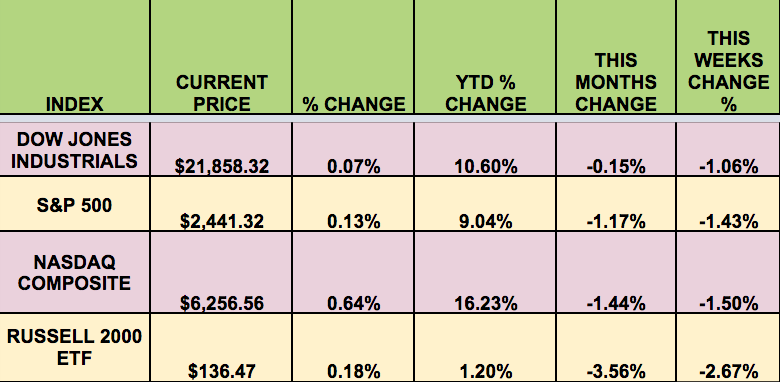

Markets: The S&P had its worst week since March, as global political tensions concerning N. Korea rattled investors. Volatility awoke from its long slumber, and went to its highest level since Feb.

The DOW lost the least, and the RUSSELL small caps trailed by a wide margin.

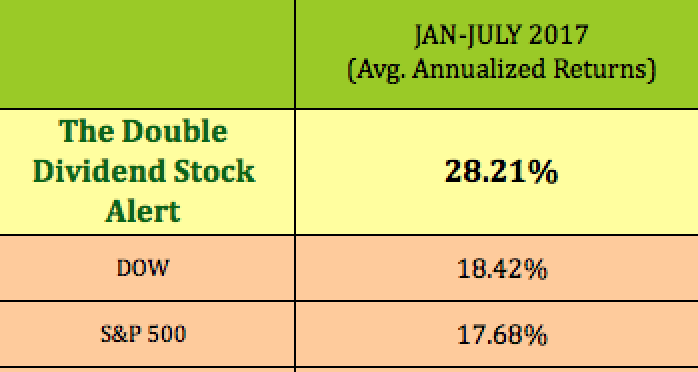

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Alon USA Partners LP (NYSE:ALDW), Corenergy Infras (NYSE:CORR), Harvest Capital Credit Corporation (NASDAQ:HCAP), Fortress Transportation and Infrastructure Investors LLC (NYSE:FTAI), Gladstone Investment Corporation (NASDAQ:GAIN), Gladstone Capital Corporation (NASDAQ:GLAD), Gladstone Commercial Corporation (NASDAQ:GOOD), Main Street Capital Corporation (NYSE:MAIN).

