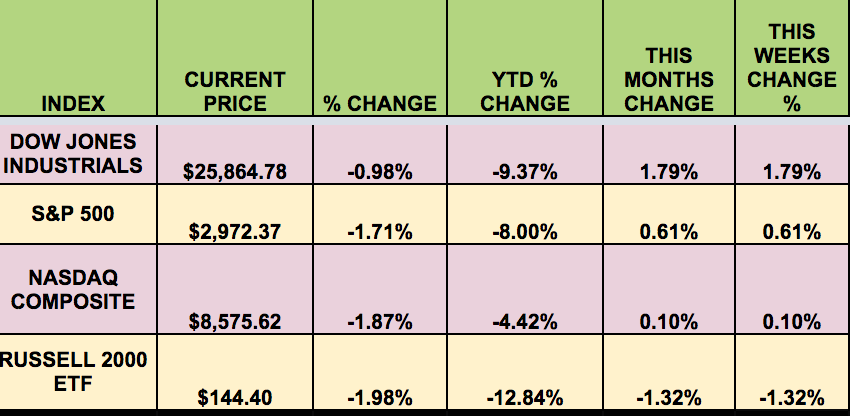

Volatility continued this week in the market, although the Fed’s rate cut inspired a 1-day rally mid-week, which resulted in 3 of the 4 indexes gaining ground for the week. Only the Russell small caps posted a loss. Adding to the virus-inspired pressures, crude oil fell 10% on Friday, after an OPEC proposal to cut output collapsed.

“The Federal Reserve, in a rare inter-meeting move, on Tuesday cut its benchmark interest rate to counter the threat to the economy from the coronavirus epidemic. The Fed said it cut its fed funds target rate by a half percentage point to a range of 1%-1.25%.

“The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity,” the statement said. At a press conference later, Fed Chairman Jerome Powell said officials saw the virus spreading and this represented a material change in the outlook for economic growth.

“We’ve come to the view now that it is time to act in support of the economy. Once we reached that decision, we decided to go ahead,” Powell said. Later, he said the Fed does believe “that our action will provide a meaningful boost to the economy.”(MarketWatch)

“The OPEC plan had been intended to keep oil prices steady despite the hit to demand as the coronavirus slows travel, manufacturing and global supply chains.

However, Russia declined to participate, with talks ending with no new deal to restrain production. The result triggered some of the biggest one-day falls in prices in more than five years”. (BBC)

“The number of people infected with the new coronavirus across the world surpassed 100,000 on Friday as the economic damage intensified, with business districts beginning to empty and stock markets tumbling. Yields on long-dated U.S. Treasury bonds fell to record lows, while gold was on course for its biggest weekly gain since 2011 as investors fled to assets seen as safe havens.” (Reuters)