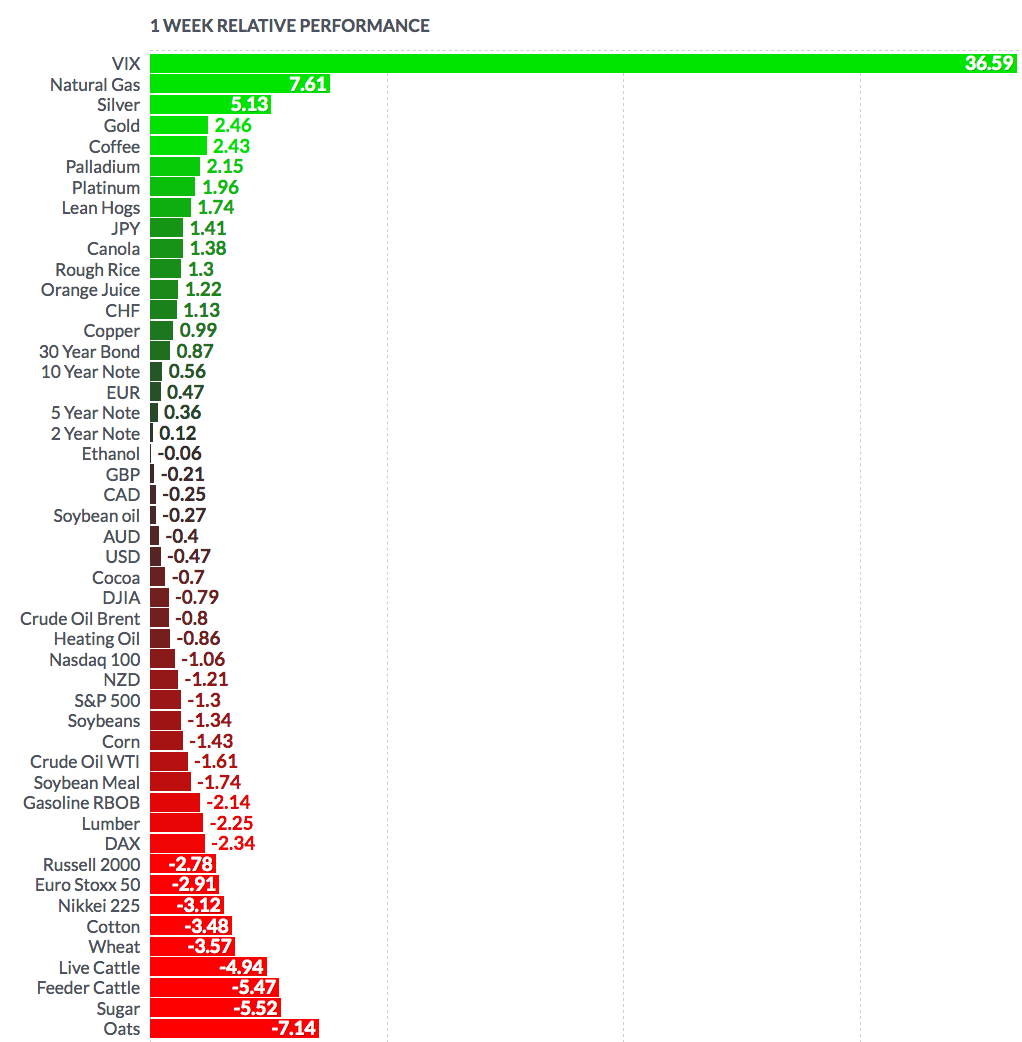

Volatility: The VIX rose as high as $16.60 this week, and finished at $15.51, up 55%.

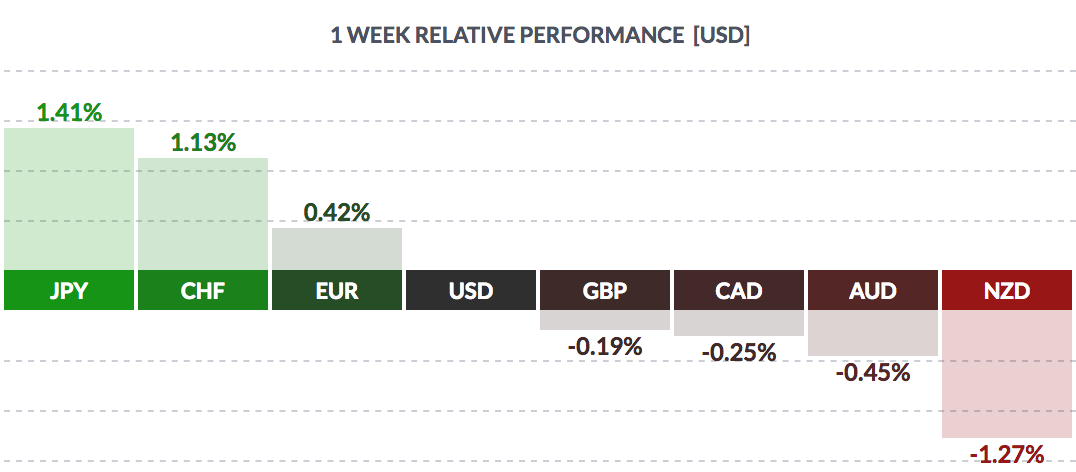

Currency: The US Dollar rose vs. the NZ and Aussie dollars, the Loonie, and the Pound over the past week, and fell vs. the Swiss Franc and Japanese yen.

Market Breadth: 5 of the DOW 30 stocks rose this week, vs. 23 last week. 20% of the S&P 500 rose, vs. 51% last week.

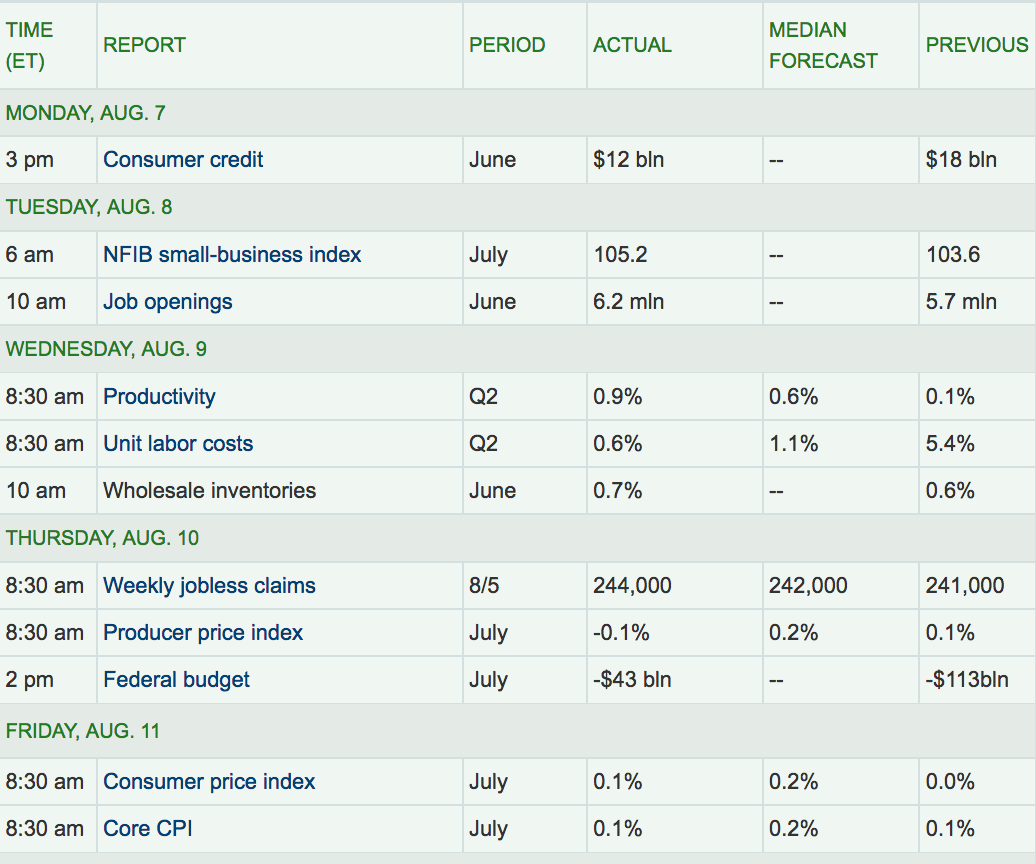

Economic News: Consumer and Producer Prices remained subdued in July; Productivity surged, rising .9%, vs. the .6% forecast, but Unit Labor costs fell vs. June.