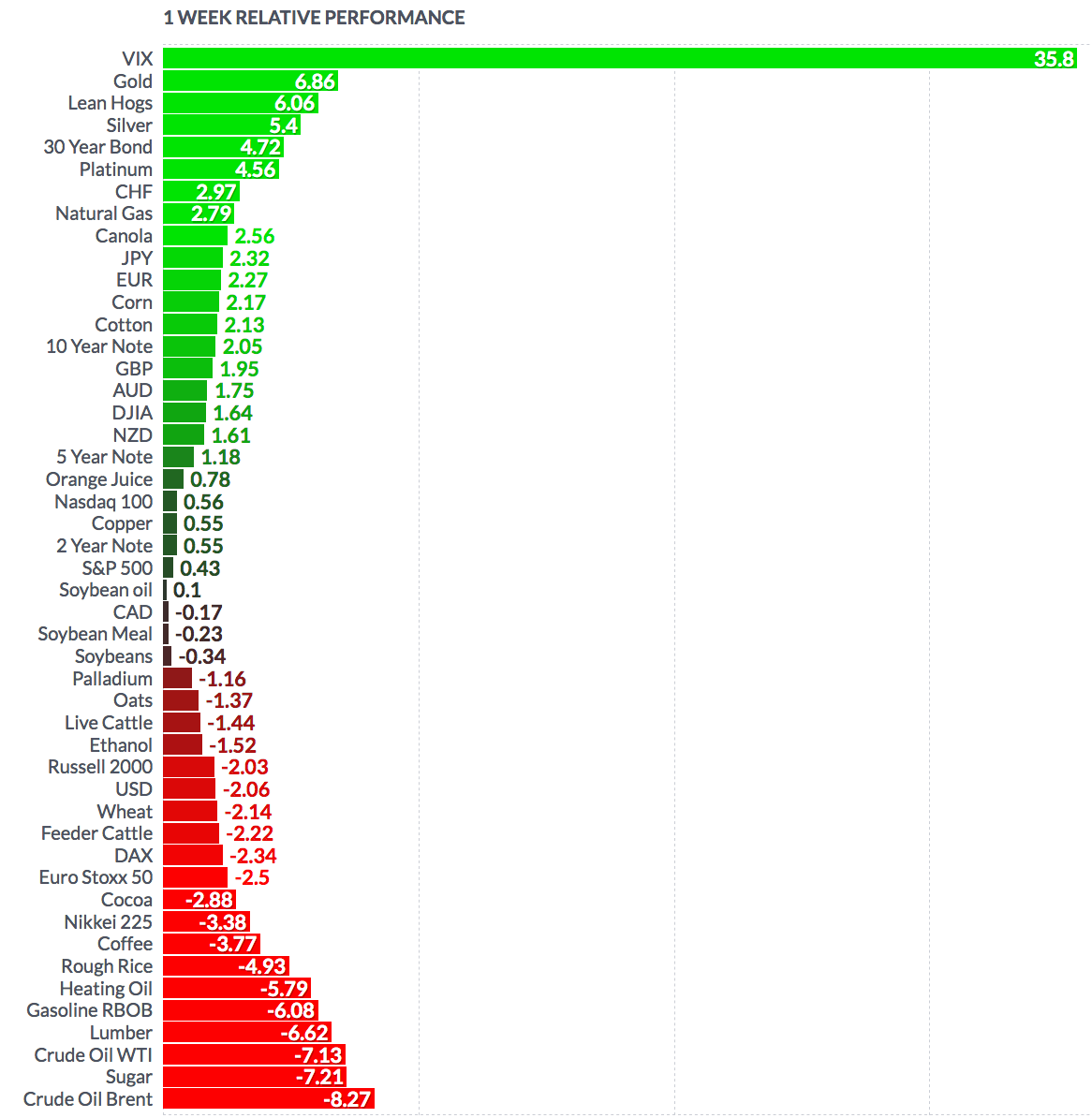

Volatility: The VIX rose 4.6% this week, ending the week at $41.93.

High Dividend Stocks: These high yield stocks go ex-dividend next week: DK, KTB, SIM, SPTN, DHF, STAY, APTS, BRY, CRWS, FDUS, KHC, NMFC, ARR, IRM.

Market Breadth: 17 out of 30 Dow stocks rose this week, vs. 0 last week. 45% of the S&P 500 rose, vs. 4% last week.

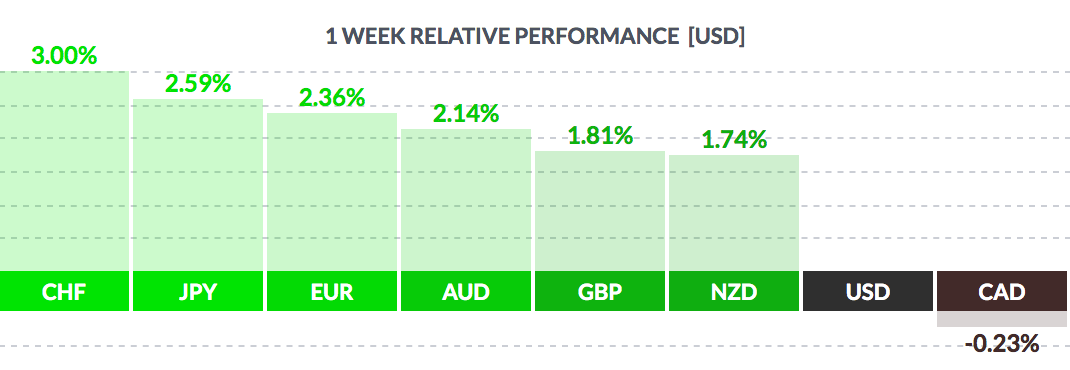

FOREX: The USD fell vs. most major currencies this week, except the Loonie.

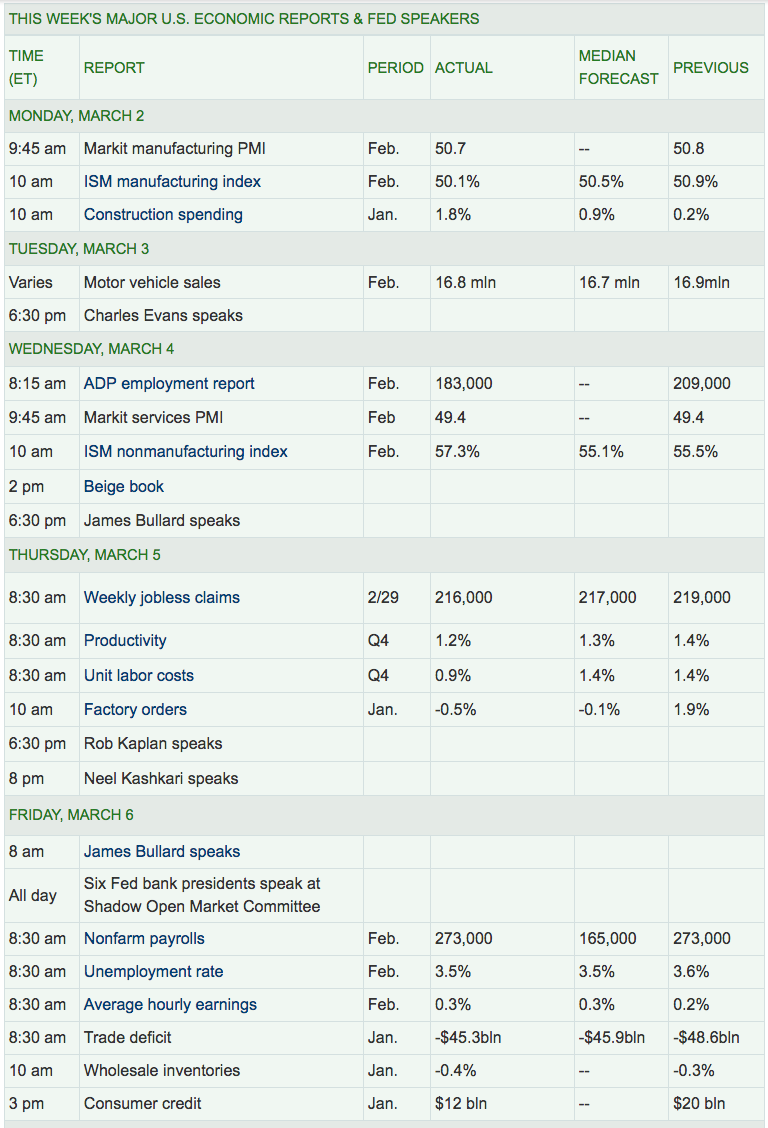

Economic News: Total non-farm payroll employment rose by 273,000 in February, and the unemployment rate was little changed at 3.5%.

“Fears about economic growth resurfaced on Thursday as the U.S. death toll rose to 11 and California reported the first corona virus-related fatality outside Washington state, a day after lawmakers approved an $8.3 billion bill to combat the outbreak. The International Air Transport Association also flagged a potential $113 billion hit to global airline revenue, sending shares in American Airlines (NASDAQ:AAL) Group Inc, Delta Air Lines (NYSE:DAL) and Spirit Airlines down more than 3%.” (Reuters)

“The number of Americans applying for unemployment benefits fell slightly at the end of February, suggesting the economic damage from the coronavirus is still in the early stages and hasn’t caused companies to lay off any workers. Initial jobless claims slipped by 3,000 to 216,000 in the seven days ended Feb. 29, the government said Thursday. The figures are seasonally adjusted.Raw or unadjusted jobless claims rose the most in New York, California and Virginia. The biggest declines took place in Massachusetts, Illinois, North Carolina and Rhode Island. The more stable monthly average of jobless claims, meanwhile, rose by 3,250 to 213,000. The four-week figure filters out the weekly ups and downs to give a better sense of labor-market trends.” (MarketWatch)

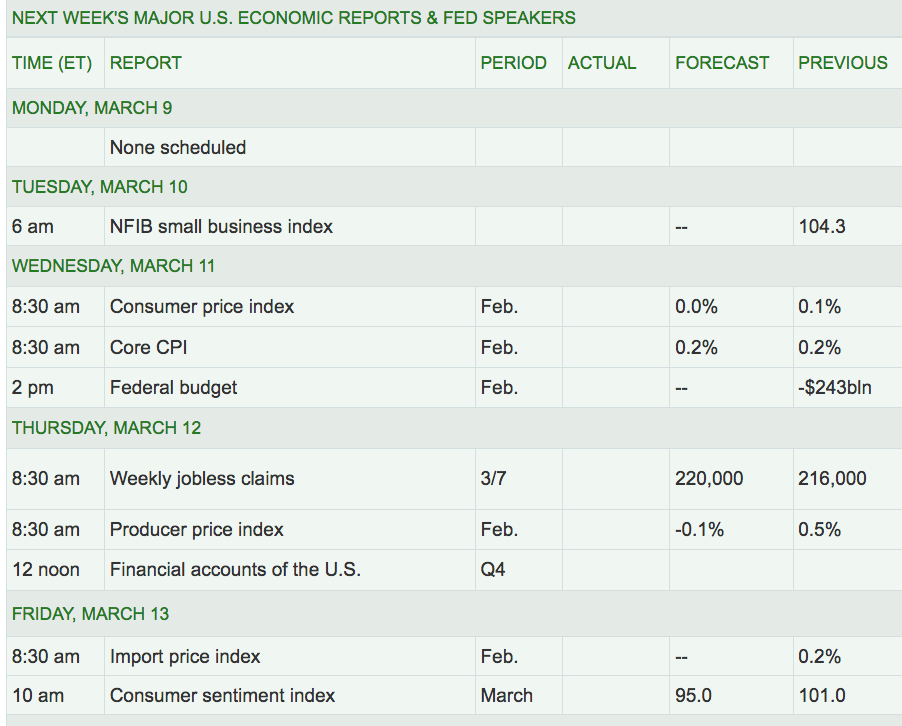

Week Ahead Highlights: It’ll be a light week for economic reports, with the focus mainly on Consumer data.

Next Week’s US Economic Reports:

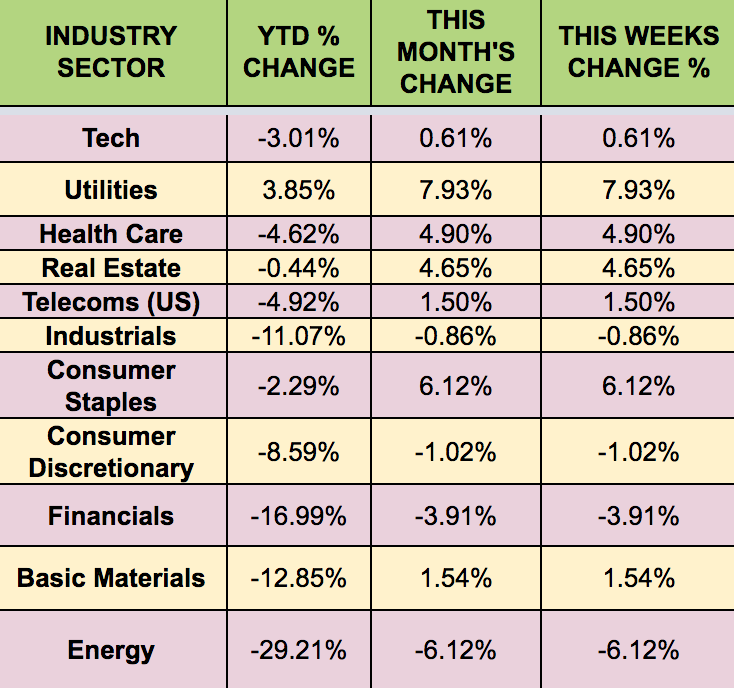

Sectors: Defensive sectors led this week – Utilities and Consumer Staples, with Energy lagging.

Futures: WTI Crude fell -7.13% this week, as the OPEC production cut proposal wasn’t ratified on Friday by Russia.