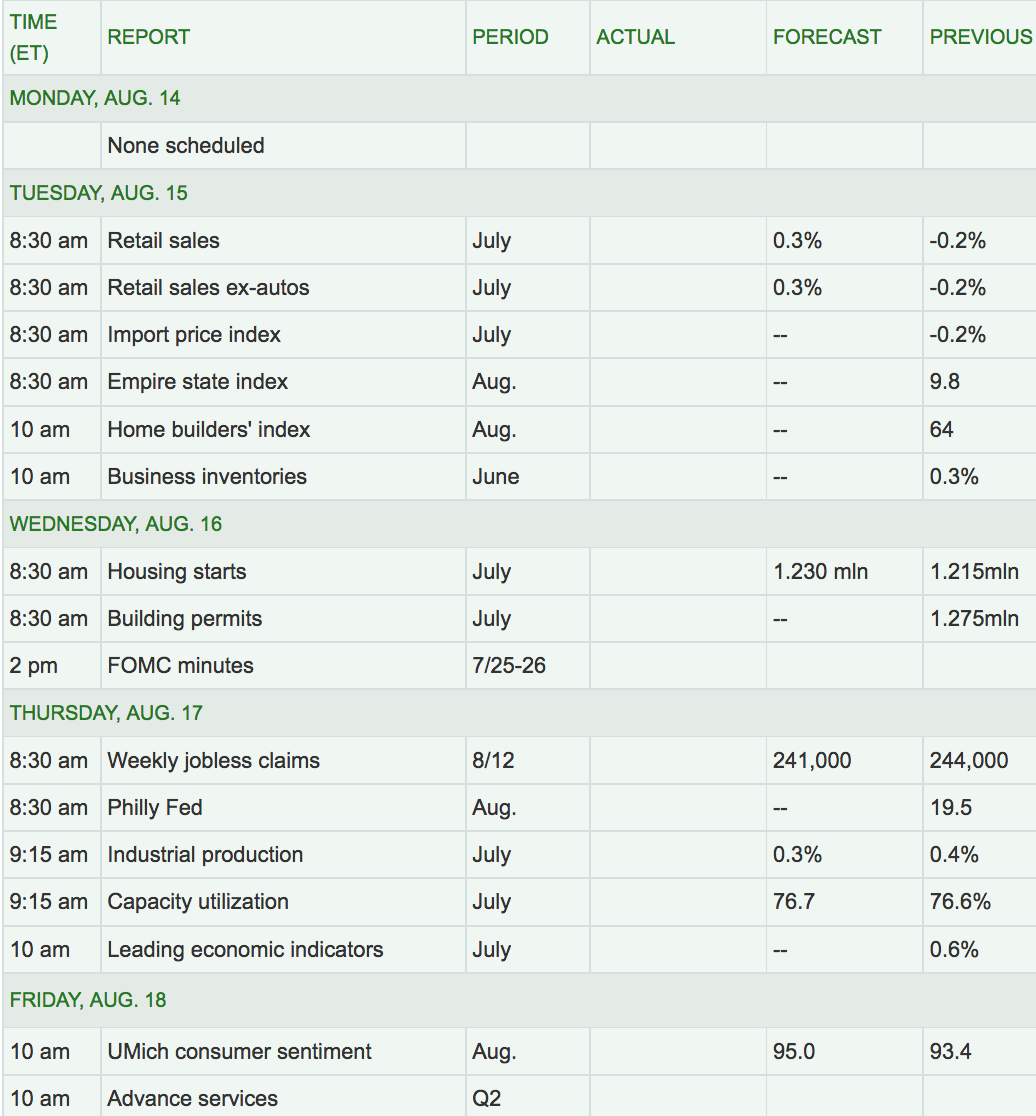

Week Ahead Highlights: Q2 Earnings season continues, with many retailers, such as Wal-Mart Stores Inc (NYSE:WMT), TJX Companies Inc (NYSE:TJX), Urban Outfitters Inc (NASDAQ:URBN), Target Corporation (NYSE:TGT), iShares Edge MSCI Multifactor Consumer Staples (NYSE:CNSF), and others reporting.

Next Week’s US Economic Reports: There will be several Housing-related reports due out next week, in addition to the FOMC minutes from the July meeting.

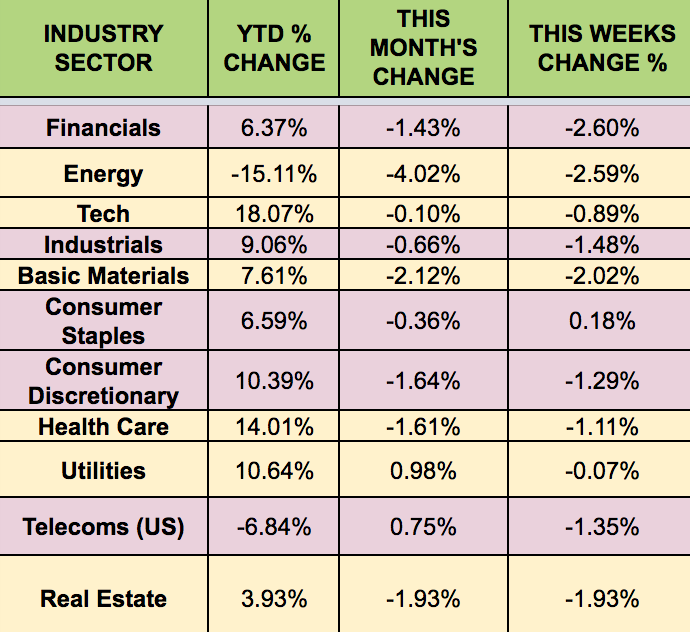

Sectors: The defensive Consumer Staples sector led this week, but were barely positive, and Energy trailed again. Financials reversed course and lagged also.

Futures: Natural Gas futures jumped 7.6% this week, while Crude Oil WTI Futures fell -1.6%: